Netherlands Footwear Market Size, Share, Trends and Forecast by Product, Material, Distribution Channel, Pricing, End-User, and Region, 2025-2033

Netherlands Footwear Market Overview:

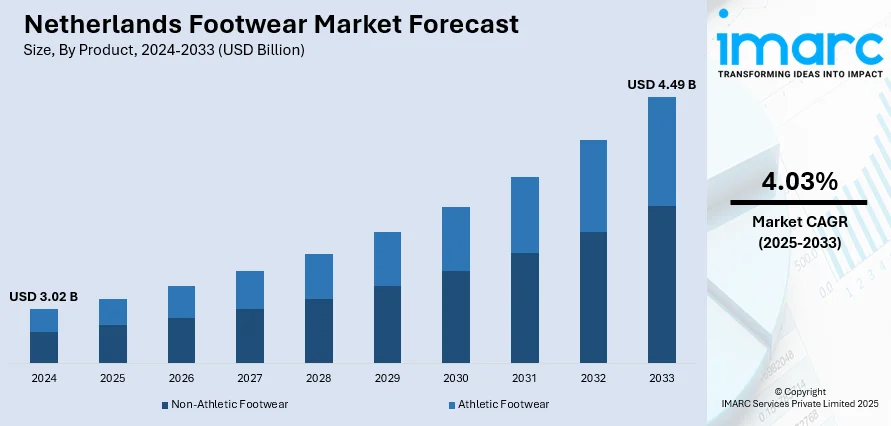

The Netherlands footwear market size reached USD 3.02 Billion in 2024. The market is projected to reach USD 4.49 Billion by 2033, exhibiting a growth rate (CAGR) of 4.03% during 2025-2033. The market is witnessing stable expansion, supported by evolving consumer preferences, increased demand for sustainable materials, and rising urbanization. Growth is visible across segments including sportswear, casual, and formal footwear, with notable traction in eco-friendly and recycled product lines. Distribution is increasingly omni-channel, with e-commerce gaining momentum alongside traditional retail. Innovation in materials and pricing strategies tailored to diverse end-user needs further stimulate growth, positively influencing the Netherlands footwear market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 3.02 Billion |

| Market Forecast in 2033 | USD 4.49 Billion |

| Market Growth Rate 2025-2033 | 4.03% |

Netherlands Footwear Market Trends:

Circular Design Movement Shapes Footwear Production

The Netherlands is a European leader in circular footwear innovation, driven by initiatives like Amsterdam's “Closing the Footwear Loop” project, launched in February 2025 by Fashion for Good and supported by 14 major brands. This initiative emphasizes circular design principles, promoting the use of mono-material shoes, low-impact adhesives, and modular construction to simplify recycling at end-of-life. Recognizing the environmental impact of mixed materials, manufacturers are implementing traceability systems and recycling infrastructure to address material complexity and improve recovery outcomes. Government-funded R&D programs in material recovery and design for disassembly are accelerating the transition. These activities reflect Netherlands footwear market trends, showcasing a shift from linear production to climate-positive innovation. As consumer awareness around sustainable products grows particularly among urban consumers, the sector is gaining both environmental credibility and economic opportunity. Circular design not only reduces waste but enables Dutch manufacturers to meet impending regulations and export cleaner, compliant products. With circularity integrated into production, the Netherlands is shaping global footwear standards by turning eco-responsibility into a competitive strength.

To get more information on this market, Request Sample

E‑Commerce Growth Expands Consumer Access

E-commerce is significantly reshaping the Dutch footwear market by facilitating seamless shopping experiences and extensive product access. In May 2025, monthly e-commerce revenue for footwear reached US millions, a rise from the month prior. Consumers now expect features like virtual try-ons, personalized recommendations, and fast delivery with easy returns. These expectations have prompted investments in UI, AR fitting rooms, and loyalty-based personalization tools across the web and mobile platforms. Improved logistics such as next-day dispatch from centralized hubs and optimized packaging enhance customer satisfaction in both urban and rural areas. This robust digital shift supports Netherlands footwear market growth, enabling smaller designers and sustainable brands to scale through niche online channels. With a digitally savvy population and deep-reaching delivery infrastructure, the Dutch footwear sector is redefining retail through reliable, engaging e-commerce solutions. Online platforms are not just sales channels but hubs for customer data, enabling brands to make more informed decisions regarding inventory management, targeted marketing, and consumer engagement.

Innovation Through Smart Manufacturing and Design

The Netherlands is at the forefront of integrating smart manufacturing in footwear, combining advanced technology with craftsmanship to modernize production. Dutch factories are piloting 3D printing for rapid prototyping and custom-fit shoe models, supported by startups in Eindhoven, while AI-driven material optimization reduces waste and ensures sustainable sourcing. A recent feature on 3D-printed footwear highlights how AI and additive manufacturing are “democratizing access to footwear design, redefining how shoes are made”. Meanwhile, Fashion for Good’s initiatives in Amsterdam are validating traceable, recyclable materials within digital design workflows. Robotics and automation in cutting and assembly lines have improved precision and consistency, preserving artisanal quality at scale. Vocational training programs offered through technical institutions equip a workforce adept at managing these hybrid manufacturing systems. Consumer demand for personalization and eco-responsibility is propelling this wave of innovation, with made-to-order models reducing waste from overproduction. By merging digital production tools with local craftsmanship, the Netherlands is forging a resilient and innovative footwear ecosystem. These developments play a central role in market trends, showcasing how technology can elevate both sustainability and quality within this competitive global sector.

Netherlands Footwear Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product, material, distribution channel, pricing, and end-user.

Product Insights:

- Non-Athletic Footwear

- Athletic Footwear

The report has provided a detailed breakup and analysis of the market based on the product. This includes non-athletic footwear and athletic footwear.

Material Insights:

- Rubber

- Leather

- Plastic

- Fabric

- Others

A detailed breakup and analysis of the market based on the material have also been provided in the report. This includes rubber, leather, plastic, fabric, and others.

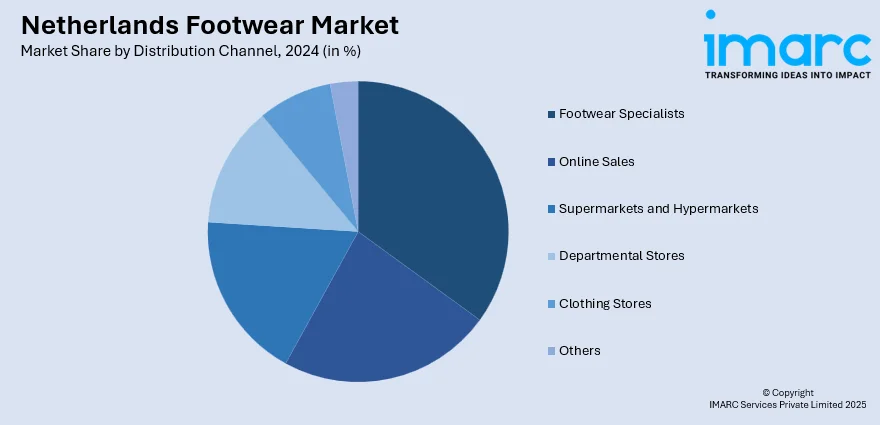

Distribution Channel Insights:

- Footwear Specialists

- Online Sales

- Supermarkets and Hypermarkets

- Departmental Stores

- Clothing Stores

- Others

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes footwear specialists, online sales, supermarkets and hypermarkets, departmental stores, clothing stores, and others.

Pricing Insights:

- Premium

- Mass

A detailed breakup and analysis of the market based on the pricing have also been provided in the report. This includes premium and mass.

End-User Insights:

- Men

- Women

- Kids

The report has provided a detailed breakup and analysis of the market based on the end-user. This includes men, women, and kids.

Regional Insights:

- Noord-Holland

- Zuid-Holland

- Noord-Brabant

- Gelderland

- Utrecht

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Noord-Holland, Zuid-Holland, Noord-Brabant, Gelderland, Utrecht, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Netherlands Footwear Market News:

- November 2024: The Netherlands witnessed a rising trend called “versneakering,” where professionals are increasingly choosing sneakers over traditional leather shoes for office wear. This shift reflects evolving fashion preferences and the country’s cycling-friendly culture, promoting comfort without compromising style. Footwear brands are adapting by focusing more on sneaker designs, responding to the demands of a younger, dynamic workforce. This trend highlights a positive move toward more casual, versatile footwear in the professional environment.

- December 2024: Dutch firm FastFeetGrinded is at the forefront of a green revolution in the footwear sector with its revolutionary shoe recycling program. Through the process of turning discarded shoes into reusable materials such as rubber, foam, and fabric, the firm is advocating for a circular production process. The recycled materials are converted into new products such as mats and footwear components. This sustainable model supports larger EU sustainability objectives and demonstrates the Netherlands' dedication to accountable production and environmental responsibility in the global footwear industry.

Netherlands Footwear Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Non-Athletic Footwear, Athletic Footwear |

| Materials Covered | Rubber, Leather, Plastic, Fabric, Others |

| Distribution Channels Covered | Footwear Specialists, Online Sales, Supermarkets and Hypermarkets, Departmental Stores, Clothing Stores, Others |

| Pricings Covered | Premium, Mass |

| End-Users Covered | Men, Women, Kids |

| Regions Covered | Noord-Holland, Zuid-Holland, Noord-Brabant, Gelderland, Utrecht, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Netherlands footwear market performed so far and how will it perform in the coming years?

- What is the breakup of the Netherlands footwear market on the basis of product?

- What is the breakup of the Netherlands footwear market on the basis of material?

- What is the breakup of the Netherlands footwear market on the basis of distribution channel?

- What is the breakup of the Netherlands footwear market on the basis of pricing?

- What is the breakup of the Netherlands footwear market on the basis of end-user?

- What is the breakup of the Netherlands footwear market on the basis of region?

- What are the various stages in the value chain of the Netherlands footwear market?

- What are the key driving factors and challenges in the Netherlands footwear?

- What is the structure of the Netherlands footwear market and who are the key players?

- What is the degree of competition in the Netherlands footwear market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Netherlands footwear market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Netherlands footwear market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Netherlands footwear industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)