Netherlands Gaming Market Size, Share, Trends and Forecast by Device Type, Platform, Revenue Type, Type, Age Group, and Province, 2025-2033

Netherlands Gaming Market Overview:

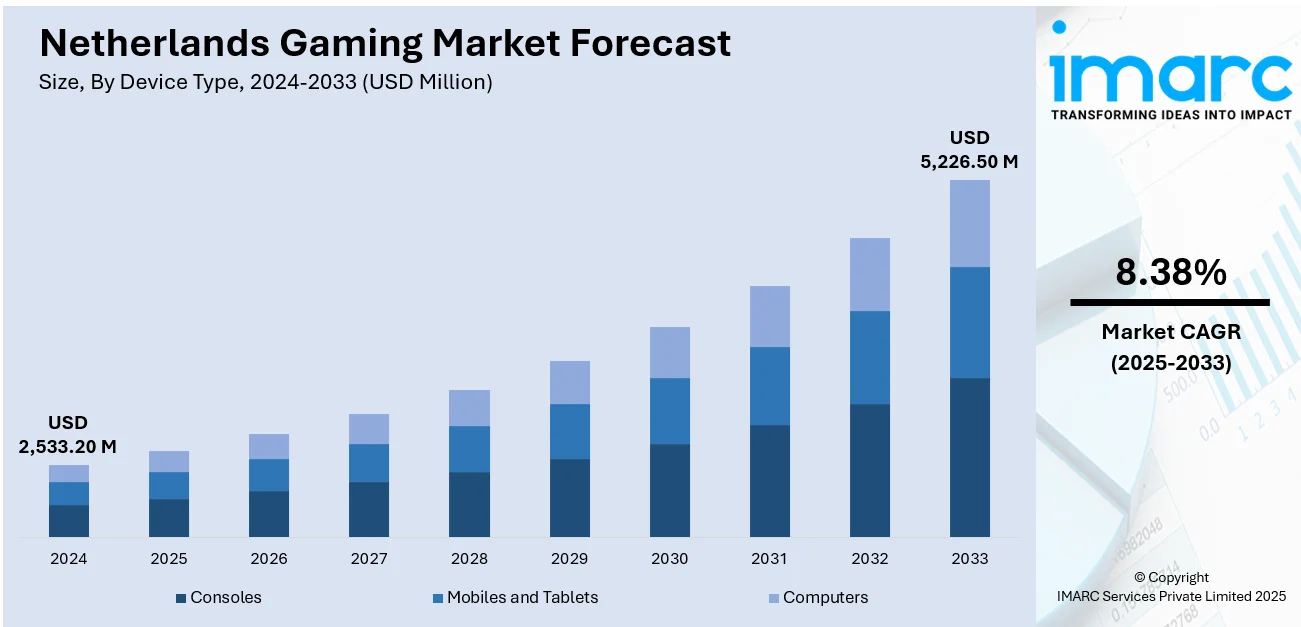

The Netherlands gaming market size reached USD 2,533.20 Million in 2024. Looking forward, the market is projected to reach USD 5,226.50 Million by 2033, exhibiting a growth rate (CAGR) of 8.38% during 2025-2033. The market is driven by the Netherlands’ strong indie game development scene, supported by cultural funding, education, as well as various creative collaborations. Global leadership in serious games has elevated gaming’s relevance in education, healthcare, and professional training. Additionally, the steady rise of esports infrastructure, professionalization, and competitive success is further augmenting the Netherlands gaming market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 2,533.20 Million |

| Market Forecast in 2033 | USD 5,226.50 Million |

| Market Growth Rate 2025-2033 | 8.38% |

Netherlands Gaming Market Trends:

Considerable Growth in the Indie Game Development Ecosystem

The Netherlands has developed a highly respected indie game development ecosystem, supported by a blend of creative talent, academic institutions, and government initiatives. Cities such as Utrecht, Amsterdam, and Eindhoven have become hotspots for independent studios producing innovative, narrative-driven, and experimental games. Institutions like the Utrecht School of the Arts and Breda University of Applied Sciences offer specialized programs in game design and development, fostering a strong talent pipeline. Additionally, organizations such as the Dutch Game Garden provide incubation programs, mentorship, and funding assistance to emerging studios. The Dutch government’s cultural funding agencies view video games as a legitimate creative industry, providing subsidies for unique, non-commercial gaming projects. As of June 2025, the number of video gamers in the Netherlands is projected to exhibit steady growth across all segments through 2030, with digital video games leading the sector. The number of digital gamers is forecasted to reach 7.18 million users by 2030, reflecting strong consumer engagement. Dutch indie titles frequently gain recognition at international game festivals, enhancing the global profile of the local industry. The close collaboration between developers, artists, and academic researchers has resulted in games that focus on storytelling, educational content, and artistic experimentation, leading to high consumer engagement. As of Q3 2024, video gaming reached over 81% of internet users in the Netherlands, reflecting a strong gaming culture across all devices. Smartphone gaming dominated with approximately 64% penetration, making it the preferred platform for most Dutch players. Desktop and laptop gaming followed, engaging around 32.6% of online users. This emphasis on creativity and innovation positions the Netherlands as a leader in the European indie gaming scene, firmly supporting the Netherlands gaming market growth and fostering a sustainable creative economy.

To get more information on this market, Request Sample

Expanding Esports and Gaming Infrastructure and Competitive Scene

The esports and gaming sector in the Netherlands is expanding steadily, supported by increasing local participation, corporate sponsorships, and dedicated infrastructure. Dutch gamers actively participate in international tournaments for popular titles, often representing European esports teams on global stages. As of 2023, the Netherlands’ gaming market showed significant growth, particularly in the console segment, driven by the popularity of Battle Royale games like Fortnite, PUBG, and Apex Legends. While PC gaming remained steady around 250 million euros in recent years, console gaming exhibited the strongest upward trajectory. Dedicated esports venues, including H20 Esports Campus in Amsterdam, are providing advanced facilities for training, events, and educational programs focused on professional gaming careers. Sponsorship from leading brands in technology, retail, and energy sectors is fueling tournament organization and player development. Additionally, Dutch educational institutions have started incorporating esports into curricula, offering specialized courses in game management, team coaching, and broadcasting. The growing popularity of esports content on platforms like Twitch and YouTube, driven by Dutch gaming influencers, is increasing audience engagement and commercial viability. Collaborative efforts between municipalities, esports organizations, and national gaming associations are helping formalize the sector’s professional standards. These developments position the Netherlands as a rising esports hub in Europe, expanding professional opportunities for players and strengthening the integration of esports within the national digital economy.

Netherlands Gaming Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on device type, platform, revenue type, type, and age group.

Device Type Insights:

- Consoles

- Mobiles and Tablets

- Computers

The report has provided a detailed breakup and analysis of the market based on the device type. This includes consoles, mobiles and tablets, and computers.

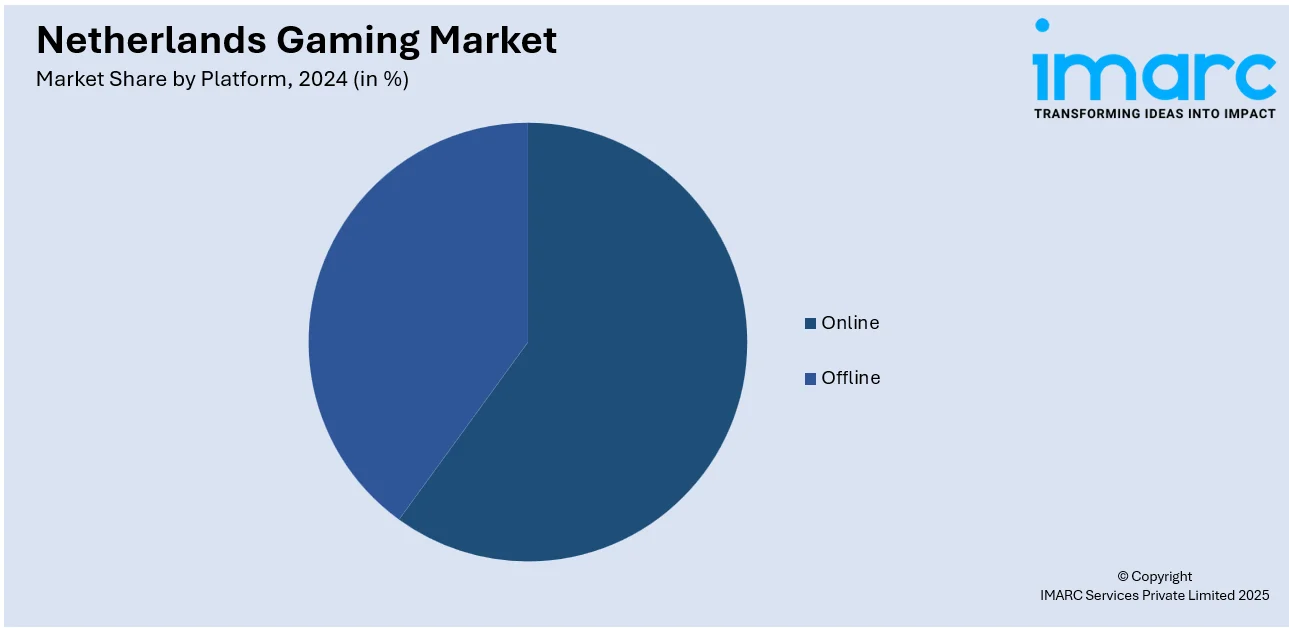

Platform Insights:

- Online

- Offline

The report has provided a detailed breakup and analysis of the market based on the platform. This includes online and offline.

Revenue Type Insights:

- In-Game Purchase

- Game Purchase

- Advertising

The report has provided a detailed breakup and analysis of the market based on the revenue type. This includes in-game purchase, game purchase, and advertising.

Type Insights:

- Adventure/Role Playing Games

- Puzzles

- Social Games

- Strategy

- Stimulation

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes adventure/role playing games, puzzles, social games, strategy, stimulation, and others.

Age Group Insights:

- Adults

- Children

The report has provided a detailed breakup and analysis of the market based on the age group. This includes adults and children.

Province Insights:

- Noord-Holland

- Zuid-Holland

- Noord-Brabant

- Gelderland

- Utrecht

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Noord-Holland, Zuid-Holland, Noord-Brabant, Gelderland, Utrecht, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Netherlands Gaming Market News:

- On January 22, 2025, Virtuos announced the acquisition of Abstraction (Netherlands), and two other studios in USA and Canada to expand its global game development footprint. These strategic acquisitions increased Virtuos’ Western workforce from 900 to over 1,200 AAA developers across 16 studios, enhancing capabilities in art, engineering, and live services.

- On June 12, 2025, CT Interactive confirmed the official launch of its gaming portfolio on Starcasino.nl, expanding its presence in the Netherlands’ regulated online gaming market. The partnership builds upon their earlier success in Belgium and aims to diversify content offerings for Dutch players through innovative, high-quality games. This collaboration complements the Netherlands’ broader iGaming expansion.

Netherlands Gaming Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Device Types Covered | Consoles, Mobiles and Tablets, Computers |

| Platforms Covered | Online, Offline |

| Revenue Types Covered | In-Game Purchase, Game Purchase, Advertising |

| Types Covered | Adventure/Role Playing Games, Puzzles, Social Games, Strategy, Stimulation, Others |

| Age Groups Covered | Adults, Children |

| Provinces Covered | Noord-Holland, Zuid-Holland, Noord-Brabant, Gelderland, Utrecht, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Netherlands gaming market performed so far and how will it perform in the coming years?

- What is the breakup of the Netherlands gaming market on the basis of device type?

- What is the breakup of the Netherlands gaming market on the basis of platform?

- What is the breakup of the Netherlands gaming market on the basis of revenue type?

- What is the breakup of the Netherlands gaming market on the basis of type?

- What is the breakup of the Netherlands gaming market on the basis of age group?

- What is the breakup of the Netherlands gaming market on the basis of province?

- What are the various stages in the value chain of the Netherlands gaming market?

- What are the key driving factors and challenges in the Netherlands gaming market?

- What is the structure of the Netherlands gaming market and who are the key players?

- What is the degree of competition in the Netherlands gaming market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Netherlands gaming market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Netherlands gaming market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Netherlands gaming industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)