Netherlands IT Training Market Size, Share, Trends and Forecast by Application, End-User, and Province, 2025-2033

Netherlands IT Training Market Overview:

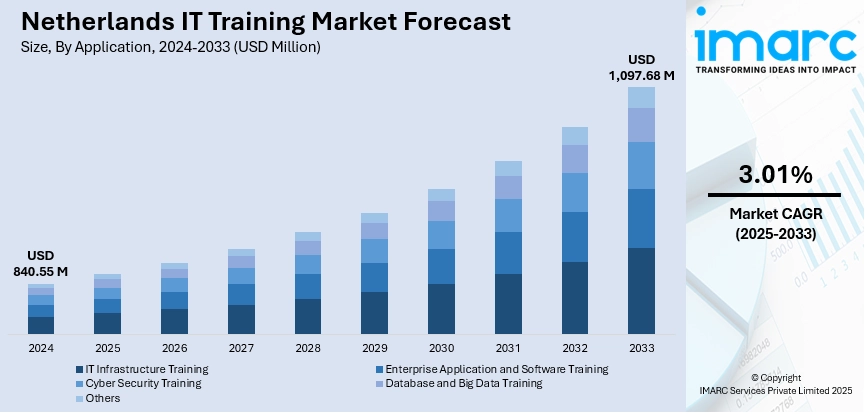

The Netherlands IT training market size reached USD 840.55 Million in 2024. The market is projected to reach USD 1,097.68 Million by 2033, exhibiting a growth rate (CAGR) of 3.01% during 2025-2033. The market is fueled by rising industry needs for digital transformation, which is pushing organizations to skill up in newer technologies like AI, cloud computing, and cybersecurity. Also, governmental programs encouraging digital literacy as well as vocational training also drive the growth of the market. Moreover, the increasing use of remote work and hybrid business models has also fueled the demand for adaptive, online IT training solutions, which is augmenting the Netherlands IT training market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 840.55 Million |

| Market Forecast in 2033 | USD 1,097.68 Million |

| Market Growth Rate 2025-2033 | 3.01% |

Netherlands IT Training Market Trends:

Increased Emphasis on Training in AI and Data Analytics

As digital transformation intensifies across industries in the Netherlands, there is a strong demand for training in artificial intelligence (AI) and data analytics. Industry reports state that the Netherlands achieved the sixth rank in the EU in using AI in 2024, with 22.7% of enterprises utilizing at least one AI technology. Natural language generation and text mining were the most common AI technologies used by these companies. Additionally, companies are incorporating AI capabilities into their businesses, ranging from automating customer support to supporting data-driven decision-making. As a result, demand for experts who can handle machine learning models, data visualization tools, and statistical programming languages has increased. IT training companies are reacting by creating customized courses in AI model building, data engineering, and business intelligence platforms. Within companies, training initiatives are being incorporated into workforce development plans to drive in-house innovation. Schools and universities are also increasing AI-driven curricula, often in cooperation with industry participants, to align with real-world business requirements. This increased interest is seen not only in large companies; small and medium-sized enterprises are also embracing AI education tools and looking for low-cost training options to remain competitive. This, therefore, is positively impacting the Netherlands IT training market growth. Moreover, the rising institutionalization of AI training also mirrors its importance in defining the future of the Dutch digital economy.

To get more information on this market, Request Sample

Focus on Cybersecurity Skill Development

Cybersecurity has emerged as a key part of IT training in the Netherlands, spurred by the changing threat environment and regulatory requirements. As companies extend their online presence, the incidence and sophistication of cyber threats have increased, leading companies to focus on employee training for cybersecurity best practices. According to industry reports, in 2024, out of every five companies in the Netherlands, one had problems due to cyberattacks. Apart from this, courses in network security, ethical hacking, incident response, and cloud-based threat mitigation are especially in demand. Furthermore, the widespread shift towards hybrid models of work has further increased the vulnerability surface, and therefore, cybersecurity awareness is crucial at all levels within an organization. As a result, IT training programs now feature role-based modules for both technical and non-technical workers so that there is a well-penetrated understanding of cyber hygiene. Collaboration between government and industry has resulted in efforts to assist upskilling within this area, particularly for public sector organizations and critical infrastructure. This increased emphasis on cybersecurity training is transforming IT training delivery, with a push towards scenario-based learning, globally recognized certifications, and simulated attack-response training that helps develop resilience among Dutch companies.

Netherlands IT Training Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on application and end-user.

Application Insights:

- IT Infrastructure Training

- Enterprise Application and Software Training

- Cyber Security Training

- Database and Big Data Training

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes IT infrastructure training, enterprise application and software training, cyber security training, data and big data training, and others.

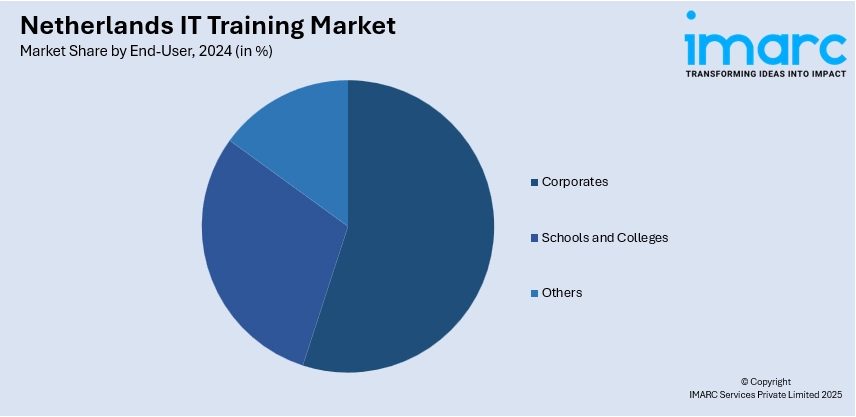

End-User Insights:

- Corporates

- Schools and Colleges

- Others

A detailed breakup and analysis of the market based on the end-user have also been provided in the report. This includes corporate, schools and colleges, and others.

Province Insights:

- Noord-Holland

- Zuid-Holland

- Noord-Brabant

- Gelderland

- Utrecht

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Noord-Holland, Zuid-Holland, Noord-Brabant, Gelderland, Utrecht, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Netherlands IT Training Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Applications Covered | IT Infrastructure Training, Enterprise Application and Software Training, Cyber Security Training, Database and Big Data Training, Others |

| End-Users Covered | Corporate, Schools and Colleges, Others |

| Provinces Covered | Noord-Holland, Zuid-Holland, Noord-Brabant, Gelderland, Utrecht, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request |

Key Questions Answered in This Report:

- How has the Netherlands IT training market performed so far and how will it perform in the coming years?

- What is the breakup of the Netherlands IT training market on the basis of application?

- What is the breakup of the Netherlands IT training market on the basis of end-user?

- What is the breakup of the Netherlands IT training market on the basis of region?

- What are the various stages in the value chain of the Netherlands IT training market?

- What are the key driving factors and challenges in the Netherlands IT training market?

- What is the structure of the Netherlands IT training market and who are the key players?

- What is the degree of competition in the Netherlands IT training market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Netherlands IT training market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Netherlands IT training market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Netherlands IT training industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)