Netherlands Logistics Market Size, Share, Trends and Forecast by Model Type, Transportation Mode, End Use, and Region, 2025-2033

Netherlands Logistics Market Overview:

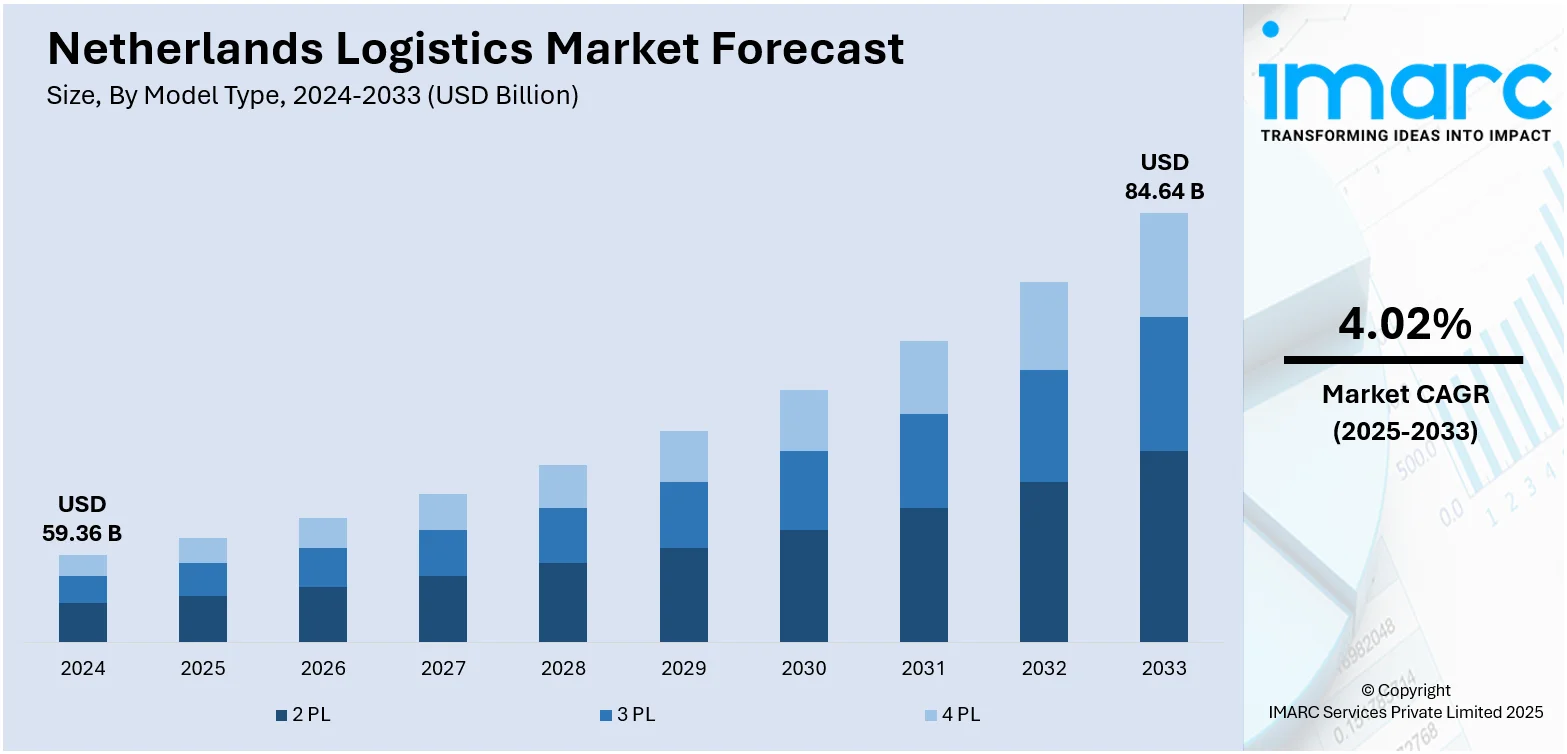

The Netherlands logistics market size reached USD 59.36 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 84.64 Billion by 2033, exhibiting a growth rate (CAGR) of 4.02% during 2025-2033. The Netherlands is witnessing strong growth in e-commerce, which is positively influencing the industry. Apart from this, the rise in investments in improving logistics infrastructure and enhancing ports, roads, railways, and airports is supporting the market growth. Moreover, the growing adoption of sustainability practices is expanding the Netherlands logistics market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 59.36 Billion |

| Market Forecast in 2033 | USD 84.64 Billion |

| Market Growth Rate (2025-2033) | 4.02% |

Netherlands Logistics Market Trends:

Growth of E-commerce

The Netherlands is witnessing strong growth in e-commerce, which is positively influencing the logistics industry. Consumers are going online shopping in greater numbers, leading companies to create better delivery systems. As per ING, in 2025, retail sales in the Netherlands are expected to increase by 3.5%. This growth in e-commerce is making logistics companies respond by improving their warehousing, transportation, and last-mile delivery services. The call for quicker, more secure delivery times is driving the use of cutting-edge technologies like automation, drones, and artificial intelligence in the supply chain. Furthermore, the growth of e-commerce websites is encouraging retailers to open fulfillment centers near urban areas to minimize delivery times and expenses. As a result, logistics companies are constantly improving their infrastructure, streamlining routes, and expanding their capacity for delivering a greater number of parcels. The strategic position of the Netherlands in Europe is also expanding e-commerce chanqnels since it is an intermediary point for delivery to neighboring nations.

To get more information on this market, Request Sample

Investment in infrastructure is rising higher

The Netherlands is investing on its logistics infrastructure, enhancing ports, roads, railways, and airports. Ongoing development of infrastructure is making the nation increasingly appealing for logistics firms, thereby supporting the Netherlands logistics market growth. Port facilities, including the Port of Rotterdam, which happens to be one of Europe's largest, are constantly improved to deal with rising volumes of goods and to cater to larger ships. Rail systems are being upgraded to enable faster inland transport, and Amsterdam Schiphol Airport and other airports are also upgrading their cargo facilities to keep pace with the demand. These investments are designed to increase the efficiency of goods flows, diminish delays, and increase supply chain performance overall. Continuous improvements in multimodal transport solutions are making connections between modes of transportation smoother, offering higher flexibility for logistics providers. Therefore, companies in the Netherlands are enjoying quicker, more efficient, and cheaper logistics operations. In 2024, OrbusNeich Medical Group Holdings Limited, a leading worldwide producer of medical devices focusing on interventional devices for percutaneous coronary intervention (PCI) and percutaneous transluminal angioplasty (PTA) procedures, announced the launch of the Group’s state-of-the-art logistics center in the Netherlands. The investment in the new warehouse addresses the rising production demands and the escalating requirement for improved logistics and storage facilities.

Adoption of Sustainability Practices

Sustainability is increasingly shaping the Dutch logistics industry with more focus on lowering the environmental footprint of transportation and supply chain operations. Firms are continually on the lookout for greener options to conventional logistics procedures, including the use of electric vehicles (EVs) for inner-city deliveries and making investments in environment friendly warehouses. The Netherlands is supporting the adoption of renewable energy in the logistics industry, with companies being urged to use more sustainable methods of operations. Regulatory pressures are also driving this emphasis on sustainability, as the government of the Netherlands is introducing policies for lowering carbon emissions and enhancing sustainable business practices. Logistics companies are already developing innovations like intelligent route planning and maximizing load capacity to reduce fuel use and cause less damage to the environment.

Netherlands Logistics Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on model type, transportation mode, and end use.

Model Type Insights:

- 2 PL

- 3 PL

- 4 PL

The report has provided a detailed breakup and analysis of the market based on the model type. This includes 2 PL, 3 PL, and 4 PL.

Transportation Mode Insights:

- Roadways

- Seaways

- Railways

- Airways

The report has provided a detailed breakup and analysis of the market based on the transportation mode. This includes roadways, seaways, railways, and airways.

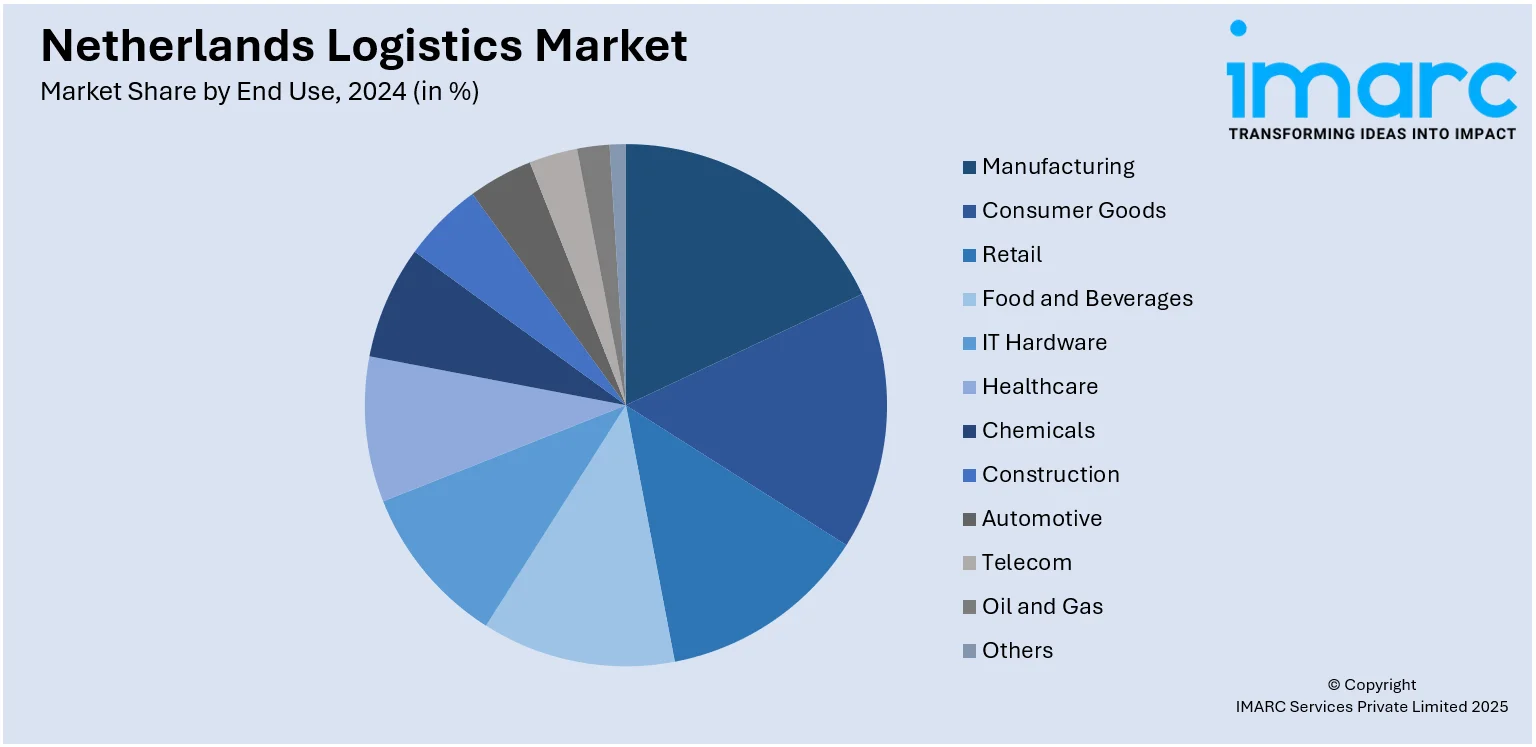

End Use Insights:

- Manufacturing

- Consumer Goods

- Retail

- Food and Beverages

- IT Hardware

- Healthcare

- Chemicals

- Construction

- Automotive

- Telecom

- Oil and Gas

- Others

A detailed breakup and analysis of the market based on the end use have also been provided in the report. This includes manufacturing, consumer goods, retail, food and beverages, IT hardware, healthcare, chemicals, construction, automotive, telecom, oil and gas, and others.

Regional Insights:

- Noord-Holland

- Zuid-Holland

- Noord-Brabant

- Gelderland

- Utrecht

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Noord-Holland, Zuid-Holland, Noord-Brabant, Gelderland, Utrecht, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Netherlands Logistics Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Model Types Covered | 2 PL, 3 PL, 4 PL |

| Transportation Modes Covered | Roadways, Seaways, Railways, Airways |

| End Uses Covered | Manufacturing, Consumer Goods, Retail, Food and Beverages, IT Hardware, Healthcare, Chemicals, Construction, Automotive, Telecom, Oil and Gas, Others |

| Regions Covered | Noord-Holland, Zuid-Holland, Noord-Brabant, Gelderland, Utrecht, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Netherlands logistics market performed so far and how will it perform in the coming years?

- What is the breakup of the Netherlands logistics market on the basis of model type?

- What is the breakup of the Netherlands logistics market on the basis of transportation mode?

- What is the breakup of the Netherlands logistics market on the basis of end use?

- What is the breakup of the Netherlands logistics market on the basis of region?

- What are the various stages in the value chain of the Netherlands logistics market?

- What are the key driving factors and challenges in the Netherlands logistics market?

- What is the structure of the Netherlands logistics market and who are the key players?

- What is the degree of competition in the Netherlands logistics market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Netherlands logistics market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Netherlands logistics market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Netherlands logistics industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)