Netherlands Menswear Market Size, Share, Trends and Forecast by Product Type, Season, Distribution Channel, and Province, 2025-2033

Netherlands Menswear Market Overview:

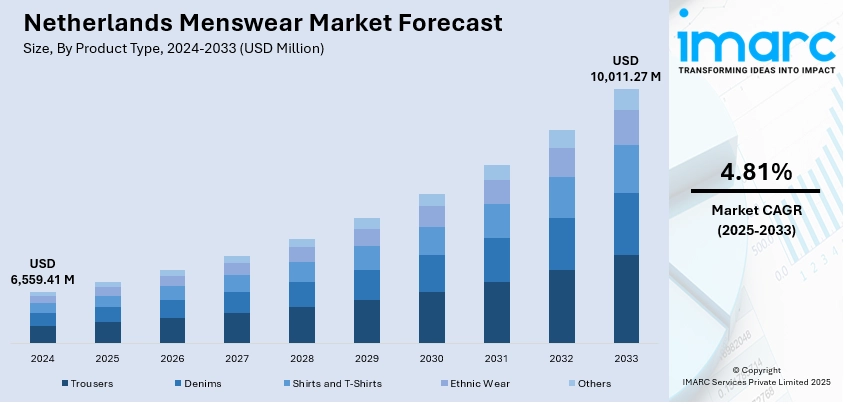

The Netherlands menswear market size reached USD 6,559.41 Million in 2024. Looking forward, the market is projected to reach USD 10,011.27 Million by 2033, exhibiting a growth rate (CAGR) of 4.81% during 2025-2033. The market is witnessing steady growth driven by evolving fashion preferences, increased focus on personal grooming, and rising demand for both casual and functional attire. Urban consumers are also leaning toward quality, sustainability, and style, prompting brands to innovate with eco-friendly fabrics and modern designs. The growing popularity of e-commerce and omnichannel retail strategies is further shaping consumer behavior, contributing to the expansion of the Netherlands menswear market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 6,559.41 Million |

| Market Forecast in 2033 | USD 10,011.27 Million |

| Market Growth Rate 2025-2033 | 4.81% |

Netherlands Menswear Market Trends:

Smart Casual Crossover

The increasing popularity of smart casual attire is a significant factor driving growth in the menswear market in the Netherlands. Contemporary Dutch consumers are looking for clothing that combines a professional appearance with everyday comfort mirroring shifts in workplace culture and lifestyle trends. For instance, in May 2023, British menswear brand Lestrange launched its first international store in Amsterdam’s Nine Streets focusing on essential, versatile pieces. The store's minimalist design showcases items like the stretch cotton ‘The 24 Trouser.’ Co-founders Tom Horne and Will Green aim to align consumption with environmental well-being through their innovative retail model. With formal dress codes becoming more relaxed and remote or hybrid work arrangements gaining traction men are leaning towards versatile pieces such as chinos, polo shirts, and tailored jackets that can easily transition from business meetings to social settings. This inclination for dual-purpose clothing is encouraging brands to develop collections that are both fashionable and practical utilizing breathable materials and neutral colors to attract a wide range of consumers. Furthermore, the smart casual movement aligns with the minimalist fashion preferences common in the Netherlands where attributes like quality, comfort, and simplicity are highly prioritized. Consequently, this hybrid style is crucial in supporting the Netherlands menswear market growth.

To get more information on this market, Request Sample

Digital-Fueled Personalization

The menswear market in the Netherlands is undergoing a transformation due to the rising impact of digital personalization. Advancements in AI and data analytics are empowering brands to deliver highly personalized shopping experiences. From virtual try-on solutions and smart size prediction tools to customized style suggestions, technology is reshaping how consumers engage with fashion. For instance, in January 2025, Omoda partnered with Google Cloud to enhance online shopping through the use of generative AI. They introduced two features: 'Omoda Stylist' and 'Discover the Look,' both of which personalize style searches and increase user engagement. With features like natural language search, users can receive tailored outfit suggestions, making it easier than ever to find their ideal looks and transforming the online fashion experience. Such advancements address significant consumer challenges like accurate fitting and the overwhelming number of choices that often accompany online shopping. As Dutch shoppers increasingly turn to e-commerce, their expectation for tailored suggestions and smooth digital interactions continues to rise. Retailers are utilizing customer information such as purchase history, body measurements, and online behavior to provide curated product offerings that enhance customer satisfaction. This shift boosts customer engagement and helps decrease return rates and fosters brand loyalty. Personalization driven by digital technologies is becoming a key strategic advantage, improving both conversion rates and customer retention in the competitive menswear sector of the Netherlands.

Netherlands Menswear Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product type, season, and distribution channel.

Product Type Insights:

- Trousers

- Denims

- Shirts and T-Shirts

- Ethnic Wear

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes trousers, denims, shirts and t-shirts, ethnic wear, and others.

Season Insights:

- Summer Wear

- Winter Wear

- All-Season Wear

A detailed breakup and analysis of the market based on the season have also been provided in the report. This includes summer wear, winter wear, and all-season wear.

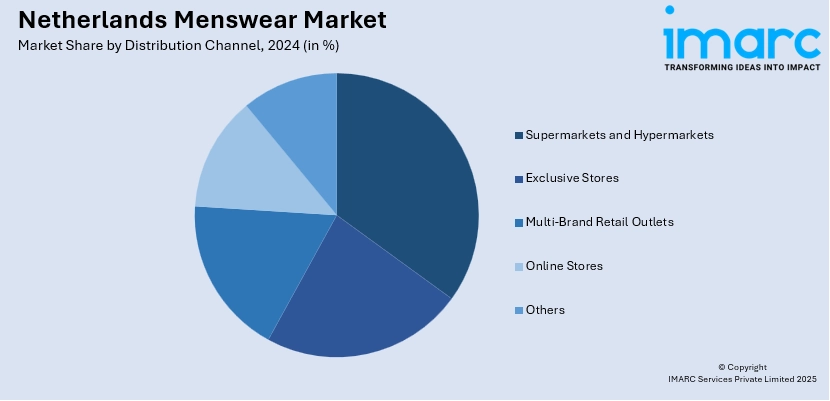

Distribution Channel Insights:

- Supermarkets and Hypermarkets

- Exclusive Stores

- Multi-Brand Retail Outlets

- Online Stores

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes supermarkets and hypermarkets, exclusive stores, multi-brand retail outlets, online stores, and others.

Province Insights:

- Noord-Holland

- Zuid-Holland

- Noord-Brabant

- Gelderland

- Utrecht

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Noord-Holland, Zuid-Holland, Noord-Brabant, Gelderland, Utrecht, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Netherlands Menswear Market News:

- In April 2025, High-end fashion brand rag & bone opened a new store in Amsterdam’s Canal District, marking its expansion in Europe. The three-floor location features a clean interior design with vintage furnishings and offers a range of men’s and women’s apparel, denim, accessories, bags, and shoes.

- In February 2025, Dutch menswear brand Marc Kappel is expanding globally, collaborating with international influencers and buyers to redefine modern gentlemen’s wardrobes. Known for its refined minimalism and premium craftsmanship, the brand aims to introduce its sophisticated designs to new markets, particularly in Asia, the Middle East, and North America.

Netherlands Menswear Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Trousers, Denims, Shirts and T-Shirts, Ethnic Wear, Others |

| Seasons Covered | Summer Wear, Winter Wear, All-Season Wear |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Exclusive Stores, Multi-Brand Retail Outlets, Online Stores, Others |

| Provinces Covered | Noord-Holland, Zuid-Holland, Noord-Brabant, Gelderland, Utrecht, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Netherlands menswear market performed so far and how will it perform in the coming years?

- What is the breakup of the Netherlands menswear market on the basis of product type?

- What is the breakup of the Netherlands menswear market on the basis of season?

- What is the breakup of the Netherlands menswear market on the basis of distribution channel?

- What is the breakup of the Netherlands menswear market on the basis of province?

- What are the various stages in the value chain of the Netherlands menswear market?

- What are the key driving factors and challenges in the Netherlands menswear market?

- What is the structure of the Netherlands menswear market and who are the key players?

- What is the degree of competition in the Netherlands menswear market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Netherlands menswear market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Netherlands menswear market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Netherlands menswear industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)