Netherlands Online Education Market Size, Share, Trends and Forecast by Type, Provider, Technology, End-User, and Province, 2025-2033

Netherlands Online Education Market Overview:

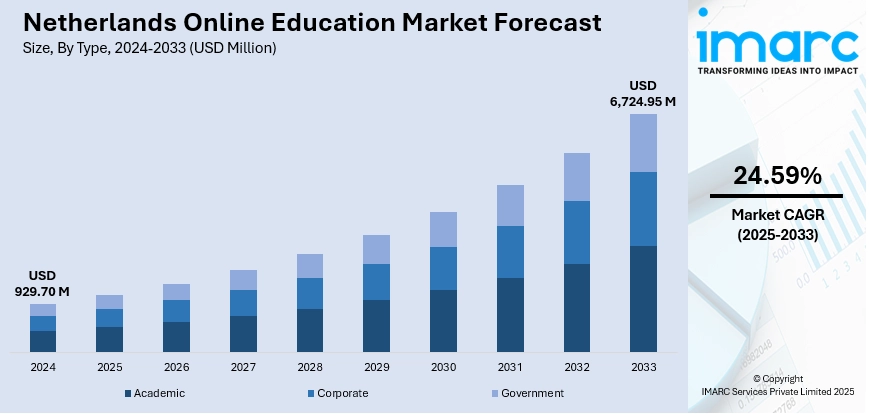

The Netherlands online education market size reached USD 929.70 Million in 2024. The market is projected to reach USD 6,724.95 Million by 2033, exhibiting a growth rate (CAGR) of 24.59% during 2025-2033. Growing demand for flexible learning, rising digital literacy, and government support for e-learning platforms are key drivers. Widespread adoption of hybrid and remote models among higher education institutions and private providers, along with technological advancements and AI integration further influence the Netherlands online education market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 929.70 Million |

| Market Forecast in 2033 | USD 6,724.95 Million |

| Market Growth Rate 2025-2033 | 24.59% |

Netherlands Online Education Market Trends:

Use of AI for Adaptive Learning

AI-driven personalization is a growing feature in the Netherlands online education market. Platforms are leveraging machine learning algorithms to adjust content difficulty, recommend resources, and give tailored feedback. Dutch universities and private providers are incorporating adaptive learning tools into core curricula, enhancing student retention and engagement. AI tutors, automated grading, and behavior analysis tools are also expanding, reducing faculty workload and improving learning outcomes. As education becomes more data-driven, these systems help identify knowledge gaps early. The integration of AI not only supports differentiated instruction but also attracts investment and innovation, contributing to long-term Netherlands online education market growth. For instance, in April 2025, Digital Bricks took part in the Dubai AI Festival 2025 as a Premium Bronze Sponsor. The company led a 60-minute roundtable on Responsible AI and presented its newest innovations during the event. The festival is part of Dubai AI Week, a global gathering centered on how AI is transforming work, education, and society.

To get more information on this market, Request Sample

Cross-Border Course Delivery

As per industry reports, international student enrolment in Dutch universities dropped 6% for 2024/25, ending years of growth. Vrije Universiteit Amsterdam saw a 23% fall, Groningen University 14%. Natural sciences dropped 13%, and language courses 17%. In response, Dutch online education providers are increasingly catering to international audiences to boost enrolment. Courses are being offered in English, with multilingual support and global accreditation. This trend aligns with the Netherlands’ reputation for high-quality, globally competitive education. Universities are building partnerships with platforms across Europe and Asia, expanding course reach and creating dual-certification options. The influx of international students into virtual classrooms enhances cultural exchange and peer learning. Cloud infrastructure, content localization, and digital credentialing are key enablers. As demand for accessible, borderless education increases, cross-border delivery strategies are becoming integral to the Netherlands online education market growth.

Netherlands Online Education Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country/province levels for 2025-2033. Our report has categorized the market based on type, provider, technology, and end-user.

Type Insights:

- Academic

- Higher Education

- Vocational Training

- K-12 Education

- Corporate

- Large Enterprises

- SMBs

- Government

The report has provided a detailed breakup and analysis of the market based on the type. This includes academic (higher education, vocational training, and K-12 education), corporate (large enterprises and SMBs), and government.

Provider Insights:

- Content

- Services

A detailed breakup and analysis of the market based on the provider have also been provided in the report. This includes content and services.

Technology Insights:

- Mobile E-Learning

- Rapid E-Learning

- Virtual Classroom

- Others

The report has provided a detailed breakup and analysis of the market based on the technology. This includes mobile e-learning, rapid e-learning, virtual classroom, and others.

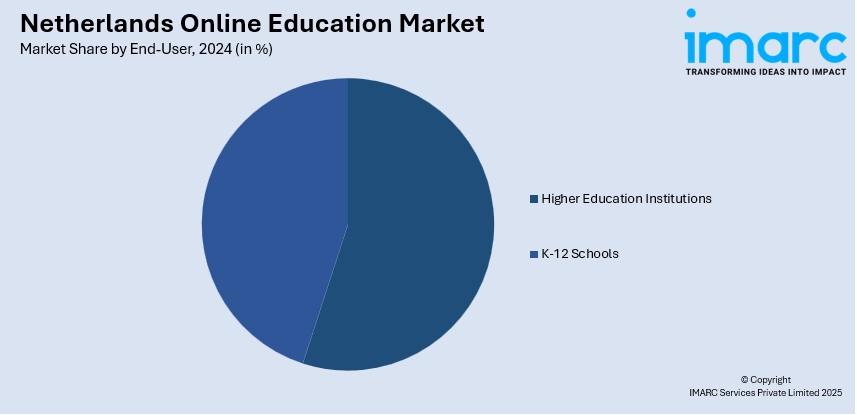

End-User Insights:

- Higher Education Institutions

- K-12 Schools

A detailed breakup and analysis of the market based on the end-user have also been provided in the report. This includes higher education institutions and k-12 schools.

Province Insights:

- Noord-Holland

- Zuid-Holland

- Noord-Brabant

- Gelderland

- Utrecht

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Noord-Holland, Zuid-Holland, Noord-Brabant, Gelderland, Utrecht, and Others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Netherlands Online Education Market News:

- In March 2025, the Btg Techniek en Gebouwde Omgeving launched a portal for digital educational resources in vocational education, as part of an MBO Raad and Npuls pilot running until June 2025. It offers centralized access to reusable learning materials for technical sectors. Schools like Talland College and ROC van Amsterdam are actively contributing. The initiative promotes flexible, tailored learning, supports lifelong development, and will later scale to other sectors. AI will help maintain updated content, ensuring ongoing relevance and accessibility in vocational training.

Netherlands Online Education Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered |

|

| Providers Covered | Content, Services |

| Technologies Covered | Mobile E-Learning, Rapid E-Learning, Virtual Classroom, Others |

| End-Users Covered | Higher Education Institutions, K-12 Schools |

| Provinces Covered | Noord-Holland, Zuid-Holland, Noord-Brabant, Gelderland, Utrecht, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Netherlands online education market performed so far and how will it perform in the coming years?

- What is the breakup of the Netherlands online education market on the basis of type?

- What is the breakup of the Netherlands online education market on the basis of provider?

- What is the breakup of the Netherlands online education market on the basis of technology?

- What is the breakup of the Netherlands online education market on the basis of end user?

- What is the breakup of the Netherlands online education market on the basis of province?

- What are the various stages in the value chain of the Netherlands online education market?

- What are the key driving factors and challenges in the Netherlands online education?

- What is the structure of the Netherlands online education market and who are the key players?

- What is the degree of competition in the Netherlands online education market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Netherlands online education market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Netherlands online education market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Netherlands online education industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)