Netherlands Online Travel Market Size, Share, Trends and Forecast by Service Type, Platform, Mode of Booking, Age Group, and Province, 2025-2033

Netherlands Online Travel Market Overview:

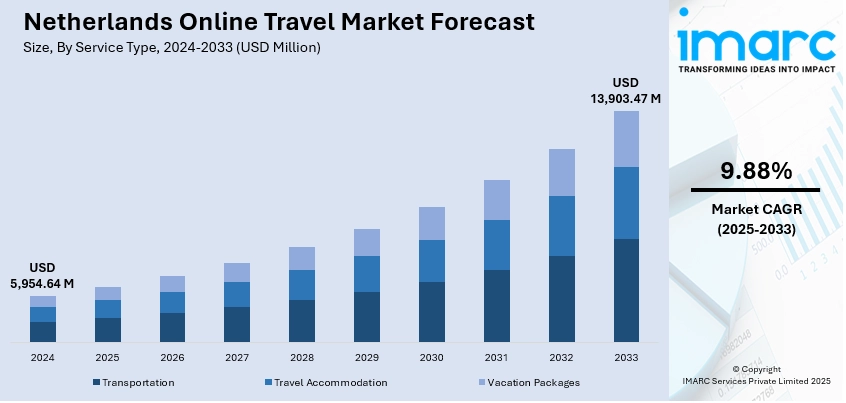

The Netherlands online travel market size reached USD 5,954.64 Million in 2024. The market is projected to reach USD 13,903.47 Million by 2033, exhibiting a growth rate (CAGR) of 9.88% during 2025-2033. The market continues to grow steadily, supported by increasing digital adoption, user-friendly mobile booking platforms, and intuitive consumer interfaces. Online booking is becoming more common with flights, accommodation, and holiday packages, as well as among younger consumers. Expansion is further fueled by the need for customized and adaptive travel planning regionally. With improving digital infrastructure and shifting consumer behavior, the market is poised to grow further. This report offers an analysis of the Netherlands online travel market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 5,954.64 Million |

| Market Forecast in 2033 | USD 13,903.47 Million |

| Market Growth Rate 2025-2033 | 9.88% |

Netherlands Online Travel Market Trends:

Contactless Payments Strengthen Digital Travel Experience

Digital payments are increasingly shaping how travelers plan and navigate their journeys in the Netherlands. Contactless options, including mobile wallets and tap-to-pay cards, have become standard across transportation services, accommodations, and tourism activities. The preference for seamless, cash-free transactions is supported by rapid advancements in fintech and strong user trust in digital platforms. In March 2025, a government update highlighted the integration of contactless systems across all major public transit networks, including metro, tram, and intercity trains. This upgrade not only facilitates faster commuting but also reducing reliance on physical tickets and currency exchanges, improving convenience for both domestic and international travelers. Hotels, museums, and attractions have also widely adopted QR code-based and mobile checkout systems, further simplifying the travel experience. The widespread use of digital payments also enables richer data insights, which can help travel platforms personalize services and improve customer satisfaction. As more businesses align with cashless infrastructure, this shift continues to contribute to Netherlands online travel market growth.

To get more information on this market, Request Sample

Legal and Consumer Pressure Drives Market Transparency

Increased legal scrutiny is pushing the Netherlands’ online travel sector toward greater transparency and consumer fairness. The travel market has been under pressure following legal action in June 2025 by Dutch consumer groups, targeting a major online travel platform over inflated hotel prices caused by contractual rate restrictions. This development has sparked wider debate about pricing transparency and the responsibilities of booking platforms. Although the case is still ongoing, it has already influenced several smaller platforms to remove restrictive clauses and adopt clearer pricing models. This shift is welcomed by hotels, which now have more flexibility in rate-setting, and by consumers, who are increasingly sensitive to hidden fees and booking conditions. Legal momentum, along with consumer demand for openness, is reshaping the competitive dynamics of the Dutch travel booking landscape. As travel platforms adjust their operations to align with fair-pricing expectations, user confidence is expected to rise. These regulatory and behavioral shifts are key indicators of evolving Netherlands online travel market trends.

Hybrid Travel Apps Expand Services Beyond Booking

Online travel platforms in the Netherlands are evolving into all-in-one ecosystems, offering more than just bookings. A growing number of apps now combine accommodation, transit options, city guides, dining recommendations, and event ticketing all within a single interface. This trend reflects travelers’ preference for consolidated services that reduce the need for multiple apps or websites. In May 2025, several Dutch travel apps introduced AI-powered travel assistants, offering real-time updates and itinerary suggestions based on user preferences and weather patterns. These innovations aim to increase traveler convenience and platform engagement. Additionally, such integrations help companies retain customers by offering end-to-end support, from planning to post-arrival assistance. This movement toward multi-functional platforms is being supported by strong mobile infrastructure and the rise of Gen Z and millennial users who prefer digital-first solutions. As these hybrid offerings mature, they are becoming a key competitive advantage in the travel tech space, signaling continued Netherlands online travel market.

Netherlands Online Travel Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on service type, platform, mode of booking, and age group.

Service Type Insights:

- Transportation

- Travel Accommodation

- Vacation Packages

The report has provided a detailed breakup and analysis of the market based on the service type. This includes transportation, travel accommodation, and vacation packages.

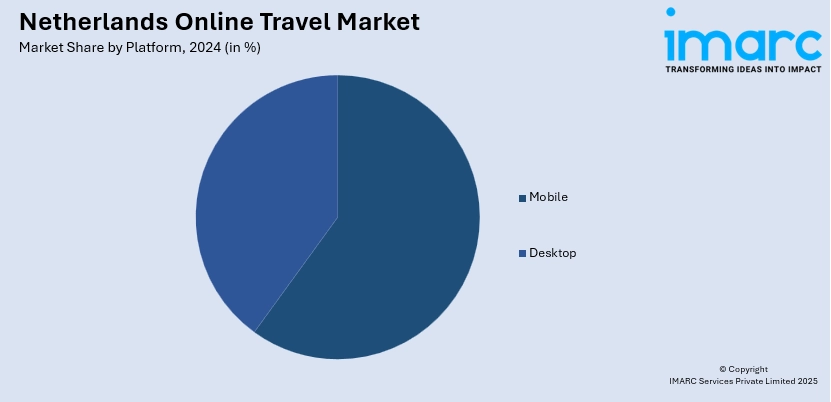

Platform Insights:

- Mobile

- Desktop

A detailed breakup and analysis of the market based on the platform have also been provided in the report. This includes mobile and desktop.

Mode of Booking Insights:

- Online Travel Agencies (OTAs)

- Direct Travel Suppliers

The report has provided a detailed breakup and analysis of the market based on the mode of booking. This includes online travel agencies (OTAs) and direct travel suppliers.

Age Group Insights:

- 22-31 Years

- 32-43 Years

- 44-56 Years

- Above 56 Years

A detailed breakup and analysis of the market based on the age group have also been provided in the report. This includes 22-31 years, 32-43 years, 44-56 years, and above 56 years.

Provincal Insights:

- Noord-Holland

- Zuid Holland

- Noord-Brabant

- Gelderland

- Utrecht

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Noord-Holland, Zuid Holland, Noord-Brabant, Gelderland, Utrecht, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Netherlands Online Travel Market News:

- January 2025: Dutch multinational Prosus has announced the acquisition of Despegar, a leading online travel agency in Latin America, marking a strategic move to expand its global footprint. The acquisition highlights the Netherlands-based company’s commitment to strengthening its presence in emerging markets through digital innovation and strategic partnerships. By leveraging Despegar’s established platform and regional expertise, Prosus aims to enhance its position in the international travel industry. This development also reflects the Netherlands’ growing influence in the global digital economy.

- January 2024: Royal Dutch event organiser Koninklijke Jaarbeurs will launch a new trade event, Travel & Tech, during Dutch Travel Week in January 2025. Hosted alongside the Vakantiebeurs Travel Trade Days in Utrecht, the two-day conference will spotlight digital transformation in travel, featuring sessions on AI, VR/AR, cybersecurity, marketing automation, and a start‑up zone showcasing emerging innovation. The initiative reinforces the Netherlands’ leadership in integrating advanced technology and sustainable practices within the global travel industry.

Netherlands Online Travel Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Service Types Covered | Transportation, Travel Accommodation, Vacation Packages. |

| Platforms Covered | Mobile, Desktop |

| Mode of Bookings Covered | Online Travel Agencies (OTAs), Direct Travel Suppliers |

| Age Groups Covered | 22-31 Years, 32-43 Years, 44-56 Years, Above 56 Years |

| Provinces Covered | Noord-Holland, Zuid Holland, Noord-Brabant, Gelderland, Utrecht, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Netherlands online travel market performed so far and how will it perform in the coming years?

- What is the breakup of the Netherlands online travel market on the basis of service type?

- What is the breakup of the Netherlands online travel market on the basis of platform?

- What is the breakup of the Netherlands online travel market on the basis of the mode of booking?

- What is the breakup of the Netherlands online travel market on the basis of age group?

- What is the breakup of the Netherlands online travel market on the basis of the region?

- What are the various stages in the value chain of the Netherlands online travel market?

- What are the key driving factors and challenges in the Netherlands online travel market?

- What is the structure of the Netherlands online travel market and who are the key players?

- What is the degree of competition in the Netherlands online travel market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Netherlands online travel market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Netherlands online travel market.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Netherlands online travel industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)