Netherlands Real Estate Market Size, Share, Trends and Forecast by Property, Business, Mode, and Region, 2025-2033

Netherlands Real Estate Market Overview:

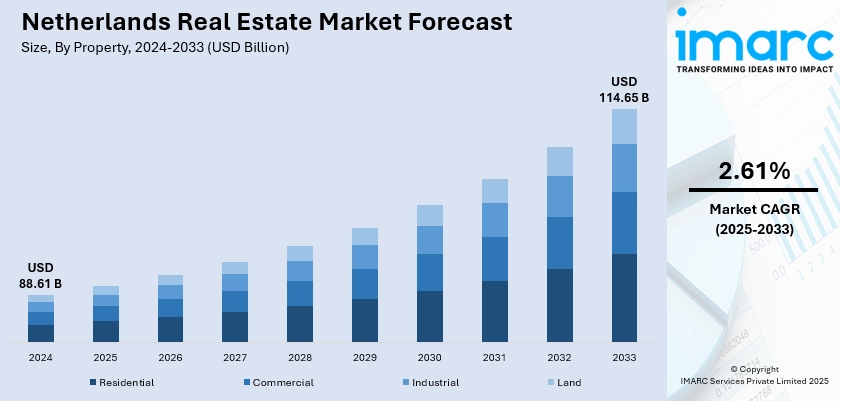

The Netherlands real estate market size reached USD 88.61 Billion in 2024. The market is projected to reach USD 114.65 Billion by 2033, exhibiting a growth rate (CAGR) of 2.61% during 2025-2033. The market is experiencing steady growth fueled by robust demand in residential and commercial sectors. Increased investments, coupled with supportive government policies, are driving this positive momentum. Urban development initiatives and sustainable building practices are also enhancing the sector’s appeal to investors and developers. These elements are gradually improving the Netherlands real estate market share, reflecting growing confidence and long-term potential across key regions. The outlook remains optimistic as infrastructure and housing demand continue to expand.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 88.61 Billion |

| Market Forecast in 2033 | USD 114.65 Billion |

| Market Growth Rate 2025-2033 | 2.61% |

Netherlands Real Estate Market Trends:

Rise of Sustainable Urban Housing Development

The Netherlands housing market is increasingly shaped by the rapid adoption of sustainable urban housing development, supported by ambitious national climate goals and strict EU energy regulations. Nearly Zero Energy Buildings (NZEB) have become the new standard for most new residential constructions, reducing operational carbon footprints dramatically. Dutch government programs such as the Energy Performance Compensation Scheme and Energiesprong retrofitting initiative encourage both new developments and upgrades of existing buildings to meet high energy-efficiency standards. Cities such as Amsterdam, Utrecht, and Rotterdam are seeing strong growth in sustainable housing projects that incorporate solar energy, superior insulation, heat pumps, and smart energy management systems. These sustainable developments are attracting middle-income buyers who value long-term affordability and lower energy bills. In parallel, institutional investors are increasing allocations to ESG-compliant real estate assets. This widespread shift toward sustainable urban housing strengthens long-term resilience and supports steady Netherlands real estate market growth in the coming years.

To get more information on this market, Request Sample

Expansion of Institutional-to-Owner Housing Conversions

A prominent trend shaping the Netherlands real estate market is the growing conversion of institutional rental portfolios into owner-occupied properties. Institutional investors, responding to evolving regulations and tightening rental yields, have been strategically selling portions of their rental holdings, making more properties available for purchase by Dutch households. As a result, the transaction volume rose by over 13% in 2024, with over 206,000 homes sold according to data from Kadaster. This shift has provided opportunities for first-time buyers and middle-income families to enter the market, especially in urban centers where supply remains limited. Additionally, mortgage rates have stabilized around 4%, enabling favorable borrowing conditions. This dynamic foster a healthier, more balanced ownership structure, reinforces transaction growth, and supports the long-term stability of the Netherlands housing market.

Growth of Energy-Efficient New-Build Construction

the Netherlands witnessed significant growth in energy efficient new build construction, driven by both European Union directives and national policies. The updated Energy Performance of Buildings Directive, passed in April, requires all new buildings to be solar energy ready and have a minimum energy performance level. To that end, the Dutch government implemented more stringent building codes that involve the installation of full-electric heat pumps in every new dwelling starting from January 2025. The efforts are complemented with government support in the form of subsidies for as much as thirty percent of the installation costs and interest-free loans. These initiatives are encouraging the adoption of advanced energy solutions in residential construction. Developers are increasingly incorporating solar panels, high performance insulation, and sustainable materials, while municipalities promote environmentally certified building practices. his alignment of regulatory frameworks and industry commitment is accelerating the development of energy efficient housing and is a key highlight of Netherlands real estate market trends.

Netherlands Real Estate Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on property, business, and mode

Property Insights:

- Residential

- Commercial

- Industrial

- Land

The report has provided a detailed breakup and analysis of the market based on the property. This includes residential, commercial, industrial, and land.

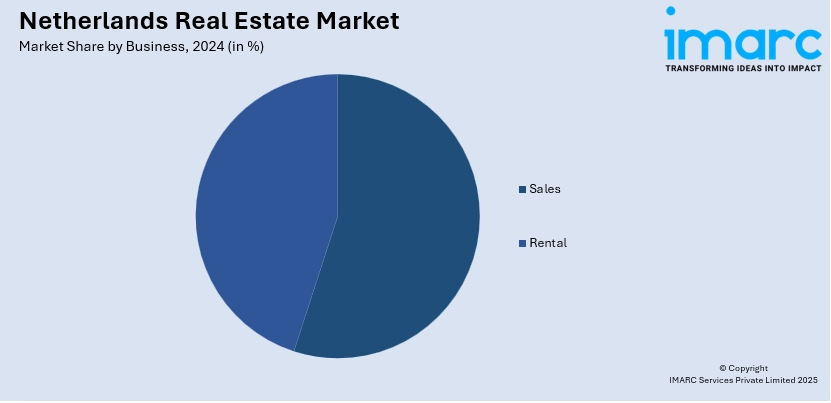

Business Insights:

- Sales

- Rental

A detailed breakup and analysis of the market based on the business have also been provided in the report. This includes sales and rental.

Mode Insights:

- Online

- Offline

A detailed breakup and analysis of the market based on the mode have also been provided in the report. This includes online and offline.

Regional Insights:

- Noord-Holland

- Zuid-Holland

- Noord-Brabant

- Gelderland

- Utrecht

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Noord-Holland, Zuid-Holland, Noord-Brabant, Gelderland, Utrecht, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Netherlands Real Estate Market News:

- In February 2025: Dutch Real Estate Company (DREC) is expanding confidently into Dubai’s dynamic property market, recognizing the city’s growing appeal for international investors. This strategic move aligns with increasing demand from Dutch nationals exploring global investment opportunities. Dubai’s vibrant economy, favorable regulations, and modern infrastructure create an ideal environment for growth.

- In May 2025: Nexera has partnered with Propchain to launch compliant on-chain real estate and ethical yield products. The collaboration integrates Propchain’s tokenized real estate offerings into Nexera Chain, utilizing its compliance infrastructure and regulatory standards. Both companies also plan to co-develop Shariah-compliant financial instruments, offering transparent and values-driven investment solutions.

Netherlands Real Estate Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Properties Covered | Residential, Commercial, Industrial, Land |

| Businesses Covered | Sales, Rental |

| Modes Covered | Online, Offline |

| Regions Covered | Noord-Holland, Zuid-Holland, Noord-Brabant, Gelderland, Utrecht, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Netherlands real estate market performed so far and how will it perform in the coming years?

- What is the breakup of the Netherlands real estate market on the basis of property?

- What is the breakup of the Netherlands real estate market on the basis of business?

- What is the breakup of the Netherlands real estate market on the basis of mode?

- What is the breakup of the Netherlands real estate market on the basis of region?

- What are the various stages in the value chain of the Netherlands real estate market?

- What are the key driving factors and challenges in the Netherlands real estate?

- What is the structure of the Netherlands real estate market and who are the key players?

- What is the degree of competition in the Netherlands real estate market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Netherlands real estate market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Netherlands real estate market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Netherlands real estate industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)