Netherlands Shrimp Market Size, Share, Trends and Forecast by Environment, Species, Shrimp Size, Distribution Channel, and Province, 2025-2033

Netherlands Shrimp Market Overview:

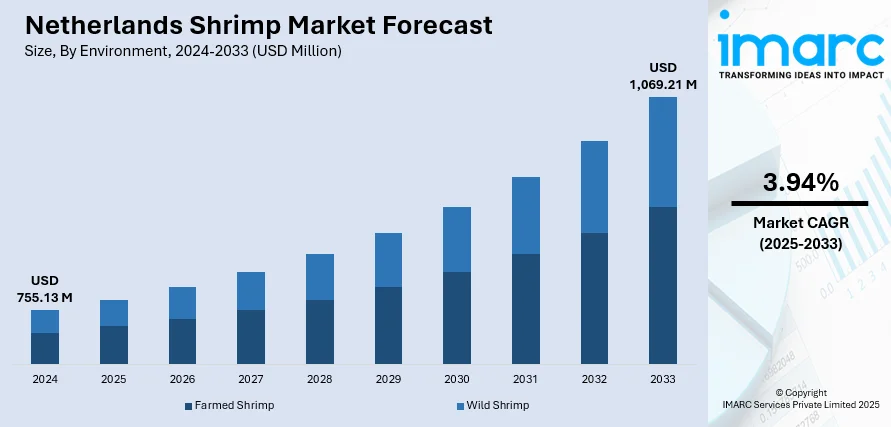

The Netherlands shrimp market size reached USD 755.13 Million in 2024. The market is projected to reach USD 1,069.21 Million by 2033, exhibiting a growth rate (CAGR) of 3.94% during 2025-2033. Growing preference for eco-certified seafood, modern processing, and convenient meal options continues to strengthen local supply. Producers benefit from steady demand for fresh, traceable shrimp and rising interest in premium packs, supporting Netherlands shrimp market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 755.13 Million |

| Market Forecast in 2033 | USD 1,069.21 Million |

| Market Growth Rate 2025-2033 | 3.94% |

Netherlands Shrimp Market Trends:

Push for Responsible Shrimp Sourcing

The demand for responsibly sourced seafood is shaping the direction of the Netherlands shrimp market growth. Buyers across retail and hospitality now expect clear proof of responsible practices that protect marine life and ensure fair working conditions. Local producers have begun improving hatchery setups and using enclosed farming systems to secure steady supply and meet strict buyer requirements. Restaurants and shops advertise origin and handling details to build trust. Better storage and transport methods with low emissions are helping keep shrimp fresh and limit losses. Many farms are testing new feeds and moving away from heavy antibiotic use to attract eco-aware buyers. Smaller farmers are teaming up to share the cost of modern gear and certification. As weather shifts and trade checks affect shrimp imports from Asian suppliers, local producers see more chances to fill that gap. Home delivery services for seafood are also gaining traction, creating extra sales channels. These changes are giving domestic suppliers an edge with European buyers who expect clean, traceable seafood from trusted sources. The move toward greener production and clearer labeling is slowly strengthening local supply and boosting shipments abroad.

To get more information on this market, Request Sample

Shift Toward Ready-to-Use Shrimp

Processing companies in the Netherlands are turning their focus to shrimp products that save time for shoppers. Basic frozen packs are giving way to seasoned portions, quick-cook mixes, and snack-sized options aimed at busy households. This reflects a wider trend where people want meals they can prepare fast without sacrificing taste. Larger factories now use advanced equipment to clean, sort, and pack shrimp with minimal manual steps. Many firms work closely with big retail brands to supply store-label packs that highlight Dutch sourcing. Special offers and tie-ins with chefs help promote these premium products both at home and in export markets. Packaging is changing too, with more recyclable and reusable materials in line with EU targets for less plastic waste. Some firms are testing smart packaging that keeps shrimp fresh for longer on the shelf. Companies monitor food safety rules carefully to make sure labeling and additives meet current standards for smooth shipping. Continued investment in better machinery and skills training is helping factories keep quality consistent. These steps protect the country’s role as a reliable shrimp supplier, especially for nearby nations that depend on Dutch shrimp for ready meals and food service orders.

Netherlands Shrimp Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional level for 2025-2033. Our report has categorized the market based on environment, species, shrimp size, and distribution channel.

Environment Insights:

- Farmed Shrimp

- Wild Shrimp

The report has provided a detailed breakup and analysis of the market based on the environment. This includes farmed shrimp and wild shrimp.

Species Insights:

- Penaeus Vannamei

- Penaeus Monodon

- Macrobrachium Rosenbergii

- Others

The report has provided a detailed breakup and analysis of the market based on the species. This includes penaeus vannamei, penaeus monodon, macrobrachium rosenbergii, and others.

Shrimp Size Insights:

- <21

- 21-25

- 26-30

- 31-40

- 41-50

- 51-60

- 61-70

- >70

The report has provided a detailed breakup and analysis of the market based on the shrimp size. This includes <21, 21-25, 26-30, 31-40, 41-50, 51-60, 61-70, and >70.

Distribution Channel Insights:

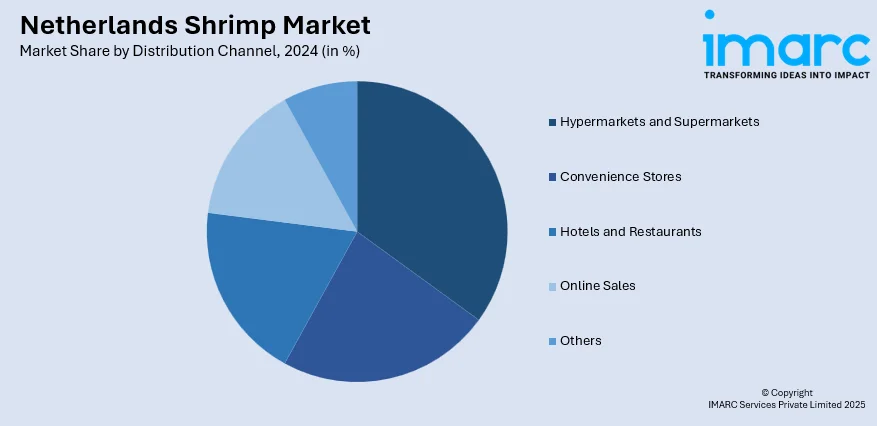

- Hypermarkets and Supermarkets

- Convenience Stores

- Hotels and Restaurants

- Online Sales

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes hypermarkets and supermarkets, convenience stores, hotels and restaurants, online sales, and others.

Provincial Insights:

- Noord-Holland

- Zuid-Holland

- Noord-Brabant

- Gelderland

- Utrecht

- Others

The report has also provided a comprehensive analysis of all the major provincial markets, which include Noord-Holland, Zuid-Holland, Noord-Brabant, Gelderland, Utrecht, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Netherlands Shrimp Market News:

- September 2024: Albert Heijn launched the Netherlands’ first farmed shrimp with higher welfare standards and a reduced marine footprint. This move, developed through years of supply chain collaboration, strengthened sustainable practices in the Dutch shrimp market and set a new benchmark for responsible seafood sourcing.

- August 2024: The AI-powered app Kampi was introduced at the Global Shrimp Forum in Utrecht, Netherlands. Developed by Canadian and Ecuadorian experts, it improved shrimp farm management through dynamic precision farming, boosting efficiency, sustainability, and real-time decision-making in the global shrimp sector.

Netherlands Shrimp Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Environments Covered | Farmed Shrimp, Wild Shrimp |

| Species Covered | Penaeus Vannamei, Penaeus Monodon, Macrobrachium Rosenbergii, Others |

| Shrimp Sizes Covered | <21, 21-25, 26-30, 31-40, 41-50, 51-60, 61-70, >70 |

| Distribution Channels Covered | Hypermarkets and Supermarkets, Convenience Stores, Hotels and Restaurants, Online Sales, Others |

| Provinces Covered | Noord-Holland, Zuid-Holland, Noord-Brabant, Gelderland, Utrecht, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Netherlands shrimp market performed so far and how will it perform in the coming years?

- What is the breakup of the Netherlands shrimp market on the basis of environment?

- What is the breakup of the Netherlands shrimp market on the basis of species?

- What is the breakup of the Netherlands shrimp market on the basis of shrimp size?

- What is the breakup of the Netherlands shrimp market on the basis of distribution channel?

- What is the breakup of the Netherlands shrimp market on the basis of provinces?

- What are the various stages in the value chain of the Netherlands shrimp market?

- What are the key driving factors and challenges in the Netherlands shrimp market?

- What is the structure of the Netherlands shrimp market and who are the key players?

- What is the degree of competition in the Netherlands shrimp market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Netherlands shrimp market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Netherlands shrimp market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Netherlands shrimp industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)