Netherlands Toys Market Size, Share, Trends and Forecast by Product Type, Age Group, Sales Channel, and Region, 2025-2033

Netherlands Toys Market Overview:

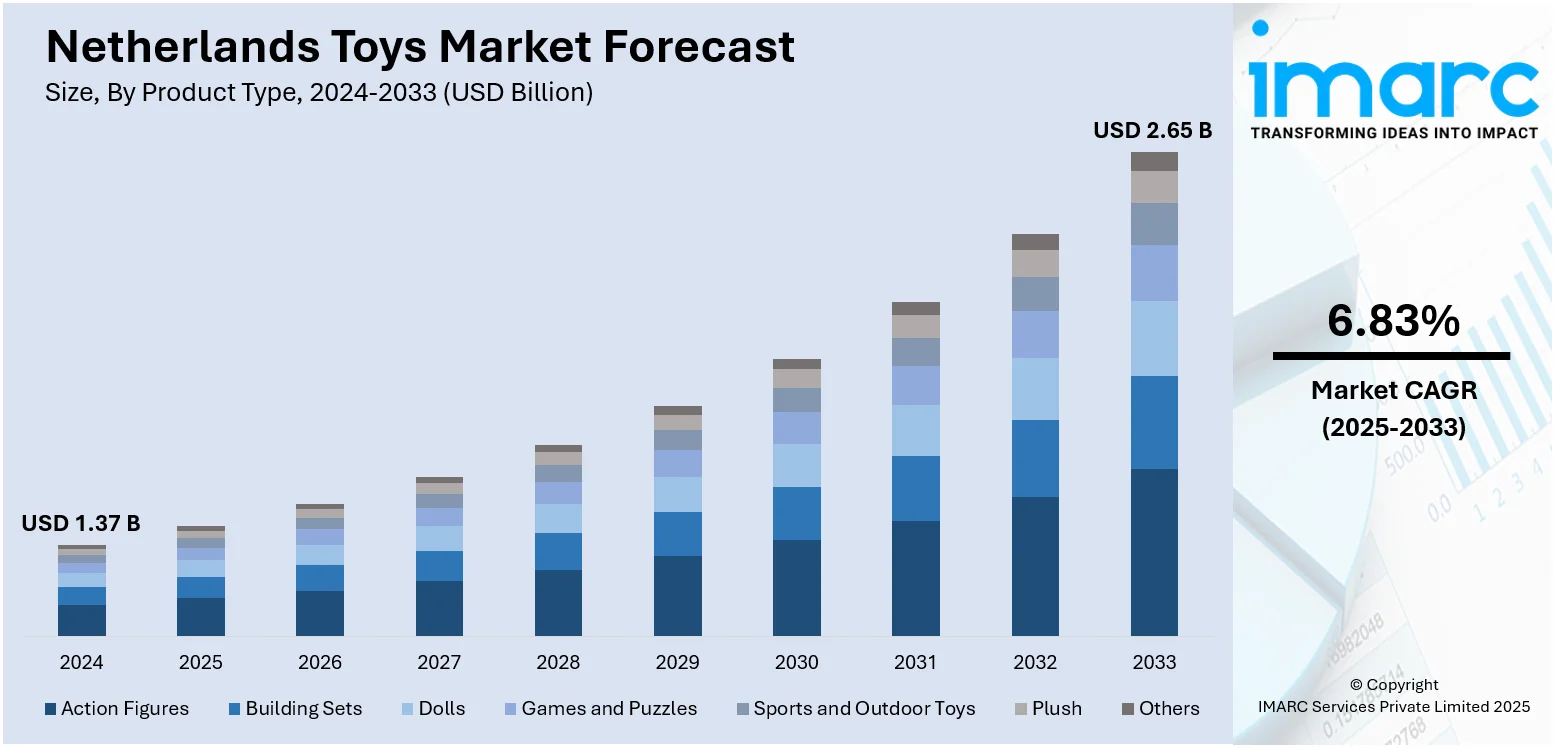

The Netherlands Toys market size reached USD 1.37 Billion in 2024. The market is projected to reach USD 2.65 Billion by 2033, exhibiting a growth rate (CAGR) of 6.83% during 2025-2033. The market is witnessing steady growth, fueled by rising interest in educational and skill-building products. STEM toys, digital learning tools, and interactive games are becoming increasingly popular among parents seeking meaningful playtime for their children. Retailers are enhancing online platforms while maintaining strong in-store experiences to meet diverse consumer preferences. Sustainability remains a key focus, with eco-friendly materials gaining traction. These combined factors are playing a crucial role in boosting the Netherlands toys market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.37 Billion |

| Market Forecast in 2033 | USD 2.65 Billion |

| Market Growth Rate 2025-2033 | 6.83% |

Netherlands Toys Market Trends:

Blending Digital Convenience with In-Store Engagement

Dutch toy companies are successfully bridging the gap between online convenience and in-store experience, meeting modern consumer expectations. In July 2024, a major collectible brand inaugurated its first permanent flagship store in Amsterdam’s Kalverstraat, complementing its established digital storefront illustrating a broader shift toward omni-channel retail. Shoppers research products and read reviews online, then visit the physical store to evaluate items in person or attend live events. At the same time, digital platforms offer real-time inventory, click‑and‑collect, and fast home delivery options. This hybrid model satisfies both the need for immediacy and the desire for hands‑on evaluation. Importantly, this approach is supported by local government grants under the Retail Innovation Programme, which encourages investments in technology-enabled retail experiences. By aligning store investments with government-supported digital tools, toy companies are enhancing shopper convenience, increasing footfall to strategic locations, and improving conversion rates. As this unified retail strategy becomes widespread, it is emerging as a key pillar of Netherlands toys market growth, strengthening company resilience and enriching consumer experiences in a digitally connected market.

To get more information on this market, Request Sample

Circular Design Drives Sustainable Toy Innovation

Toy manufacturers in the Netherlands are increasingly adopting circular design principles, responding to both consumer demand and national sustainability goals. In March 2025, several companies endorsed the Toy Circularity Charter, aligning with the Dutch government’s Circular Economy programme aimed at reducing resource usage by 50% by 2030 and achieving full circularity by 2050. Under this charter, toys are designed for recyclability and reparability using materials like FSC-certified wood, recycled plastics, and modular components. Retailers support this movement through in-store recycling kiosks and dedicated eco-toy sections, enabling families to return used toys for refurbishment. Local municipalities organize toy swap days that coincide with national circularity efforts. By integrating policy frameworks into toy design, companies are reinforcing corporate responsibility while reducing waste. As eco-conscious play continues gaining traction, this sustainable shift anchors itself in Netherlands toys market trends, promoting longevity, reuse, and environmental stewardship all while supporting long-term sector growth.

Personalized Rewards through Loyalty Apps

Dutch toy companies are responding to modern purchasing preferences by adopting personalized loyalty programs integrated across digital and in-store experiences. In June 2024, Flying Tiger Copenhagen introduced its “Customer Club” mobile app in the Netherlands, offering loyalty rewards, personalized offers, and mobile-exclusive promotions rapidly becoming a case study in omnichannel success within the retail sector. This app demonstrates how reward-driven shopping can be tailored specifically to consumers’ behavior, boosting customer satisfaction and reinforcing brand loyalty. Features like QR-code-enabled offers in toy stores, integrated earn-and-redeem points for family purchases, and exclusive access to seasonal content or DIY toy tutorials have made loyalty integration more engaging for parents and kids alike. This initiative is supported by the national Retail Innovation Fund, which co-finances digital transformation in customer-facing services. The combined effect of personalized rewards, mobile convenience, and strategic public funding is now a significant driver of Netherlands Toys market growth, encouraging toy companies to deepen digital cohesion and drive repeat business.

Netherlands Toys Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product type, age group, and sales channel.

Product Type Insights:

- Action Figures

- Building Sets

- Dolls

- Games and Puzzles

- Sports and Outdoor Toys

- Plush

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes action figures, building sets, dolls, games and puzzles, sports and outdoor toys, plush, and others.

Age Group Insights:

- Up to 5 Years

- 5 to 10 Years

- Above 10 Years

A detailed breakup and analysis of the market based on the age group have also been provided in the report. This includes up to 5 years, 5 to 10 years, and above 10 years.

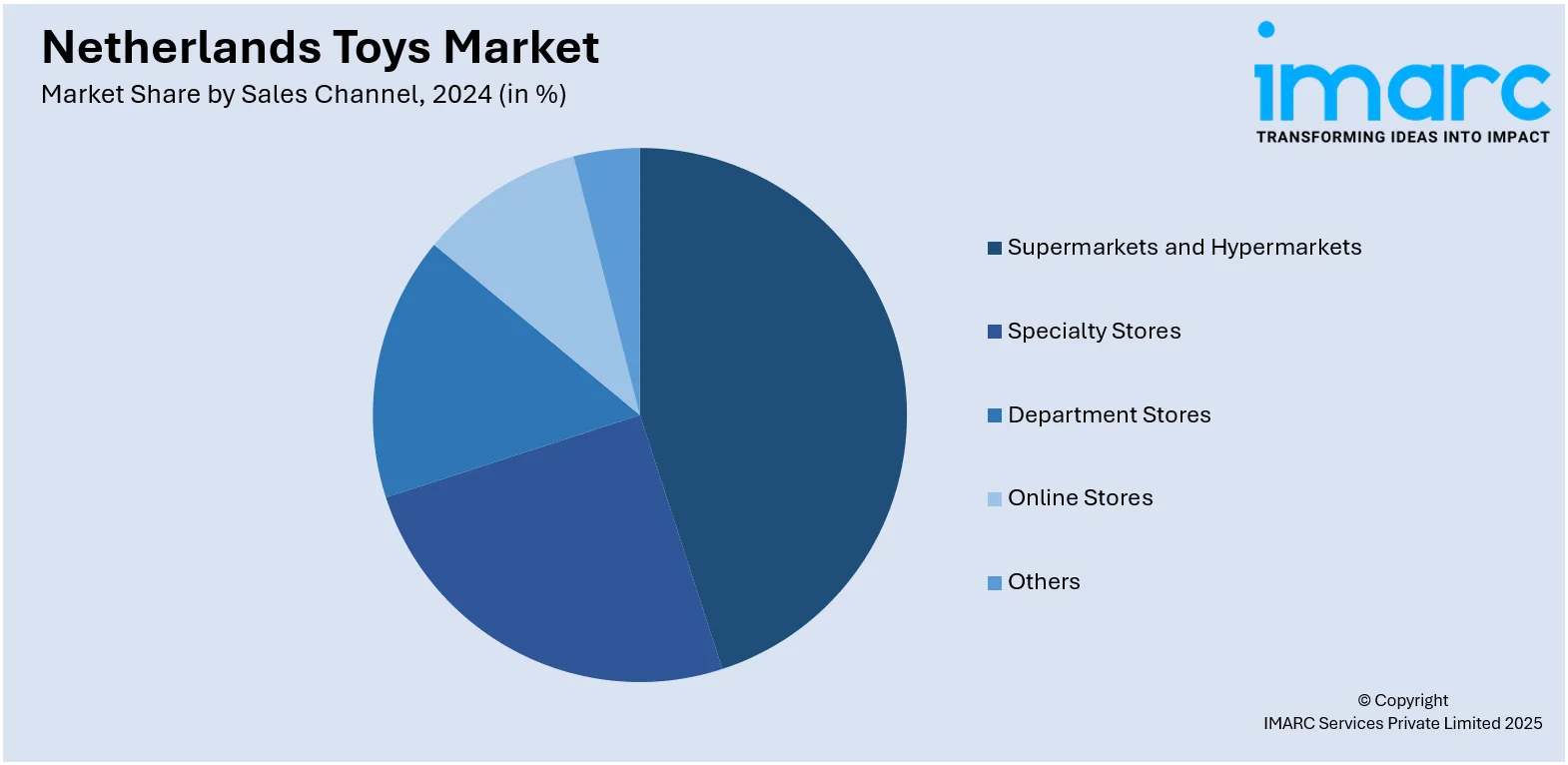

Sales Channel Insights:

- Supermarkets and Hypermarkets

- Specialty Stores

- Department Stores

- Online Stores

- Others

A detailed breakup and analysis of the market based on the sales channel have also been provided in the report. This includes supermarkets and hypermarkets, specialty stores, department stores, online stores, and others.

Regional Insights:

- Noord-Holland

- Zuid-Holland

- Noord-Brabant

- Gelderland

- Utrecht

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Noord-Holland, Zuid-Holland, Noord-Brabant, Gelderland, Utrecht, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Netherlands Toys Market News:

- July 2024: Belgian‑Chinese collectible toy brand Pop Mart has opened its first permanent store in the Netherlands, launching a 67 m² flagship in Amsterdam’s Kalverstraat on July 13, 2024. The location showcases a wide range of designer toys, limited‑edition releases and exclusive collectibles—all part of Pop Mart’s aggressive European expansion following recent openings in London, Paris and Milan. This Amsterdam store strengthens the brand’s position in the Benelux region and brings its curated “blind‑box” collector‑centric experience to Dutch fans permanently.

- October 2024: Belgian toy retailer ToyChamp has completed the acquisition of Intertoys' Dutch stores, securing 95.1% ownership of the business. With this move, ToyChamp significantly strengthens its presence in the Benelux toy market, adding Intertoys' 220 outlets to its existing portfolio. Both ToyChamp and Intertoys will continue to operate under their current formats, with no changes to management or staff. The acquisition positions ToyChamp as a key player in the region’s toy retail sector, pending final regulatory approval.

Netherlands Toys Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Action Figures, Building Sets, Dolls, Games and Puzzles, Sports and Outdoor Toys, Plush, Others |

| Age Groups Covered | Up to 5 Years, 5 to 10 Years, Above 10 Years |

| Sales Channels Covered | Supermarkets and Hypermarkets, Specialty Stores, Department Stores, Online Stores, Others |

| Regions Covered | Noord-Holland, Zuid-Holland, Noord-Brabant, Gelderland, Utrecht, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Netherlands toys market performed so far and how will it perform in the coming years?

- What is the breakup of the Netherlands toys market on the basis of product type?

- What is the breakup of the Netherlands toys market on the basis of age group?

- What is the breakup of the Netherlands toys market on the basis of sales channel?

- What is the breakup of the Netherlands toys market on the basis of region?

- What are the various stages in the value chain of the Netherlands toys market?

- What are the key driving factors and challenges in the Netherlands toys?

- What is the structure of the Netherlands toys market and who are the key players?

- What is the degree of competition in the Netherlands toys market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Netherlands toys market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Netherlands toys market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Netherlands toys industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)