Netherlands Vegetable Oil Market Size, Share, Trends and Forecast by Oil Type, Application, and Province, 2025-2033

Netherlands Vegetable Oil Market Overview:

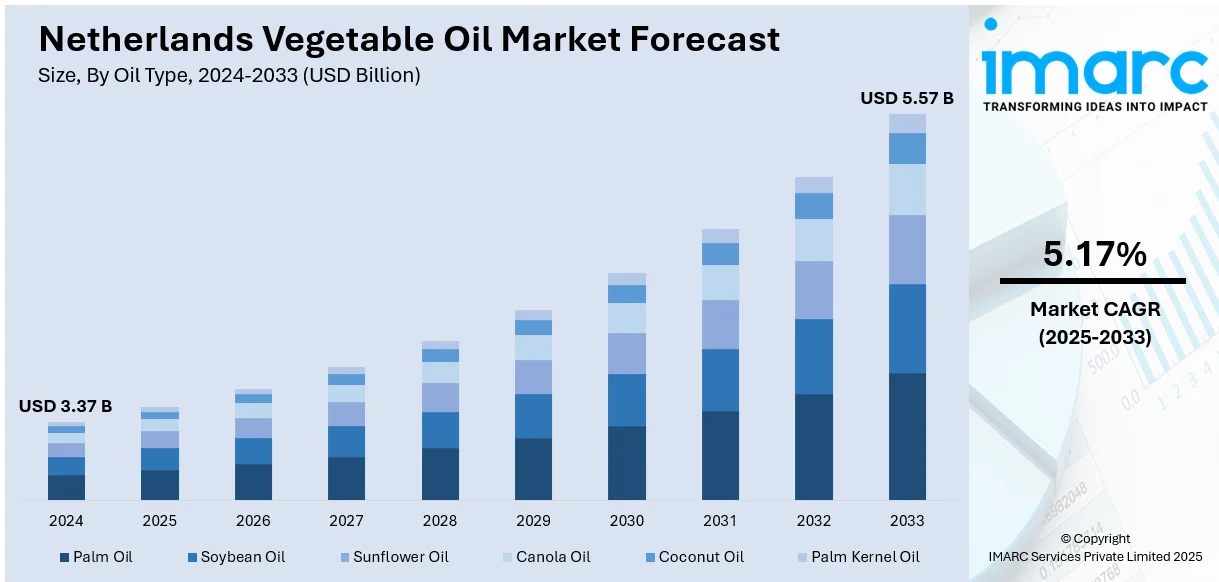

The Netherlands vegetable oil market size reached USD 3.37 Billion in 2024. Looking forward, the market is projected to reach USD 5.57 Billion by 2033, exhibiting a growth rate (CAGR) of 5.17% during 2025-2033. The market is driven by the Netherlands’ status as a processing and re-export hub for vegetable oils, serving EU and global supply chains. Domestic consumers increasingly demand health-conscious, sustainable oils, prompting market segmentation and innovation. Circular economy policies and traceable, certified sourcing are further augmenting the Netherlands vegetable oil market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 3.37 Billion |

| Market Forecast in 2033 | USD 5.57 Billion |

| Market Growth Rate 2025-2033 | 5.17% |

Netherlands Vegetable Oil Market Trends:

Major Agro-Processing and Re-Export Hub

The Netherlands is one of Europe’s leading agro-logistics and food processing centers, playing a dual role as both a consumer and distributor of vegetable oils. Rotterdam hosts some of the largest edible oil refineries and terminals in Europe, handling vast quantities of soybean, palm, rapeseed, and sunflower oil for domestic use and export. These oils are refined for use in processed foods, margarine, sauces, and bakery goods before being re-exported to EU and non-EU markets. The country’s logistical strengths, dense transport infrastructure, advanced cold chain logistics, and world-class port efficiency, enable smooth flows of oil from global suppliers to European industries. Dutch refineries apply advanced processing technologies to produce specialized and value-added oils, including low-trans-fat and high-stability variants suitable for large-scale manufacturing. Multinational food producers such as Unilever and FrieslandCampina anchor their production in the Netherlands, sourcing refined oils locally for their European and global operations. As a result, oil demand is not limited to domestic consumption but embedded in export-oriented processed food chains. The Netherlands vegetable oil market growth is sustained by this strong industrial base and the country’s strategic role in Europe’s food supply chain.

To get more information on this market, Request Sample

Health-Conscious Consumer Behavior and Retail Premiumization

Dutch consumers increasingly prioritize nutritional quality, ingredient traceability, and environmental impact when purchasing cooking oils. Rapeseed and sunflower oils are the most popular household choices due to their balanced fat profiles and affordability. However, there is rising interest in specialty oils such as cold-pressed flaxseed, walnut, and organic olive oil, particularly among younger, health-oriented urban populations. Supermarkets and organic food stores promote these oils as part of the broader trend toward clean-label and sustainable consumption. Brands that emphasize “non-GMO,” “free from trans fats,” or “high omega-3” attract consumers looking to align food choices with wellness goals. Food bloggers, nutritional coaches, and digital platforms further drive awareness, recommending certain oils for salads, low-heat cooking, or supplementation. Dutch consumers also exhibit a willingness to pay premium prices for imported oils with traceable origins and eco-friendly packaging. E-commerce platforms now offer curated selections of artisanal oils, further expanding consumer access to niche products. These changing patterns of health-conscious consumption are reshaping the domestic oil landscape and driving market segmentation, resulting in demand for innovation and diversification across retail shelves and culinary applications.

Circular Economy and Sustainable Sourcing Policies

Sustainability is central to the Netherlands’ national food strategy, and the vegetable oil market is increasingly shaped by eco-regulatory frameworks and corporate ESG commitments. Palm oil usage, once controversial due to deforestation concerns, is now almost entirely certified sustainable (RSPO) within the country’s supply chain, driven by NGO pressure and proactive industry alignment. The Dutch government, in collaboration with industry coalitions, supports initiatives promoting traceability, carbon footprint reduction, and circular production models. Used cooking oil (UCO) collection is widespread and repurposed in the biodiesel sector, aligning with EU targets for renewable energy and reducing waste. Food manufacturers are also reformulating recipes to meet green labeling criteria and climate-related product disclosures. In this context, the vegetable oil market is increasingly defined by transparency, reuse, and sustainable land use practices. Research institutions and startups are also innovating with algae oil and fermentation-based alternatives, integrating biotech into the edible oil supply chain. These eco-centric developments are not only in response to regulation but also to consumer expectations around climate impact and ethical sourcing. Sustainability as a market driver reinforces long-term competitiveness and resilience for vegetable oils in the Netherlands.

Netherlands Vegetable Oil Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on oil type and application.

Oil Type Insights:

- Palm Oil

- Soybean Oil

- Sunflower Oil

- Canola Oil

- Coconut Oil

- Palm Kernel Oil

The report has provided a detailed breakup and analysis of the market based on the oil type. This includes palm oil, soybean oil, sunflower oil, canola oil, coconut oil, and palm kernel oil.

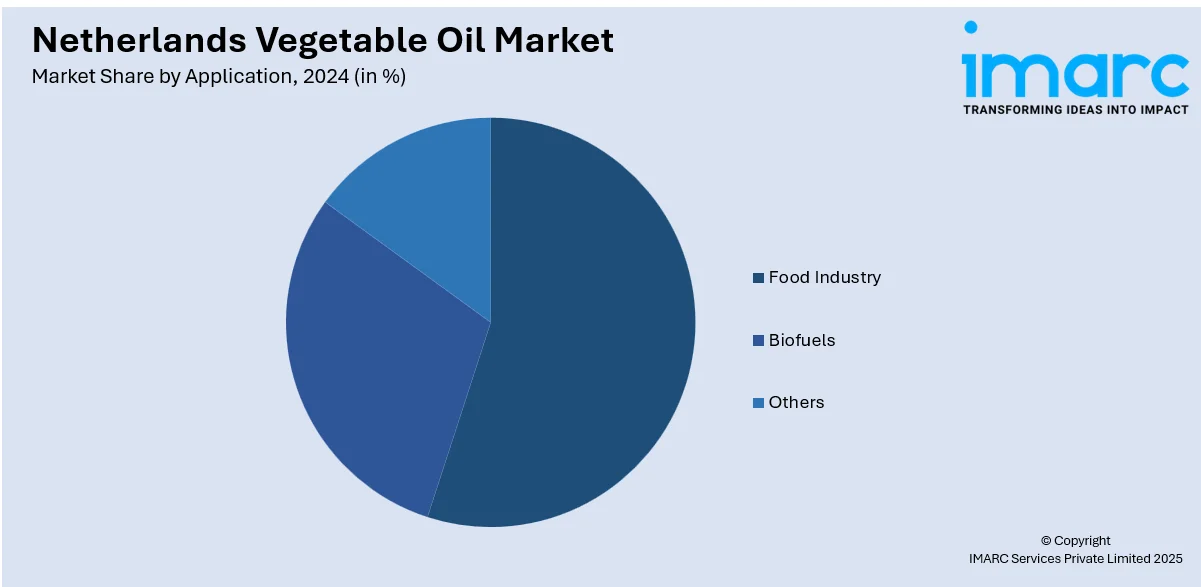

Application Insights:

- Food Industry

- Biofuels

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes food industry, biofuels, and others.

Province Insights:

- Noord-Holland

- Zuid-Holland

- Noord-Brabant

- Gelderland

- Utrecht

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Noord-Holland, Zuid-Holland, Noord-Brabant, Gelderland, Utrecht, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Netherlands Vegetable Oil Market News:

- On January 23, 2024, Golden Agri-Resources (GAR) announced a multi-year strategic partnership with Netherlands-based Verborg Group for the exclusive supply of over one million tons of tropical oils, including Crude Palm Oil, Crude Palm Kernel Oil, and Coconut Oil. Verborg Group’s state-of-the-art vegetable oil refinery in Farmsum, equipped with 60,000m³ of storage capacity and advanced logistics infrastructure, is set to begin operations in late January 2024. This collaboration significantly enhances the Netherlands' role as a refined vegetable oil hub in Europe.

- On September 10, 2024, the 3rd Sustainable Vegetable Oils Conference was held in Rotterdam, The Netherlands, with over 250 participants from 16 countries, including industry leaders and international organizations such as the FAO, WTO, and IRENA. The event emphasized innovation, sustainability, and inclusivity in the vegetable oils sector, particularly in light of the upcoming European Union Deforestation Regulation (EUDR).

Netherlands Vegetable Oil Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Oil Types Covered | Palm Oil, Soybean Oil, Sunflower Oil, Canola Oil, Coconut Oil, Palm Kernel Oil |

| Applications Covered | Food Industry, Biofuels, Others |

| Provinces Covered | Noord-Holland, Zuid-Holland, Noord-Brabant, Gelderland, Utrecht, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Netherlands vegetable oil market performed so far and how will it perform in the coming years?

- What is the breakup of the Netherlands vegetable oil market on the basis of oil type?

- What is the breakup of the Netherlands vegetable oil market on the basis of application?

- What is the breakup of the Netherlands vegetable oil market on the basis of province?

- What are the various stages in the value chain of the Netherlands vegetable oil market?

- What are the key driving factors and challenges in the Netherlands vegetable oil market?

- What is the structure of the Netherlands vegetable oil market and who are the key players?

- What is the degree of competition in the Netherlands vegetable oil market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Netherlands vegetable oil market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Netherlands vegetable oil market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Netherlands vegetable oil industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)