Network as a Service Market Size, Share, Trends and Forecast by Type, Application, End Use Industry, and Region, 2025-2033

Network as a Service Market 2024, Size and Trends:

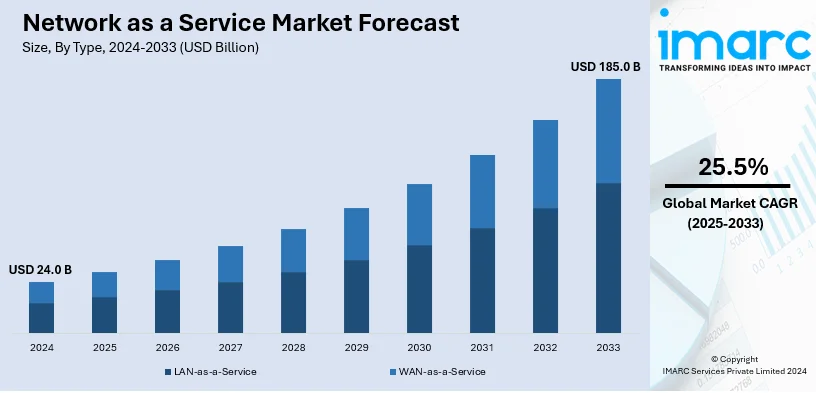

The global network as a service market size was valued at USD 24.0 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 185.0 Billion by 2033, exhibiting a CAGR of 25.5% from 2025-2033. North America currently dominates the market, holding a market share of over 41.4% in 2024. The growing demand for scalable, flexible, and cost-effective networking solutions, heightened need for real-time data processing, and rising focus on maintaining seamless communication across various industries are major factors boosting the network as a service market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 24.0 Billion |

| Market Forecast in 2033 | USD 185.0 Billion |

| Market Growth Rate 2025-2033 | 25.5% |

The network as a service (NaaS) market growth is significantly driven by the move to cloud computing among companies. Businesses are increasingly adopting cloud-based infrastructure for their IT needs at present. Traditional hardware-based networks require high capital investment and ongoing maintenance, which are becoming less viable for organizations seeking agility, scalability, and cost-efficiency. Cloud-based network services offered via NaaS enable companies to scale their network resources up depending on their needs, thereby lowering operational costs. Software-Defined Networking (SDN) plays a pivotal role in the NaaS ecosystem. SDN enables network operators to centrally control and manage their networks through software, providing a more flexible and programmable approach to networking compared to traditional hardware-based networks. This flexibility is one of the core tenets of NaaS, as it allows businesses to dynamically adjust network configurations and services as needed.

The United States has emerged as a key region for the NaaS market owing to the rapid digital transformation of businesses. As companies move their operations to the cloud, they require flexible and scalable networking solutions that can handle the demands of cloud-based services and distributed systems. Traditional on-premises networking solutions, with their capital-intensive infrastructure, are increasingly becoming less viable for businesses that require agility, cost-efficiency, and the ability to scale quickly. The proliferation of the internet of things (IoT) is supporting the growth of the market in the US. With billions of connected devices expected to be deployed in the coming years, managing the resulting network traffic and ensuring seamless connectivity are becoming increasingly complex. Traditional networks are often ill-equipped to handle the massive volume of data generated by IoT devices, which include everything from sensors and wearables to smart home devices and industrial equipment. As per the predictions of the IMARC Group, the United States IoT integration market is expected to exhibit a growth rate (CAGR) of 27% during 2024-2032.

Network as a Service Market Trends:

Growing Demand for Scalability and Flexibility

NaaS solutions are fundamental in supporting scalability and flexibility, which are critical in today’s rapidly changing business environment. As companies face fluctuating network demands, particularly in industries like healthcare, NaaS allows for the seamless expansion and contraction of network resources. According to a recent study on healthcare IT spending, 75% of US healthcare providers and payers have increased their IT investments, underscoring the growing need for adaptable solutions. Among payers, 65% cited legacy technology as a major challenge, facilitating the shift towards scalable solutions like NaaS. Healthcare providers are prioritizing areas like cybersecurity and interoperability, both of which benefit from NaaS’s ability to scale resources quickly in response to evolving needs. Additionally, the rise of AI strategies, with 15% of providers and 25% of payers adopting AI, further emphasizes the need for flexible network solutions. NaaS enables these organizations to experiment with new configurations, deploy applications rapidly, and adjust service levels dynamically to meet strategic goals. Furthermore, NaaS supports geographic expansion and remote workforce management, aligning network infrastructure with the evolving demands of businesses.

Increasing Focus on Cost-Efficiency

Conventional networking standard is highly capitalized for initial physical infrastructure costs and up-to-date operational expenses. NaaS brings digital transformation by going through the conventional model where businesses simply pay for the network services they use and not as a full ownership package. Industry reports indicate that NaaS can lower the total cost of ownership (TCO) by 30% to 50% compared to traditional capital expenditure-based network models. Moreover, NaaS providers offer centralized C2B tools for cost control and transparency. Organizations can track and analyze real-time network usage and make intelligent decisions as well as place nearly perfect cost of management. This liberation of budget is however foremost during uncertain economic states where wise resource allocation is required. The business continuity of NaaS also reduces the total cost ownership (TCO) by automating network management procedures, removing the professional in-house services, and decreasing off-time due to maintenance and upgrade. This is one of the main factors that make NaaS a favorable solution for firms that care about the amount they spend on IT wherever they want their networks performance and strength to be the same as stand-alone technologies. The scalability of NaaS provides an extra advantage as businesses can now easily expand their network assets when they need and shrink them when they do not, thus running without the excess network provisioning and extra costs. Such agreeable cost-effective approach is consistent with the objectives for efficient allocation of resources in contemporary organizations today.

Technological Advancements in Software-Defined Networking (SDN) and Network Automation

The rapid advancements in SDN and network automation is bolstering the network as a service market demand. SDN enables centralized control over the network by separating the control plane from the data plane, which allows businesses to manage and configure their network infrastructure through software. This abstraction provides the flexibility to optimize network performance, automate tasks, and reduce the complexity of traditional networking. Moreover, network automation, which often accompanies SDN implementations, plays a critical role in reducing the operational burden on IT teams. Automated network management tools can detect network issues, optimize traffic flow, and address performance bottlenecks in real-time, without requiring manual input. This leads to faster troubleshooting, reduced downtime, and a more reliable network experience for users. Network automation also facilitates the seamless integration of new technologies and applications into the network infrastructure, further enhancing the agility and scalability of the network. The IMARC Group predicts that the global network automation market is expected to reach USD 103.6 billion by 2033.

Network as a Service Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global network as a service market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on type, application, and end use industry.

Analysis by Type:

- LAN-as-a-Service

- WAN-as-a-Service

As per the network as a service market forecast, WAN-as-a-Service leads the industry with 66.2% of market share in 2024. WAN-as-a-Service solutions provide businesses with the option for getting set up quickly with secure and high-performance wide area networks at low capital investment cost rather than investing in their infrastructure. The need for WAN-as-a-Service arises as a result of the rapid evolving of business actors whose geography is an important driver and also the increasing significance of uninterrupted connectivity between data centers, branch offices and the cloud. As employee mobility and cloud acceptance soars, WAN-as-a-Service is growing as it provides the critical linkage for remote workforce and fast-paced data swapping between different parts of the globe.

Analysis by Application:

- Cloud-based Services

- Bandwidth on Demand

- Integrated Network Security-as-a-Service

- Wide Area Network

- Virtual Private Network

According to the network as a service market trends, cloud-based services lead the industry with 23.9% of the market share. The increase in cloud computing activities is revolutionizing how businesses are accessing and managing IR infrastructure. NaaS provides networking capabilities like virtual private networks (VPNs), bandwidth management, and software defined wide area networks (SD WANs), through cloud platforms. Traditionally, setting up and maintaining network infrastructure involved significant capital expenditures and operational overhead. NaaS disrupts this model by providing a pay-as-you-go solution that allows companies to scale their network resources dynamically. One of the most significant advantages of NaaS in cloud applications is its scalability. Businesses leveraging cloud platforms often experience fluctuating workloads and user demands. NaaS allows them to expand or reduce their network capacity in real-time, ensuring that resources are always optimized. Besides this, cloud-based applications demand robust and consistent network performance. NaaS leverages technologies like software-defined networking (SDN) to simplify network configuration and management.

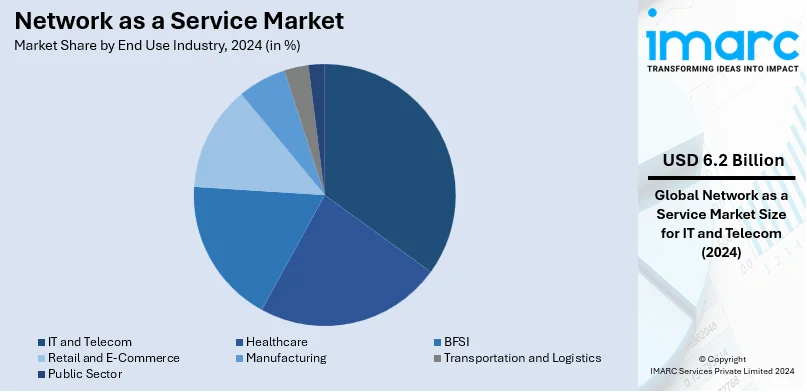

Analysis by End Use Industry:

- Healthcare

- BFSI

- Retail and E-Commerce

- IT and Telecom

- Manufacturing

- Transportation and Logistics

- Public Sector

Based on the network as a service market outlook, IT and telecom lead the market with 25.8% of market share in 2024. IT and telecommunication are the major segment in the NaaS market, due to the diverse demand from individuals for high-speed and stable information. IT and telecom companies are hiring network solutions to empower them with robust and scalable networks for transferring large amounts of data, global connectivity, as well as telecommunications infrastructure. NaaS is a cloud-based service model that provides organizations with network infrastructure, management, and security on-demand, eliminating the need for significant capital investments in physical hardware and infrastructure. This model offers a range of benefits to businesses across the IT and telecom industries, enabling more flexible and agile network solutions. Traditionally, businesses in the IT and telecom sectors are investing heavily in physical network infrastructure, including routers, switches, and cables. These upfront costs, along with the ongoing expenses of maintenance and upgrades, can be substantial. NaaS shifts the financial burden to the service provider, allowing organizations to pay for only the resources they need.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest network as a service market share of 41.4%. The NaaS market in North America is driven by heightened need for businesses to adopt more flexible, scalable, and cost-efficient network solutions. One of the most prominent trends driving the NaaS market in North America is the increased adoption of cloud-based services. Cloud computing is becoming ubiquitous in the region, with businesses shifting from traditional on-premises IT infrastructures to more flexible cloud environments. NaaS fits naturally into this broader cloud ecosystem, as it provides companies with virtualized network services over the internet. Moreover, the rapid deployment of 5G networks and the growing interest in edge computing is positively influencing the market in the region. The rollout of 5G technology is poised to revolutionize the telecom and IT sectors, offering faster data speeds, lower latency, and more reliable connections. As per the predictions of the IMARC Group, the US 5G infrastructure market size is expected to exhibit a growth rate (CAGR) of 42.60% during 2024-2032.

Key Regional Takeaways:

United States Network as a Service Market Analysis

The United States accounts for 70.10% of the market share in North America. The U.S. Network as a Service (NaaS) market continues to grow as more investments in hybrid cloud infrastructure and federal government initiatives gain momentum. In 2023, the Biden-Harris Administration announced over USD 40 Billion to ensure nationwide access to affordable, reliable broadband, including secure internet networks, the White House stated. The government BEAD Program funded by Bipartisan Infrastructure Law has budgeted USD 42.45 Billion for improving high-speed internet access, which supports the NaaS market and the overall industry. US enterprises are rapidly adopting the solution of NaaS since they need flexibility and scalability. The companies majorly involved in this venture include Cisco and HPE. The rising demand to integrate 5G along with IoT further expands the market. The federal push toward improving the internet infrastructure ensures that U.S. leadership in NaaS is maintained, supporting innovation and increasing access to sophisticated network services.

Europe Network as a Service Market Analysis

The NaaS market in Europe is growing at a good pace, driven by sizeable investments from the government and the private sector. The European Commission has set aside more than €108 million (approximately USD 115 million) to drive digital skills, capacity, and technology through the Digital Europe Programme. This includes €55 million (about USD 58 million) for specialized education programs in key digital fields such as edge computing, robotics, and quantum computing, aimed at addressing the ICT skills gap and driving digital transformation. The program also allocates €25 million (around USD 26 million) to support Multi-Country Projects (MCPs), promoting collaborative, large-scale digital infrastructure projects across multiple EU member states. These initiatives will boost critical competencies in the areas of data sharing, public administration, and digital services. The €20 million (approximately USD 21 million) in investments on Local Digital Twins (LDTs) focuses on developing AI-powered solutions for cities and communities toward EU's Digital Decade. Collectively, these initiatives are moving Europe forward as the forerunner in NaaS market.

Asia Pacific Network as a Service Market Analysis

The Asia Pacific Network as a Service (NaaS) market is growing further with investments in digital infrastructure and government-backed initiatives. According to an industrial report, IT spending in Asia Pacific, excluding Japan, is expected to grow by 4.4% in 2023. This is compared to 3.8% in 2022, despite uncertainty in the economy. However, specific figures for networking-related IT spending in the region are not reported in the sources available. Programs in government form, such as India's "Digital India" and China's "New Infrastructure", are accelerating NaaS's adoption, particularly in enterprise and public sectors. The overall objective of such programs is to boost their digital capabilities by enhancing networking, such as advanced networking technologies - 5G, data center, and the rest, hence essential for the deployment of NaaS. The region's growing digital economy, in conjunction with these strategic investments, makes Asia Pacific a key player in the global NaaS market.

Latin America Network as a Service Market Analysis

The Latin America NaaS market is promising, driven by both governmental programs and the digital transformation of the region. According to the Economic Commission for Latin America and the Caribbean, the transformative potential of digital technologies, including NaaS, can be instrumental in overcoming regional development challenges-such as inequality and low growth capacity. In 2023, total economic contribution of AI was worth USD 70.748 billion, or 1.11% of GDP. Increasingly, technology is growing importance in the region; its use is becoming even more important for ECLAC's "Digital Agenda for Latin America and the Caribbean 2026 (eLAC2026)" to improve competitiveness while working to reduce inequality by implementing AI and digital tools. The organization also highlights the need for digital infrastructure, where more than 80% of the urban population has access to the internet, though it is still a long way off in rural and lower-income areas. Such developments only highlight the need for quality, affordable connectivity to maximize NaaS adoption and ensure inclusive growth across the region.

Middle East and Africa Network as a Service Market Analysis

The NaaS market of the Middle East and Africa is gaining momentum with the growing investment in ICT infrastructure. As per an industrial report, the region's spending on ICT has already exceeded USD 40 billion in 2023 with large chunks of it spent on cloud-based services. The UAE and Saudi Arabia lead with smart city projects. Saudi Arabia's NEOM project, for example, focuses on advanced network solutions with an investment of over USD 500 billion. South Africa is also embracing NaaS to upgrade connectivity in its financial and mining sectors. Local players, such as Liquid Intelligent Technologies, are expanding their offerings, while global players, including AWS and Google Cloud, are entering partnerships to meet the demand. Adoption of NaaS is also driven by the region's focus on secure, scalable networks for e-commerce, education, and healthcare. This area's market development is accelerated by the growing regulatory support for digital transformation.

Competitive Landscape:

The key players in the network as a service (NaaS) market are actively pursuing strategies aimed at expanding their market presence and addressing evolving customer needs. They are heavily investing in research and development (R&D) to innovate and enhance their NaaS offerings, focusing on technologies, such as software-defined networking (SDN), automation, and security. Additionally, these players are forming strategic partnerships and collaborations to extend their reach and provide comprehensive solutions. They are also working on global expansion efforts, tapping into emerging markets with substantial network-as-a-service market growth potential. Furthermore, sustainability and energy efficiency are becoming priorities, with investments in green networking solutions and data center optimization. Overall, the key players are committed to delivering advanced, scalable, and secure NaaS solutions to meet the demands of an increasingly interconnected world. The key players in the network as a service (NaaS) market are actively pursuing strategies aimed at expanding their market presence and addressing evolving customer needs. For instance, in 2024, Broadcom and Telia announced the expansion of their partnership to modernize Telia's telco and cloud infrastructure. Telia will leverage VMware Telco Cloud Platform and Cloud Foundation to further automation, scalability, and operational efficiency. As a Broadcom Pinnacle Partner, Telia will focus on innovative, secure NaaS offerings supporting monetizable 5G and cloud services across the Nordics and Baltics.

The report provides a comprehensive analysis of the competitive landscape in the network as a service market with detailed profiles of all major companies, including:

- Akamai Technologies Inc.

- AT&T Inc.

- Broadcom Inc.

- Ciena Corporation

- Cisco Systems Inc.

- GTT Communications Inc.

- Hewlett Packard Enterprise Development LP

- International Business Machines Corporation

- Juniper Networks Inc.

- Nokia Corporation

- Oracle Corporation

- Telstra Corporation Limited

- Verizon Communications Inc.

- VMware Inc. (Dell Technologies Inc.), etc.

Latest News and Developments:

- September 2024: GTT Communications Inc. recently announced GTT Envision, a unified global platform for Network-as-a-Service (NaaS). Based on a Tier 1 backbone, the product brings together EnvisionCORE, EnvisionEDGE, and EnvisionDX for orchestration and security management of the enterprise network. Advanced analytics, AI, and interoperability are used to tackle complex networking needs. It has recently added expanded global points of presence and more NFV nodes in the U.S. GTT places NaaS alongside SD-WAN, SSE, and SASE for an integrated digital experience, scalable, automated, and controlled.

- June 2024: Hewlett Packard Enterprise, in collaboration with NVIDIA, expanded its partner program, offering networking competencies, certifications, and updated HPE GreenLake features. These enhancements enable partners to architect AI-driven solutions, deploy NVIDIA-certified systems, and support NaaS opportunities, fostering innovation and profitability across hybrid cloud and data-intensive AI workloads.

- February 2024: Akamai Technologies announced Generalized Edge Compute, or Gecko, an advance on its network as a service strategy by incorporating cloud computing into its edge network. Gecko will allow full-stack computing nearer to users for AI, gaming, IoT, and media workloads. This new technology meets the industry's requirement for lower latency and greater performance in distributed computing. Akamai is to take Gecko to 100 cities in 2024 to enhance its cloud computing footprint. The initiative aligns with Akamai’s strategy to unify cloud and edge computing, ensuring scalability and efficiency.

Network as a Service Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | LAN-as-a-Service, WAN-as-a-Service |

| Applications Covered | Cloud-based Services, Bandwidth on Demand, Integrated Network Security-as-a-Service, Wide Area Network, Virtual Private Network |

| End Use Industries Covered | Healthcare, BFSI, Retail and E-Commerce, IT and Telecom, Manufacturing, Transportation and Logistics, Public Sector |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Akamai Technologies Inc., AT&T Inc., Broadcom Inc., Ciena Corporation, Cisco Systems Inc., GTT Communications Inc., Hewlett Packard Enterprise Development LP, International Business Machines Corporation, Juniper Networks Inc., Nokia Corporation, Oracle Corporation, Telstra Corporation Limited, Verizon Communications Inc., VMware Inc. (Dell Technologies Inc.), etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the network as a service market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global network as a service market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the network as a service industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Network as a Service (NaaS) is a cloud-based networking solution that offers scalable, on-demand connectivity. It enables businesses to procure and manage network services virtually, reducing infrastructure costs and enhancing flexibility in managing IT resources.

The network as a service market was valued at USD 24.0 Billion in 2024.

IMARC estimates the global network as a service market to exhibit a CAGR of 25.5% during 2025-2033.

The market is driven by increased adoption of cloud computing, demand for scalable and flexible networking solutions, cost-efficiency of cloud-based models, and advancements in software-defined networking (SDN) and network automation technologies.

In 2024, WAN-as-a-Service represented the largest segment by type, driven by the need for high-performance and secure wide-area networks.

Cloud-based services, bandwidth on demand, integrated network security-as-a-service, wide area network, and virtual private network are the key application of network as a service.

Key end users adopting network as a service solution include healthcare, banking, financial services, and insurance (BFSI), retail and e-commerce, IT and telecom, manufacturing, transportation and logistics, and public sectors.

North America and Europe are the early adopters of network as a service solutions.

Some of the key vendors in the global network as a service market include Akamai Technologies Inc., AT&T Inc., Broadcom Inc., Ciena Corporation, Cisco Systems Inc., GTT Communications Inc., Hewlett Packard Enterprise Development LP, International Business Machines Corporation, Juniper Networks Inc., Nokia Corporation, Oracle Corporation, Telstra Corporation Limited, Verizon Communications Inc., VMware Inc. (Dell Technologies Inc.), etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)