Dimethyl Ether Prices Influenced by Global Market Dynamics: Q2 2025 Update

14-Jul-2025

The dimethyl ether (DME) market recorded notable pricing volatility across leading global regions, primarily influenced by fluctuations in feedstock availability, evolving demand conditions, and logistical challenges. IMARC Group’s latest report, Dimethyl Ether (DME) Price Trend, Index and Forecast Data Report 2025 Edition, offers updated insights for Q2 2025, detailing the way industry is adapting to production disruptions, transport inefficiencies, and shifting consumption trends. Major economies, such as the North America, Asia Pacific and Europe, continue to play a central role in shaping global price movements.

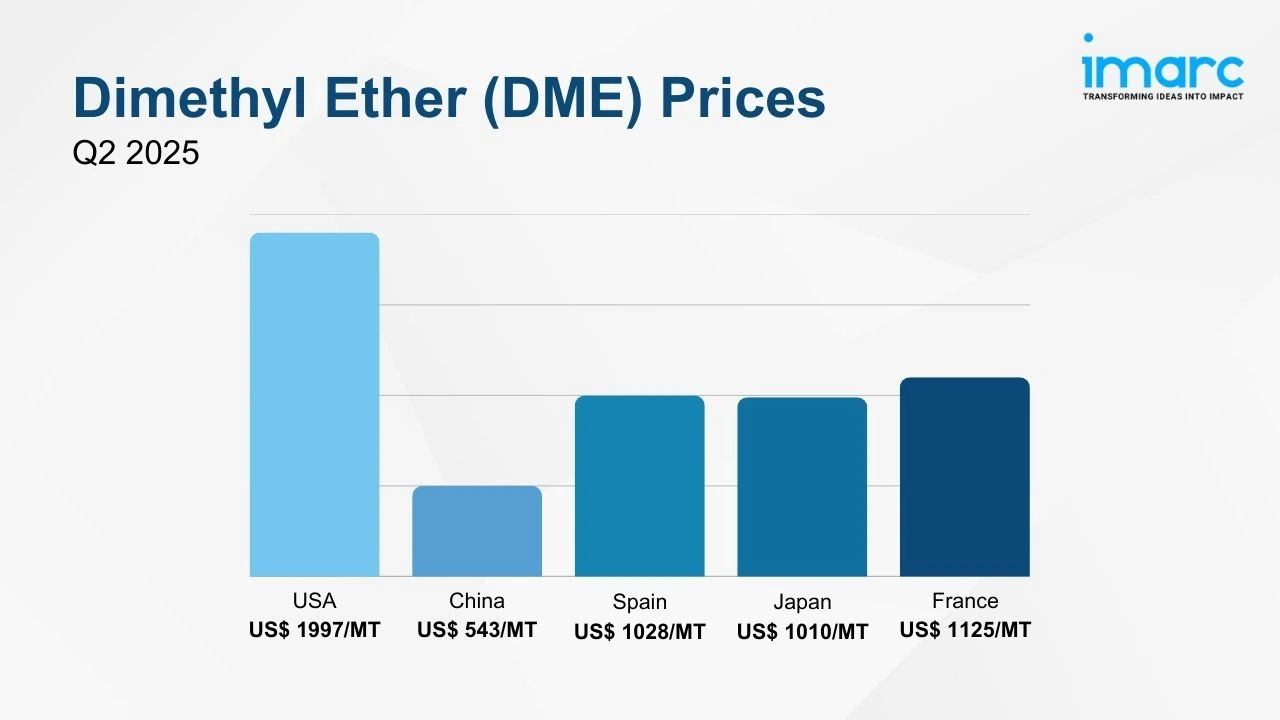

Q2 2025 Dimethyl Ether (DME) Prices:

- USA: USD 1997/MT

- China: USD 543/MT

- Spain: USD 1028/MT

- Japan: USD 1010/MT

- France: USD 1125/MT

To access real-time prices Request Sample

The prevailing dimethyl ether (DME) price levels underscore its significance in high-performance end-use industries, such as aerosol propellants and transportation fuels. This further underscores the compound’s strategic importance and continues to support a stable upward global pricing trajectory.

Key Regional Price Trends and Market Drivers:

United States

Dimethyl ether (DME) prices rose to USD 1997/MT in Q2 2025, driven by fluctuations in natural gas and methanol feedstock prices. Seasonal demand and upstream supply variations impacted production, while infrastructure constraints in certain regions affected distribution efficiency and delivery lead times. Demand remained stable from the LPG blending and industrial fuel sectors.

China

In China, dimethyl ether prices reached USD 543/MT due to restricted methanol availability, primarily caused by reduced coal-based production in inland provinces. Environmental inspections led to operational adjustments at several manufacturing units. Demand from the residential and industrial fuel sectors remained stable, while logistics challenges and container shortages at major ports further influenced prices.

Spain

Prices in Spain stood at USD 1028/MT in Q2 2025, influenced by higher feedstock costs due to fluctuations in methanol imports and natural gas prices. Domestic consumption from the aerosol and transportation fuel sectors remained steady. Operational inefficiencies at blending facilities and exposure to maritime freight volatility also contributed to pricing pressure.

Japan

Dimethyl ether prices in Japan reached USD 1010/MT in Q2 2025, with feedstock constraints impacting the price structure. Demand from residential and industrial fuel sectors stayed consistent. Government initiatives promoting low-emission fuels played a significant role in shaping consumption patterns across downstream industries.

France

In France, dimethyl ether prices were USD 1125/MT in Q2 2025, reflecting constrained supply from maintenance at key production units and limited regional methanol availability. Rising energy costs contributed to higher processing expenses, while stable demand from the heating and aerosol sectors, alongside shifts in environmental policy, influenced consumption patterns.

Dimethyl Ether (DME) Industry Overview:

The global dimethyl ether (DME) market reached a value of USD 7.16 Billion in 2024 and is projected to grow to USD 14.9 Billion by 2033, expanding at a CAGR of 8.08% during 2025–2033. This market growth is driven by the increasing demand for cleaner, alternative fuels and the advancements in dimethyl ether (DME) production technologies, such as renewable DME processes and more efficient catalytic methods. These developments are making DME a commercially viable and sustainable alternative to traditional fossil fuels.

Key drivers contributing to the growth of the market include the global transition towards renewable energy, advancements in biomass gasification, and improvements in carbon capture technologies. In addition to these, the rising focus on reducing greenhouse gas emissions and the growing adoption of DME as a clean-burning fuel alternative in various sectors, including transportation, heating, and aerosol products, are further accelerating market demand. As governments and industries continue to prioritize sustainability, DME is positioned as a key player in the renewable energy landscape.

Recent Market Trends and Industry Analysis:

Dimethyl ether (DME) is gaining momentum as a clean, efficient fuel alternative, supported by technological advancements in catalytic processes and syngas conversion that enhance production efficiency and lower costs. Its ability to be produced from renewable feedstocks such as biomass and agricultural waste positions it as a key player in the global shift toward sustainable energy.

In addition to energy applications, DME’s compatibility with existing LPG infrastructure and its clean-burning properties support its use in diesel engines, heating systems, and aerosol propellants. Its ability to reduce greenhouse gas emissions while offering high combustion efficiency makes it valuable across transport, agricultural, and chemical sectors. As industries seek cost-effective, sustainable alternatives to fossil fuels, DME’s growing demand reflects its importance in meeting both energy and environmental targets.

Strategic Forecasting and Analysis:

IMARC’s report incorporates forecasting models that project near-term price movements based on evolving trade policies, raw material supply, and technological trends. These tools enable businesses to mitigate risk, enhance sourcing strategies, and support long-term planning.

Key Features of the Report:

- Price Charts and Historical Data

- FOB and CIF Spot Pricing

- Regional Demand-Supply Assessments

- Port-Level Price Analysis

- Sector-Specific Demand and Supply Insights

.webp)

.webp)