Vanadium Prices Reflect Global Market Shifts: Q2 2025 Update

17-Jul-2025

The vanadium market continues to tighten amid strengthening steel standards and the rapid scale-up of long-duration batteries, according to IMARC Group’s latest publication, Vanadium Price Trend, Index and Forecast Data Report 2025 Edition, that provides updated insights for Q2 2025. The report highlights supply constraints and expanding demand from both high-strength steel, which sustained firm prices. Key market including North America, Asia Pacific, and Europe experienced notable developments contributing to regional price fluctuations.

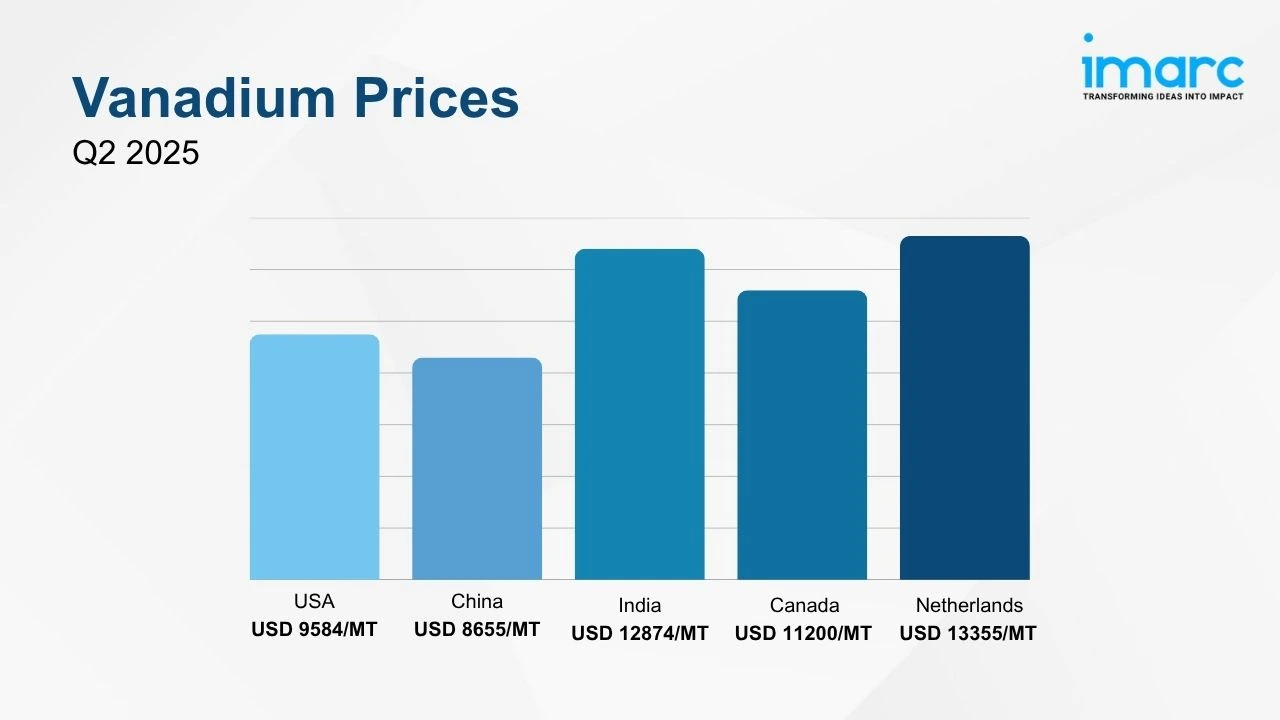

Q2 2025 Vanadium Prices:

- USA: USD 9584/MT

- China: USD 8655/MT

- India: USD 12874/MT

- Canada: USD 11200/MT

- Netherlands: USD 13355/MT

To access real-time prices Request Sample

The present vanadium prices across key regions reflect its critical role in high-performance industries such as energy storage and steel production, with strong demand from vanadium redox flow batteries (VRFBs) and infrastructure development contributing to a stable or upward global price trend.

Key Regional Price Trends and Market Drivers:

United States

Prices in the country rose to USD 9584/MT in June 2025, driven by increasing domestic demand and tightening global supply. The growth in energy storage applications, particularly VRFBs, was a key factor pushing prices higher.

China

Prices in China stood at USD 8655/MT in Q2 2025, supported by steady demand from the steel industry, particularly for high-strength rebar, and the ongoing adoption of VRFBs for energy storage solutions.

India

With a price point of USD 12874/MT in June 2025, India continued to see strong demand from its expanding infrastructure sector, which relies heavily on high-strength steel, further driving vanadium consumption.

Canada

At USD 11200/MT, Canada saw price increases due to reduced domestic production and growing demand from both the steel and energy sectors during Q2 2025. This led to a tighter market and upward price pressure.

Netherlands

In Netherlands, vanadium prices reached USD 13355/MT in Q2 2025, influenced by increased demand for VRFBs driven by the continent's push for renewable energy solutions. Fluctuations in energy input costs for vanadium processing also added volatility to prices.

Vanadium Industry Overview:

The global vanadium market reached a volume of 103.1 Thousand Tons in 2024 and is projected to reach a volume of 135.7 Thousand Tons by 2033, expanding at a CAGR of 2.95% during 2025–2033. The market is supported by steady industrial demand and constrained supply chains. Emerging economies and renewable-focused markets are increasingly relying on vanadium for both metallurgical and energy-related applications.

Key drivers contributing to this growth include the expanding use of vanadium redox flow batteries in grid-scale energy storage, heightened demand for high-strength steel in infrastructure projects, and efforts by governments to modernize their energy and construction sectors. In addition, rising global infrastructure investments, tightening rebar standards in key manufacturing hubs, and reduced vanadium production in select markets are further intensifying supply-demand imbalances. The intersection of energy transition goals and advanced metallurgical applications positions vanadium as a critical material.

Recent Market Trends and Industry Analysis:

The vanadium industry is experiencing significant growth, driven by its vital role in producing high-strength steel for construction, automotive, and aerospace applications. With the global steel market significantly expanding, the demand for vanadium as an alloying element continues to rise. Vanadium's use enhances steel's strength and durability, supporting the development of resilient infrastructure and lightweight, fuel-efficient vehicles.

Additionally, advancements in energy storage, particularly vanadium redox flow batteries (VRFBs), are accelerating market demand. Vanadium's applications in defense and aerospace are also expanding, supported by increased budget allocations, while large-scale infrastructure investments worldwide are further strengthening market momentum.

Strategic Forecasting and Analysis:

IMARC’s report incorporates forecasting models that project near-term price movements based on evolving trade policies, raw material supply, and technological trends. These tools enable businesses to mitigate risk, enhance sourcing strategies, and support long-term planning.

Key Features of the Report:

- Price Charts and Historical Data

- FOB and CIF Spot Pricing

- Regional Demand-Supply Assessments

- Port-Level Price Analysis

- Sector-Specific Demand and Supply Insights

.webp)

.webp)