Zinc Prices Q2 2025 – IMARC Examines Regional Market Variations

05-Sep-2025

Amid evolving energy tariffs, environmental regulations, and logistics costs, the global zinc industry is exhibiting notable pricing dynamics, according to IMARC Group’s latest publication, Zinc Price Trend, Index and Forecast Data Report 2025 Edition, which provides updated insights for Q2 2025. The report underscores how sectoral demand in construction, automotive, and manufacturing, together with currency movements and freight considerations, shaped regional pricing across North America, Asia Pacific, and Europe.

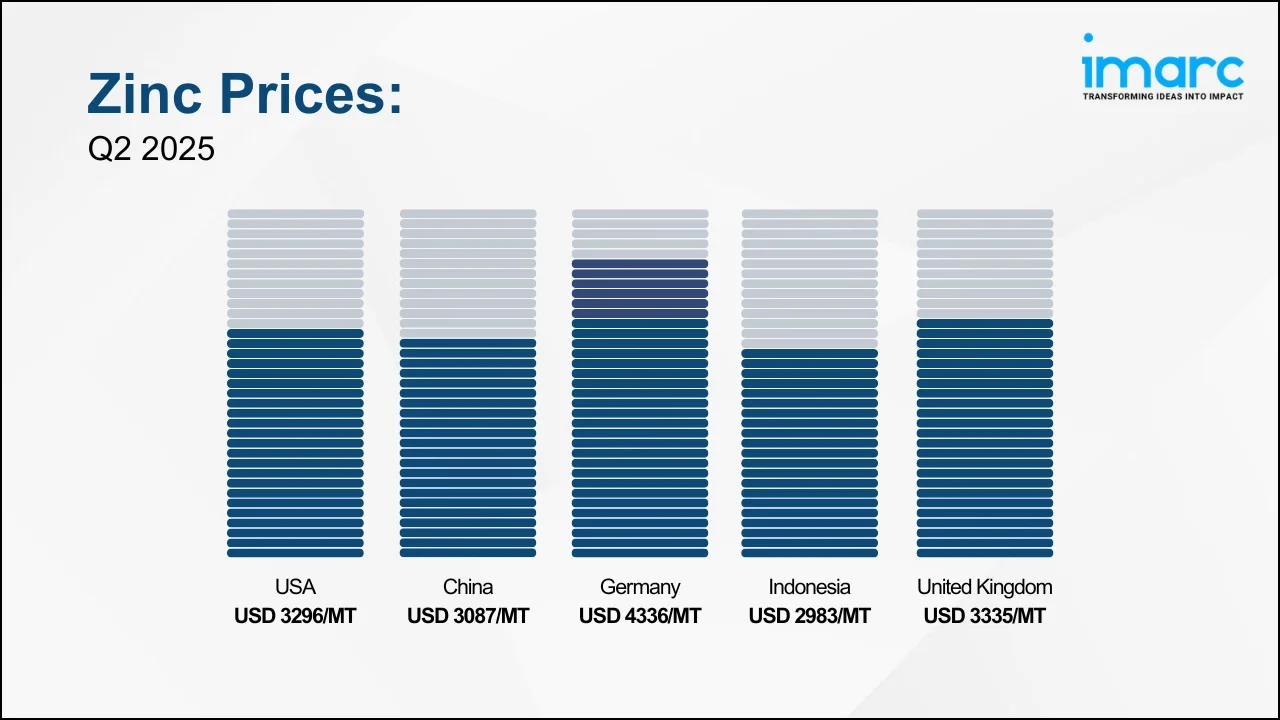

Q2 2025 Zinc Prices:

- USA: USD 3296/MT

- China: USD 3087/MT

- Germany: USD 4336/MT

- Indonesia: USD 2983/MT

- United Kingdom: USD 3335/MT

To access real-time prices Request Sample

The current zinc prices highlight the material’s essential role in galvanizing, construction, and automotive supply chains, with sector-specific demand and cost factors, such as energy tariffs, environmental compliance, and freight, shaping price formation across regions.

Key Regional Price Trends and Market Drivers:

United States

Zinc prices in the USA reached USD 3296/MT in June 2025, supported by steady demand from construction, automotive, and galvanizing industries. Supply conditions were shaped by feedstock availability from domestic mines and imports, while energy and labor costs influenced production economics. Currency movements and freight charges on imports affected procurement.

China

China’s Zinc prices settled at USD 3087/MT in Q2 2025, pricing reflected demand from construction, infrastructure, and manufacturing. Domestic mining output and refining capacity were pivotal, with energy tariffs and stricter environmental regulations adding to production costs. Export flows to Southeast Asia and Europe shaped domestic allocation, while inland transportation and port congestion contributed to logistics expenses.

Germany

Zinc prices in the Germany stood at USD 4336/MT in June 2025 amid strong demand from automotive, construction, and machinery manufacturing. Supply was influenced by imports from other European producers and Asia, with shipping costs and customs procedures affecting landed expenses. Also, feedstock availability and regional smelting operations shaped production economics.

Indonesia

In Indonesia, zinc prices reached USD 2983/MT in Q2 2025, influenced by demand from construction, galvanizing, and industrial manufacturing. Exports to Asia Pacific markets shaped local availability, while port logistics and inland transportation added to expenses. Currency movements against the US dollar influenced export competitiveness.

United Kingdom

Zinc prices in the United Kingdom stood at USD 3335/MT in June 2025, propelled by demand from construction, automotive, and industrial equipment sectors. Currency fluctuations between the pound and the US dollar influenced procurement competitiveness, with domestic trucking and storage adding further distribution costs.

Q2 vs. Q1:

| Country | Q2 2025 | Q1 2025 | Q2 vs. Q1 Trends |

|---|---|---|---|

| USA | USD 3296/MT | USD 3415/MT | Prices decreased in Q2. Q1 was marked by low demand and high inventories following late-2024 pre-tariff stocking, while Q2 reflected steady end-use demand with costs shaped by energy, labor, and logistics |

| China | USD 3087/MT | USD 3206/MT | Prices dropped slightly from Q1. Q1 saw price swings tied to inventory levels and oversupply; Q2 demand came from construction, infrastructure, and manufacturing, with energy tariffs and environmental regulations adding cost pressures |

| Germany | USD 4336/MT | USD 4161/MT | Prices rose in Q2. Q1 conditions were muted by weak demand signals and softer international offers; Q2 showed strong demand in automotive, construction, and machinery, alongside higher energy and compliance costs |

| Indonesia | USD 2983/MT | USD 3145/MT | Prices decreased in Q2. The market in Q2 was driven by construction and galvanizing demand, however energy tariffs and regulations influenced costs |

Zinc Industry Overview:

The global zinc market reached a volume of 14.02 Million Tons in 2024 and is projected to reach a volume of 17.51 Million Tons by 2033, expanding at a CAGR of 2.30% during 2025-2033. The market demand is anchored by zinc’s central role in galvanizing steel for buildings, bridges, pipelines, and other infrastructure—applications that support longer asset lifecycles, especially in coastal and industrial environments.

In addition to this, construction activity and public infrastructure programs further reinforce zinc consumption. Automotive uses in galvanized chassis, panels, and underbody components sustain demand, while emerging applications in renewable-energy storage (zinc-air and zinc-bromine batteries) and electronics (die-cast alloys, zinc oxide in semiconductors, photovoltaics, and LEDs) underpin longer-term growth.

Recent Market Trends and Industry Analysis:

Zinc’s dominant application in galvanizing continues to protect steel from corrosion, extending the lifespan of critical infrastructure and supporting large-scale construction programs. This durability benefit is central to roads, bridges, pipelines, and urban development, particularly where environmental exposure requires high corrosion resistance. In automotive, zinc-coated steels enhance durability for chassis and body components, aligning with manufacturers’ objectives to reduce maintenance and improve lifecycle performance across both internal-combustion and electric vehicle platforms.

Beyond these core sectors, zinc is increasingly relevant in renewable energy and electronics. Zinc-air and zinc-bromine batteries are being developed as cost-effective, scalable storage options for grid applications supporting solar and wind power. In electronics, zinc alloys are valued in die-casting for connectors, housings, and thermal components, while zinc oxide finds use in semiconductors, photovoltaics, and light-emitting devices—broadening zinc’s technology footprint.

Strategic Forecasting and Analysis:

IMARC’s report incorporates forecasting models that project near-term price movements based on evolving trade policies, raw material supply, and technological trends. These tools enable businesses to mitigate risk, enhance sourcing strategies, and support long-term planning.

Key Features of the Report:

- Price Charts and Historical Data

- FOB and CIF Spot Pricing

- Regional Demand-Supply Assessments

- Port-Level Price Analysis

- Sector-Specific Demand and Supply Insights

.webp)

.webp)