North America Anhydrous Milk Fat Market Size, Share, Trends and Forecast by End-Use and Region, 2025-2033

North America Anhydrous Milk Fat Market Size and Share:

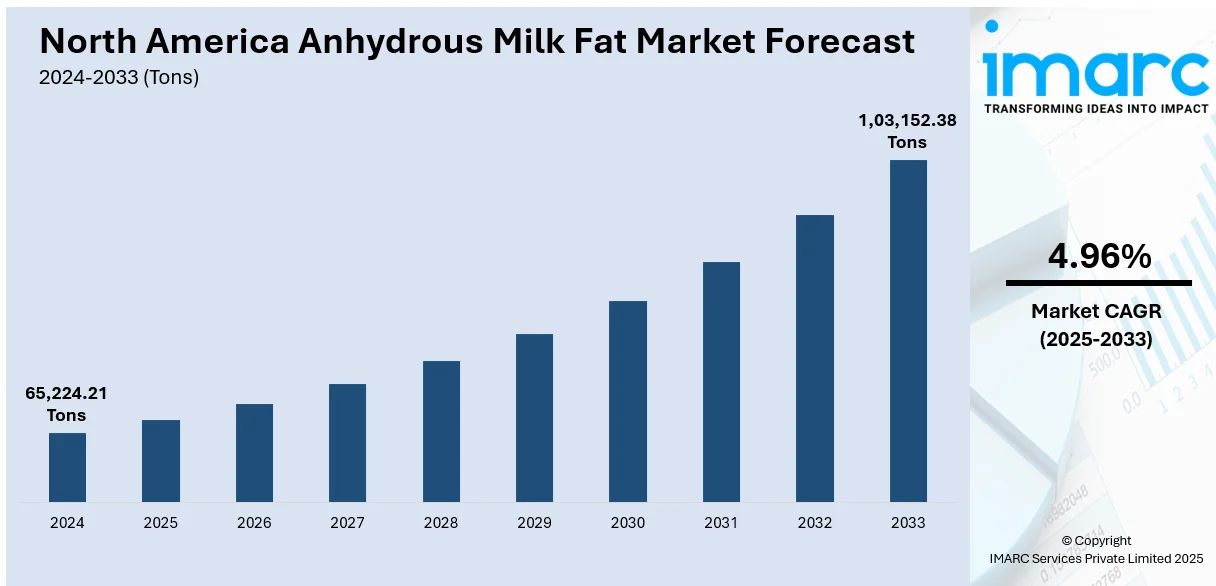

The North America anhydrous milk fat market size was valued at 65,224.21 Tons in 2024. Looking forward, IMARC Group estimates the market to reach 1,03,152.38 Tons by 2033, exhibiting a CAGR of 4.96% from 2025-2033. The market is driven by the proliferation of plant-based alternatives, ongoing technological breakthroughs in production, and the rise of e-commerce platforms, all contributing to improved product quality, production efficiency, and enhanced consumer accessibility to specialized AMF products.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

65,224.21 Tons |

|

Market Forecast in 2033

|

1,03,152.38 Tons |

| Market Growth Rate (2025-2033) | 4.96% |

The market in North America is experiencing robust growth, attributed to the increasing demand for premium dairy products. As consumers prioritize high-quality, nutritious ingredients, AMF has become essential in gourmet foods, baked goods, and confectioneries. Its enhanced flavor, texture, and versatility render it a preferred choice for manufacturers catering to health-conscious consumers. Moreover, the rising popularity of clean-label trends, where transparency and minimal processing are emphasized, is further accelerating the North America anhydrous milk fat market share. According to Acosta Group's Clean Label Insights Study, 81% of shoppers prioritize clean label products, with 83% familiar with the term. Clean label sales exceed total store sales by 8% CAGR, with Gen Z and Millennials particularly focused on health benefits. This aligns well with AMF’s natural composition, reinforcing its appeal as a clean, high-quality ingredient.

In addition to this, the growing applications of in food processing, especially in spreads, dairy-based beverages, and ice cream, are fueling market expansion. Similarly, AMF enhances sensory qualities and shelf life, making it a preferred ingredient across multiple sectors. Additionally, the rising popularity of high-fat, low-carbohydrate diets like keto and paleo aligning with the dietary needs of these consumers is strengthening the North America anhydrous milk fat market demand. According to a December 2024 survey by the Physicians Committee for Responsible Medicine, nearly half of U.S. adults plan to start a new diet in 2025. Of those, 40% aim to eat fewer calories, 26% will try low-carb diets like keto, and just 7% plan to follow a plant-based diet, despite its proven health benefits. As the foodservice industry evolves, the expansion of quick-service restaurants (QSR) and convenience foods is further driving the growth of AMF in North America.

North America Anhydrous Milk Fat Market Trends:

Expansion of Plant-Based Alternatives

One of the notable North America anhydrous milk fat market trends is its growing integration into plant-based dairy alternatives. As consumer requirement for plant-based items continues to increase, AMF is being increasingly used to enhance the flavor, texture, and mouthfeel of these products, making them more appealing to both plant-based and omnivore consumers. AMF’s versatility in replicating the richness of traditional dairy has made it a key ingredient in vegan cheese, plant-based milk, plant-based butter, and other non-dairy items. This shift reflects the broader trend of improving the sensory experience of plant-based foods to compete with conventional dairy products. In 2023, the U.S. retail plant-based food market reached USD 8.1 Billion, with plant-based milk sales rising by 1%, totaling USD 2.9 Billion, while plant-based meat and seafood faced a 12% decline. AMF’s ability to improve product quality and appeal directly influences its growing role in the North America AMF market, driving increased demand.

Continual Technological Advancements in Production

The market is benefiting from significant advancements in production technology, improving efficiency and consistency. For instance, on March 4, 2024, GEA introduced separator innovations at Anuga FoodTec 2024 to enhance dairy production. The ecoclear i separator, featuring direct drive technology, and the EngySpeed system, which reduces energy consumption by up to 40%, focus on minimizing energy and water use. GEA also unveiled KPInsight, a digital tool offering real-time performance monitoring and process optimization. These innovations help producers meet the rising demand for high-quality AMF while controlling production costs. Moreover, ongoing improvements in packaging technology have extended shelf life and ensured better storage conditions. These advancements also support sustainability goals by reducing waste and lowering carbon footprints, further aligning with industry trends toward eco-friendly production. As consumer preferences shift toward cleaner and more sustainable products, these innovations position manufacturers to contribute to the north America anhydrous milk fat market growth market growth.

Growth of E-Commerce and Industry Expansions

In North America, the rise of e-commerce platforms is significantly driving the market, offering both consumers and businesses easy access to premium AMF products for use in food, cosmetics, and more. As demand for high-quality dairy ingredients grows in gourmet cooking, baking, and skincare, online marketplaces serve as convenient channels for purchasing specialized products. This trend is reinforced by the ability to compare brands, read customer reviews, and access information on product sourcing and sustainability, catering to the growing preference for clean-label, ethical AMF. According to the 2024 Organic Industry Survey by the Organic Trade Association, organic dairy and eggs, the fourth-largest organic food category, saw a 5.5% increase in sales in 2023, totaling USD 8.2 Billion. Organic dairy now accounts for over 8% of total dairy sales, with milk and cream rising 5% and organic dairy alternatives growing nearly 14%, influencing the North America anhydrous milk fat market outlook.

North America Anhydrous Milk Fat Industry Segmentation:

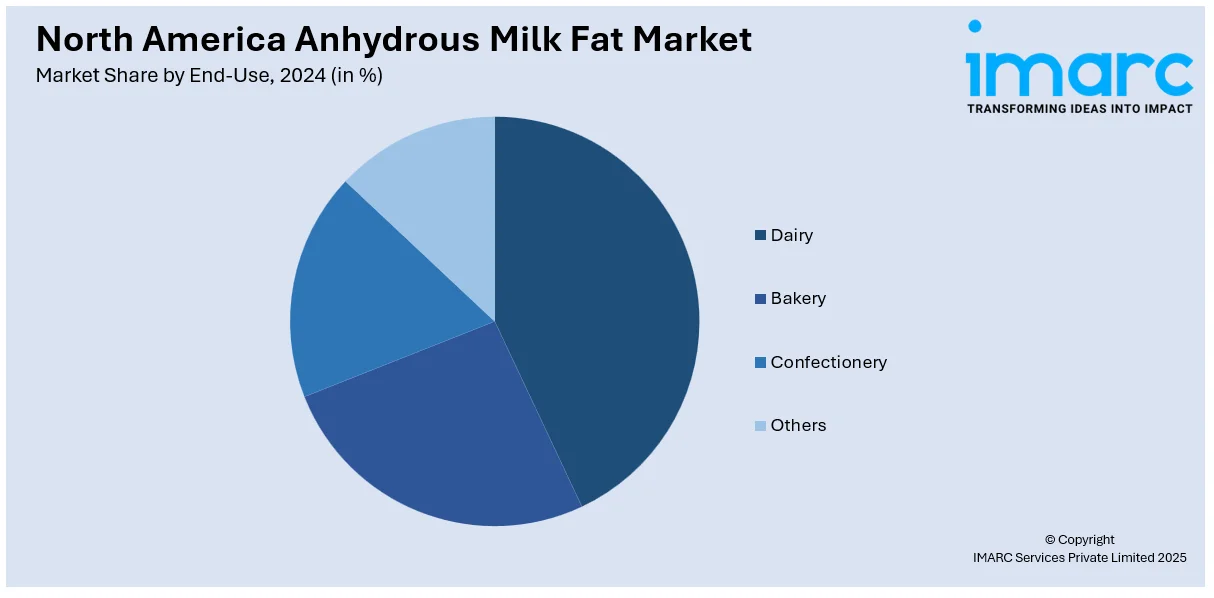

IMARC Group provides an analysis of the key trends in each segment of the North America anhydrous milk fat market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on end-use.

Analysis by End-Use:

- Dairy

- Bakery

- Confectionery

- Others

Dairy dominates the market in 2024 due to its rich, versatile properties that are essential for a wide range of food products, from baked goods to premium dairy items. AMF offers superior texture, flavor, and mouthfeel, making it the preferred choice for both traditional and innovative dairy products. Its ability to replicate the richness of whole milk makes it indispensable in the production of butter, cheese, and ice cream. Additionally, consumer demand for high-quality dairy ingredients and the growing popularity of clean-label, natural products further reinforce dairy’s dominance and bolsters the North America anhydrous milk fat market price.

Region Analysis:

- United States

- Canada

In 2024, the United States accounts for a major share in the market attributed to its vast dairy production, advanced infrastructure, and technological innovations. The U.S. dairy industry supplies high-quality milk, essential for AMF production, while advancements in dairy processing enhance efficiency and product quality. For example, on October 4, 2024, the USDA announced a USD 11.04 Million investment in the Dairy Business Innovation Initiatives (DBI) to aid small and mid-sized dairy firms. These funds will assist with production, marketing, and distribution, focusing on new market access and innovative practices. The strong consumer demand for both traditional and plant-based dairy, combined with well-established e-commerce platforms, further fuels market growth. U.S. leadership in innovation and its ability to cater to varied customer needs keeps it ahead in the competitive AMF market.

Competitive Landscape:

The competitive landscape in the North America anhydrous milk fat (AMF) market consists of both long-standing companies and new entrants. Major companies are concentrating on advanced processing, strong supply chain, and R&D to generate high-quality AMF. Consumers' increasing demands for clean label, sustainability, and plant-based alternatives enable them to adapt by coming up with products that cater specifically to those markets. Companies concentrate on production efficiency, cost cuts, and sustainability to maintain market competitiveness. Regional players are differentiating themselves through localized solutions and strong customer relationships with dairy farmers. This puts companies in the best position to capture a greater share of the growing AMF market in the region.

The report provides a comprehensive analysis of the competitive landscape in the North America anhydrous milk fat market with detailed profiles of all major companies.

Latest News and Developments:

- September 23, 2024: Flora Food Group announced the acquisition of a manufacturing facility in Hugoton, Kansas, to expand its creams and clarified butter production. This acquisition supports Flora’s growth in the U.S. and Americas, focusing on plant-based alternatives to traditional dairy. The facility will contribute to the company’s broader strategy to lead in the plant-based food sector.

- August 3, 2024: Aterian, Inc. made a strategic minority equity investment in 4th & Heart, a leading U.S. ghee butter brand, investing approximately USD 200,000 in cash and 145,000 shares of Aterian's stock. This partnership aims to expand 4th & Heart's growth in existing and emerging markets, aligning with Aterian’s focus on healthier living and e-commerce growth.

- August 1, 2024: Challenge Dairy launched its rebranded Spreadable Lactose-Free Clarified Butter with Canola Oil. This product is popular among health-conscious customers and those with lactose aversion. The rebranding aims to highlight its quality, versatility, and health benefits. Available in 8-ounce tubs, it caters to the growing lactose-free market, projected to reach USD 20 Billion by 2025.

North America Anhydrous Milk Fat Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Tons |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| End Uses Covered | Dairy, Bakery, Confectionery, Others |

| Regions Covered | United States, Canada |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the North America anhydrous milk fat market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the North America anhydrous milk fat market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the North America anhydrous milk fat industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The North America anhydrous milk fat market was valued at 65,224.21 Tons in 2024.

The growth of the North America market is largely driven by rising demand for premium dairy products, increasing popularity of plant-based alternatives, significant technological advancements in production, the rise of e-commerce platforms, clean-label trends, and consumer preference for high-quality, nutritious, and versatile ingredients in food and beverages.

The North America anhydrous milk fat market is projected to reach a value of 1,03,152.38 Tons by 2033, growing at a CAGR of 4.96% from 2025-2033.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)