North America Logistics Market Size, Share, Trends and Forecast by Model Type, Transportation Mode, End-Use, and Country, 2025-2033

North America Logistics Market Size and Share:

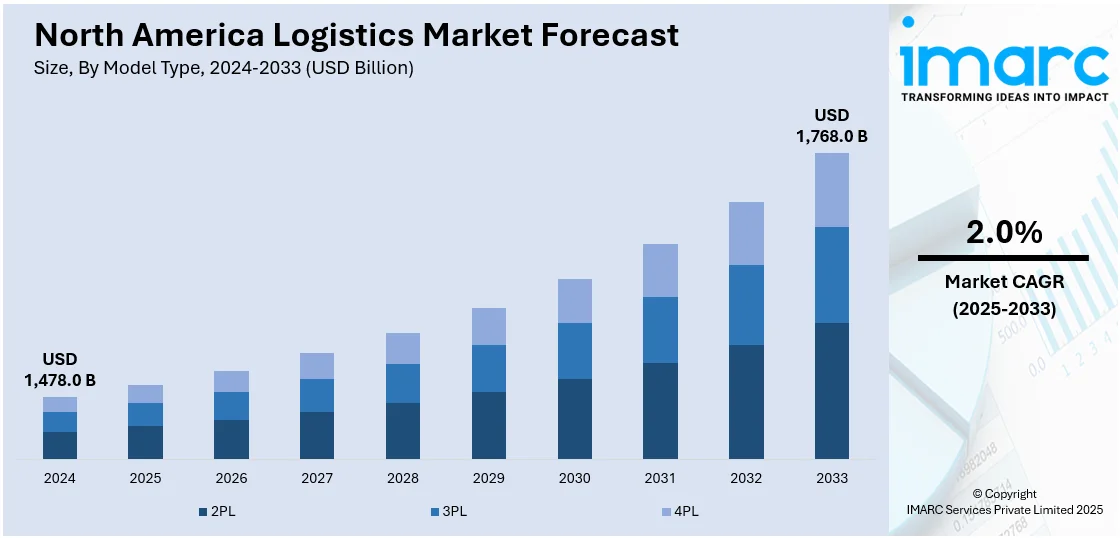

The North America logistics market size was valued at USD 1,478.0 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 1,768.0 Billion by 2033, exhibiting a CAGR of 2.0% during 2025-2033. The United States currently dominates the market, holding a significant market share of 81.9% in 2024. The increasing number of e-commerce activities, rising trade activities, technological advancements like automation and AI, increasing investments in infrastructure, and the adoption of Industry 4.0 technologies are some of the major growth-inducing factors fueling the North America logistics market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033 |

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1,478.0 Billion |

| Market Forecast in 2033 | USD 1,768.0 Billion |

| Market Growth Rate 2025-2033 | 2.0% |

The logistics market in North America is being driven by a combination of technological, economic, and consumer behavior factors. Foremost among these is the explosive growth of e-commerce, which has increased the need for advanced logistics and last-mile delivery solutions. Consumers now expect faster, more reliable deliveries, pressuring logistics providers to optimize their operations. This demand is met with innovations in automation, robotics, AI, and data analytics, all enhancing supply chain visibility, route optimization, and operational efficiency. For instance, in November 2024, C.H. Robinson, the worldwide frontrunner in third-party logistics (3PL) and fourth-party logistics (4PL) services, overseeing 35 million shipments and $22 billion in freight annually, revealed the introduction of C.H. Robinson Managed Solutions™, the future of logistics management. This advancement will address a rising void in the market for shippers seeking effortless access to state-of-the-art TMS technology, managed transportation by 3PL, and 4PL services from a single provider, on a larger scale, with unparalleled configurability, as supply chains become more intricate.

The North America logistics market growth is also driven by the increasing infrastructure investments. Governments and private firms are pouring resources into upgrading road, rail, air, and port systems to reduce congestion and improve freight movement. Additionally, the increasing adoption of Industry 4.0 practices, such as smart warehouses and IoT-enabled fleet management, has significantly improved efficiency and accuracy in inventory and delivery management. For instance, in March 2024, technology company LG Business Solutions USA revealed that it plans to debut its warehousing autonomous mobile robots (AMRs) in the United States at the industry trade show MODEX in Atlanta. The CLOi CarryBot series of robots, launched in Asian markets in 2022, consists of two models: the Rolltainer Type CLOi CarryBot and the Mounting Type CLOi CarryBot.

North America Logistics Market Trends:

Inflating E-Commerce Industry

The rising number of e-commerce activities is primarily driving the regional market. In May 2024, the Census Bureau of the Department of Commerce announced that the estimated U.S. retail e-commerce sales for the first quarter of 2024 was approximately USD 289.2 Billion, an increase of roughly 2.1% from the fourth quarter of 2023. Consequently, the expanding growth of online retail is inflating the need for efficient logistics systems. According to the data showcased by Talking Logistics, in 2022, carrier-related factors were responsible for around 82% of the delivery issues in the United States. As a result, various businesses are focusing on conducting data-driven analysis on their choice of carriers or third-party logistics providers, which is elevating the market revenue. As per a survey by Rakuten Insight Global, consumers in the U.S. tend to value speed and cost above all else when it comes to delivery experiences. According to the North America logistics market forecast, prominent delivery firms are enhancing logistics infrastructures to handle the increasing volume of shipments. For example, United Parcel Service, Inc., invested USD 40 Billion in new equipment, thereby increasing its daily processing capacity to 70 Million packages in 2023 from 60 Million in 2022.

Introduction of Advanced Solutions

The development of novel automated solutions to gain valuable insights into supply chain processes is strengthening the market in the region. According to LogisticsIQ's latest market research study, the warehouse automation market is expected to reach USD 30 Billion by 2026, at a CAGR of around 14% between 2020 and 2026. Additionally, automated solutions also help in providing real-time monitoring and tracking systems. For example, in September 2023, A.P. Moller & Maersk (Maersk) and Fabric cooperated to provide innovative e-commerce fulfillment solutions, combining Maersk's logistics knowledge and Fabric's world-class automation fulfillment technology. In keeping with this, they opened a 38,000-square-foot automated fulfillment center in Texas, USA. Moreover, the introduction of state-of-the-art warehousing solutions represents one of the North America logistics market recent opportunities. For instance, in February 2024, HWArobotics partnered with Darwynn, one of the e-commerce logistics providers in Canada, to deploy sophisticated robotic automated storage and retrieval systems (Shuttle ASRS) at its Toronto location. Apart from this, the widespread adoption of advanced analytics is also propelling the regional market. For example, in February 2024, Dexory announced its strategic expansion into North America by introducing its autonomous robotics and AI-powered analysis solution, DexoryView, for the evolving landscape of logistics and warehousing. Furthermore, the increasing popularity of last-mile delivery options is acting as another significant growth-inducing factor. For instance, in April 2024, UniUni, a tech firm in Canada, secured USD 50 Million in an oversubscribed Series C funding round led by venture capital company DCM to improve its B2C last-mile delivery system.

Increasing 3PL Providers

The rising need for streamlining supply chain operations for businesses across several industries is one of the drivers fueling the regional market. Furthermore, these providers offer a wide range of services, thereby enabling companies to focus on their core competencies while outsourcing complex logistics tasks. According to a report published by CBRE in April 2023, in North America, 3PL providers rented more large-scale (200,000 sq. ft. or more) warehouse space than any other category of occupiers. Apart from this, businesses across the region are seeking cost-effective solutions to manage the rapid movement of goods, which is also creating a North America logistics market outlook. For example, in May 2024, LIXIL Americas appointed Kenco, one of the third-party logistics providers in North America, to manage its Groveport distribution center in Ohio. Additionally, strategic collaborations among key players to offer better service to their clients are further driving the market. For instance, in February 2023, Kenco Group, one of the third-party logistics (3PL) providers, opened the North Georgia Distribution Center to offer customers of Kerry timely product distribution. Moreover, in January 2024, Kenco, a 3PL company in North America, acquired the Shippers Group, a Dallas-based third-party warehousing company that added to Kenco’s capabilities of broader geographic reach, an expanded suite of services for the benefit of customers, providing increased capacity, etc.

North America Logistics Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global North America logistics market, along with forecasts at the regional and country levels from 2025-2033. The market has been categorized based on model type, transportation mode, and end-use.

Analysis by Model Type:

- 2 PL

- 3 PL

- 4 PL

2PL stand as the largest model type in 2024, holding around 61.2% of the market. 2PL or second-party logistics providers are gaining popularity, owing to their direct control over transportation assets and infrastructure, such as trucks, ships, and aircraft. Unlike third-party logistics providers, which offer comprehensive supply chain management services, they focus specifically on the transportation segment of the logistics chain, providing essential freight and transport services. For example, in February 2024, FedEx Freight, one of the 2PL providers in North America, expanded its fleet and service coverage to accommodate the elevating requirement for efficient and reliable transportation solutions across various industries. This specialization allows businesses to leverage dedicated transportation resources and expertise, ensuring reliable and efficient movement of goods. Additionally, the escalating demand for efficient transportation solutions amid growing e-commerce activities and complex supply chains is augmenting the segment's growth. This, in turn, is increasing the North America logistics market's recent price.

Analysis by Transportation Mode:

- Roadways

- Seaways

- Railways

- Airways

Roadways leads the market with around 68.2% of market share in 2024. The dominance of road transportation is driven by its ability to offer door-to-door delivery, making it an essential component for both short-haul and long-haul logistics. According to the North America logistics market overview, the rise of e-commerce has further amplified the demand for roadways as businesses and consumers increasingly rely on the timely and efficient delivery of goods. Moreover, road transportation benefits from lower initial infrastructure investment compared to rail and air transport, making it a more accessible and scalable option for many companies. In October 2023, Renault and CMA CGM partnered to offer electric urban transport solutions for businesses in the logistics and transportation industry, aiming to reduce the carbon emissions of their fleets. In the U.S. trucking sector, over 1 Billion appointments are scheduled annually, typically via phone calls and emails.. The versatility of trucks in handling a wide variety of goods, coupled with advancements in vehicle technology and logistics management systems, will continue to fuel the North America logistics market demand in the coming years. In February 2024, C.H. Robinson created an innovative technology that helps eliminate the task of arranging an appointment at the pickup location for a load and organizing a second appointment, resulting in significant efficiency improvements in freight shipping.

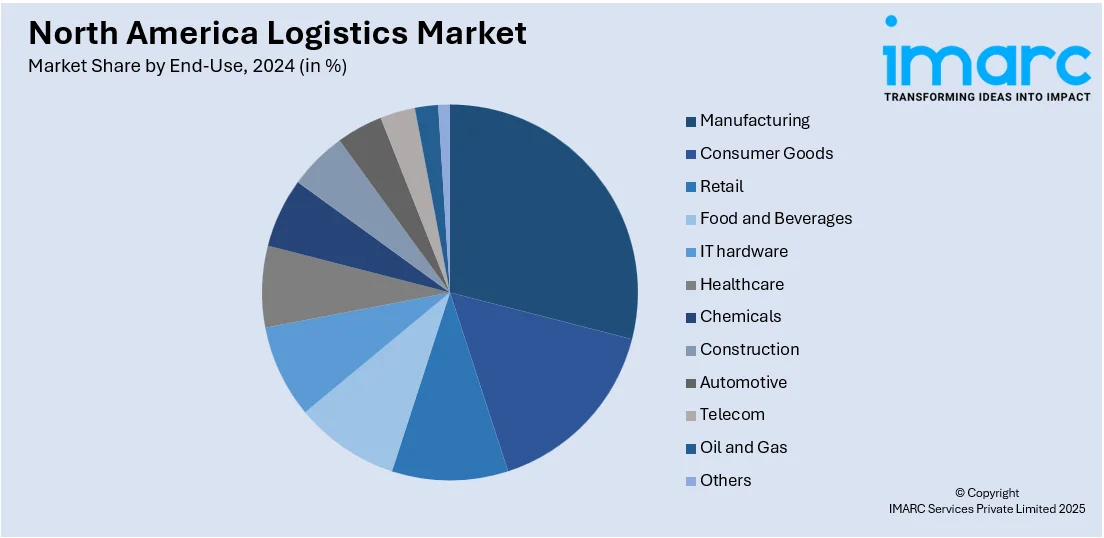

Analysis by End-Use:

- Manufacturing

- Consumer Goods

- Retail

- Food and Beverages

- IT Hardware

- Healthcare

- Chemicals

- Construction

- Automotive

- Telecom

- Oil and Gas

- Others

Manufacturing leads the market with around 17.5% of market share in 2024. The manufacturing sector relies heavily on logistics for the procurement of raw materials, efficient production processes, and the distribution of finished goods. As manufacturers seek to optimize their operations and reduce costs, the need for reliable and efficient logistics services becomes paramount. The complexity of manufacturing supply chains, which often involve multiple suppliers, intricate assembly processes, and diverse distribution channels, necessitates robust logistics support to ensure timely delivery and maintain production schedules. Additionally, the growth of advanced manufacturing techniques, such as just-in-time production and lean manufacturing, further increases the dependence on sophisticated logistics networks to minimize inventory costs and enhance operational efficiency. For example, in April 2024, Ascend Elements developed a complex logistics simulation model for its EV battery materials (pCAM) manufacturing facility in Kentucky, United States.

Country Analysis:

- United States

- Canada

In 2024, the United States accounted for the largest market share of over 81.9%. The expanding e-commerce industry is driving the market in the United States. As per the Statista Research Department, the revenue in the e-commerce market across the U.S. is estimated to reach USD 1.9 Trillion by 2029. Additionally, the increasing number of distribution facilities equipped with enhanced technologies is also acting as another significant growth-inducing factor. For example, in August 2023, DHL eCommerce opened a distribution center in Illinois, United States, encompassing a total area of 352,000 square feet. Moreover, the facility is equipped with an Automated Honeywell Cross-belt Loop Sorter, which can handle up to forty thousand parcels and packages an hour. Apart from this, the rising focus on adopting sustainable practices in logistics operations is creating a positive outcome for the market across the country. For instance, in April 2023, DHL Express announced the expansion of its sustainable business services in the U.S. Furthermore, the introduction of GoGreen Plus, a service that allows customers to set the carbon footprint of their shipments, is anticipated to bolster the market over the forecasted period.

Competitive Landscape:

The North America logistics market is highly competitive, dominated by key players including FedEx, UPS, C.H. Robinson, XPO Logistics, and DHL. These companies compete on factors like delivery speed, technology integration, global reach, and service diversity. Rapid e-commerce growth has also led to the rise of niche players offering specialized last-mile and same-day delivery solutions. Additionally, tech-driven startups and autonomous logistics firms are disrupting traditional models with innovations in AI, robotics, and real-time tracking. Strategic partnerships, acquisitions, and investments in automation and sustainability are further intensifying competition. As consumer expectations grow and supply chains become more complex, companies are increasingly focusing on digital transformation and operational efficiency to maintain market share and drive growth.

The report provides a comprehensive analysis of the competitive landscape in the North America logistics market with detailed profiles of all major companies.

Latest News and Developments:

- April 2025: Radiant Logistics, Inc. acquired USA Logistics Services, Inc. and USA Carrier Services, LLC, strengthening its Mid-Atlantic freight forwarding and cartage operations. Both companies, based in Philadelphia, have been part of Radiant's Service by Air brand since 2014.

- March 2025: CMA CGM Group announced a USD 20 billion investment in US maritime, logistics and supply chain capabilities over the next four years. The investment will aim to enhance shipbuilding, port infrastructure, logistics networks, and air cargo services, in addition to creating 10,000 new jobs.

- February 2025: DHL Group and Neste announced that they would deepen their collaboration to reduce logistics emissions, aiming for net-zero greenhouse gas emissions by 2050. The partnership will focus on using renewable diesel and sustainable aviation fuel to decarbonize DHL's transportation network.

- February 2025: FedEx acquired RouteSmart Technologies to enhance global pickup and delivery optimization. This move combines RouteSmart’s 40+ years of routing expertise with FedEx’s vast logistics network.

- February 2025: Bertelsmann expanded its US presence through its subsidiary’s (Arvato's) acquisition of Carbel LLC and United Customs Services. The deal increases Arvato's US network to 16 distribution centers with 650,000 square meters of warehouse space.

North America Logistics Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Model Types Covered | 2 PL, 3 PL, 4 PL |

| Transportation Modes Covered | Roadways, Seaways, Railways, Airways |

| End-Uses Covered | Manufacturing, Consumer Goods, Retail, Food and Beverages, IT Hardware, Healthcare, Chemicals, Construction, Automotive, Telecom, Oil and Gas, Others |

| Countries Covered | United States, Canada |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the North America logistics market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the North America logistics market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the North America logistics industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The North America logistics market was valued at USD 1,478.0 Billion in 2024.

The North America logistics market is projected to exhibit a CAGR of 2.0% during 2025-2033, reaching a value of USD 1,768.0 Billion by 2033.

Key factors driving the North America logistics market include the surge in e-commerce, advancements in automation and AI, rising demand for faster delivery, infrastructure investments, and increasing cross-border trade. These elements collectively enhance supply chain efficiency, meet evolving consumer expectations, and support the region’s growing economic and commercial activities.

The United States currently dominates the North America logistics market due to e-commerce growth, automation, infrastructure upgrades, labor shortages, and consumer demand for fast, reliable delivery.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)