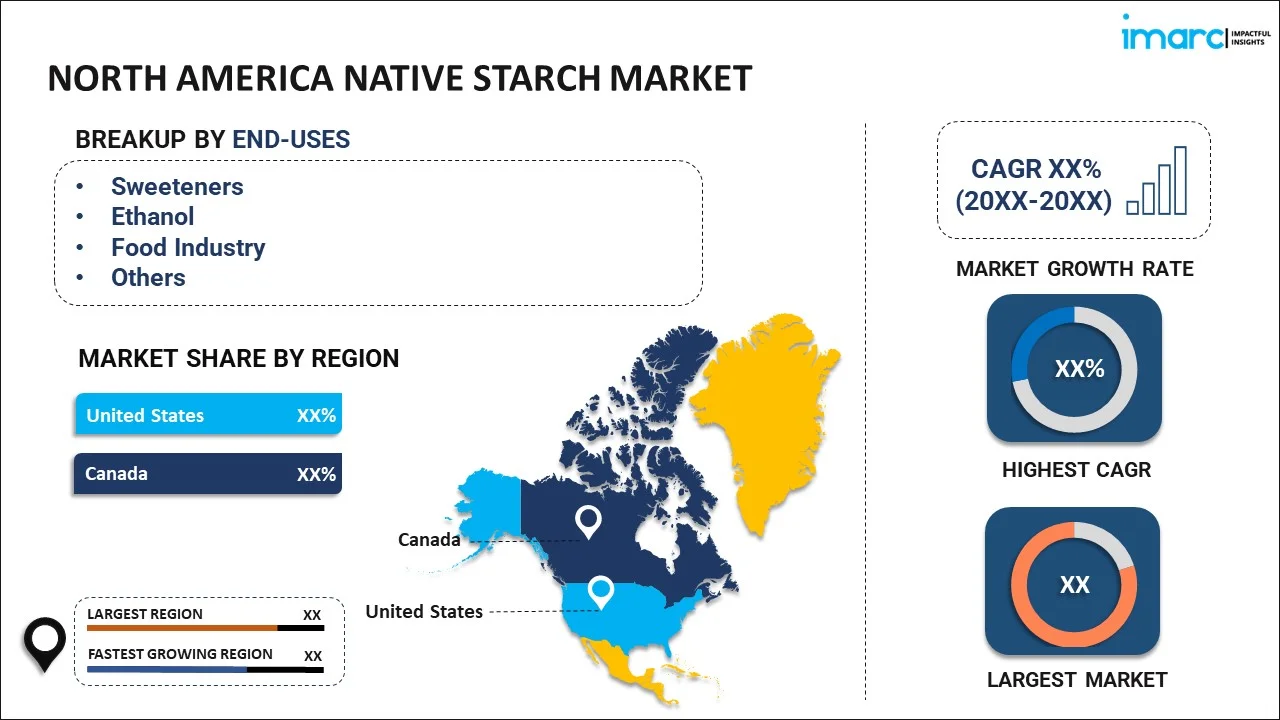

North America Native Starch Market Report by End-Use (Sweeteners, Ethanol, Food Industry, Paper Industry, and Others), Feedstock (Corn, Wheat, Cassava), and Country 2025-2033

Market Overview:

The North America native starch market size reached 28.1 Million Tons in 2024. Looking forward, IMARC Group expects the market to reach 38.2 Million Tons by 2033, exhibiting a growth rate (CAGR) of 3.10% during 2025-2033.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

28.1 Million Tons |

|

Market Forecast in 2033

|

38.2 Million Tons |

| Market Growth Rate 2025-2033 | 3.10% |

Native starch refers to a white, odorless, and tasteless substance obtained from plant sources like maize, wheat, tapioca, and potato. It is mainly present in seeds, roots or tubers, stem pith, and fruits and acts as a major energy reserve for plants. Furthermore, native starch serves as a thickening, binding, and gelling agent, and offers freeze-thaw stability, moisture retention, and anti-staling properties. Owing to these benefits, native starch is widely used across the food, paper, cosmetic, textile, adhesive, and pharmaceutical sectors.

The North America native starch market is being driven by several factors. Native starch is being increasingly used as a thickening agent in the preparation of soups and sauces, salad dressings, custard, creamy spreads, and other canned food items. The emergence of the on-the-go lifestyle in the region has boosted the demand for these food products, thereby propelling the native starch market growth. Furthermore, rising health consciousness amongst consumers has fueled the demand for low-calorie sweeteners, which are made by using native starch as a key ingredient. Other than this, a large volume of corn-based native starch is widely used for livestock feed and manufacturing ethanol, which is impacting the market growth positively.

Key Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the North America native starch market report, along with forecasts at the regional and country levels from 2025-2033. Our report has categorized the market based on end-use and feedstock.

- Key Regions Analysed

- United States

- Canada

- Analysis for Each Country

- Market by End-Use

- Sweeteners

- Ethanol

- Food Industry

- Paper Industry

- Others

- Market by Feedstock

- Corn

- Wheat

- Cassava

-

Value Chain Analysis

-

Key Drivers and Challenges

-

Porters Five Forces Analysis

-

Competitive Landscape

- Competitive Structure

- Key Player Profiles

Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million Tons |

| Segment Coverage | End-Use, Feedstock, Country |

| Countries Covered | United States, Canada |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the North America native starch market performed so far and how will it perform in the coming years?

- What are the key regions in the North America native starch market?

- What has been the impact of COVID-19 on the North America native starch market?

- What is the breakup of the North America native starch market on the basis of end-use?

- What is the breakup of the North America native starch market on the basis of feedstock?

- What are the various stages in the value chain of the North America native starch industry?

- What are the key driving factors and challenges in the North America native starch industry?

- What is the structure of the North America native starch industry and who are the key players?

- What is the degree of competition in the North America native starch industry?

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)