North America Pasta Market Size, Share, Trends and Forecast by Type, Raw Material, Distribution Channel, and Region, 2025-2033

North America Pasta Market Size and Share:

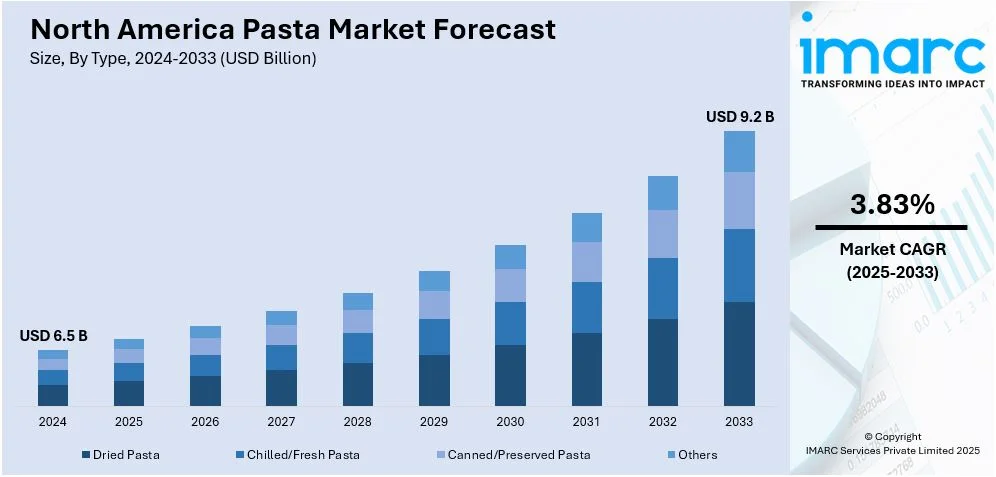

The North America pasta market size was valued at USD 6.5 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 9.2 Billion by 2033, exhibiting a CAGR of 3.83% from 2025-2033. The North America pasta market share is propelled by the increasing consumer demand for convenience foods, the growing popularity of healthier pasta alternatives, the rising number of Italian cuisine enthusiasts, the expansion of retail and online distribution channels, and innovations in pasta products, such as gluten-free and organic options.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 6.5 Billion |

|

Market Forecast in 2033

|

USD 9.2 Billion |

| Market Growth Rate (2025-2033) | 3.83% |

The North America pasta market growth is primarily driven by the demand for convenient and ready-to-cook food, particularly among urban consumers. Busy lifestyles and time constraints in urban cities are reshaping consumer behaviors, for which pasta is well-suited in its quicker preparation time and versatility in various dishes. According to industry reports, 82.2% of the total population in North America lives in urban areas in 2024. The proliferation of ready-to-eat microwaveable pasta or meal kits also fuels this interest. In addition, pasta is very affordable and shelf-friendly, appealing to consumers seeking budget-friendly pantry staples. Thus, the consumption of pasta keeps growing, particularly among busy families and individuals seeking convenient meal solutions.

Other than this, expanding retail and online distribution channels for pasta products are also creating a positive North America pasta market outlook. With the rise in e-commerce and convenience through online grocery shopping, more options in pasta types from different brands are now within consumer reach. For instance, as per industry reports, the United States e-commerce market is projected to grow at a CAGR of 6.80% during 2025-2033. Moreover, in November 2024, retail e-commerce sales accounted for approximately 6.1% of the total number of retail sales in Canada. Supermarkets and specialty stores are also improving their offerings by making a wide variety of pasta shapes, flavors, and healthier options more readily available.

North America Pasta Market Trends:

Rising demand for healthier and specialty pasta options

Healthy and specialty pasta alternatives have become a major North America pasta market trend. There is an increase in health consciousness. Thus, individuals tend to move toward gluten-free, organic, and high-protein pasta. This segment serves customers who have special dietary requirements or those with gluten intolerance, as well as individuals on keto or paleo diets. Moreover, pasta made from alternative grains such as quinoa, chickpeas, lentils, and brown rice is being consumed more because of its higher nutritional content. There is also a demand for more nutritious meals, enhanced by the trend toward plant-based eating; as a result, many pasta manufacturers have innovated and put forth a wide range of healthy, nutrient-rich pasta options. This increasing demand for specialty pasta products is expected to continue as consumers focus on healthier food choices.

Innovation in pasta shapes, flavors, and functional ingredients

The North America pasta market analysis also reveals that innovation in pasta shapes, flavors, and functional ingredients is significantly driving the industry. Manufacturers are adding new types of pasta in a growing number of shapes to appeal to different types of consumer tastes and preferences. Novel pasta shapes are appearing, ranging from colorful ones to flavored with spices, herbs, or vegetable inclusions. Functionality is also being enhanced through additives such as fiber or protein, as well as the introduction of probiotics. This allows consumers increased flexibility in using the product for diverse meals. This has prompted brands to diversify their product lines to cater to the health conscious and adventurous consumers, propelling market demand.

Increased interest in international and ethnic cuisine

The North America pasta market demand is also driven by the growing interest in international and ethnic cuisine. As consumers seek more diverse flavors and culinary experiences, pasta has become a key component of various global dishes. The increase in social media influencers focusing on food and the emergence of popular cooking programs and platforms is also responsible for the increasing popularity of Italian pasta dishes, as well as pasta-themed recipes inspired by Mediterranean, Middle Eastern, and Asian cultures. Furthermore, there is an increasing demand in ethnic restaurants and other foodservice institutions for pasta, particularly ramen, pho noodles, and pasta salad. This trend is expected to continue as North American consumers explore and adopt more diverse food cultures, further driving pasta consumption.

North America Pasta Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the North America pasta market, along with forecasts at the regional and country levels from 2025-2033. The market has been categorized based on type, raw material, and distribution channel.

Analysis by Type:

- Dried Pasta

- Chilled/Fresh Pasta

- Canned/Preserved Pasta

- Others

Dried pasta represents the leading market segment in 2024. This is mainly because of its shelf life, ease of use, and affordability. Fresh pasta does not have a long shelf life and cannot be stored without refrigeration. This is one of the main reasons dried pasta is considered a staple for many households to store in their pantries. Easy preparation and adaptability to most recipes make it popular. It is also generally cheaper than fresh pasta products, appealing to a large consumer base. The significant market share of several established dried pasta brands and their widespread presence in stores, as well as through online channels, helps solidify its position.

Analysis by Raw Material:

- Durum Wheat Semolina

- Wheat

- Mix

- Barley

- Rice

- Maize

- Others

Durum wheat semolina accounts for the largest market share in 2024. Due to its high quality and good texture, durum wheat semolina takes the top share in the pasta market in North America. This dominance is also because of its high protein and gluten content, which make it the right material for giving pasta its strength and elasticity while cooking. Coarse flour that is ground from durum wheat takes the shape of semolina with a unique yellow color and a rich texture to enhance the whole pasta experience. This makes it the preferred choice for manufacturers and consumers, as it keeps a desirable bite and consistency of the pasta. The widespread availability and established reputation of durum wheat semolina ensure its market domination.

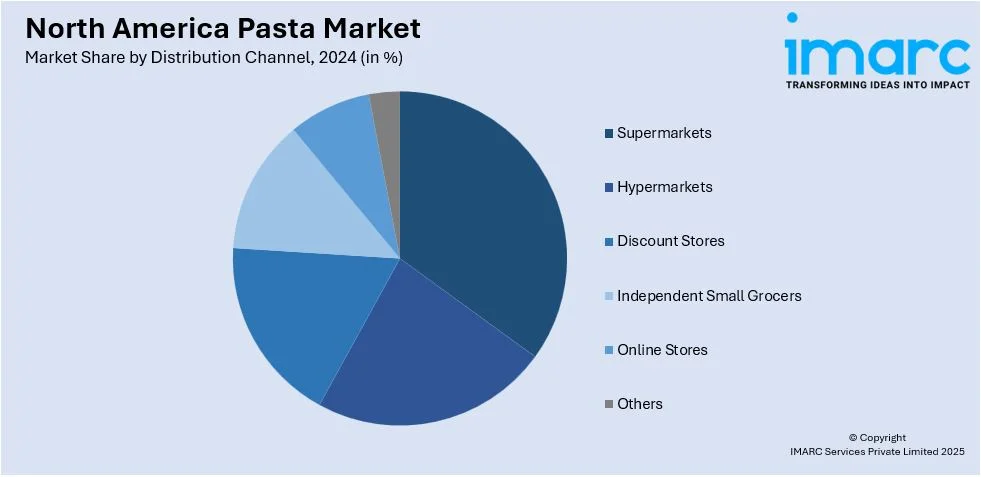

Analysis by Distribution Channel:

- Supermarkets

- Hypermarkets

- Discount Stores

- Independent Small Grocers

- Online Stores

- Others

Supermarkets hold the majority of the market share in 2024. Supermarkets remain the leading force in the North America pasta market because they provide extensive access and offer a large range of pasta products. The large consumer base and extensive networks of stores in supermarkets allow convenience for consumers to buy pasta from their grocery stores along with other grocery items. The promotion deals also tend to make pasta an affordable and accessible staple for most households. Moreover, there is an extensive array of pasta brands, types, and sizes offered in supermarkets that cater to a variety of consumer preferences. Online shopping options provided by supermarkets add yet another level of convenience and flexibility so that consumers can now easily purchase pasta products at home.

Analysis by Country:

- United States

- Canada

In 2024, the United States accounts for the largest share in the North America pasta market. The North America pasta market is dominated by the United States due to its large and diversified population and its demand for easy-to-use food products. The country has a strong food culture with both traditional dishes and Italian fusion cuisines, all of which lead to the higher consumption of pasta. There is also a well-established retail infrastructure system in the United States, with supermarkets and specialty stores online having a significant number of pasta products available. The growing interest in healthier versions, such as gluten-free and organic pasta, combined with innovative production of pasta, also increases the United States' market dominance in the region.

Competitive Landscape:

The North America pasta market leaders are driving growth with many strategic activities. Major players are making their portfolios extensive by producing various healthier and more specialized kinds of pasta, such as gluten-free, organic, and high-protein. They are also focusing on innovation. Numerous companies are making products in many different pasta shapes and flavors, as well as pre-prepared meals that are ready to cook and suit varied customer preferences. Besides this, investments in marketing and distribution networks have become the foundation of consumer access. From e-commerce platforms to the availability of the product in more retailers and restaurants, numerous players are expanding their market reach. Improvements in packaging and sustainable practices are catering to the needs of environmentally conscious consumers, thereby further increasing demand in the market.

The report provides a comprehensive analysis of the competitive landscape in the North America pasta market with detailed profiles of all major companies including:

- Barilla G. e R. Fratelli S.p.A.

- Dakota Growers Pasta Company, Inc

- Dreamfields Foods, Inc

- F.Lli De Cecco Di Filippo Fara San Martino Sp

- La Moderna SA de CV

- Riviana Foods Inc. (EBRO Foods, SA)

- Treehouse Private Brands, Inc. (Treehouse Foods Inc)

Latest News and Developments:

- 24 January 2025: Il Pastaio, an Italian gnocchi manufacturing company, has announced its expansion into North America with the construction of its first pasta factory in Union County, Pennsylvania. The facility will be built in the Gregg Township, spanning 71,300 square feet, and create approximately 74 local jobs with full-time employment.

- 20 September 2024: The Buitoni Food Company, a renowned refrigerated pasta manufacturer based in the United States, has been acquired by the Artisan Chef Manufacturing Company, a leading manufacturer of fresh pasta, bread, and sauces. With this acquisition, Artisan Chef aims to expand its product line and set up the business for future retail and collaboration prospects.

- 26 July 2024: Leading Canadian brand AGT Foods has opened a new pasta manufacturing facility in Minot, North Dakota, United States. The factory will manufacture cutting-edge plant-based pasta products. With the opening of this facility, AGT Foods and Minot remain at the forefront of innovation in pulse-based foods and gluten-free pasta products.

- 12 March 2024: Andriani S.p.A., a renowned Italian welfare corporation and pioneer in the healthy food industry, has expanded into North America with the launch of its brand, Felicia. The brand will be launched at the Natural Products Expo West in Anaheim, where it will present a cutting-edge portfolio of ten healthy pastas produced entirely from organic and 100% natural ingredients.

- 7 February 2024: Andriani, a leading pasta manufacturer based in Italy, plants to build its first North American manufacturing plant in London, Ontario, Canada. The facility will span 61,225 square feet and produce GMO-free and gluten-free pasta products. The construction of the plant will cost approximately USD 25 Million and will generate at least 42 jobs locally.

North America Pasta Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Dried Pasta, Chilled/Fresh Pasta, Canned/Preserved Pasta, Others |

| Raw Materials Covered | Durum Wheat Semolina, Wheat, Mix, Barley, Rice, Maize, Others |

| Distribution Channels Covered | Supermarkets, Hypermarkets, Discount Stores, Independent Small Grocers, Online Stores, Others |

| Countries Covered | United States, Canada |

| Companies Covered | Barilla G. e R. Fratelli S.p.A., Dakota Growers Pasta Company, Inc, Dreamfields Foods, Inc, F.Lli De Cecco Di Filippo Fara San Martino Sp, La Moderna SA de CV, Riviana Foods Inc. (EBRO Foods, SA), Treehouse Private Brands, Inc. (Treehouse Foods Inc), etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the North America pasta market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the North America pasta market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the North America pasta industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The North America pasta market was valued at USD 6.5 Billion in 2024.

The increasing focus on plant-based diets, rising disposable incomes and changing lifestyles, growing demand for quick and easy meal options, availability of a wide variety of pasta shapes and flavors, and strong presence of key pasta brands and manufacturers in the region are the primary factors driving the growth of the North America pasta market.

IMARC estimates the North America pasta market to exhibit a CAGR of 3.83% during 2025-2033.

The United States currently dominates the market due to its large consumer base, high demand for convenience foods, and the growing popularity of Italian cuisine.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)