North America Smart Agriculture Market Size, Share, Trends and Forecast by Agriculture Type, Offering, Farm Size, and Country, 2026-2034

North America Smart Agriculture Market Overview:

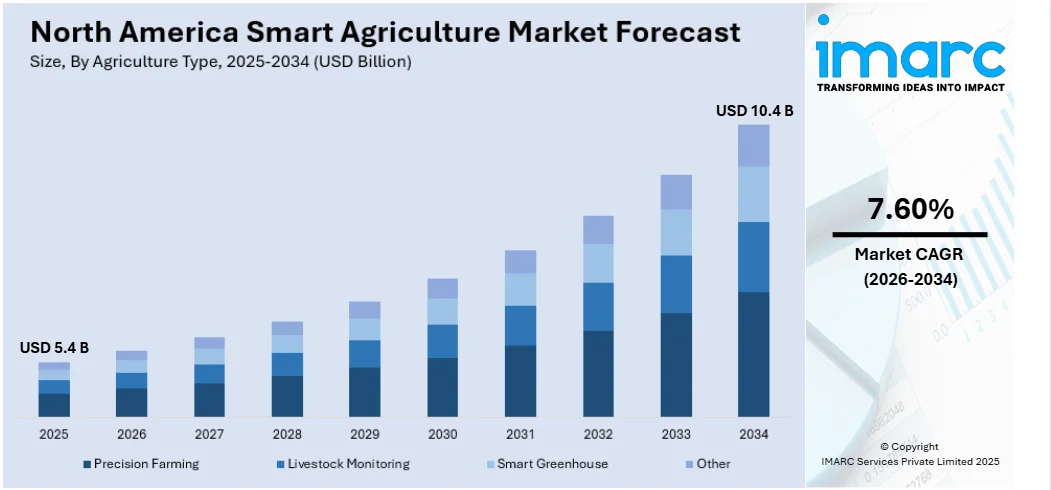

The North America smart agriculture market size reached USD 5.4 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 10.4 Billion by 2034, exhibiting a growth rate (CAGR) of 7.60% during 2026-2034. The market growth is spurred by advancing technologies such as IoT, AI, and big data analytics that improve crop observation, yield forecast, and asset management. The increasing demand for sustainable agriculture practices, government initiatives, lack of labor, and the requirement to apply precision agriculture to maximize output further drive the growth of the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 5.4 Billion |

| Market Forecast in 2034 | USD 10.4 Billion |

| Market Growth Rate 2026-2034 | 7.60% |

Access the full market insights report Request Sample

North America Smart Agriculture Market Trends:

Adoption of Internet of Things (IoT) for Precision Farming

The application of Internet of Things (IoT) technologies within agriculture is transforming agriculture practices in North America. Food production over the next few years must increase significantly to meet the needs of the world's population, which is expected to reach 9.7 billion mid-century. IoT allows farmers to gather real-time information from their fields, enabling them to optimize the use of resources and enhance farm management overall. Through sensors, networked devices, and wireless networks, IoT-based systems enable farmers to know soil moisture, temperature, crop health, and climatic conditions so that decisions can be based on scientific information. The movement towards precision farming is gaining a lot of momentum in North America through its association with IoT. For example, the U.S. Department of Agriculture (USDA) introduced the Partnerships for Climate-Smart Commodities, a program designed to boost the production and promotion of climate-smart agricultural goods. With an investment surpassing USD 3.1 billion, it supports 141 pilot projects that assist farmers, ranchers, and forest owners in adopting practices that lower greenhouse gas emissions and capture carbon.

To get more information on this market Request Sample

Farmers are now looking towards IoT devices to keep fields under surveillance and regulate irrigation automatically, optimize the application of fertilizers, and detect early stages of diseases or pests, avoiding wastage and expense and improving yield. Smart agriculture technologies driven by IoT allow farmers to use precision irrigation that saves water by giving just the right amounts according to live soil moisture measurements. Such technologies are paramount for mitigating water scarcity, which is an issue in many areas of North America. Besides, the IoT-enabled sensors also help in energy conservation through the regulation of irrigation systems and equipment based on real-time information, ensuring energy efficiency and cutting down costs. Additionally, the use of IoT devices in crop monitoring enables farmers to detect issues before they become widespread, which helps in minimizing pesticide and chemical usage, supporting sustainable agriculture practices. By minimizing the use of harmful chemicals, IoT also supports environmental preservation, a growing concern for many North American consumers and policymakers. As IoT technology continues to evolve, its role in smart agriculture will become even more pronounced, with advancements in machine learning and AI.

Growth of Autonomous Agricultural Equipment

Another prominent trend in North America smart agriculture market is the increasing adoption of autonomous agricultural equipment. These innovations, which include autonomous tractors, harvesters, and drones, are transforming the way farms operate by automating labor-intensive tasks. With labor shortages in rural areas and the increasing demand for more efficient farming methods, the use of autonomous machinery is gaining traction in North America. Autonomous tractors, for instance, have GPS technology, sensors, and artificial intelligence that can carry out operations like tilling, planting, and cultivating independently. This saves labor expenses and eliminates human error. The accuracy of the machines allows them to work even in difficult conditions, which is very useful for large farms and those located far from urban areas where labor is limited. Drones, a crucial part of this movement, are commonly used to monitor crops and conduct aerial photography. Equipped with cameras and sensors that take high-definition pictures, drones supply farmers with timely information about crop conditions, patterns of growth, and imminent danger from pests or disease. Farmers can therefore take prompt actions and make better uses of pesticides or fertilizers, cutting wastage and harmfulness to the environment.

The use of autonomous machinery also results in greater operational efficiency. These machines run continuously, independent of human labor, and therefore enhance productivity while enabling farmers to engage in more advanced tasks. Data collection and analysis capacity of autonomous equipment lead to better-informed decision-making, enhancing farm management overall. In addition, government incentives and collaborations with ag-tech firms are driving autonomous agricultural equipment development and deployment in North America.

North America Smart Agriculture Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on agriculture type, offering, and farm size.

Agriculture Type Insights:

- Precision Farming

- Livestock Monitoring

- Smart Greenhouse

- Other

The report has provided a detailed breakup and analysis of the market based on the agriculture type. This includes precision farming, livestock monitoring, smart greenhouse, and others.

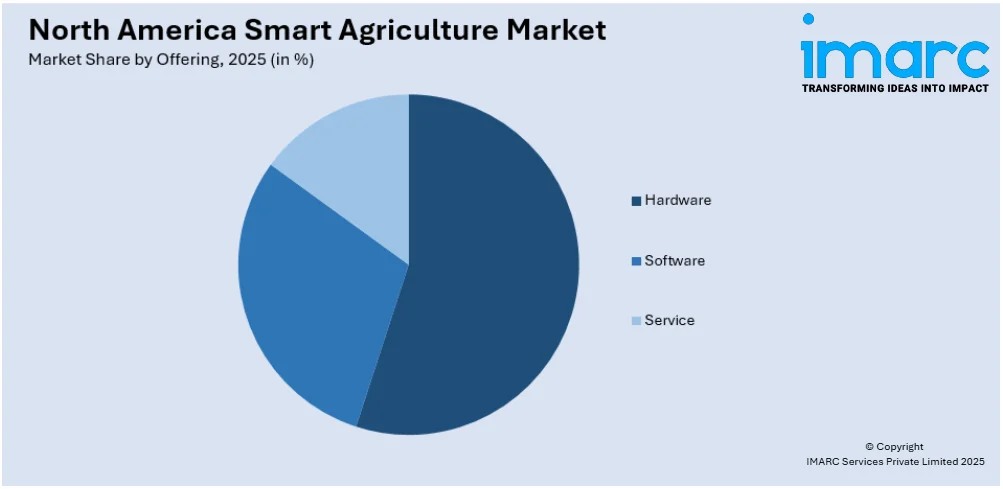

Offering Insights:

To get detailed segment analysis of this market Request Sample

- Hardware

- Software

- Service

A detailed breakup and analysis of the market based on the offering have also been provided in the report. This includes hardware, software and service.

Farm Size Insights:

- Small

- Medium

- Large

The report has provided a detailed breakup and analysis of the market based on the farm size. This includes small, medium and large.

Country Insights:

- United States

- Canada

The report has also provided a comprehensive analysis of all the major regional markets, which include United States and Canada.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

North America Smart Agriculture Market News:

- In January 2025, John Deere unveiled its new autonomous equipment in a CES 2025 press event for improving agriculture, construction, and commercial landscaping for its customers. As a follow-up to its earlier autonomous technology launch unveiled at CES 2022 the company's second-generation autonomy kit integrates sophisticated computer vision, AI, and cameras to help the machines navigate around their surroundings.

- In February 2025, AGCO one of the world's leading designers, manufacturers and distributors of agricultural equipment and precision ag technology, and SDF one of the world's top tractor, harvester, electric autonomous tractor and diesel engine manufacturers, formed a new alliance to enhance their global presence in low-mid horsepower tractor segment.

- Topcon Agriculture, a world leader in precision farming technology, and Bonsai Robotics, a pioneer in vision-based autonomy for agriculture, announced a program for next-generation agricultural automation for permanent crops. The partnership will combine Bonsai Robotics' industrial experience in vision-based autonomous driving technology and Topcon Agriculture's industry-leading capabilities through sensors, connectivity, and smart implementations to deliver farmers unprecedented efficiency and productivity in farming solutions.

North America Smart Agriculture Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Agriculture Types Covered | Precision Farming, Livestock Monitoring, Smart Greenhouse, Other |

| Offerings Covered | Hardware, Software, Service |

| Farm Sizes Covered | Small, Medium, Large |

| Countries Covered | United States, Canada |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the North America smart agriculture market performed so far and how will it perform in the coming years?

- What is the breakup of the North America smart agriculture market on the basis of agriculture type?

- What is the breakup of the North America smart agriculture market on the basis of offering?

- What are the various stages in the value chain of the North America smart agriculture market?

- What are the key driving factors and challenges in the North America smart agriculture?

- What is the structure of the North America smart agriculture market and who are the key players?

- What is the degree of competition in the North America smart agriculture market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the North America smart agriculture market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the North America smart agriculture market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the North America smart agriculture industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)