Nucleic Acid Isolation and Purification Market Size, Share, Trends and Forecast by Product, Type, Method, End User, and Region, 2025-2033

Nucleic Acid Isolation and Purification Market Size and Share:

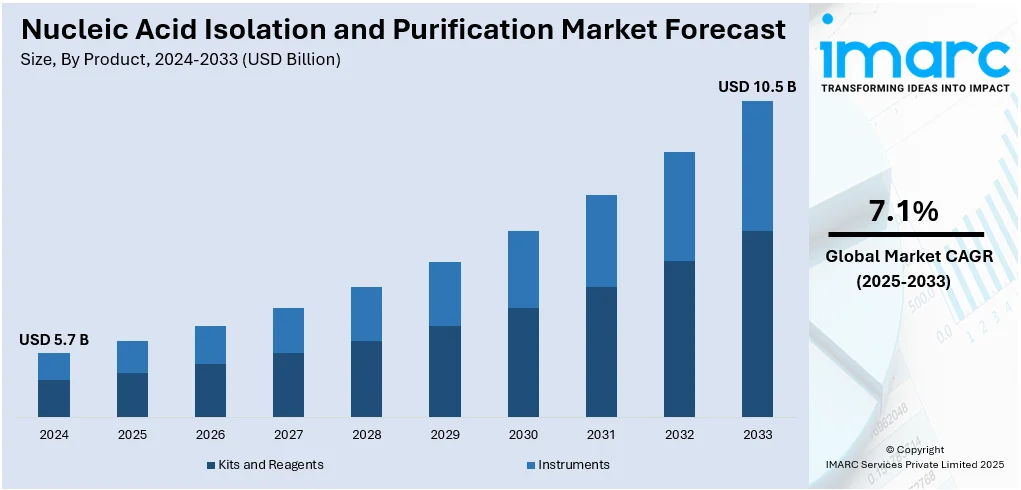

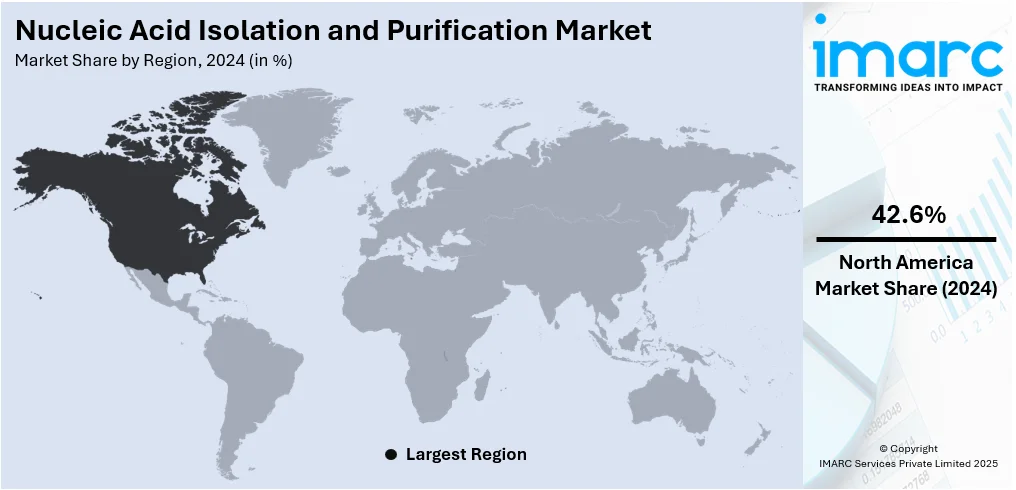

The global nucleic acid isolation and purification market size was valued at USD 5.7 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 10.5 Billion by 2033, exhibiting a CAGR of 7.1% during 2025-2033. North America currently dominates the market, holding a significant market share of over 42.6% in 2024. This is driven by advanced research infrastructure, strong government and private funding, early adoption of innovative purification technologies, and a high concentration of key market players. This results in strong nucleic acid isolation and purification market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 5.7 Billion |

| Market Forecast in 2033 | USD 10.5 Billion |

| Market Growth Rate (2025-2033) | 7.1% |

The global nucleic acid isolation and purification market is primarily driven by the expanding applications of nucleic acid-based technologies in agriculture, environmental testing, and forensic science. Increasing collaborations between academic institutions and biotechnology firms to advance genomic research are fostering innovation in purification methods. The proliferation of high-throughput sequencing and automation technologies has significantly improved workflow efficiency and sample processing accuracy. For instance, the 2024 commercial launch of Bionano’s Stratys™ and Ionic® systems highlights the industry's shift toward automation and high-efficiency solutions. The Stratys™ System enables comprehensive detection of structural variants via optical genome mapping, while the Ionic® System automates nucleic acid purification from complex samples using isotachophoresis. Eliminating the need for columns, beads, or harsh chemicals, it reduces sample loss and fragmentation, requiring minimal hands-on time and improving the quality and consistency of research data. Furthermore, the growing demand for high-purity nucleic acids in cell and gene therapy, along with rising regulatory focus on standardization in molecular procedures, supports market growth. Emerging economies are also investing in life sciences infrastructure, enhancing market accessibility and contributing to the global expansion of nucleic acid isolation and purification solutions.

To get more information on this market, Request Sample

In the United States, the nucleic acid isolation and purification market growth benefits from a robust pipeline of clinical trials leveraging nucleic acid-based diagnostics and therapeutics. Federal funding through institutions such as the NIH has accelerated research in genomics and transcriptomics, spurring demand for advanced isolation technologies. The presence of sophisticated laboratory infrastructure and early adoption of automation and AI-integrated platforms contribute to market maturity. Additionally, the rise in direct-to-consumer genetic testing and increasing interest in preventative healthcare are driving demand for efficient sample preparation solutions. The expanding biopharmaceutical sector, particularly in personalized oncology and infectious disease research, further reinforces the critical role of high-quality nucleic acid purification tools across clinical and academic settings.

Nucleic Acid Isolation and Purification Market Trends:

Increasing demand for molecular diagnostics and genetic research

The nucleic acid isolation and purification market forecast anticipates that the rising demand for molecular diagnostics and genetic research will remain a key growth driver, with this trend expected to sustain and accelerate market expansion in the coming years. In the healthcare sector, there is a rising emphasis on personalized medicine, where genetic information is used to tailor treatments to individual patients. An industry survey revealed that about 11% of Canadian adults have used direct-to-consumer genetic testing kits, while 60% are open to trying one. This trend has spurred the need for efficient and accurate nucleic acid isolation and purification methods. Concurrent with this, researchers and clinicians require high-quality DNA and RNA samples to perform various molecular tests, including PCR, sequencing, and gene expression analysis. Similarly, the biotechnology and pharmaceutical industries heavily rely on nucleic acid isolation and purification to develop and test new drugs, vaccines, and therapies. This sustained demand across multiple sectors is a key driving force behind the market's growth.

Advancements in automation and high-throughput technologies

Another prominent nucleic acid isolation and purification market trends include the continuous advancement of automation and high-throughput technologies in nucleic acid isolation and purification processes. Automation systems and robotic platforms have been developed to streamline and standardize these procedures, reducing the dependence on manual labor and minimizing the risk of contamination. An industry report indicated that automating core laboratory systems can reduce manual processing steps by as much as 86%. In line with this, High-throughput instruments and methods enable researchers to process a larger number of samples simultaneously, improving efficiency and scalability. These technological innovations save time and enhance the reproducibility and consistency of nucleic acid isolation and purification, making them increasingly attractive to laboratories and research facilities seeking higher throughput and improved precision.

Impact of the COVID-19 pandemic

The ongoing COVID-19 pandemic has exerted a significant influence on the nucleic acid isolation and purification industry. PCR-based testing, a crucial tool for diagnosing COVID-19, relies heavily on the isolation and purification of viral RNA. The surge in demand for COVID-19 testing, along with the need for research and surveillance, has led to an unprecedented uptick in the utilization of nucleic acid isolation and purification products. Market players quickly adapted to meet this demand by scaling up production and developing specialized kits and reagents for SARS-CoV-2 detection. The WHO reported that between May 5 and May 11, 2025, a total of 52,586 SARS-CoV-2 samples were tested across 78 countries. Although the pandemic's dynamics may change over time, the heightened awareness of the importance of robust nucleic acid isolation and purification processes in infectious disease control and research is expected to have a lasting impact on the nucleic acid isolation and purification market outlook.

Nucleic Acid Isolation and Purification Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global nucleic acid isolation and purification market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on product, type, method, and end user.

Analysis by Product:

- Kits and Reagents

- Instruments

Kits and reagents stand as the largest product in 2024, holding around 75.9% of the market. The demand for nucleic acid isolation and purification products, specifically kits and reagents, is propelled by the expanding application of nucleic acid-based techniques in the fields of forensic science and environmental monitoring. These areas increasingly rely on nucleic acid isolation and purification for DNA profiling, crime scene analysis, and identifying microbial contaminants. Additionally, the growing interest in agriculture and food safety drives the need for genetic testing and traceability, spurring demand for nucleic acid products. Apart from this, the emergence of innovative and specialized kits and reagents tailored to specific applications, such as RNA sequencing or viral RNA extraction, is attracting researchers and diagnostic labs, strengthening the market growth. Furthermore, the continuous development of user-friendly, cost-effective, and high-performance products accelerate the utilization of nucleic acid isolation and purification kits and reagents across various industries, providing impetus to the market growth.

Analysis by Type:

- Plasmid DNA Isolation and Purification

- Total RNA Isolation and Purification

- Circulating Nucleic Acid Isolation and Purification

- Genomic DNA Isolation and Purification

- Messenger RNA Isolation and Purification

- microRNA Isolation and Purification

- PCR Cleanup

- Others

Plasmid DNA isolation and purification stand as the largest component in 2024, holding around 20.4% of the market. The increasing importance of plasmid DNA in biotechnology and gene therapy applications is driving the demand for plasmid DNA isolation and purification. Plasmids are vital tools for genetic engineering, gene expression, and recombinant protein production, making them indispensable in the biopharmaceutical industry. Moreover, the rise of gene and cell therapies has created a surge in the demand for high-quality plasmid DNA for vector construction and therapeutic gene delivery, aiding in market expansion. Concurrent with this, the expanding field of synthetic biology, where custom-designed plasmids are employed to create novel biological systems, fuels the need for efficient plasmid DNA isolation and purification methods. The development of advanced purification techniques, such as chromatography and membrane-based systems, further enhances the purity and yield of plasmid DNA, making them essential components in the biotechnology and medical sectors and driving market demand.

Analysis by Method:

- Column-Based Isolation and Purification

- Magnetic Bead-Based Isolation and Purification

- Reagent-Based Isolation and Purification

- Others

Column-based isolation and purification leads the market with around 33.6% of market share in 2024. The demand for nucleic acid isolation and purification, specifically through column-based methods, is fueled by the preference for column-based techniques in research and clinical laboratories due to their efficiency, simplicity, and scalability. These methods offer researchers a reliable and convenient means of isolating and purifying nucleic acids with high purity and yield. Additionally, the versatility of column-based systems enables their use across a wide range of applications, from fundamental research to diagnostics, impelling the market growth. Moreover, advancements in column technology, such as improved matrix materials and design, have led to enhanced performance and faster processing times, making them increasingly attractive to users seeking rapid and consistent results. Furthermore, the stringent quality control requirements in genomics, molecular diagnostics, and pharmaceuticals have led to the continued adoption of column-based nucleic acid isolation and purification methods, driving sustained demand in the market.

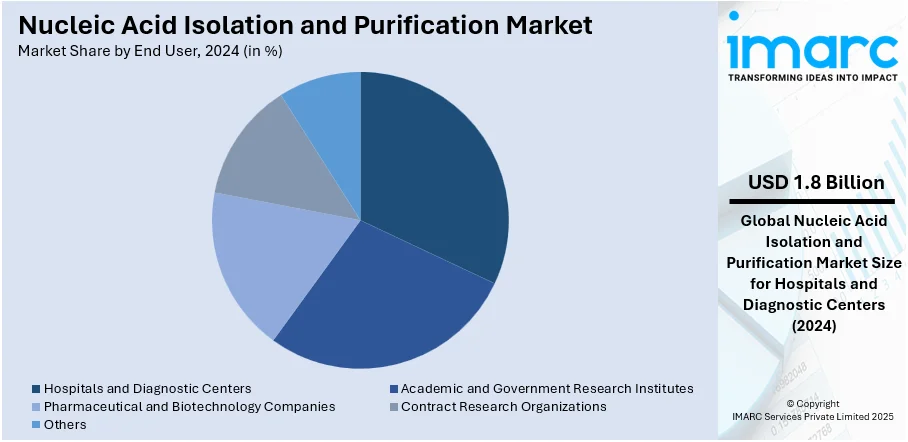

Analysis by End User:

- Hospitals and Diagnostic Centers

- Academic and Government Research Institutes

- Pharmaceutical and Biotechnology Companies

- Contract Research Organizations

- Others

Hospitals and diagnostic centers lead the market with around 32.1% of market share in 2024. The demand for nucleic acid isolation and purification products, particularly among hospital and diagnostic end-users, is primarily driven by the growing significance of molecular diagnostics in healthcare. Hospitals and diagnostic laboratories increasingly rely on nucleic acid-based tests to accurately diagnose various diseases, including infectious diseases, cancer, and genetic disorders. This has resulted in a consistent demand for high-quality DNA and RNA samples, thus fueling the need for efficient nucleic acid isolation and purification methods. Additionally, the rapid adoption of point-of-care testing and the emergence of novel diagnostic assays have amplified the demand for streamlined nucleic acid extraction processes that can be integrated into diagnostic workflows, thereby bolstering the market growth. As precision medicine gains prominence in patient care, hospitals are also utilizing nucleic acid purification techniques for personalized treatment strategies, propelling the market forward.

Regional Analysis:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of over 42.6%. North America's well-established and advanced healthcare infrastructure, along with a robust presence of pharmaceutical and biotechnology companies, has created a significant demand for nucleic acid isolation and purification products. As precision medicine and genetic research gain momentum, the need for high-quality DNA and RNA samples in North America continues to rise, driving the market's growth. In addition to this, the increasing prevalence of chronic conditions such as cancer, infectious diseases, and genetic disorders in the region has led to an elevated demand for molecular diagnostics, further boosting the requirement for efficient nucleic acid isolation and purification methods. For instance, the World Health Organization projects that by 2050, there will be more than 35 million new cancer cases globally. Furthermore, North America has been at the forefront of research and development in genomics, gene therapy, and biopharmaceuticals, contributing to the adoption of advanced purification techniques and specialized kits and reagents, thus playing a pivotal role in driving market expansion in the region.

Key Regional Takeaways:

United States Nucleic Acid Isolation and Purification Market Analysis

In 2024, the United States held a market share of around 91.60% in North America. The United States nucleic acid isolation and purification market is primarily driven by the rising demand for precision medicine. In addition to this, the growth of genetic research and personalized therapeutics, which encourages the adoption of advanced isolation technologies, is impelling the market. The increasing prevalence of infectious diseases, driving the demand for more effective diagnostic tools, is fostering market expansion. It has been reported that over 40 countries or territories have reported at least one infectious disease resurgence that's 10-fold or more over their pre-pandemic baseline. Similarly, continual advancements in biotechnology and pharmaceutical sectors are contributing to a wider implementation of nucleic acid purification methods. As such, Thermo Fisher Scientific announced a USD 2 Billion investment in U.S. operations, including USD 1.5 Billion for biotech manufacturing expansion and USD 500 Million for R&D, aiming to enhance innovation and domestic life sciences capabilities. The expanding genomics market, particularly in agriculture and forensic research, is also propelling market growth. Furthermore, rising investments in research infrastructure are strengthening the industry. The increasing demand for efficient diagnostic solutions in infectious diseases is driving the adoption of nucleic acid isolation techniques. Moreover, the growing applications in gene therapy and stem cell research are creating lucrative market opportunities.

Europe Nucleic Acid Isolation and Purification Market Analysis

The European market is experiencing growth due to the increasing focus on genomic research and personalized medicine. Accordingly, the Luxembourg Institute of Health received a EUR 20 Million grant for the Genome of Europe project, a EUR 45 Million initiative aimed at creating a European reference genome. This collaboration across 26 countries will revolutionize genomic research and personalized healthcare. In line with this, the rising prevalence of genetic disorders and cancer is creating a higher need for sophisticated diagnostic and therapeutic solutions. Similarly, increased investments in biotechnology and pharmaceutical research across the region are supporting the adoption of these technologies. The expanding use of nucleic acids in forensic science and agriculture is further contributing to market growth. Additionally, the European Union’s funding programs for healthcare and biotechnology innovation are stimulating market appeal. The emerging trend of academic and commercial collaborations is encouraging the use of cutting-edge nucleic acid extraction methods. Moreover, the rapid integration of automation and artificial intelligence in laboratories is enhancing efficiency, while the expansion of life sciences infrastructure across Europe is providing support for the market’s development.

Asia Pacific Nucleic Acid Isolation and Purification Market Analysis

The Asia Pacific nucleic acid isolation and purification market is largely propelled by the rapid growth of the biotechnology and pharmaceutical sectors in the region. Additionally, the growing focus on molecular diagnostics and genetic research is fueling market expansion. Consequently, Seegene and Springer Nature launched the "Nature Awards MDx Impact Grants" to support innovative PCR diagnostic assays, offering up to USD 600,000 in funding. The 2023 program attracted 281 applications from 47 countries, with 26 selected proposals. The rising incidence of infectious diseases and genetic disorders is creating a need for more efficient nucleic acid extraction methods. Furthermore, government support and investments in healthcare infrastructure are contributing to the market's accessibility. The increasing adoption of personalized medicine in the Asia Pacific is also augmenting the demand for high-quality isolation systems. Besides this, the expanding number of contract research organizations (CROs) and clinical trials in the region is further strengthening the market's presence.

Latin America Nucleic Acid Isolation and Purification Market Analysis

In Latin America, the market is advancing, driven by increasing government investments in healthcare and biotechnology, which support research and development. In accordance with this, the increasing prevalence of infectious diseases and genetic disorders is intensifying market demand. The CDC reported that chikungunya, dengue, and Zika are the main arboviral diseases in Brazil, transmitted primarily by Aedes aegypti mosquitoes. In 2022, the combined incidence rate for these diseases was 766 per 100,000 people, with outbreaks occurring during the rainy season. Similarly, the expansion of clinical trial activities and research collaborations across the region is accelerating the adoption of nucleic acid isolation technologies. Furthermore, the growing presence of local biotechnology companies and academic institutions focused on genomics is predominantly influencing market trends.

Middle East and Africa Nucleic Acid Isolation and Purification Market Analysis

The market for nucleic acid isolation and purification in the Middle East and Africa is significantly influenced by the rapid development of healthcare infrastructure and the expansion of biotechnology research hubs across the region. Similarly, the growing focus on non-communicable diseases, such as cancer and diabetes, is accelerating the adoption of molecular diagnostics. According to GLOBOCAN 2022, breast cancer accounted for 25% of cancer cases and nearly 20% of cancer deaths among women in MENA, with 118,200 new cases and 41,000 deaths. By 2050, these numbers are expected to rise to 219,000 new cases and 88,900 deaths, representing an 86% and 117% increase, respectively. Furthermore, numerous collaborations between the government and private sectors in genomic research are further driving the development of innovative nucleic acid extraction methods. Apart from this, the increasing adoption of personalized medicine in clinical settings is creating a positive market outlook.

Competitive Landscape:

The competitive landscape of the nucleic acid isolation and purification market is characterized by the presence of several well-established players and emerging biotechnology firms competing on the basis of product innovation, technological advancement, and global distribution networks. Companies are focusing on the development of automated, high-throughput systems that offer improved yield, purity, and efficiency. Strategic collaborations with research institutions and pharmaceutical companies are common, aimed at enhancing R&D capabilities and expanding application areas. Intellectual property, regulatory approvals, and product differentiation through ease of use and compatibility with downstream processes serve as key competitive parameters. Additionally, many players are expanding their footprints in emerging markets by investing in local manufacturing and support infrastructure to meet growing demand and regulatory requirements. For instance, in April 2025, QIAGEN announced plans to launch three new automated sample preparation instruments—QIAsymphony Connect (2025), QIAsprint Connect, and QIAmini (both in 2026). These systems aim to improve nucleic acid extraction efficiency across high- and low-throughput labs. Designed for applications like oncology, genomics, and liquid biopsy, the instruments offer enhanced automation, reduced hands-on time, and sustainability features. This expansion strengthens QIAGEN’s position in the global nucleic acid isolation and purification market.

The report provides a comprehensive analysis of the competitive landscape in the nucleic acid isolation and purification market with detailed profiles of all major companies, including

- Abcam plc

- Agilent Technologies Inc.

- Bio-Rad Laboratories Inc.

- Illumina Inc.

- Macherey-Nagel Gmbh & Co. Kg

- New England Biolabs

- Norgen Biotek Corp.

- Omega Bio-Tek Inc.

- Promega Corporation

- Qiagen

- Roche Molecular Systems Inc. (F. Hoffmann-La Roche AG)

- Takara Bio Inc. (Takara Holdings Inc.)

- Thermo Fisher Scientific Inc.

Latest News and Developments:

- June 2025: Xpedite Diagnostics partnered with Stratech Ltd to distribute its SwiftX™ rapid nucleic acid extraction kits across the United Kingdom and Ireland. The collaboration enabled faster access to the kits, offering improved delivery times, local stock, and expert support, eliminating customs delays and international logistics issues for labs in these regions. This partnership enhanced the availability of high-quality nucleic acid extraction solutions for critical genomic applications.

- May 2025: RevoluGen and ProteoQuest announced a partnership to distribute Fire Monkey High Molecular Weight DNA extraction kits across China, Hong Kong, and Taiwan. The kits enable cost-efficient hybrid sequencing and are designed for both short- and long-read sequencing, enhancing DNA extraction for genomic applications.

- January 2025: Applied BioCode enhanced its BioCode Gastrointestinal Pathogen Panel (GPP) by adding nucleic acid extraction support for the ThermoFisher Scientific KingFisher Flex platform. This expansion improves workflow efficiency, increasing throughput for gastrointestinal testing, and enabling clinical labs to streamline operations for better diagnostic outcomes.

- December 2024: QIAGEN reported surpassing 1,000 installations of its EZ2 Connect automated sample preparation system, bringing the global count of its EZ series instruments to 5,500 units. Originally launched in 2021, the EZ2 Connect improves nucleic acid purification workflows across genomics, diagnostics, and microbiome research, and now supports the EZ2 PowerFecal Pro Kit for enhanced sample processing.

- December 2024: BiOptic Inc. announced the successful integration of its subsidiary OpenGene, consolidating nucleic acid extraction production at its Xindian plant. This expansion increases production capacity by over 50%, enhances operational efficiency, and supports growth in precision medicine, genetic testing, and clinical diagnostics markets.

Nucleic Acid Isolation and Purification Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Products Covered | Kits and Reagents, Instruments |

| Types Covered | Plasmid DNA Isolation and Purification, Total RNA Isolation and Purification, Circulating Nucleic Acid Isolation and Purification, Genomic DNA Isolation and Purification, Messenger RNA Isolation and Purification, microRNA Isolation and Purification, PCR Cleanup, Others |

| Methods Covered | Column-Based Isolation and Purification, Magnetic Bead-Based Isolation and Purification, Reagent-Based Isolation and Purification, Others |

| End Users Covered | Hospitals and Diagnostic Centers, Academic and Government Research Institutes, Pharmaceutical and Biotechnology Companies, Contract Research Organizations, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Abcam plc, Agilent Technologies Inc., Bio-Rad Laboratories Inc., Illumina Inc., Macherey-Nagel Gmbh & Co. Kg, New England Biolabs, Norgen Biotek Corp., Omega Bio-Tek Inc., Promega Corporation, Qiagen, Roche Molecular Systems Inc. (F. Hoffmann-La Roche AG), Takara Bio Inc. (Takara Holdings Inc.), Thermo Fisher Scientific Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the nucleic acid isolation and purification market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global nucleic acid isolation and purification market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the nucleic acid isolation and purification industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The nucleic acid isolation and purification market was valued at USD 5.7 Billion in 2024.

The nucleic acid isolation and purification market is projected to exhibit a CAGR of 7.1% during 2025-2033, reaching a value of USD 10.5 Billion by 2033.

The market is driven by growing research in genomics and molecular diagnostics, rising demand for personalized medicine, increasing prevalence of infectious and genetic disorders, and technological advancements in extraction and purification techniques.

North America currently dominates the market, holding a share of around 42.6% in 2024, due to advanced healthcare infrastructure, strong presence of key biotechnology and pharmaceutical companies, significant investments in research and development, and widespread adoption of molecular diagnostics and genomic technologies. Supportive government initiatives and high demand for personalized medicine also drive regional growth.

Some of the major players in the nucleic acid isolation and purification market include Abcam plc, Agilent Technologies Inc., Bio-Rad Laboratories Inc., Illumina Inc., Macherey-Nagel GmbH & Co. KG, New England Biolabs, Norgen Biotek Corp., Omega Bio-Tek Inc., Promega Corporation, Qiagen, Roche Molecular Systems Inc. (F. Hoffmann-La Roche AG), Takara Bio Inc. (Takara Holdings Inc.), Thermo Fisher Scientific Inc., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)