Oat Milk Market Size, Share, Trends, and Forecast by Source, Product, Packaging Type, Application, Distribution Channel, and Region, 2025-2033

Oat Milk Market Size and Share:

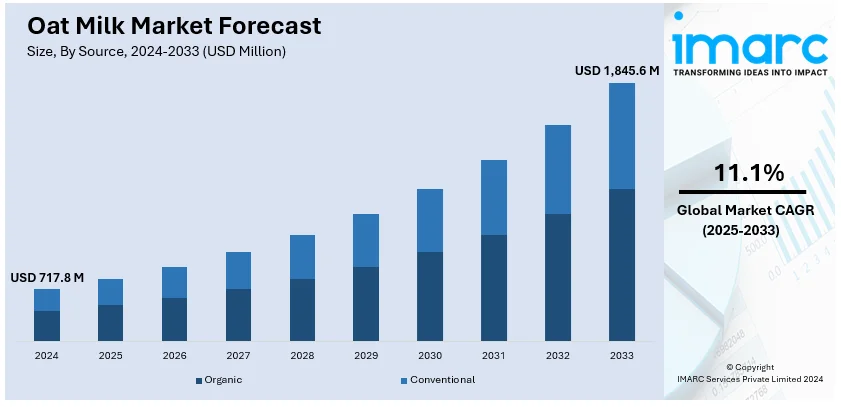

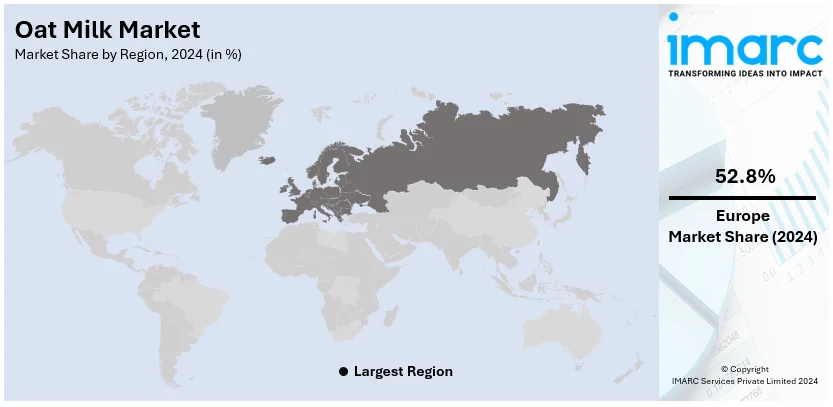

The global oat milk market size was valued at USD 717.8 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 1,845.6 Million by 2033, exhibiting a CAGR of 11.1% from 2025-2033. Europe currently dominates the market, holding a market share of over 52.8% in 2024. The increasing product demand as a dairy milk substitute in the region is driving the market growth. In addition, the inflating disposable incomes of consumers, the rising awareness regarding the health benefits offered by the product, and the growing number of lactose-intolerant individuals are some of the factors propelling the market demand.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 717.8 Million |

|

Market Forecast in 2033

|

USD 1,845.6 Million |

| Market Growth Rate 2025-2033 | 11.1% |

Rising consumer demand for plant-based and dairy-free alternatives, driven by health, environmental, and dietary concerns, has been acting as the prime factor driving the growth of the oat milk market. Its nutritional profile, such as fiber and low fat, appeals to health-conscious consumers. Besides this, the increasing prevalence of lactose intolerance and the rise in veganism are boosting product adoption worldwide. Moreover, innovation in flavor variations and fortified versions is greatly enhancing market appeal. In line with this, the inclusion of oat milk in food service to coffee and dessert menus fuels its rising demand. Furthermore, social media consciousness and promotions from nutritionists enhance consumer preference, thereby contributing to the steady growth of the market in developed as well as emerging economies.

The U.S. oat milk market is witnessing significant growth, holding 75.3% of the total market share. One of the primary drivers is the growing incidence of lactose intolerance among Americans, estimated at 36%, which fuels the demand for dairy substitutes such as oat milk. Additionally, the increase in veganism and plant-based diets has expanded the outlet for oat milk products. As of 2023, 4% of U.S. consumers identify as vegan, reflecting a shift towards more ethical eating preferences like oats milk. Its nutritious content of high fiber and essential vitamins makes it a popular choice among health-conscious consumers. Besides this, the growing popularity of oat milk in food service industries, such as among coffee shops is also impelling the market growth.

Oat Milk Market Trends:

Easy Product Availability in Convenient Packaging Solutions

The easy product availability in convenient packaging solutions is fueling the oat milk market growth. The accessibility of oat milk in various sizes, including single-serve containers and larger cartons, makes it incredibly convenient for consumers to incorporate into their daily routines. In 2023, cartons represented the most popular packaging type for oat milk, accounting for a share of 53.1% of the total global oat milk market. This packaging convenience aligns well with modern, fast-paced lifestyles, allowing people to enjoy oat milk on the go, at work, or home without hassle. The portability of these packaging solutions has also contributed to oat milk's popularity in cafes and coffee shops, enabling baristas to incorporate it into beverages easily. The widespread distribution of oat milk in grocery stores, along with its user-friendly packaging, has increased its exposure and made it a viable option for a broader range of consumers, thus bolstering the market.

Increasing Product Endorsement by Celebrities

The increasing product endorsement by celebrities has significantly contributed to the oat milk market growth. Celebrities often have a large and dedicated fan base and wield considerable influence over consumer choices. When well-known individuals openly endorse oat milk, whether through social media posts, interviews, or partnerships, it not only boosts the product's visibility but also lends it an element of desirability. According to an industrial report, there were 5.22 billion social media users around the world at the start of October 2024, equating to 63.8 percent of the total global population. Consumers often seek to emulate the lifestyles and choices of their favorite celebrities, and when they see them enjoying oat milk, it can motivate them to try it as well. This form of indirect recommendation can lead to a rapid expansion of the consumer base. As more and more celebrities choose to promote oat milk as part of their health-conscious or environment-friendly lifestyles, the market for oat milk experiences a corresponding boost in demand and popularity.

Rising Product Innovations and Varieties

The continuous rise in product innovations and varieties is fostering the market. As consumer preferences diversify and evolve, manufacturers have responded by introducing a wide array of oat milk options to cater to different tastes, dietary needs, and usage scenarios. Innovations such as flavored oat milk (vanilla, chocolate, etc.), barista blends for coffee, low-sugar or unsweetened variations, and organic options have expanded the appeal of oat milk to a broader audience. These innovations ensure that oat milk can seamlessly integrate into various culinary applications, from coffee to cooking and baking. Furthermore, specialized formulations targeting specific dietary requirements, such as gluten-free or nut-free oat milk, have extended oat milk's accessibility to those with allergies or sensitivities. By continually pushing the boundaries of what oat milk can offer, manufacturers have managed to captivate the interest of consumers seeking novel and customizable alternatives to dairy milk, thereby propelling the market. The oat milk market revenue is on an upward trajectory, reflecting the robust growth driven by consumer demand for plant-based dairy alternatives and expanding product offerings.

Oat Milk Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global oat milk market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on source, product, packaging type, application, distribution channel, and region.

Analysis by Source:

- Organic

- Conventional

Conventional oat milk accounts for the majority of the market share at 74.0% in 2024. A wide lead for conventional oat milk is explained by wide availability, low-cost production, and traditional consumer trust. In line with this, this oat milk variant usually covers a very large scope of customers, mainly in countries where cost and accessibility matter the most. These traditional products continue to perform well as are integrated into existing supply chains and have strong brand recognition. Their ability to meet the demands of a price-sensitive market ensures sustained dominance, even while organic and premium oat milk variants gradually increase their foothold in the industry.

Analysis by Product:

- Plain

- Flavored

Plain oat milk holds the largest market share at around 58.3% in 2024. It is so popular due to its flexibility and preference among most consumers for unsweetened additive-free options. Plain oat milk is a staple for various purposes, such as to drink on its own, for cooking, or when mixed with other beverages, such as coffee. It's extremely convenient for this reason and highly appealing to clean-label-conscious consumers. In addition to this, it serves vegan and lactose-intolerant customers. Being a neutral base, plain oat milk also enables customization in terms of flavors or sweeteners, which is the driving force behind its dominance in both the retail and food service segments across the world.

Analysis by Packaging Type:

- Cartons

- Bottles

- Others

In 2024, cartons accounted for about 53.2% of the oat milk market. Their popularity can be attributed to such factors as convenience, eco-friendliness, and effective preservation of the product's freshness. Cartons offer light and easily transportable packaging that is preferred by consumers and retailers alike. In confluence with this, the increased need for recyclable packaging solutions to achieve sustainability is also contributing to their growing adoption and aiding in market expansion. This adaptability to different sizes and branding also makes them attractive to manufacturers who seek visually and functionally appealing options, making cartons the most dominant packaging type in the market for oat milk.

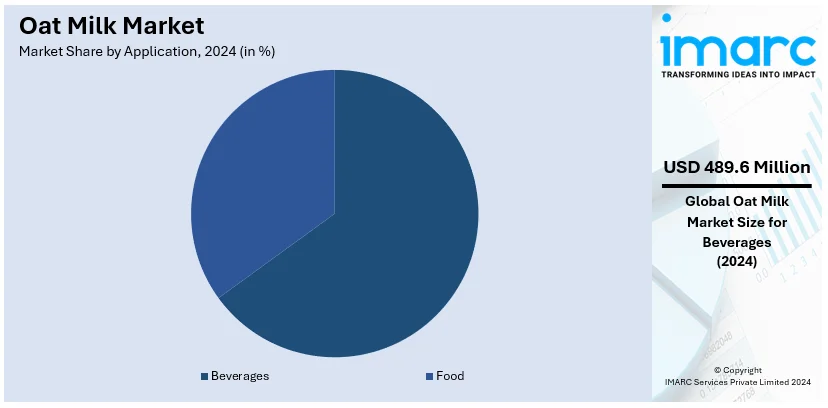

Analysis by Application:

- Food

- Beverages

Beverages dominate the oat milk market in 2024, holding approximately 68.2% of the market share. This dominance is driven by oat milk's widespread use as a dairy alternative in coffee, smoothies, and other drink formulations. Its creamy texture and neutral flavor make it a favorite for consumers seeking plant-based, lactose-free options in cafes and households. The versatility of oat milk in enhancing both hot and cold beverages leading to its high demand is presenting lucrative opportunities for market expansion. Apart from this, its nutritional profile and growing popularity among health-conscious consumers reinforce its application as a preferred ingredient, ensuring the beverages segment remains the market leader.

Analysis by Distribution Channel:

- Supermarkets and Hypermarkets

- Grocery Stores

- Online Stores

- Others

Supermarkets and hypermarkets dominate the oat milk market in 2024, capturing approximately 40.4% of the market share. These outlets remain the primary choice for consumers due to their extensive product variety, convenience, and competitive pricing. Supermarkets and hypermarkets offer well-organized sections that make it easy for customers to compare brands, sizes, and prices, enhancing the shopping experience. Concurrent with this, strategic product placement and promotional activities within these stores drive higher sales volumes, creating a positive outlook for market expansion. Besides this, their widespread presence in urban and suburban areas ensures accessibility, making them a key distribution channel for oat milk in both developed and emerging markets.

Regional Analysis:

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Europe holds the largest market share in the oat milk market, accounting for over 52.8%. The region’s dominance is fueled by the growing adoption of plant-based diets and heightened consumer awareness of sustainable and dairy-free alternatives. In line with this, countries like Sweden, Germany, and the UK have been at the forefront of this shift, driven by strong environmental consciousness and a high prevalence of lactose intolerance. Furthermore, Europe’s advanced food processing infrastructure and widespread availability of oat milk in retail and food service channels further bolster its leadership. Apart from this, the implementation of favorable government policies supporting sustainable and vegan products contributes to the region's market strength, fostering the market expansion.

Key Regional Takeaways:

North America Oat Milk Market Analysis

The growth of oat milk in North America is driven by increasing demand for plant-based alternatives, with approximately 41% of U.S. households purchasing non-dairy milk regularly, with a repeat purchase rate of 76%. Lactose intolerance, affecting around 36% of the population, significantly influences this shift. The rise in veganism, with about 4% of Americans identifying as vegan in 2023, further accelerates demand. Oat milk’s nutritional benefits, such as high fiber and beta-glucan content, attract health-conscious consumers, while its environmental sustainability appeals to eco-aware buyers. Food service adoption, particularly in coffee shops, has also surged, with oat milk becoming a preferred choice for lattes and specialty beverages. Additionally, product innovation, including fortified options and flavored varieties, continues to expand its appeal. With increasing retail availability and robust marketing campaigns, oat milk is rapidly establishing itself as a staple in North American households, reflecting a broader trend toward plant-based, sustainable, and health-focused dietary preferences.

United States Oat Milk Market Analysis

Robust growth is being experienced in the U.S. oat milk market with the spate of health trends, dietary shifts, and sustainability concerns. Consumer demand for plant-based and lactose-free alternatives for boosting the market increases due to oat milk being a popular dairy alternative. According to an industrial report, more than half (52%) of U.S. consumers are eating more plant-based foods and they believe it makes them feel healthier. The market share has significantly expanded, thanks largely to the presence of dominant brands like Oatly, Califia Farms, and Silk. Oatly, for example, has emerged as a prominent leader with increased market share due to its strong brand presence and innovations in product development. Similarly, the distribution channels for oat milk are expanding rapidly, where it is growing more intensively throughout the stores, cafes, and coffee shops throughout the country. With the growth of health-conscious consumers, oat milk is the nutritious and eco-friendly substitute over traditional dairy. Furthermore, product innovation, including barista-specific oat milk, will increase demand in the cafe segment. This will be a significant driver of future growth.

Europe Oat Milk Market Analysis

Among the largest markets for oat milk is Europe, which leads the way in oat milk sales, at least in countries like the UK, Sweden, and Germany. The market shift towards plant-based diets is greatly supported by growing concerns about sustainability, health, and environmental impact about dairy farming. European consumers increasingly accept oat milk as a viable alternative to traditional dairy products. Such rising acceptance is traced to the health benefits encompassing oat milk, which is lactose-free and high in fiber. In 2023, oat milk sales exceeded all other plant-based milk alternatives in terms of growth across many European markets. Strong distribution channels are driving this market, and major brands such as Oatly, Alpro, and Minor Figures are increasingly penetrating the European home and cafe. Europe continues to harmonize its regulatory approach towards sustainability and plant-based products, which is also supporting the growth in this market. Innovations, like the barista-specific formulations targeted to coffee shops, make oat milk more attractive not only to consumers but also to the industry players.

Asia Pacific Oat Milk Market Analysis

The Asia Pacific oat milk market is growing rapidly, driven by increased health awareness, dietary preferences, and a shift towards plant-based diets. Countries such as China, Japan, South Korea, and Australia are facing major adoption of oat milk due to lactose intolerance, veganism, and health concerns that keep consumers away from traditional dairy. For example, oat milk sales in China increased rapidly after international brands such as Oatly arrived in the country and gained market dominance. There is increased awareness about health matters across the region, along with a burgeoning middle-class population, which has fueled the consumption of plant-based beverages. Other factors contributing to the accessibility of oat milk products will be the high growth rate of e-commerce and online grocery shopping. Thus, there will be more people reaching into this category of dairy-free products; the market is expected to continue its growth path further, driven by increasing interest in nutrition, sustainability, and clean-label products.

Latin America Oat Milk Market Analysis

As consumers are reaching out for dairy alternatives in growing numbers, the market of oat milk is rising in Latin America. Health and wellness awareness increases along with dietary changes in countries like Brazil and Mexico toward plant-based and lactose-free diets. Oat milk's increased availability in local supermarkets and coffee shops is further stimulating adoption. Regional brands also introduce oat milk products, following the global trends and catering to the demand of healthier beverages and more environmentally friendly options in the region. As the region’s middle-class population and their disposable income grows, consumers are willing to spend more on higher-quality plant milks. According to world bank data, in Latin America and the Caribbean, the share of high-income countries has climbed from 9% in 1987 to 44% in 2023. All these factors will likely to infuse the market.

Middle East and Africa Oat Milk Market Analysis

Growth in the oat milk market is occurring early in the Middle East and Africa, where growth in health consciousness and demand for dairy alternatives is continuously increasing. Purchasing is prominent in countries such as the UAE, Saudi Arabia, and South Africa as oat milk gains higher visibility in grocery stores and cafes. Trending consumer preferences toward plant-based diets and the growing vegan culture are fueling the expansion of this market. A plant-based revolution is underway in the Middle East. A survey by a leading research organization found that 87% of respondents in the UAE and 81% in Saudi Arabia have tried plant-based food and beverages. Key motivators for adopting plant-based or vegan diets in the region include improving quality of life, ethics, and addressing health issues. With the region seeing higher disposable incomes and higher awareness of health and wellness, the demand for oat milk is sure to increase further

Competitive Landscape:

Top companies are strengthening the market through strategic initiatives. They invest in robust marketing campaigns to enhance brand visibility, leveraging celebrity endorsements and social media influencers to reach a wider audience. These companies also focus on widespread distribution, ensuring their products are readily available in grocery stores, cafes, and online platforms, thus maximizing consumer accessibility. Furthermore, continuous product innovation remains a key strategy. These companies introduce new flavors, formulations, and packaging sizes to cater to diverse preferences. Collaborations with coffee chains and food establishments have also helped integrate oat milk into mainstream menus, driving adoption. Top brands also prioritize sustainability, aligning with eco-conscious consumer values. They attract environmentally-aware customers by emphasizing their products' environmental benefits and ethical sourcing practices.

The report provides a comprehensive analysis of the competitive landscape in the oat milk market with detailed profiles of all major companies, including:

- Califia Farms LLC

- Earth's Own Food Company Inc

- Elmhurst Milked Direct LLC

- Happy Planet Foods Inc.

- Oatly AB (Cereal Base Ceba AB)

- Pacific Foods of Oregon LLC (Campbell Soup Company)

- Planet Oat Oatmilk (HP Hood LLC.)

- RISE Brewing Co.

- The Hain Celestial Group Inc.

- Thrive Market Inc.

Latest News and Developments:

- August 2024: Califia Farms announced the acquisition of Uproot Inc., a self-serve dairy alternative dispenser brand. The US oat, almond and coconut milk manufacturer plans to incorporate its own product range into Uproot Inc.’s dispenser unit, which is currently present in more than 150 US colleges, universities, and hospitals.

- August 2024: Milkadamia unveiled the launch of Flat Pack Organic Oat Milk, its latest addition to the dairy-free products portfolio. The new product highlights the combination of innovation with sustainability through a 2D-printing process, making oat milk sheets that cut packaging waste drastically by 94% and weight by 85%.

- May 2024: Nestlé Singapore announced the launch of OAT and ALMOND & OAT drinks, with essential nutrients including vitamins B2, B3, and D and calcium.

- February 2024: Thrive Market announced its acceptance of SNAP EBT, making it the first-ever online-only retailer to receive USDA approval.

- January 2024: Oatly announced the launch of two new oat milk variants – Unsweetened Oatmilk and Super Basic Oatmilk. Both products are formulated with enhanced nutritional value without compromising on the taste.

Oat Milk Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Sources Covered | Organic, Conventional |

| Products Covered | Plain, Flavored |

| Packaging Types Covered | Cartons, Bottles, Others |

| Applications Covered | Food, Beverages |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Grocery Stores, Online Stores, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Califia Farms LLC, Earth's Own Food Company Inc, Elmhurst Milked Direct LLC, Happy Planet Foods Inc., Oatly AB (Cereal Base Ceba AB), Pacific Foods of Oregon LLC (Campbell Soup Company), Planet Oat Oatmilk (HP Hood LLC.), RISE Brewing Co., The Hain Celestial Group Inc., Thrive Market Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the oat milk market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global oat milk market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the oat milk industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Oat milk is a plant-based dairy alternative made by blending oats with water and straining the mixture. It is known for its creamy texture, mild flavor, and nutritional benefits, such as being rich in fiber and low in fat, appealing to health-conscious and lactose-intolerant consumers.

The oat milk market was valued at USD 717.8 Million in 2024.

IMARC estimates the global oat milk market to exhibit a CAGR of 11.1% during 2025-2033.

The rising demand for plant-based alternatives, growing health awareness, increasing prevalence of lactose intolerance, innovation in flavors and fortified products, and expanding food service adoption are some of the key factors influencing the market growth.

In 2024, Conventional oat milk represented the largest segment by market share (74.0%), driven by its affordability, availability, and consumer trust.

Plain oat milk leads the market by product type, owing to its versatility and preference for unsweetened, additive-free options.

The cartons segment is the leading by packaging type, driven by convenience, eco-friendliness, and effective freshness preservation.

The beverages segment is the leading application, driven by oat milk’s popularity in coffee, smoothies, and other drinks.

The supermarkets and hypermarkets segment is the leading distribution channel, driven by extensive product variety, convenience, and competitive pricing.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein Europe currently dominates the global market.

Some of the major players in the global oat milk market include Califia Farms LLC, Earth's Own Food Company Inc, Elmhurst Milked Direct LLC, Happy Planet Foods Inc., Oatly AB (Cereal Base Ceba AB), Pacific Foods of Oregon LLC (Campbell Soup Company), Planet Oat Oatmilk (HP Hood LLC.), RISE Brewing Co., The Hain Celestial Group Inc., Thrive Market Inc., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)