Office Supplies Market Size, Share, Trends and Forecast by Product Type, Application, Distribution Channel, and Region, 2026-2034

Office Supplies Market Size and Share:

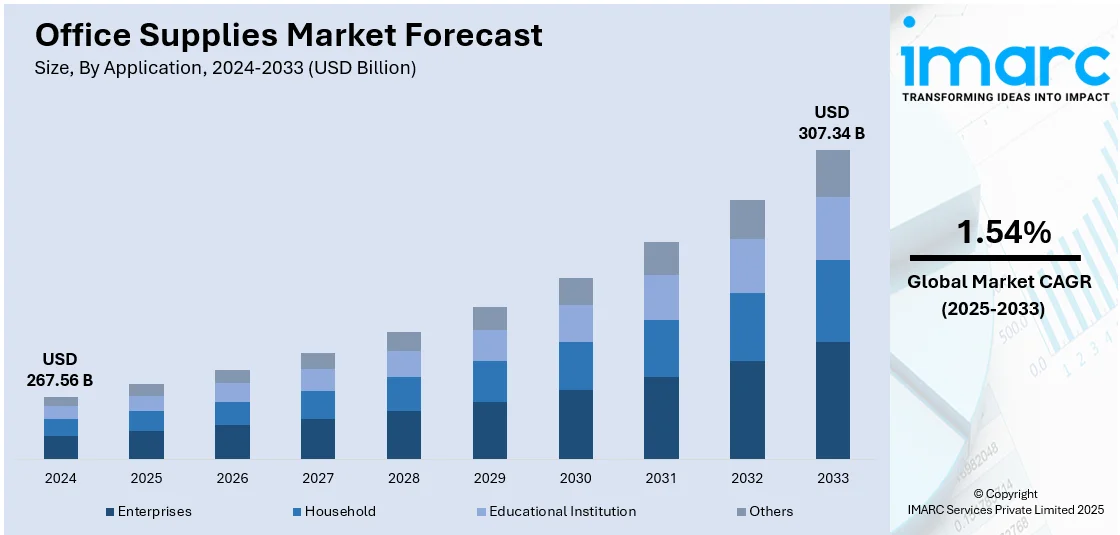

The global office supplies market size was valued at USD 267.56 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 307.34 Billion by 2034, exhibiting a CAGR of 1.54% from 2026-2034. Asia Pacific currently dominates the market, holding a market share of over 45.7% in 2024. The proliferation of small and medium enterprises (SMEs), increasing demand for sustainable and eco-friendly products, and rising reliance on e-commerce platforms offering a convenient and effective shopping experience are some of the factors impelling the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 267.56 Billion |

| Market Forecast in 2034 | USD 307.34 Billion |

| Market Growth Rate (2026-2034) | 1.54% |

The office supplies marketplace shows substantial market changes primarily driven by sustainability practices while adopting advanced technology in the industry. There is a notable shift towards eco-friendly products due to consumers’ increasing environmental awareness, which in turn surging the demand for products like recycled paper, sustainable writing instruments, and energy-efficient office electronics. Business applications of digital transformation lead to the adoption of cloud-based tools and digital document management systems that primarily reduces traditional paper dependence. Additionally, remote and hybrid work models create additional market need for ergonomic furniture, tech accessories, and personalized stationery items. The e-commerce sector expands constantly by providing seamless service while delivering competitive market prices to businesses and individual buyers.

In the United States, the office supplies market is largely influenced because of shifts in remote work patterns and changing business requirements. As more companies adopt flexible work models, there is increased demand for home office equipment, including ergonomic solutions and tech devices. For instance, as of May 2024, 9.48% of new job postings in the U.S. included remote or hybrid work options in the job description, reflecting an increasing shift towards flexible work arrangements. Online sales platforms are becoming the dominant channel, providing easy access to a wide range of products. Businesses also seek cost-effective options, which have led to an uptick in bulk purchasing and subscription services. Sustainability is further driving product innovation, encouraging companies to focus on greener alternatives in office supplies.

Office Supplies Market Trends:

Proliferation of Small and Medium Enterprises (SMEs)

Small and medium enterprises (SMEs), which make up a notable portion of the business landscape, are driving the demand for various office supplies. According to United Nations, MSMEs account for 90% of businesses, 60 to 70% of employment and 50% of GDP worldwide. These companies require a variety of items, ranging from simple office supplies to complex machinery, in order to sustain their daily activities. SMEs frequently focus on finding cost-effective yet efficient office supplies that are multifunctional and affordable. Moreover, the growing shift towards remote and hybrid work structures is encouraging SMEs to purchase home office arrangements, driving the need for ergonomic and technologically innovative products. In 2024, KOAS Co. introduced its latest office furniture line, Space, created specifically for compact and minimalist work environments. The online store of the brand provides cost-effective, high-quality office furniture such as desks, standing desks, and desk-bookshelf combinations. The launch was intended to address the increasing need for coworking spaces and small businesses.

Sustainability and Eco-Friendly Products

Individuals and businesses are prioritizing environmentally responsible products, which is driving the demand for recycled, biodegradable, and sustainably sourced office supplies. For instance, global online searches for sustainable goods have increased 71% in five years. 55% of consumers are willing to pay more for eco-friendly brands. This trend is especially noticeable in paper goods, with recycled paper and sustainably sourced materials becoming common options. Furthermore, manufacturers are working on creating office equipment that is energy-efficient and reducing the use of harmful chemicals during production. The shift towards sustainability not only meets regulatory and individual expectations but also opens up new market opportunities and fosters innovation in the development of sustainable office supplies. In 2023, Humanscale introduced the Path office chair, created for use in both home and office settings and focusing on sustainability and inclusivity. Designed in partnership with Todd Bracher, the chair includes a counterbalancing mechanism and is covered in recycled polyethylene terephthalate (r-PET) fabric. It was advertised as the most environment-friendly and accessible because of its climate-positive certification and absence of manual adjustments.

Rise of E-commerce Platforms

E-commerce is transforming the process of purchasing office supplies for individuals and businesses, offering a convenient and effective shopping experience. Modern buyers find e-commerce platforms appealing due to their diverse product offerings, competitive prices, and the convenience of having items delivered to their homes. The capability to compare items, read buyer reviews, and access exclusive online discounts increases the attractiveness of buying office supplies on digital platforms. Additionally, the inclusion of artificial intelligence (AI) and data analysis in online retail is offering personalized suggestions, enhancing client contentment and encouraging loyal purchases. In 2024, OMNIA Partners expanded its OPUS e-commerce platform, introducing over 4 Million additional items from eight primary vendors. The update sought to simplify the purchasing process for public sector and nonprofit organizations (NPOs), improving their ability to obtain office supplies, industrial equipment, and medical training materials.

Office Supplies Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global office supplies market, along with forecast at the global, regional, and country levels from 2026-2034. The market has been categorized based on product type, application, and distribution channel.

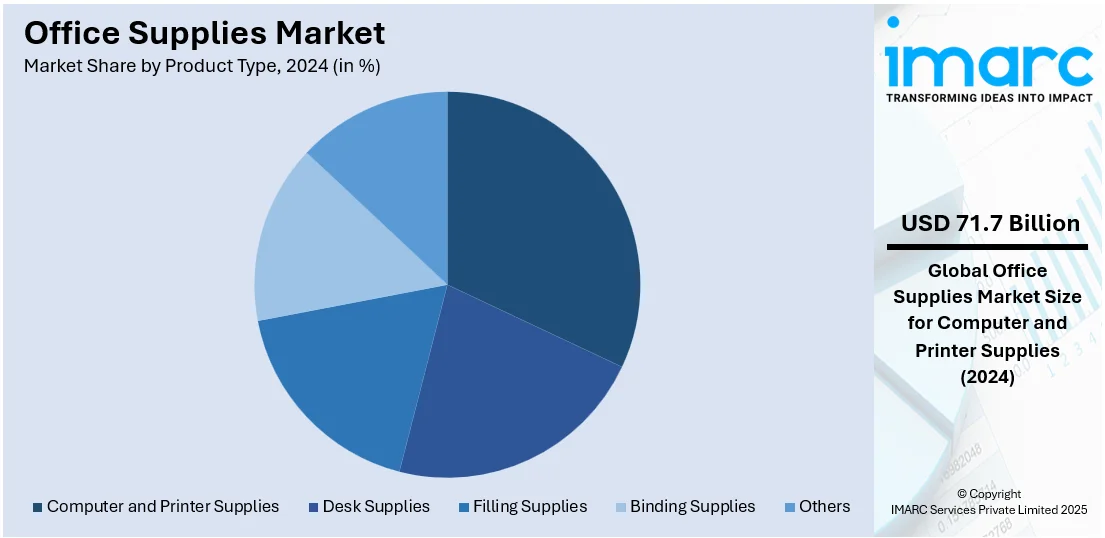

Analysis by Product Type:

- Desk Supplies

- Filling Supplies

- Binding Supplies

- Computer and Printer Supplies

- Others

Computer and printer supplies account for the majority of the market share. This segment consists of a variety of items including printers, toner and ink cartridges, paper for printing, and different computer accessories. The growing dependence on digital documentation and printing requirements, particularly in business settings, is catalyzing the demand for these supplies. Moreover, manufacturers are creating eco-friendly and high-efficiency products like recycled ink cartridges and energy-saving printers to meet the changing demands of eco-conscious individuals and businesses, thereby supporting the office supplies market growth. In March 2024, Canon unveiled that 11 of its printing items achieved the EPEAT Climate+ certification for meeting strict climate change standards. The specified items consisted of a range of office multifunction devices (MFD), inkjet printers, and large-format printers.

Analysis by Application:

- Enterprises

- Household

- Educational Institution

- Others

Educational institution holds the biggest market share as per the office supplies market outlook. This segment includes a variety of items, such as notebooks, pens, pencils, paper, binders, and other educational tools and supplies. The dominance of this section is because of the growing demand from educational institutions, like schools, colleges, and universities, which need a steady supply of materials for their teaching and learning needs. Furthermore, the rise of online and remote learning is driving the demand for a variety of high-quality office supplies to aid in distance education.

Analysis by Distribution Channel:

- Supermarket and Hypermarket

- Stationery Stores

- Online Stores

- Others

Supermarket and hypermarket play a crucial role in the distribution of office supplies because of their extensive coverage and convenience. These big retail stores provide a wide variety of office supplies in one location, offering a convenient shopping experience for buyers. Their extensive networks and high foot traffic ensure consistent sales, making them an essential channel for both individual and corporate buyers. Additionally, the presence of discounts and promotional offers in supermarket and hypermarket is driving the office supplies demand.

Stationery stores continue to be a conventional and reliable option for buying office supplies. These niche stores provide a limited selection of goods, often featuring exclusive and top-tier products not available in bigger stores. Stationery stores serve both regular buyers and specialized groups like artists and designers, offering individualized assistance and professional guidance. Their ability to offer a curated selection of products and foster buyer loyalty positions them as a vital segment in the office supplies market.

Online stores are rapidly becoming the most popular distribution channel for office supplies, driven by the convenience of shopping from anywhere and the ability to compare prices easily. E-commerce platforms provide an extensive selection of products, often at competitive prices. Advancements in logistics and delivery services guarantee fast and dependable shipping. This shift towards online purchasing is increasing the office supplies market value, as it broadens the reach of suppliers and caters to the evolving preferences of both individuals and corporations. In September 2023, Uber Eats collaborated with Staples to provide immediate delivery of office and school supplies in the US. Nearly 1,000 Staples stores were added to the Uber Eats app, enabling buyers to request paper, ink, and backpacks for home delivery.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Asia-Pacific accounted for the largest market share of over 45.7%. Asia Pacific dominates the market owing to fast industrialization, economic expansion, and a growing presence of small and medium-sized enterprises (SMEs). Leading companies in the region are making investments in corporate infrastructure and education, leading to a higher demand for office supplies. Moreover, the growing number of e-commerce platforms are enhancing the availability of office supplies to a wider range of buyers. The move towards modernizing and digitizing workplaces and educational institutions is driving the demand for high-tech office supplies. The office supplies market dynamics are influenced by changing workplace trends, technological advancements, and shifting consumer preferences towards sustainable and ergonomic products. In February 2023, Canon launched the TC-20, a multi-purpose Desktop A1 Plus large format printer in India. The TC-20 featured a compact design suitable for small workspaces, supported roll paper up to A1 Plus width, and included a built-in Auto Sheet Feeder for enhanced productivity. This printer, ideal for home offices and remote worksites, delivered high-quality, smudge-resistant prints and was recognized as an environment-friendly product.

Key Regional Takeaways:

United States Office Supplies Market Analysis

The growing adoption of office supplies in the United States is increasingly driven by the rise in demand for eco-friendly and sustainable products. For instance, 75% of US consumers care about products environmental impacts. In recent years, 85% of consumers have become “greener” in their purchasing habits. As businesses, organizations, and individuals become more conscious of their environmental impact, there has been a notable shift toward using office supplies that are biodegradable, recyclable, or made from renewable resources. This change is not only fuelled by consumer awareness but also by regulatory initiatives and incentives encouraging environmentally friendly practices. The availability of these products, which range from recycled paper to eco-friendly writing instruments, helps meet the rising demand for sustainable options. Moreover, various initiatives from government and non-government entities that emphasize sustainability have prompted businesses to reconsider their supply chains, pushing them toward greener alternatives. As a result, a growing number of organizations are prioritizing environmentally conscious decisions in their office supplies purchasing, leading to a broader adoption of these products across sectors.

North America Office Supplies Market Analysis

The market for North American office supplies demonstrates a steady growth due to consumers’ need of essential products, including writing tools, technological accessories, and paper supplements. The evolution of remote working and hybrid work arrangements facilitates the magnifying requirements for home office supplies. In line with rising environmental awareness among businesses, office products that are sustainable and environment-friendly are getting more traction. Moreover, customers increasingly rely on e-commerce sales channels that improve their market access opportunities. For instance, as per industry reports, it is estimated that U.S. retail e-commerce sales for the third quarter of 2024 totaled USD 300.1 billion, a 2.6% increase from the second quarter. Key factors such as productivity tools, cost-effectiveness, and convenience continue to drive consumer purchasing decisions, fueling office supplies market demand and contributing to market expansion in the region.

Europe Office Supplies Market Analysis

The growing adoption of office supplies in Europe is driven by the increasing number of working professionals. According to reports, the employment rate has moved steadily closer to the EU target, increasing from 70.9% in 2017 to 75.3% in 2023. The rise of professionals in industries such as technology, finance, healthcare, and consulting are creating a higher demand for office supplies, particularly in urban centers. The workforce is increasingly reliant on efficient office tools to meet deadlines, enhance productivity, and maintain organizational effectiveness. As professionals shift towards hybrid and remote work models, there has been a surge in demand for home-office supplies, including ergonomic office furniture, computing devices, and organization tools. Additionally, the European emphasis on work-life balance and employee well-being has spurred a preference for comfortable, high-quality office supplies that cater to both functionality and style. As the number of professionals continues to grow, the office supplies market in the region remains dynamic, with more innovative solutions coming to the forefront to meet evolving workplace needs.

Asia Pacific Office Supplies Market Analysis

In Asia-Pacific, the increasing adoption of office supplies is closely tied to the rapid growth of small and medium-sized businesses. According to India Brand Equity Foundation, the number of MSMEs in the country is projected to grow from 6.3 crore to around 7.5 crore at a CAGR of 2.5%. As these enterprises expand, they require various office supplies to maintain efficient operations, improve productivity, and support organizational growth. The increasing number of startups and small businesses in the region is fostering a demand for affordable, practical, and scalable office supplies solutions. This growth is supported by advancements in technology, which enable these businesses to access high-quality office supplies with ease. Additionally, the shift towards flexible and remote work arrangements within the region is contributing to greater demand for office equipment such as ergonomic furniture, desktop organizers, and digital office tools. The expansion of SMEs fosters competition in the office supplies sector, driving further innovation and improving the availability of customized solutions to meet specific business needs.

Latin America Office Supplies Market Analysis

In Latin America, the adoption of office supplies is seeing significant growth due to the expansion of online e-commerce distribution channels. According to reports, the Latin America market currently boasts over 300 Million digital buyers. The increased availability and accessibility of office supplies through online platforms have made it easier for both individuals and businesses to acquire essential products at competitive prices. E-commerce channels offer a wide range of options, from basic office supplies to more specialized products, allowing customers to purchase according to their specific needs. The convenience of online shopping, along with competitive pricing and delivery services, has spurred greater demand for office supplies across the region. As online marketplaces continue to evolve and cater to a broader audience, it is expected that the trend of purchasing office supplies via e-commerce will continue to increase, further driving the adoption of office supplies in the region.

Middle East and Africa Office Supplies Market Analysis

The growing adoption of office supplies in the Middle East and Africa is driven by the expanding number of educational institutions in the region. For instance, the number of schools is expected to increase from 1,258 in 2022 to 1,308 by 2027. As educational systems evolve and more institutions are established, the demand for office supplies, ranging from stationery to classroom materials, has grown significantly. Educational institutions, from schools to universities, require a wide range of office supplies to facilitate learning, administrative tasks, and communication. The region's increasing investment in education and the rise in student enrollment rates are contributing to this surge in demand. In parallel, the trend toward digitalization in education is influencing the office supplies market, driving the adoption of technologically advanced supplies such as interactive whiteboards and digital learning tools. This growth in the education sector is playing a pivotal role in expanding the market for office supplies in the region.

Competitive Landscape:

Key players in the market are focusing on innovation, sustainability, and strategic acquisitions to maintain competitive advantage and gain comprehensive office supplies market insights to stay ahead. They are developing eco-friendly products and integrating advanced technologies like smart devices and digital tools to meet evolving user preferences. Enhancing their online presence and optimizing e-commerce platforms are also crucial strategies to reach a broader audience and facilitate seamless purchasing experiences. Additionally, collaboration and partnerships with other businesses and educational institutions are also pivotal in strengthening market growth. In November 2023, Faber-Castell acquired Robert E. Huber GmbH, a German manufacturer of precision mechanical products and high-quality writing instruments, to strengthen its position in the premium writing instruments market. The acquisition enhanced the product range and manufacturing capabilities of Faber-Castell.

The report provides a comprehensive analysis of the competitive landscape in the office supplies market with detailed profiles of all major companies, including:

- 3M Company

- Canon Inc.

- Deli Group Co. Ltd

- Faber-Castell AG

- Sasco Group

- Shoplet, Stanley Black & Decker Inc.

- Staples Inc.

- Tesco PLC

- The ODP Corporation

- Wenzhou Aihao Pen Trade Co. Ltd.

- Wesfarmers Limited

Latest News and Developments:

- November 2024: Pelican Group has launched Pelicanwork, a premium line of ergonomic office furniture in India, aiming to enhance workplace comfort and productivity. The collection features high-end chairs and desks designed with cutting-edge ergonomics and sustainable materials. Targeting professionals in metro cities, Pelicanwork redefines office supplies with elegance and efficiency. This launch reinforces Pelican Group's commitment to innovation in office furniture design.

- October 2024: Visplay is launching its Omnio Office modular furniture system at Orgatec 2024 in Cologne, Germany. The flexible design, originally created for retail, is now adapted for modern workplace planning. The system is ideal for various office environments, offering versatile solutions for office supplies and furniture. This launch highlights Visplay's innovative approach to adaptable office spaces.

- May 2024: Greenwell Equipment has launched a new office furniture section on their website, featuring over 1,000 products. The collection includes a variety of office supplies, from ergonomic chairs to executive desks. Customers can now easily browse and purchase high-quality office furniture online. This expansion enhances Greenwell's reputation as a leader in office and industrial supplies.

- March 2024: IKEA revealed the upcoming release of the MITTZON office furniture line, scheduled to be available in stores in July. The product line of 85 items was created for adaptable workspaces and offered features, such as soundproof screens and comfortable chairs.

- February 2024: Value Office Furniture has launched a new collection of ergonomic office chairs designed to enhance comfort and productivity in the workplace. This collection offers various seating options, including task chairs, executive chairs, and specialized drafting chairs, all built to provide customizable support. With a focus on quality, the chairs are AFRDI-certified to meet stringent ergonomic standards. This move reaffirms Value Office Furniture's commitment to offering premium office supplies for Australian businesses.

Office Supplies Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Desk Supplies, Filling Supplies, Binding Supplies, Computer and Printer Supplies, Others |

| Applications Covered | Enterprises, Household, Educational Institution, Others |

| Distribution Channels Covered | Supermarket and Hypermarket, Stationery Stores, Online Stores, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | 3M Company, Canon Inc., Deli Group Co. Ltd, Faber-Castell AG, Sasco Group, Shoplet, Stanley Black & Decker Inc., Staples Inc., Tesco PLC, The ODP Corporation, Wenzhou Aihao Pen Trade Co. Ltd., Wesfarmers Limited, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the office supplies market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global office supplies market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the office supplies industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The office supplies market was valued at USD 267.56 Billion in 2024.

IMARC estimates the global office supplies market to reach USD 307.34 Billion in 2033, exhibiting a CAGR of 1.54% during 2025-2033.

The market is driven by rising corporate demand, growth in remote and hybrid work models, increasing digitalization, and sustainability trends. Moreover, businesses seek cost-effective, eco-friendly products, while e-commerce expansion enhances accessibility, fueling market growth across various sectors.

Asia Pacific currently dominates the market, holding a market share of over 45.7% in 2024. This strong presence in the market is backed up by the expanding corporate sector, rising employment rates, and increasing government investments in education. In addition, strong manufacturing capabilities, cost-effective production, and the growing e-commerce sector further drive demand, positioning the region as a key contributor to market growth.

Some of the major players in the office supplies market include 3M Company, Canon Inc., Deli Group Co. Ltd, Faber-Castell AG, Sasco Group, Shoplet, Stanley Black & Decker Inc., Staples Inc., Tesco PLC, The ODP Corporation, Wenzhou Aihao Pen Trade Co. Ltd., Wesfarmers Limited, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)