Oil Filter Market Size, Share, Trends and Forecast by End-Use, Fuel Type, and Region, 2025-2033

Oil Filter Market Size and Share:

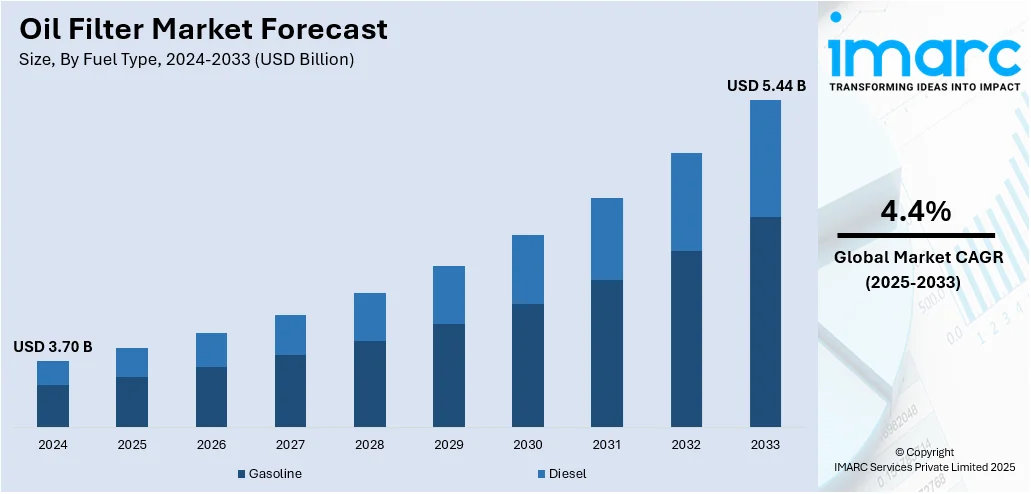

The global oil filter market size was valued at USD 3.70 Billion in 2024. The market is projected to reach USD 5.44 Billion by 2033, exhibiting a CAGR of 4.4% from 2025-2033. Asia Pacific currently dominates the market, holding a market share of over 35.3% in 2024, because of amplified vehicle production, growing automotive aftermarket, and rising consumer focus on frequent engine maintenance and emission conformity. The market is also driven by more attention towards preventive maintenance, and stricter emissions rules globally. Moreover, passenger vehicles and gasoline-powered vehicles lead the way on the basis of strong ownership and need for frequent servicing. Companies are responding by developing new products to match changing engine performance requirements and environmental demands, propelling oil filter market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 3.70 Billion |

|

Market Forecast in 2033

|

USD 5.44 Billion |

| Market Growth Rate 2025-2033 | 4.4% |

The global oil filter market is dominated by the increasing demand for effective vehicle maintenance solutions that guarantee optimal engine performance and lifespan. As internal combustion engines continue to lead the global vehicle market across different categories, it has become increasingly important to maintain clean engine oil to prevent contaminants from affecting engine performance. Oil filters are central to this function through the filtering out of harmful particles, which helps to reduce wear and tear as well as improve fuel consumption. Increasing awareness among vehicle owners and fleet operators regarding preventive maintenance behaviors, combined with a growing parc of vehicles, especially in developing economies, has driven the consistent replacement and aftermarket oil filter demand. Moreover, the improvement in technology in the materials and construction of filtration equipment has contributed to more resilient and effective products that allow for increased oil change intervals. For instance, This continuous development tracks with international initiatives toward minimizing vehicle emissions and maintenance expense, further solidifying oil filters as pivotal elements in car care.

To get more information on this market, Request Sample

The United States oil filter market is highly driven by the extensive motor vehicle infrastructure of the country and the relatively high number of vehicle ownership per capita with a share of 88.20% in 2024. The culture of regular vehicle maintenance, bolstered by the existence of a ubiquitous network of service centers, dealerships, and do-it-yourself (DIY) consumers, generates persistent demand for oil filter changes. In addition, the existence of interstate driving and diverse climatic conditions between states requires regular oil changes to maintain smooth engine performance. Consequently, oil filters are a standard part of scheduled and unscheduled maintenance. Regulatory focus on environmental performance also spurred the use of state-of-the-art filtration systems that not only improve engine efficiency and lower emissions but also improve engine durability. According to the sources, in March 2024, the U.S. EPA finalized its toughest emissions standards for heavy-duty vehicles (2027–2032), aiming to cut one billion tons of greenhouse gases and yield \$13 billion in environmental benefits. Further, sustained demand for light trucks and SUVs, traditionally more demanding in terms of maintenance requirements, has supported aftermarket sales of oil filters. Along with a well-established logistics and distribution network, these aspects facilitate timely availability and consumer access, thus fueling the oil filter market's consistent growth in the United States.

Oil Filter Market Trends:

Increasing Environmental Consciousness and Optimization of Engine Performance

One of the most important trends in the oil filter market is heightened environmental awareness among people and regulatory bodies, resulting in greater focus toward minimizing greenhouse gas (GHG) emissions. With emission rates still increasing around the world, governments are strengthening regulations that require better engine efficiency and lower exhaust emissions. Oil filters, in terms of providing cleaner engine oil, are responsible for sustaining optimal combustion conditions and reducing toxic emissions. At the same time, consumers are becoming more aware of the role that oil filters can play in boosting vehicle performance, fuel efficiency, and engine longevity. This has spurred increased usage rates of sophisticated filtration technologies capable of withstanding longer service periods while efficiently removing impurities. Furthermore, OEMs are incorporating effective oil filtration solutions into new models of vehicles to meet tougher environmental standards. These concerted efforts are likely to continue driving the direction of oil filter adoption worldwide.

Growth in the Automotive and Construction Industries

The oil filter market is also experiencing strong momentum as a result of strong growth in the automotive and construction industries. With growing urbanization and infrastructure development around the world, demand for commercial vehicles like trucks, loaders, and construction machinery is increasing steadily. These vehicles are subjected to heavy-duty usage, and hence timely maintenance and filtration are very essential to their functioning. Oil filters play an important role in safeguarding engines against premature wear in such stress applications and hence encouraging their regular replacement, thereby creating market demand. At the same time, the overall auto industry keeps on expanding, particularly in developing countries where car ownership is on the rise. With the automotive output increasing to supply consumer and commercial demand, oil filters are still staple parts in both original equipment manufacturer (OEM) chains and aftermarkets. This expansion is also fueled by state-supported building work in other parts of the world, such as the United States, where massive projects drive up the need for reliable fleets of vehicles that have well-maintained high-quality filters.

Preventive Maintenance Practices and Vehicle Longevity

Preventive maintenance culture is a dominant trend fueling expansion in the market for oil filters, as vehicle owners become more proactive towards prolonging the life and performance of assets. As the average age of cars on the road is slowly rising with advances in automotive design and longevity, the necessity for periodic engine oil filtration has become all the more necessary. Older cars, especially, need regular care to function properly, and oil filters are essential in averting sludge, debris, and impurities caused engine degradation. Additionally, consumers and fleet operators are better aware of the advantages of scheduled maintenance for lowering long-term repair costs and preventing mechanical failure. This move towards preventive maintenance is aided by continuous improvement in oil filter technology, including synthetic oil-compatible filters and extended service life. Consequently, regular oil filter replacement is becoming an integral part of good vehicle ownership and fleet management culture.

Oil Filter Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global oil filter market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on end-use and fuel type.

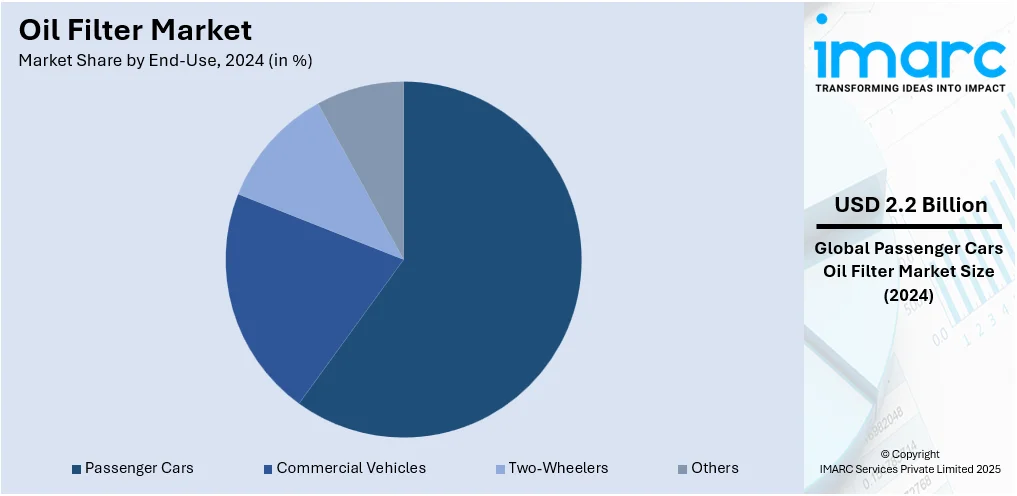

Analysis by End-Use:

- Passenger Cars

- Commercial Vehicles

- Two-Wheelers

- Others

Passenger vehicles captured the largest market share of the oil filter market with 60.0% in 2024 due to their high production volumes and constant requirement for maintenance. With urbanization increasing and disposable incomes rising, especially in the emerging markets, ownership of personal cars is highly on the rise. The cars need regular replacement and servicing of filters and oil change to ensure they deliver their best performance, hence becoming the largest consumers of oil filters. Contemporary automobile engines have increased precision and, as a result, are more susceptible to impurities, hence higher demands on high-quality filtration systems. In addition, advances in automotive design and engine technology have incorporated longer-lasting, high-efficiency filters as a matter of course. The heightened focus on fuel efficiency and emissions control in private vehicles also further supports the importance of effective oil filtration. With strong sales and high aftermarket activity, passenger vehicles continue to lead most of the oil filter demand throughout international markets.

Analysis by Fuel Type:

- Gasoline

- Diesel

Gasoline cars maintained the top spot in the oil filter industry with 64.2% market share during 2024, owing to their dominance across both developed and emerging automotive markets. Gasoline engines, found in most passenger vehicles and light-duty vehicles, have a high maintenance need as a result of the combustion by-products that tend to build up over time. These residues need to be efficiently filtered out to facilitate smooth engine running and prevent wear on components. Consequently, gasoline cars continually create vigorous demand for oil filters. Moreover, regulatory frameworks that pursue cleaner fuel systems have driven up the implementation of sophisticated filters with capabilities to sustain low-emission performance. The vast accessibility of gasoline cars reduced initial cost when compared to diesel or electric counterparts, and also the high incidence of short- to medium-distance driving behaviors enhance this segment's robustness. As automotive trends move towards high-efficiency internal combustion engines, the role of gasoline-compatible oil filters is crucial to ensure compliance and engine well-being.

Regional Analysis:

- Asia Pacific

- North America

- Europe

- Middle East and Africa

- Latin America

Asia Pacific became the market leader in oil filters with 35.3% market share in 2024, driven by the large automotive production base and increasing car ownership in the region. China, India, Japan, and Indonesia are among the primary drivers on account of their massive automotive production capacities and fast-growing middle-class populations. All these factors have resulted in growing demand for passenger and commercial cars, both of which need periodic maintenance of oil filters. The governments in the regions are also implementing tougher pollution control measures, promoting the use of better engine filtration systems to minimize emissions and improve fuel efficiency. Local suppliers and manufacturers enjoy low production costs and an established base of distribution networks, which enable them to achieve extensive market penetration. The aftermarket business is also booming, supported by a robust culture of car maintenance and a growing chain of repair outlets and service outlets. Taken together, these conditions cement Asia Pacific's leading position in dictating the course of the international oil filter market.

Key Regional Takeaways:

North America Oil Filter Market Analysis

The North American oil filter industry is fueled primarily by the increasing use of automotive and industrial equipment, particularly as cars get older and more maintenance is needed to ensure their highest performance. Environmental regulations on transportation emissions are driving the need for higher-performing, multi-stage filters that provide cleaner oil and prolong engine life. Based on industry reports, the US transportation sector contributes 28% of overall greenhouse gas (GHG) emissions in the United States. In addition to this, improvements in technology involving filter media, such as synthetics and nanofiber technology, are enhancing the efficiency of particle capture and the durability of these filters, rendering them attractive to OEMs as well as aftermarket consumers. In addition, growing demand for heavy machinery in industries such as construction, farming, mining, and energy is driving the demand for strong filtration solutions that can handle high temperatures, pressures, and high levels of contaminants. Growing awareness among consumers about preventative care, boosting do-it-yourself (DIY) trends, and easy access to oil filters via car dealerships and online marketplaces is also fueling increased replacement frequency. In addition, strategic collaborations among filter makers and large auto service chains are making distribution more streamlined and raising brand awareness, which is propelling the market growth throughout North America.

Asia Pacific Oil Filter Market Analysis

The Asia Pacific oil filter industry is growing as a result of rising automobile ownership, industrialization, and regulatory pressure. With developing economies like China, India, and Indonesia growing at a high rate in sales of vehicles, especially passenger cars, commercial fleets, and two-wheelers, the need for quality oil filters is on the rise to sustain engine health and reduce downtime. In India, for example, sales of passenger vehicles attained 4.3 Million units in 2024 with a growth of 4.2% compared to 2023, according to India Brand Equity Foundation (IBEF). Parallelly, growth in heavy industries, mining, and construction across the region is also encouraging mass utilization of earth-moving and farm equipment, which are dependent on high-performance filtration systems with the ability to thrive in extreme environments. Apart from this, increased consumer concern for engine performance and environmental protection has also fueled the development of environmentally friendly filter recycling and remanufacturing practices, further influencing market trends and fueling growth.

Europe Oil Filter Market Analysis

Demand in the Europe oil filter market is spurred primarily by regulatory developments, technological advancements, and shifting vehicle use patterns. Stringent emissions regulations within the European Union are motivating the use of high-efficiency multi-stage filters, and advanced synthetic media that can enable cleaner engine operation and reduced particulate emissions. For example, in April 2023, the European Parliament and Council amended Regulation 2019/631 to enhance the CO2 emissions performance targets for new passenger cars and vans. This amendment reaffirmed current emission standards, introduced to come into force beginning 2030, and created a 100% emissions reduction goal for cars and vans beginning 2035. It will also ensure at least 55% reduction in net greenhouse gas (GHG) emissions by 2030 compared to 1990, and climate neutrality by 2050. With European motorists increasingly keeping their cars for longer, there is a greater demand for premium aftermarket filters that prolong engine life and preserve fuel economy. In addition, the growing trend toward electrified powertrains, such as hybrid vehicles, is pushing innovation in filter designs for thermal management components and engine-assist applications. Aside from this, collaboration between filter producers and dealership networks is amplifying brand visibility and customer confidence throughout the continent, reinforcing mass adoption.

Latin America Oil Filter Market Analysis

The Latin American oil filter industry is considerably driven by local industrial development, increasing vehicle ownership, and changing regulatory standards. For example, Brazil's industrial output grew 4.1% in June 2024, according to the Agência de Notícias. With nations like Brazil, Mexico, and Argentina developing their infrastructure and agricultural activities, demand for heavy-duty equipment filters is on the rise. Moreover, the expanding middle class of the region is increasingly buying more passenger vehicles and commercial fleets, driving sales of aftermarket filters. Governments are also implementing stricter emission standards and vehicle inspection requirements, driving drivers and service centers to install higher-quality filters to meet compliance requirements.

Middle East and Africa Oil Filter Market Analysis

The Middle East and Africa oil filter market is also witnessing strong growth because of increased investment in logistics, mining, and public transport, where big fleets of vehicles need periodic maintenance to maintain operational efficiency. As per a report by the IMARC Group, the Middle East logistics industry stood at USD 250.0 Billion in 2024 and is expected to expand at a CAGR of 5.57% from 2025 to 2033. Urbanisation and growing infrastructure development are also driving equipment usage in the construction sector, placing greater emphasis on high-capacity, long-lasting oil filters. Additionally, liberal trade policies and free zones in the region are encouraging importation and distribution of automotive parts, ensuring quality filters are easily available. Vocational training initiatives and improved aftersales services are raising awareness for vehicle maintenance, thus helping to ensure steady market growth.

Competitive Landscape:

The oil filter industry has a relatively fragmented competitive environment with various global and regional players producing a wide variety of filtration products. Companies are emphasizing improving the efficiency of products, compatibility with new generation engines, and support for longer maintenance intervals. Ongoing innovation in materials like synthetic fiber media and multi-layer filtration technologies has emerged as a principal strategy among companies to establish competitive grounds. Additionally, the majority of companies are also positioning their lines of products according to changing trends within the auto industry, such as the incorporation of filtration systems in hybrid and alternative fuel vehicles. The aftermarket space continues to be competitive as manufacturers provide tailored solutions based on vehicle type and operating conditions. Strategic partnerships with automotive manufacturers, as well as the growth of distribution networks through online stores and service outlets, are further defining the competitive landscape. In general, the market is characterized by the ongoing quest for technological advancement and optimal market reach.

The report provides a comprehensive analysis of the competitive landscape in the oil filter market with detailed profiles of all major companies, including:

- Ahlstrom-Munksjö Oyj

- CLARCOR Inc.

- DENSO Corporation

- MAHLE GmbH

- MANN+HUMMEL International GmbH & Co. KG.

Latest News and Developments:

- March 2025: MANN+HUMMEL started delivering its new CO2-reduced filters that were created with the help of renewable energy, featuring eco-friendly, recyclable packaging materials and are impregnated with vegetable-based raw materials. In the first instance, some of MANN-FILTER oil filters and air filters have been fitted with this new technology. This technology leads to a lowering of about 27% in the amount of crude oil used for impregnation.

- March 2025: Purolator launched the Purolator 20K Premium Oil Filter, the newest innovation by the company. The 20K Premium Oil Filter is designed for high-performance driving conditions and provides remarkable engine protection for up to 20,000 miles. It is for drivers who look for affordability, reliability, and durability.

- February 2025: Standard Motor Products, Inc. (SMP) announced the addition to its Oil Filter Housing Kits and Assemblies line. Factory-assembled with the oil filter and sensors pre-installed, Standard Oil Filter Housing Kits are application-specific and consist of updated components and manifold gaskets.

- November 2024: MANN+HUMMEL formed an alliance with PT. Bquik Otomotif Indonesia (B-Quik) to distribute state-of-the-art automobile filtration products in Indonesia under MANN-FILTER and WIX Filters aftermarket brands. This alliance signifies MANN+HUMMEL's commitment to enhancing driver safety, environmental responsibility, and engine performance as part of its continued expansion and growth in Asia.

Oil Filter Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| End-Uses Covered | Passenger Cars, Commercial Vehicles, Two-Wheelers, Others |

| Fuel Types Covered | Gasoline, Diesel |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Companies Covered | Ahlstrom-Munksjö Oyj, CLARCOR Inc., DENSO Corporation, MAHLE GmbH, MANN+HUMMEL International GmbH & Co. KG, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the oil filter market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global oil filter market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the oil filter industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The oil filter market was valued at USD 3.70 Billion in 2024.

The oil filter market is projected to exhibit a CAGR of 4.4% during 2025-2033, reaching a value of USD 5.44 Billion by 2033.

Key drivers of the oil filter market are increasing global vehicle manufacturing, mounting emphasis on preventive maintenance, stringent emission norms, and escalating demand for fuel efficiency and engine durability. The growing automotive aftermarket and the development of filtration technology also fuel continued market growth.

Asia Pacific currently dominates the oil filter market, accounting for a share of 35.3%, fueled by strong automobile manufacturing, increasing vehicle ownership, favorable government policies, and increasing vehicle care consciousness across developing and emerging economies in the region.

Some of the major players in the oil filter market include Ahlstrom-Munksjö Oyj, CLARCOR Inc., DENSO Corporation, MAHLE GmbH, MANN+HUMMEL International GmbH & Co. KG, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)