Oil and Gas Separation Market Size, Share, Trends and Forecast by Technology Type, Vessel Type, Product Type, Application, and Region, 2025-2033

Oil and Gas Separation Market Size and Share:

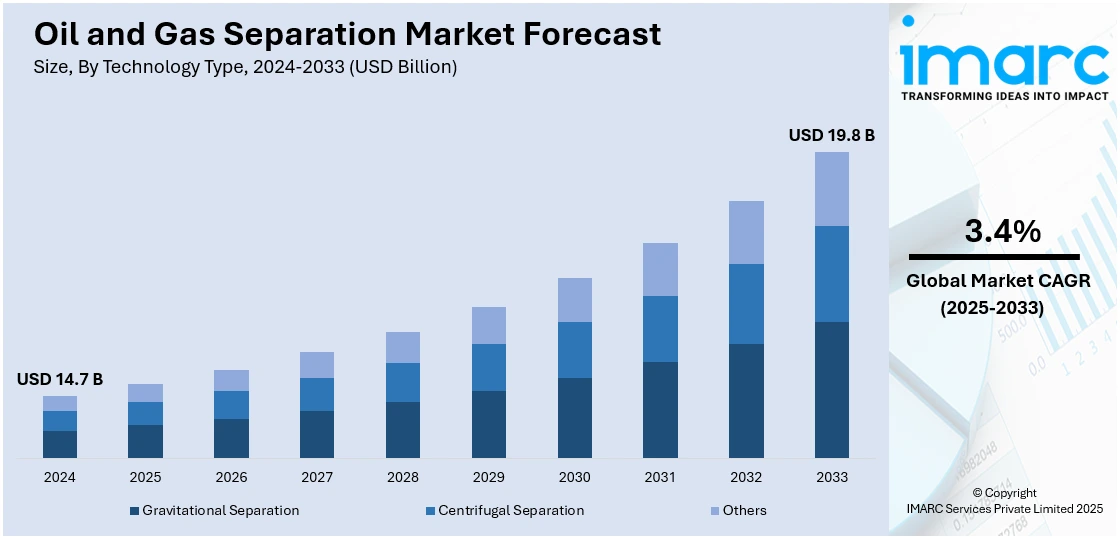

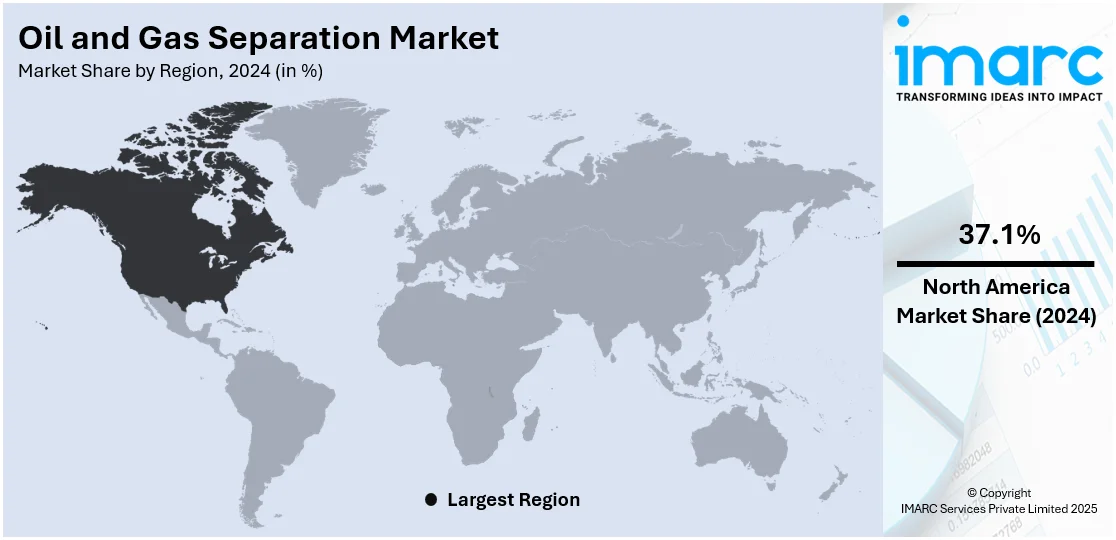

The global oil and gas separation market size was valued at USD 14.7 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 19.8 Billion by 2033, exhibiting a CAGR of 3.4% from 2025-2033. North America currently dominates the market, holding a market share of 37.1% in 2024. The market is experiencing steady growth driven by rising global energy demand, increased exploration activities, and the push for operational efficiency in extraction processes. Technological advancements and growing investments in upstream infrastructure are further enhancing the market landscape. Environmental regulations are encouraging the adoption of more efficient separation systems, contributing to the overall expansion of the oil and gas separation market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 14.7 Billion |

|

Market Forecast in 2033

|

USD 19.8 Billion |

| Market Growth Rate 2025-2033 | 3.4% |

The oil and gas separation market is driven by rising global energy demand, increasing exploration of unconventional resources, and the need for enhanced operational efficiency. Stringent environmental regulations are pushing companies to adopt advanced separation technologies to minimize emissions and waste. Growth in offshore and deepwater projects further boosts demand for compact, high-performance separation systems. Additionally, technological advancements and the need to process complex fluids from mature fields are contributing to market expansion, especially in regions with ongoing upstream development. For instance, in August 2024, TotalEnergies' Libra Consortium approved the development of an innovative subsea facility in Brazil's Mero field to separate and reinject CO2-rich gas, enhancing production while reducing greenhouse gas emissions. This HISEP technology will connect to the Marechal Duque de Caxias FPSO, supporting sustainable energy practices in the region.

The United States oil and gas separation market is driven by high levels of domestic oil and gas production, particularly from shale formations. According to the data published by the U.S. Energy Information Administration, in 2023, the United States achieved a historic production level of 12.9 million barrels per day (b/d) of crude oil, exceeding the prior record of 12.3 million b/d set in 2019. Alongside Russia and Saudi Arabia, the U.S. contributed to 40% of the world's total oil production. The need to efficiently separate oil, gas, and water in complex upstream operations fuels demand for advanced separators. Environmental regulations enforce strict treatment of produced water and emissions, further boosting technology adoption. Additionally, ongoing technological innovation, including automation and compact separation systems, enhances performance and lowers operational costs, making them attractive for both onshore and offshore applications across the country.

Oil and Gas Separation Market Trends:

Advancements in Separation Techniques

The adoption of advanced separation techniques is transforming operational efficiency in the oil and gas industry. Technologies such as membrane separation, cyclonic separators, and electrostatic coalescers offer improved separation of oil, gas, and water phases with greater precision and lower energy use. For instance, In May 2024, Air Products launched the PRISM® GreenSep LNG membrane separator for bio-LNG production, eliminating the need for intermediate purification technologies and enhancing yield and cost-efficiency. The new technology will be showcased at BIOGAS AMERICAS 2024, where Rory Deledda will present on its benefits for system designers. These methods enhance throughput and reduce downtime, especially in high-pressure, high-temperature environments. As producers seek to optimize performance and meet environmental goals, such innovations are set to shape the oil and gas separation market outlook.

Integration with Renewable Energy

As the energy sector moves toward decarbonization, the integration of renewable energy systems into oil and gas separation facilities is gaining momentum. Separation units are increasingly being adapted for hybrid operations that utilize solar or wind energy to power equipment, reducing reliance on fossil fuels and lowering carbon footprints. This shift not only improves sustainability but also supports compliance with green energy targets. It reflects a growing trend toward cleaner, more energy-efficient solutions in the oil and gas industry.

Growing Focus on Environmental Compliance

Environmental compliance is a significant driver shaping the oil and gas separation market forecast. With stricter global regulations on emissions and water discharge, the industry is investing heavily in advanced separation technologies. For instance, in June 2023, Clariant Oil Services introduced PHASETREAT™ WET, an eco-friendly demulsification solution that employs advanced nanoemulsion technology. This innovation reduces chemical dosages by up to 75%, optimizing oil and gas operations while lowering carbon emissions. It is part of Clariant's D3 PROGRAM, aimed at enhancing sustainability in the industry. These systems are designed to efficiently treat produced water, reduce gas flaring, and lower greenhouse gas emissions. Compliance with environmental standards not only avoids penalties but also enhances operational sustainability. This trend is expected to continue, influencing equipment design and technology adoption in future projects.

Oil and Gas Separation Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global oil and gas separation market, along with forecast at the global and regional levels from 2025-2033. The market has been categorized based on technology type, vessel type, product type, and application.

Analysis by Technology Type:

- Gravitational Separation

- Centrifugal Separation

- Others

Gravitational separation stands as the largest technology type in 2024, holding around 60.4% of the market. According to oil and gas separation market report, gravitational separation is the most prominent technology in the oil and gas separation market due to its simplicity, cost-effectiveness, and efficiency in separating oil, gas, and water phases. This method leverages the natural differences in density between fluids, allowing them to separate under gravity without the need for complex mechanical components. Widely used in upstream operations, gravitational separators are especially favored in large-scale production facilities for their reliability, low maintenance requirements, and ability to handle high-volume processing with minimal energy consumption.

Analysis by Vessel Type:

- Horizontal

- Vertical

- Spherical

Horizontal leads the market with around 51.2% of market share in 2024. Horizontal separators dominate the oil and gas separation market due to their superior handling of high liquid volumes and efficient phase separation capabilities. These separators offer a larger surface area, enabling better separation of oil, gas, and water, especially in applications with high gas-liquid ratios. Their compact design and stability make them ideal for onshore and offshore operations. Additionally, horizontal separators are easier to maintain and operate, contributing to operational efficiency and reduced downtime, thereby driving oil and gas separation market growth.

Analysis by Product Type:

- Two-Phase Separators

- Three-Phase Separators

- Scrubbers

- Others

Three-phase separator leads the market with around 41.3% of market share in 2024. Three-phase separators lead the oil and gas separation market due to their ability to efficiently separate oil, gas, and water in a single unit. These separators are crucial in upstream operations where mixed production streams require clear phase separation for further processing or disposal. Their design ensures precise control of fluid interfaces, enhancing operational efficiency and safety. Widely used in both onshore and offshore facilities, three-phase separators support cost-effective production and optimal resource recovery, significantly contributing to market growth.

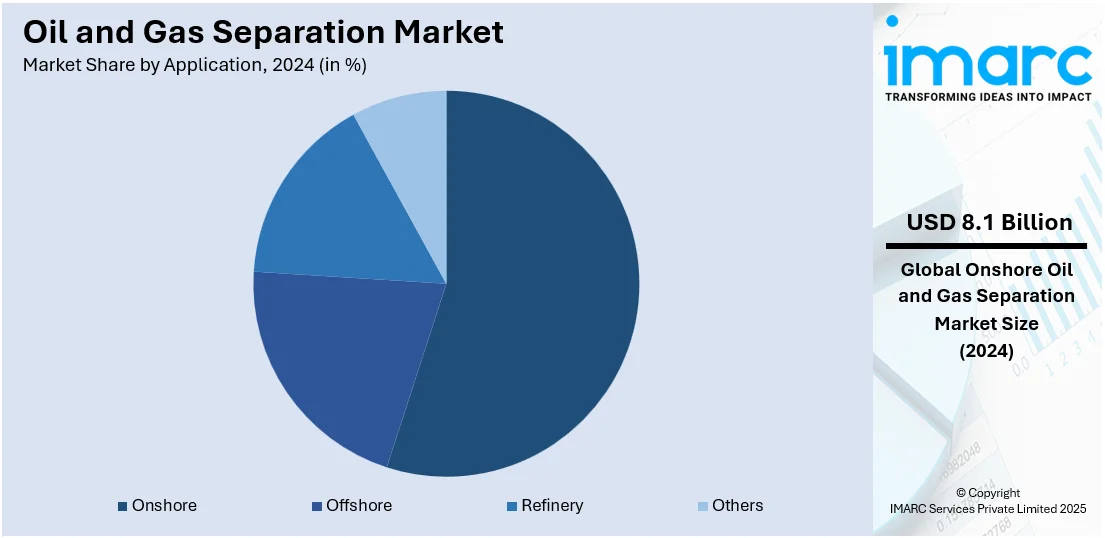

Analysis by Application:

- Onshore

- Offshore

- Refinery

- Others

Onshore leads the market with around 55% of market share in 2024. Onshore operations lead the oil and gas separation market due to the extensive presence of land-based oil fields and the ease of infrastructure development. These facilities offer lower installation and operational costs compared to offshore setups, making them more economically viable for producers. Onshore separation units are also easier to maintain and upgrade, ensuring continuous production efficiency. With increasing global energy demand and ongoing investments in onshore exploration and production, this segment continues to drive significant market growth.

Regional Analysis:

- North America

- Europe

- Asia Pacific

- Middle East and Africa

- Latin America

In 2024, North America accounted for the largest market share of over 37.1%. North America accounted for the largest share in the oil and gas separation market, driven by extensive upstream activities and a strong presence of mature oilfields, particularly in the United States and Canada. The region benefits from advanced technologies, well-developed infrastructure, and significant investments in shale oil and gas exploration. Additionally, regulatory support and the rising demand for efficient separation solutions further boost market expansion. These factors collectively position North America as a dominant contributor to global market growth.

Key Regional Takeaways:

United States Oil and Gas Separation Market Analysis

In 2024, the United States accounted for over 85.00% of the oil and gas separation market in North America. In the United States, the oil and gas separation market is experiencing significant growth due to substantial investments in the energy sector. The growing exploration and production activities have resulted in a heightened need for efficient separation technologies. For example, the U.S. Energy Information Administration reported that the proved reserves of crude oil and lease condensate in the U.S. rose by 9%, increasing from 44.4 billion barrels to 48.3 billion barrels by the end of 2022. Advanced technologies enable enhanced recovery processes, improving operational efficiency and supporting the country's energy needs. The increased capital infusion into oil and gas projects, combined with innovations in separation techniques, is driving the adoption of these systems. The focus on achieving more sustainable energy practices is further boosting the market's growth, making oil and gas separation a crucial part of the country's energy strategy.

Asia Pacific Oil and Gas Separation Market Analysis

In Asia-Pacific, the oil and gas separation market is expanding due to the rising importance of non-conventional energy resources such as shale gas and coal bed methane. For instance, the APAC region holds 9.1% of the world's total recoverable oil and gas reserves. These sources require specialized separation technologies to extract valuable hydrocarbons effectively. As the demand for energy continues to surge, the adoption of oil and gas separation technologies in this region becomes more critical. For instance, the oil production in the Asia-Pacific region in 2023 was around 7.3 million barrels per day. The growing emphasis on non-conventional energy resources has spurred further investments in advanced separation systems, optimizing production and reducing environmental impact. Additionally, technological advancements in separation processes are enabling better handling of the diverse energy resources found in this region.

Europe Oil and Gas Separation Market Analysis

Europe is witnessing a surge in the adoption of oil and gas separation technologies driven by the expansion of conventional energy resources, particularly natural gas and oil fields. According to Eurostat, in 2022, EU refineries generated 544.3 million tonnes of oil equivalent (Mtoe) in petroleum products. This marked a 4.5% increase compared to the prior year. As exploration efforts expand, the demand for effective separation systems is on the rise. These technologies play a critical role in enhancing the productivity and efficiency of the extraction process, supporting Europe’s energy transition goals. With the rising demand for cleaner energy, the oil and gas separation market in Europe is focused on sustainable solutions, fostering innovation in separation technologies. This shift toward more efficient and environmentally friendly practices is fueling the growth of the sector across the continent.

Latin America Oil and Gas Separation Market Analysis

In Latin America, the oil and gas separation market is gaining momentum due to the deployment of advanced drilling rigs that support exploration and development in challenging environments. These modern rigs facilitate access to deepwater and pre-salt formations, especially offshore Brazil, unlocking previously unreachable reserves. According to Brazil’s Energy Expansion Plan for 2022–2032, the country’s oil production is anticipated to hit 4.9 million barrels per day by 2032, with pre-salt fields expected to contribute around 80% of that total. The increased extraction of hydrocarbons in these areas drives demand for efficient separation technologies to manage complex mixtures of oil, gas, and water. This shift not only boosts production capabilities but also enhances operational efficiency and safety, positioning the region as a key player in the global energy sector while spurring technological advancements in separation processes.

Middle East and Africa Oil and Gas Separation Market Analysis

In the Middle East and Africa, the growing adoption of oil and gas separation is driven by the expanding oil and gas projects in the region. According to reports, during the period 2024-2028, a total of 668 oil and gas projects are expected to commence operations in the Middle East. With a strong focus on energy production, these projects require advanced separation systems to improve efficiency and reduce operational costs. The increasing number of oil and gas ventures in this region has created a surge in demand for separation technologies, which are essential for optimizing the production and extraction of hydrocarbons.

Competitive Landscape:

The oil and gas separation market is highly competitive, featuring numerous prominent companies that are emphasizing technological innovations, strategic alliances, and expansion into new regions to enhance their market presence. Leading firms significantly influence the industry by providing a diverse array of separation solutions designed to meet a variety of operational needs. These players are investing in R&D to develop more efficient and environmentally friendly systems, especially for high-pressure and high-temperature conditions. The market also sees participation from regional manufacturers, contributing to price competitiveness and localized service, further intensifying the global competitive environment.

The report provides a comprehensive analysis of the competitive landscape in the oil and gas separation market with detailed profiles of all major companies, including:

- Frames Energy Systems B.V.

- Honeywell International Inc.

- TechnipFMC plc

- ALFA LAVAL Corporate AB

- Halliburton Energy Services, Inc.

- Schlumberger Limited

- ACS Manufacturing, Inc.

- AMACS Process Tower Internals

- CECO Environmental Corporation

- GEA Group Aktiengesellschaft

Latest News and Developments:

- April 2025: Kazakhstan awarded a multibillion-dollar EPC contract for a new gas processing plant focused on oil and gas separation at the Tengiz oilfield. The facility, led by an Italian consortium, would process ethane and propane one kilometer from existing oil and gas infrastructures.

- March 2025: Tetra Technologies conducted a pilot project with EOG Resources to apply its Tetra Oasis Total Desalination Solution for treating produced water from oil and gas wells. The project integrated proprietary treatment and exclusive membrane technologies to manage varying water qualities across oil and gas basins. The pilot reportedly achieved a 92% recovery rate of desalinated water, surpassing municipal drinking water standards, and supported enhanced oil and gas separation processes.

- March 2025: H2SITE and SNAM collaborated on an oil and gas separation project focused on hydrogen and natural gas mixtures. The project, promoted by ARERA, featured a Pd-alloy membrane separator designed by H2SITE to extract hydrogen from low concentrations.

- March 2025: Cairn Oil & Gas signed a strategic alliance with TechnipFMC to accelerate deepwater exploration in India. The collaboration focused on deploying integrated subsea infrastructure using TechnipFMC’s iEPCITM model. The initiative also supported advanced oil and gas separation techniques to optimize offshore production efficiency.

- January 2025: Arkema and OOYOO LTD. partnered to develop advanced gas separation membranes for CO2 capture. They focused on high-performance polymers and membrane design to enhance oil and gas separation.

Oil and Gas Separation Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Technology Types Covered | Gravitational Separation, Centrifugal Separation, Others |

| Vessel Types Covered | Horizontal, Vertical, Spherical |

| Product Types Covered | Two-Phase Separators, Three-Phase Separators, Scrubbers, Others |

| Applications Covered | Onshore, Offshore, Refinery, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Companies Covered | Frames Energy Systems B.V., Honeywell International Inc., TechnipFMC plc, ALFA LAVAL Corporate AB, Halliburton Energy Services, Inc., Schlumberger Limited, ACS Manufacturing, Inc., AMACS Process Tower Internals, CECO Environmental Corporation, and GEA Group Aktiengesellschaft, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the oil and gas separation market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global oil and gas separation market.

- The study maps the leading, as well as the fastest-growing, regional markets.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the oil and gas separation industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The oil and gas separation market was valued at USD 14.7 Billion in 2024.

The oil and gas separation market is projected to reach USD 19.8 Billion by 2033, exhibiting a CAGR of 3.4% from 2025-2033.

Key factors driving the oil and gas separation market include rising global energy demand, increasing upstream exploration and production activities, and the need for efficient separation technologies. Technological advancements and stricter environmental regulations are also encouraging the adoption of advanced systems, boosting market growth.

North America currently dominates the oil and gas separation market, accounting for a significant share due to extensive shale oil production, advanced technologies, and strong infrastructure investments.

Some of the major players in the oil and gas separation market include Frames Energy Systems B.V., Honeywell International Inc., TechnipFMC plc, ALFA LAVAL Corporate AB, Halliburton Energy Services, Inc., Schlumberger Limited, ACS Manufacturing, Inc., AMACS Process Tower Internals, CECO Environmental Corporation, and GEA Group Aktiengesellschaft, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)