Oleochemicals Market Report by Type (Fatty Acids, Fatty Alcohols, Glycerine, and Others), Form (Liquid, Solid), Application (Soaps and Detergents, Plastics, Paper, Lubricants, Rubber, Coatings and Resins, Personal Care Products, and Others), Feedstock (Palm, Soy, Rapeseed, Sunflower, Tallow, Palm Kernel, Coconut, and Others), and Region 2026-2034

Global Oleochemicals Market:

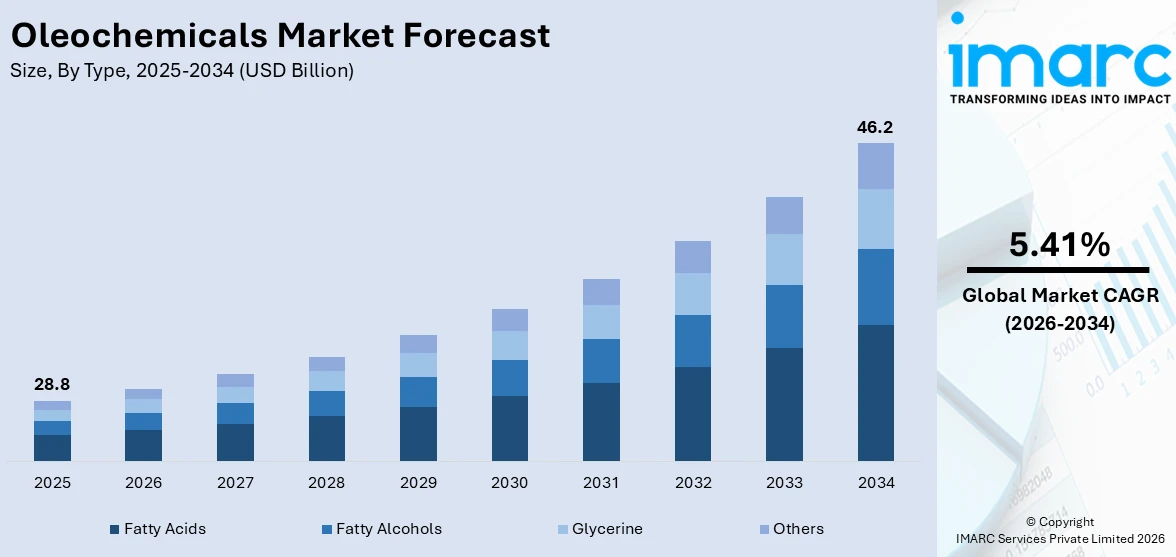

The global oleochemicals market size reached USD 28.8 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 46.2 Billion by 2034, exhibiting a growth rate (CAGR) of 5.41% during 2026-2034. The increasing environmental awareness towards maintaining sustainability, along with the escalating demand for bio-based skincare, is primarily driving the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 28.8 Billion |

| Market Forecast in 2034 | USD 46.2 Billion |

| Market Growth Rate 2026-2034 | 5.41% |

Oleochemicals Market Analysis:

- Major Market Drivers: The growing inclination among individuals towards seeking alternatives to petroleum-based chemicals is one of the key drivers augmenting the market. Apart from this, the easy availability of various feedstock is further propelling the overall global market.

- Key Market Trends: The rising trend of adopting green technologies to minimize carbon footprints is acting as a significant growth-inducing factor. Moreover, the inflating focus among consumers on using healthier and natural ingredients is also catalyzing the market.

- Geographical Trends: Asia Pacific exhibits a clear dominance in the market, owing to the increasing number of advanced manufacturing facilities. Additionally, extensive applications of oleochemicals across various industries, such as personal care, pharmaceuticals, paper, etc., will continue to fuel the regional market in the coming years.

- Competitive Landscape: As per the oleochemicals market overview, some of the prominent players include Emery Oleochemicals, Evonik, Evyap Sabun Malaysia Sdn Bhd, IOI Oleochemical, Kao Chemicals, KLK OLEO, Oleon NV, Procter & Gamble Company, Sulzer Ltd, Twin Rivers Technologies, Inc., and Wilmar International Ltd., among many others.

- Challenges and Opportunities: One of the primary challenges in the oleochemicals industry is the volatility in the price and availability of raw materials. However, continuous advancements in production technologies and numerous innovations in sustainable agricultural practices are expected to drive the overall market growth over the foreseeable future.

To get more information on this market Request Sample

Oleochemicals Market Trends:

Favorable Government Initiatives

Regulatory authorities across several countries are implementing stringent rules and regulations regarding environmental standards to minimize carbon emissions levels. Additionally, they are also launching numerous initiatives to promote the usage of bio-based and renewable chemicals, such as oleochemicals, that do not emit any harmful gases, which is strengthening the market. For instance, government bodies in the Netherlands, coupled with employers, trade unions, and environmental organizations, are working to achieve a low-carbon energy supply by 2050 that will be reliable, safe, and affordable. Apart from this, government authorities are investing in R&D activities, pilot plants, and commercialization of oleochemicals, which is also propelling the oleochemicals market demand. For example, managed by the U.S. Department of Agriculture (USDA), the goal of the BioPreferred Program is to increase the purchase and adoption of biobased products, as they minimize the reliance on petroleum, elevate the usage of renewable agricultural resources, aid in reducing adverse environmental and health impacts, etc. Similarly, the European Union (EU) and its Member States also offer financial support to companies for the transition to a sustainable and safe chemical sector. Some of these programs include Horizon Europe, InvestEU, LIFE program, etc. As oleochemicals are derived from natural oils and fats, primarily sourced from plants and animals, regulatory bodies are further providing tax incentives and subsidies to elevate the domestic production of these oils, which, in turn, is contributing to the market growth. For example, the Union Cabinet, chaired by the Prime Minister Narendra Modi, launched a National Mission on Edible Oils – Oil Palm (NMEO-OP) as a Centrally Sponsored Scheme to increase the domestic production of edible oils.

Increasing Applications in Personal Care

The elevating consumer preference for natural ingredients in skin care products is augmenting the adoption of oleochemicals, as they are derived from natural oils. Moreover, it is gaining traction as an ingredient that is used for creating desirable consistencies and textures in cosmetic formulations. It also contributes to the spread ability and smoothness of products, including lipsticks, foundations, creams, etc. Oleochemicals can also function as a solubilizer, helping to dissolve certain ingredients and improve the overall formulation stability. Besides this, it can improve skin barrier function and enhance skin hydration, further influencing the oleochemicals market outlook. For instance, KLK OLEO, one of the global players in oleochemicals and phytonutrients, offers a wide array of high-quality, natural, and sustainable products that can be used in the cosmetics industry. Moreover, various brands are also promoting the adoption of oleochemicals, such as glycerin, which is bolstering the market. For example, Medimix launched a digital campaign to encourage consumers to switch to its glycerin soap, which has numerous skin-friendly properties. Apart from this, UBE introduced glycerin carbonate for applications in cosmetics. Similarly, in October 2023, Lipoid Kosmetik, one of the leading manufacturers of natural raw materials for the cosmetic and personal care industry, introduced Acai Herbasol Extract Glycerine SB, which provides antioxidant, anti-aging, anti-inflammatory, and skin protective properties.

Advancements in Production Processes

Continuous innovations in processing technologies are allowing oleochemical manufacturers to reduce waste, improve efficiency and yield, lower production costs, etc. These advancements are also enabling the development of higher purity oleochemicals, which are required in industries, including pharmaceuticals and food and beverage (F&B). For example, in May 2023, Desmet announced the opening of the Oils & Derivatives Innovation Center in Malaysia. Additionally, the facility is built to bring cutting-edge environmental and efficiency innovations closer to the local plant-based oil producers. Similarly, in June 2023, Oleon NV inaugurated an oleochemicals production plant that can operate purely based on proteins of all-natural origin. A total of US$ 19.56 Million was invested in the INCITE project. In line with this, YNY Technology helps the oleochemical key players to achieve operational efficiency through total manufacturing integration. Moreover, companies are further investing in production technologies, which represents one of the oleochemicals market recent opportunities. For example, CMB S.p.A. is one of the leaders in the design and manufacturing of technologies for the vegetable oil and oleochemical industries. Furthermore, UW-Madison researchers led by Prof. Brian Pfleger developed various technologies to enhance the production of high-value oleochemicals from renewable feedstocks using engineered microbes. Their metabolic engineering strategies advance the economic and sustainable production of medium-chain length oleochemicals through the fermentation of carbohydrates. Besides this, the changing preference from traditional petrochemicals towards oleochemicals is offering lucrative growth opportunities to industry investors. For instance, BASF provides a comprehensive portfolio of adsorbents and catalysts that cover a wide range of oleochemical processing needs.

Oleochemicals Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with the global oleochemicals market forecast at the global, regional, and country levels for 2026-2034. Our report has categorized the market based on the type, form, application, and feedstock.

Breakup by Type:

- Fatty Acids

- Fatty Alcohols

- Glycerine

- Others

Fatty acids represent the largest market segment

The report has provided a detailed breakup and analysis of the market based on the type. This includes fatty acids, fatty alcohols, glycerine, and others. According to the report, fatty acids accounted for the largest market share.

Fatty acids represent the largest segment in the market due to their diverse applications across various industries. Derived from natural oils via processes, such as distillation and hydrolysis, they serve as essential building blocks for various products. Moreover, fatty acids find extensive applications in the production of candles, soaps, lubricants, biofuels, etc. Furthermore, the escalating demand for sustainable and eco-friendly alternatives to petrochemical-based products is also increasing the oleochemicals market revenue. For example, in August 2022, Kraton Chemical LLC appointed one of the leading chemical distributors, Redox Limited (Redox), as a channel partner for their Ink Polyamides and Tall Oil Fatty Acid range in New Zealand and Australia.

Breakup by Form:

- Liquid

- Solid

- Flakes

- Pellets

- Beads

- Others

Liquid accounts for the majority of the market share

The report has provided a detailed breakup and analysis of the market based on the form. This includes liquid and solid (flakes, pellets, beads, and others). According to the report, liquid accounted for the largest market share.

The growth in this segmentation is propelled by the widespread adoption of liquid oleochemicals in the pharmaceutical sector, as they aid in enhancing the solubility and bioavailability of certain drugs. Additionally, they are widely adopted in the formulation of hair care items, skincare products, etc. They can act as humectants, emollients, or surfactants that enhance the performance and texture of these products. This, in turn, is bolstering the oleochemicals market's recent price. Moreover, in the food and beverage (F&B) industry, they serve as food additives or emulsifiers. For example, Univar Solutions provides a wide range of oleochemicals that can act as lubricants and greases, pharmaceutical ingredients, oilfield chemicals, plastics additives, etc.

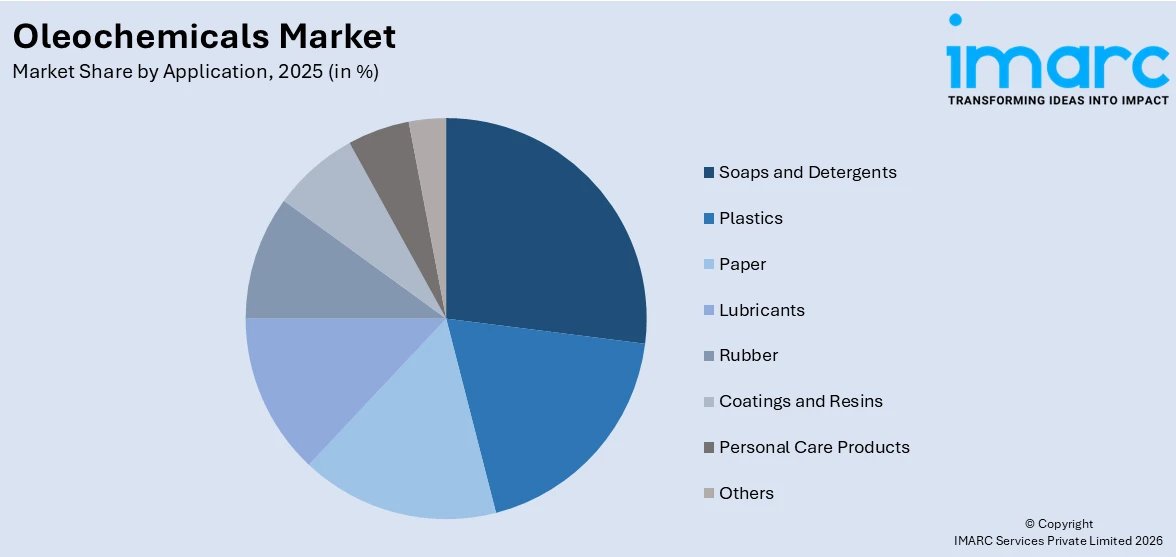

Breakup by Application:

Access the comprehensive market breakdown Request Sample

- Soaps and Detergents

- Plastics

- Paper

- Lubricants

- Rubber

- Coatings and Resins

- Personal Care Products

- Others

Soaps and detergents hold the biggest oleochemicals market share

The report has provided a detailed breakup and analysis of the market based on the application. This includes soaps and detergents, plastics, paper, lubricants, rubber, coatings and resins, personal care products, and others. According to the report, soaps and detergents represented the largest segment.

The inflating use of oleochemicals, such as fatty acids and glycerin, in the manufacturing of both traditional soap and detergent formulations is driving the growth of this segmentation. For detergents, oleochemical-based surfactants are key ingredients. Surfactants help break down oils and grease, which makes them effective cleaning agents. Besides this, according to the oleochemicals market statistics, the presence of many facilities engaged in producing detergents will continue to fuel the market in this segmentation over the forecasted period. For instance, in Europe, there are around 700 separate facilities for detergents, out of which 85% are operated by SMEs.

Breakup by Feedstock:

- Palm

- Soy

- Rapeseed

- Sunflower

- Tallow

- Palm Kernel

- Coconut

- Others

Palm dominates the market segment

The report has provided a detailed breakup and analysis of the market based on the feedstock. This includes palm, soy, rapeseed, sunflower, tallow, palm kernel, coconut, and others. According to the report, palm represented the largest segment.

Palm oil and its derivatives serve as a primary source for various oleochemical products. Palm oil is extracted from the fruit of oil palm trees, which is cost-effective and abundant. It is rich in triglycerides, which can be hydrolyzed into fatty acids and glycerin. It is used in various applications, such as personal care products, food additives, and industrial processes. In line with this, the escalating demand for sustainable and certified palm oil that encourages responsible sourcing practices is anticipated to fuel the market in the coming years. For example, in March 2024, the first integrated oil palm processing unit in India by 3F Oil Palm, one of the largest oil palm development companies in India, started its commercial production.

Breakup by Region:

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Chile

- Peru

- Others

- Middle East and Africa

- Turkey

- Saudi Arabia

- Iran

- United Arab Emirates

- Others

Asia Pacific exhibits a clear dominance, accounting for the largest market share

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Latin America (Brazil, Mexico, Argentina, Colombia, Chile, Peru, and others); and the Middle East and Africa (Turkey, Saudi Arabia, Iran, United Arab Emirates, and others). According to the report, Asia Pacific accounted for the largest market share.

The easy availability of palm oil, coconut oil, and other oilseeds, which serve as primary feedstocks for oleochemicals, is primarily driving the regional market. Moreover, Asia Pacific has emerged as a manufacturing hub for oleochemicals, with countries like Malaysia, Indonesia, Thailand, and the Philippines leading production. Besides this, the established infrastructures, skilled labor, and government support are fostering a conducive environment for oleochemical production, thereby acting as another significant growth-inducing factor. For example, favorable regulatory policies by the Registration, Evaluation, and Authorization of Chemicals (REACH) to promote the adoption of sustainable chemicals and petrochemical alternatives are positively influencing the regional market. In line with this, key players are entering into merger and acquisition activities, which are anticipated to fuel the market in Asia Pacific over the forecasted period.

Competitive Landscape:

Several manufacturers are investing in research and development (R&D) activities to innovate and develop new products and processes. They are improving the efficiency of oleochemical production, discovering novel applications, and enhancing the performance of existing products. In addition, many oleochemicals market companies are focusing on sustainable practices by ensuring responsible sourcing of raw materials, particularly palm oil. They are also seeking to obtain certifications like Roundtable on Sustainable Palm Oil (RSPO) to demonstrate their commitment to environmentally friendly production methods. Besides this, key players are diversifying their portfolios by producing a wide range of oleochemical derivatives, such as fatty acids, glycerin, surfactants, and more, to meet specific industry demands.

The market research report has provided a comprehensive analysis of the competitive landscape. Detailed profiles of all major companies have also been provided. Some of the key players in the market include:

- Emery Oleochemicals

- Evonik

- Evyap Sabun Malaysia Sdn Bhd

- IOI Oleochemical

- Kao Chemicals

- KLK OLEO

- Oleon NV

- Procter & Gamble Company

- Sulzer Ltd

- Twin Rivers Technologies, Inc.

- Wilmar International Ltd

(Please note that this is only a partial list of the key players, and the complete list is provided in the report.)

Oleochemicals Market Recent Developments:

- March 2024: Arjun Munda, one of the union agriculture ministers in India, said the government has launched a mission to boost production of oilseeds and reduce imports of cooking oils.

- February 2024: The Solvent Extractors' Association in India requested the central government to take steps to safeguard the interests of the domestic oleochemicals industry, citing a sharp rise in their imports.

- February 2024: BMD signed an agreement with the Dalian Commodity Exchange (DCE) for the licensing of the soybean oil futures settlement price for its upcoming new product, the Bursa Malaysia DCE Soybean Oil Futures (FSOY).

Oleochemicals Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Types Covered | Fatty Acids, Fatty Alcohols, Glycerine, Others |

| Forms Covered |

|

| Applications Covered | Soaps and Detergents, Plastics, Paper, Lubricants, Rubber, Coatings and Resins, Personal Care Products, Others |

| Feedstocks Covered | Palm, Soy, Rapeseed, Sunflower, Tallow, Palm Kernel, Coconut, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico, Argentina, Colombia, Chile, Peru, Turkey, Saudi Arabia, Iran, United Arab Emirates |

| Companies Covered | Emery Oleochemicals, Evonik, Evyap Sabun Malaysia Sdn Bhd, IOI Oleochemical, Kao Chemicals, KLK OLEO, Oleon NV, Procter & Gamble Company, Sulzer Ltd, Twin Rivers Technologies, Inc., Wilmar International Ltd., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC's industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the oleochemicals market from 2020-2034.

- The research report study provides the latest information on the market drivers, challenges, and opportunities in the global oleochemicals market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the oleochemicals industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The global oleochemicals market was valued at USD 28.8 Billion in 2025.

We expect the global oleochemicals market to exhibit a CAGR of 5.41% during 2026-2034.

The rising utilization of oleochemicals in the manufacturing of toothpaste, household cleaners, printer inks, lubricants, pesticides, paints, condiments, etc., owing to their low toxicity, renewable nature, biodegradability, etc., is primarily driving the global oleochemicals market growth.

The sudden outbreak of the COVID-19 pandemic had led to the implementation of stringent lockdown regulations across several nations, resulting in the temporary halt in numerous production activities for oleochemicals.

Based on the type, the global oleochemicals market has been divided into fatty acids, fatty alcohols, glycerin, and others. Among these, fatty acids currently exhibit a clear dominance in the market.

Based on the form, the global oleochemicals market can be categorized into liquid and solid. Currently, liquid accounts for the majority of the global market share.

Based on the application, the global oleochemicals market has been segregated into soaps and detergents, plastics, paper, lubricants, rubber, coatings and resins, personal care products, and others, where soaps and detergents currently hold the largest market share.

Based on the feedstock, the global oleochemicals market can be bifurcated into palm, soy, rapeseed, sunflower, tallow, palm kernel, coconut, and others. Currently, palm feedstock exhibits a clear dominance in the market.

On a regional level, the market has been classified into North America, Europe, Asia Pacific, Latin America, and Middle East and Africa, where Asia Pacific currently dominates the global market.

Some of the major players in the global oleochemicals market include Emery Oleochemicals, Evonik, Evyap Sabun Malaysia Sdn Bhd, IOI Oleochemical, Kao Chemicals, KLK OLEO, Oleon NV, Procter & Gamble Company, Sulzer Ltd, Twin Rivers Technologies, Inc., and Wilmar International Ltd.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)