Onion Powder Market Report by Product Type (Conventional, Organic), Packaging Type (Pouches, Cans, Aseptic Cartons, and Others), Distribution Channel (Speciality Stores, Supermarkets/Hypermarkets, Convenience Stores, Online Retailers, and Others), End User (Home Users, Institutional Users), and Country 2025-2033

Global Onion Powder Market:

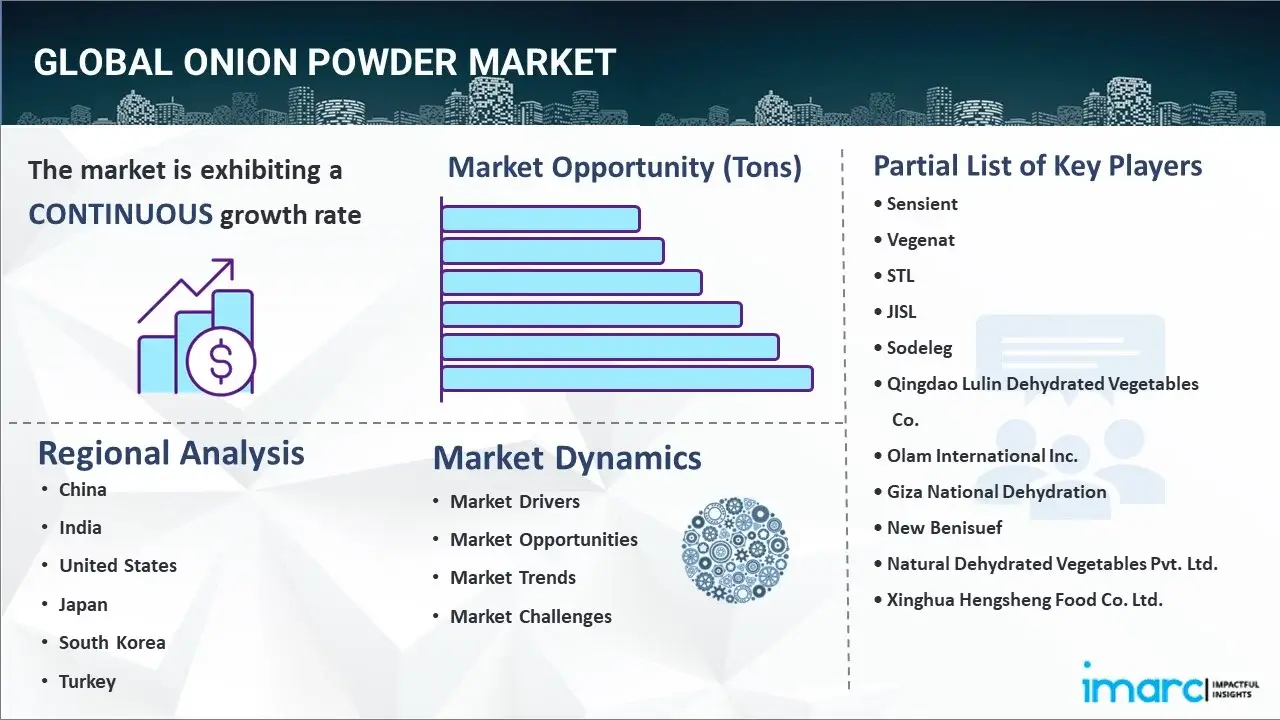

The global onion powder market size reached 73,100 Tons in 2024. Looking forward, IMARC Group expects the market to reach 98,700 Tons by 2033, exhibiting a growth rate (CAGR) of 3.4% during 2025-2033. The growing requirement for a flavoring element in a variety of food products, such as snacks, sauces, and salads, is stimulating the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

73,100 Tons |

|

Market Forecast in 2033

|

98,700 Tons |

| Market Growth Rate 2025-2033 | 3.4% |

Onion Powder Market Analysis:

- Major Market Drivers: The elevating popularity of ready-to-eat meals is boosting onion powder market growth as a key seasoning ingredient.

- Key Market Trends: The increasing preference for healthier and cleaner-label products, driven by consumer demand for organic and non-GMO alternatives, is acting as a significant growth-inducing factor.

- Competitive Landscape: Some of the prominent players in the market include Sensient, Vegenat, STL, JISL, Sodeleg, Qingdao Lulin Dehydrated Vegetables Co., Olam International Inc., Giza National Dehydration, New Benisuef, Natural Dehydrated Vegetables Pvt. Ltd., and Xinghua Hengsheng Food Co. Ltd., among many others.

- Geographical Trends: China dominates the market, owing to the inflating usage of dehydrated spices in packaged and processed meals.

- Challenges and Opportunities: The fluctuating raw material prices due to seasonal variations impede the market. However, using modern storage and preservation procedures to keep supplies stable will continue to drive the market during the forecast period.

To get more information on this market, Request Sample

Onion Powder Market Trends:

Expansion in Export Opportunities

The market for onion powder is witnessing robust export growth, especially from the prominent producers like China and India, where production in an economical way provides them with a price advantage in international trade. India, for example, witnessed a spectacular surge in exports of dehydrated onions due to the high production from states like Gujarat. The state saw a 67% year-over-year surge in dehydrated white onion exports during the 2023-24 financial year, the best in four years. The spike indicates the strengthening market position of Indian onion powder suppliers in global markets, particularly in markets that require reliable, long-shelf-life food ingredients. Exporters are gaining from eased agricultural trade policies and increased overseas demand from North America, Europe, and Southeast Asia. Furthermore, the stable quality and shelf life of onion powder make it an appealing option for importers looking for substitutes for fresh onions. Such increasing export activity underpins wider onion powder market trends and demonstrates the product's increasing global importance.

Health-Conscious Consumer Preferences

The trend towards healthful eating is greatly influencing the outlook of the onion powder market. People are increasingly demanding natural food ingredients that do not contain artificial additives, and onion powder is such a requirement because it is minimally processed and has nutritional benefits. It is being adopted as a healthier flavoring aid and a substitute for excessive salt, especially in heart-healthy and weight-care diets. In August 2024, Toxics Link findings reported microplastic contamination in everyday kitchen essentials like salt and sugar, triggering public health alarms. In reaction, customers are switching to alternatives like garlic and onion powders, which not only steer clear of such contamination but also provide other added benefits such as antioxidants and antimicrobial compounds. This movement has consolidated the usage of onion powder in home cooking as well as in packaged food, particularly among urban health-conscious consumers. Continuation of emphasis on clean-label products keeps driving the market's growth into health-oriented segments.

Expanded Application in Processed Foods

The growth of convenience-oriented lifestyles has led to a boost in the consumption of ready-to-eat and processed food products, which, subsequently, is driving the demand for onion powder as a principal flavoring agent. Its flexibility and long shelf life have made it attractive for inclusion in various end applications, ranging from instant noodles and soups to seasoning mixes, sauces, and snacks. In July 2024, Cup Noodles introduced summer-themed Campfire S'mores ramen for microwave cooking, which shows how even unusual items are adopting creative flavor profiles through spice powders. Onion powder provides intense flavor without the water content of raw onions, and thus it is best suited for dry mixes and shelf-stable foods. Its consistency, ease of mixing, and flavor retention over time are benefits appreciated by food manufacturers. As the processed foods market keeps growing all around the world—especially within city limits and in developing countries—onion powder is an integral ingredient that serves both flavor and functional purposes.

Onion Powder Market Challenges:

The market for onion powder is confronted with a number of challenges that can shape its long-term growth path. One of the major ones is raw onion price volatility, which can be affected by uncertain weather patterns, crop infections, and regional shortages. These fluctuations directly impact manufacturers' production costs and profit margins. Secondly, ensuring constant quality throughout processing and storage is a challenge, particularly in humid weather areas where water content can spoil the shelf life and taste of the product. There is also limited awareness among rural and semi-urban consumers regarding the benefits of utilizing onion powder over fresh onions, which can limit market penetration in some markets. Regulatory conditions for food safety and additive consumption also differ in international markets, which creates compliance issues for exporters. Finally, although demand is expanding, competition from other flavoring agents and seasoning mixes might restrict market share if differentiation strategies are not properly executed on the part of producers and suppliers.

Global Onion Powder Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with the market forecasts at the global and country levels for 2025-2033. Our report has categorized the market based on product type, packaging type, distribution channel, and end user.

Breakup by Product Type:

- Conventional

- Organic

The report has provided a detailed breakup and analysis of the market based on the product type. This includes conventional and organic.

Conventional onion powder, which accounts for a significant onion powder market share, is commonly used due to its low cost and availability. In contrast, organic onion powder appeals to health-conscious consumers looking for pesticide-free alternatives.

Breakup by Packaging Type:

- Pouches

- Cans

- Aseptic Cartons

- Others

The report has provided a detailed breakup and analysis of the market based on the packaging type. This includes pouches, cans, aseptic cartons, and others.

Pouches are preferred for their lightweight and easy-to-store nature. Cans give stronger protection and a longer shelf life. Additionally, aseptic cartons, observed for keeping freshness, appeal to consumers looking for long-term storage without preservatives, making them popular for both retail and bulk purchases.

Breakup by Distribution Channel:

- Speciality Stores

- Supermarkets/Hypermarkets

- Convenience Stores

- Online Retailers

- Others

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes speciality stores, supermarkets/hypermarkets, convenience stores, online retailers, and others.

Specialty stores specialize in one-of-a-kind or high-quality products, and they frequently draw niche clients seeking organic or gourmet options. Supermarkets/hypermarkets provide a large range of products to mass-market consumers at competitive prices. Convenience stores offer convenient access to daily necessities, making them perfect for rapid purchases. Online retailers provide convenience and a diverse range, appealing to tech-savvy shoppers looking for home delivery.

Breakup by End User:

- Home Users

- Institutional Users

The report has provided a detailed breakup and analysis of the market based on the end user. This includes home users and institutional users.

Home users choose smaller and more convenient packaging for everyday cooking, but institutional users, such as restaurants and food producers, require bulk volumes for large-scale food preparation and processing.

Breakup by Country:

- China

- India

- United States

- Japan

- South Korea

- Turkey

- Iran

- Pakistan

- Egypt

- Others

China dominates the market

The market research report has also provided a comprehensive analysis of all the major countries, which include China, India, the United States, Japan, South Korea, Turkey, Iran, Pakistan, Egypt, and others. According to the report, China accounted for the largest market share.

China has the highest market share in the international onion powder market, thanks to its extensive agricultural sector and ability to produce onions at high volumes. The nation has well-developed processing facilities, allowing for effective dehydration and powder manufacture at affordable prices. This has made China a major supplier not just to its local market but also to various global markets. Demand in the nation is also growing gradually, driven by changing food habits and an expanding inclination toward convenient, shelf-stable food ingredients. Onion powder finds extensive application in sauces, instant noodles, ready-to-eat foods, and seasonings blends—all of which are becoming progressively consumed by working and urban classes. In addition, the strong growth of China's food and beverage industry, driven by both private investment and government efforts, is forecast to maintain momentum for onion powder demand. With continued upscaling of food manufacturing, China will be expected to retain its leading *onion powder market share* worldwide.

Competitive Landscape:

The research report has provided a comprehensive analysis of the competitive landscape. Detailed profiles of all major market companies have also been provided. Some of the key players in the market include:

- Sensient

- Vegenat

- STL

- JISL

- Sodeleg

- Qingdao Lulin Dehydrated Vegetables Co.

- Olam International Inc.

- Giza National Dehydration

- New Benisuef

- Natural Dehydrated Vegetables Pvt. Ltd.

- Xinghua Hengsheng Food Co. Ltd.

(Please note that this is only a partial list of the key players, and the complete list is provided in the report.)

Onion Powder Market Recent Developments:

- August 2024: An environmental research organization Toxics Link discovered microplastics in 10 salt and five sugar samples ranging in size from 0.1 mm to 5 mm. This has boosted interest in garlic and onion powder as better salt replacements that enhance flavor while also providing health benefits.

- July 2024: Cup Noodles introduced new Campfire S'mores ramen to cook in the microwave instead of an open flame for summer.

- June 2024: Gujarat, India, recorded a 67% increase export of dehydrated white onion in the financial year 2023-24, which is the highest in the last four years.

Onion Powder Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | ‘000 Tons |

|

Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Product Types Covered | Conventional, Organic |

| Packaging Types Covered | Pouches, Cans, Aseptic Cartons, Others |

| Distribution Channels Covered | Speciality Stores, Supermarkets/Hypermarkets, Convenience Stores, Online Retailers, Others |

| End Users Covered | Home Users, Institutional Users |

| Countries Covered | China, India, United States, Japan, South Korea, Turkey, Iran, Pakistan, Egypt, Others |

| Companies Covered | Sensient, Vegenat, STL, JISL, Sodeleg, Qingdao Lulin Dehydrated Vegetables Co., Olam International Inc., Giza National Dehydration, New Benisuef, Natural Dehydrated Vegetables Pvt. Ltd., Xinghua Hengsheng Food Co. Ltd., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC's industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the onion powder market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global onion powder market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the onion powder industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

The global onion powder market reached a volume of 73,100 Tons in 2024.

We expect the global onion powder market to exhibit a CAGR of 3.4% during 2025-2033.

The rising demand for onion powder as a flavoring agent in various food products, such as snacks, sauces, salads, soups, etc., is primarily driving the global onion powder market.

The sudden outbreak of the COVID-19 pandemic has led to the changing consumer inclination from conventional brick-and-mortar distribution channels toward online retail platforms for the purchase of onion powder.

On a regional level, the market has been classified into China, India, the United States, Japan, South Korea, Turkey, Iran, Pakistan, Egypt, and others, where China currently dominates the global market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)