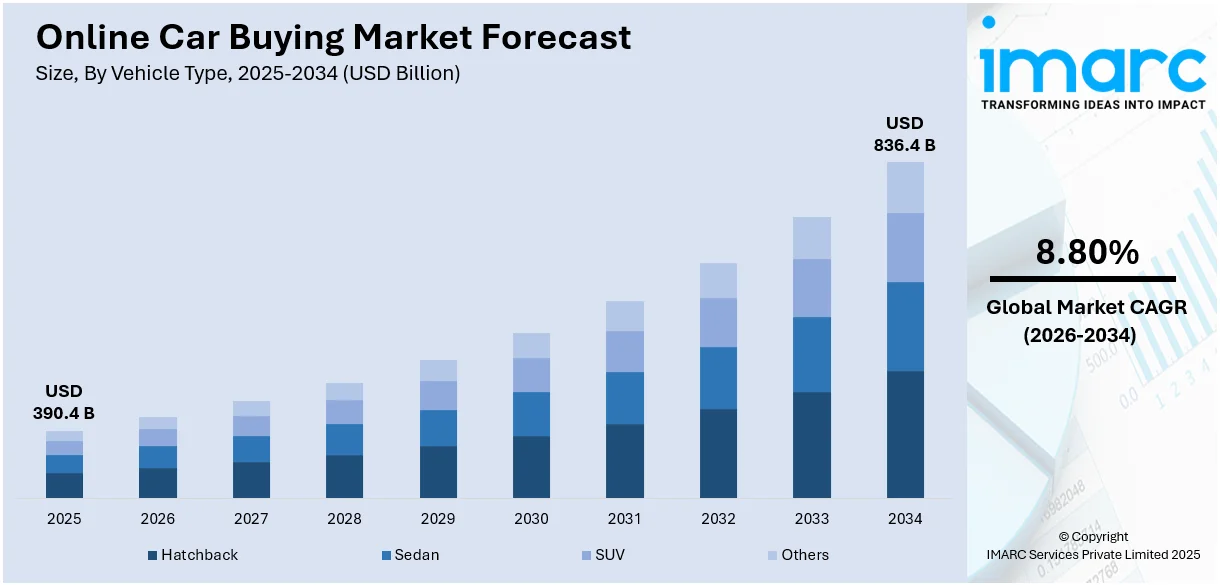

Online Car Buying Market Report by Vehicle Type (Hatchback, Sedan, SUV, and Others), Propulsion Type (Petrol, Diesel, and Others), Category (Pre-Owned Vehicle, New Vehicle), and Region 2026-2034

Online Car Buying Market Size:

The global online car buying market size reached USD 390.4 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 836.4 Billion by 2034, exhibiting a growth rate (CAGR) of 8.80% during 2026-2034. The market is experiencing strong growth driven by the convenience and accessibility offered by the platform, transparency and information availability, rapid digitalization of the automotive industry, changing consumer preferences and behavior, and cost-efficiency and competitive pricing.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 390.4 Billion |

|

Market Forecast in 2034

|

USD 836.4 Billion |

| Market Growth Rate 2026-2034 | 8.80% |

Online Car Buying Market Analysis:

- Market Growth and Size: The online car buying market overview highlights a strong growth attributed to the rising inclination towards online transactions.

- Technological Advancements: Improvements in artificial intelligence (AI)-driven chatbots, augmented reality (AR), and virtual showrooms are all improving user engagement and streamlining the buying process.

- Industry Applications: Online car buying extends beyond simply buying automobiles. It offers buyers a complete solution by including a number of features, such as home delivery services, pricing comparison, financing, and car research.

- Geographical Trends: The adoption of online car buying varies across regions, influencing the online car buying market recent price trends. Developed regions have embraced it, such as North America and Europe, while emerging economies like Asia and South America are catching up slowly as more individuals access the internet.

- Competitive Landscape: The market is highly competitive, with both established automakers and startups offering online platforms, contributing to the online car buying market revenue. This competition is leading to improved services, pricing transparency, and a wider range of vehicle options for individuals.

- Challenges and Opportunities: Challenges include the requirement for a smooth transition from the virtual to the real-world purchasing experience, trust difficulties, and worries about the legitimacy of online car listings. Opportunities in the growing service offered, such as online financing and building client confidence with open and honest dealings, are projected to overcome these challenges.

- Future Outlook: The online car buying market statistics reveal an upward trend as technology advances and trust among buyers in online channels for automobile purchases develops.

To get more information on this market Request Sample

Online Car Buying Market Trends:

Convenience and Accessibility Offered by the Platform

Online car buying helps bypass the need for frequent trips to an auto dealership, therefore, saves a lot of energy and time. The buyers are also able to check the specifications, pricing and reviews of a vast array of automobiles, all within the comfort of their homes. In addition to routine business hours, users can conduct research and decision-making at their own pace owing to the availability of internet connectivity. Moreover, people have the opportunity of choosing more options of vehicles by exploring dealerships that are not restricted within their geographical location. Online environment gives a high degree of accessibility to even those who live in remote districts which often have no physical dealerships. The World Bank’s 2021 report claims that around 3.4 billion people lived in rural areas.

Transparency and Information Availability

At present, people are seeking openness in all aspects of the products they buy, and this also applies to the automobile sector. Online resources offer a wealth of information regarding cars, including features, costs, and specs, User reviews and ratings are also frequently included. Buyers may quickly and simply evaluate features and prices between different models and dealerships, giving them the power to make well-informed decisions. Furthermore, a lot of online car-buying sites include tools to calculate monthly payments, total cost of ownership, and financing options, which assist buyers in creating well-informed financial plans. Through abundant information available, buyers may make well-informed decisions that suit their needs and budget.

Digitalization of the Automotive Industry

The digitalization of the automotive industry is offering a favorable online car buying market outlook. Digital technologies are being adopted by automakers and dealerships more often to improve user engagement and operational efficiency. Online automobile sales are becoming easier due to the creation of user-friendly websites and mobile applications. The incorporation of augmented reality (AR) technologies and virtual showrooms are noteworthy components of this digitization. Buyers can turn, examine, and even picture how cars might fit into their lifestyles in a virtual setting. Real-time experimentation with various automobile colors and combinations is made possible with AR technology. Furthermore, AI-powered chatbots and virtual assistants are becoming increasingly common in the automobile sector. These tools help users with their queries, aid in the decision process, and even walk them through financing choices.

Changing Preferences and Behavior

Changing preferences and behavior of buyers play a pivotal role in driving the online car buying market demand. The younger generations are becoming more accustomed to digital encounters and online purchases. As per the Eurostat in 2022, 96% of young people in the EU used the internet every day compared to 84% of the general population. Convenience, openness, and the capacity to investigate and compare goods and services online are things they appreciate highly. The trend of online car buying was further amplified by the COVID-19 epidemic. Lockdowns and social distancing tactics reduced the number of in-person dealership visits, which led buyers to look at internet alternatives. When the epidemic hit, a lot of people who had been apprehensive about buying such a big item online discovered that it was not only possible but also safer and more convenient. Furthermore, the growth of online car-buying platforms that accommodate buyer habits has been driven by the demand for seamless, end-to-end digital experiences.

Cost Efficiency and Competitive Pricing

Competitive pricing and cost effectiveness are two important drivers propelling the online car buying industry. Compared to typical dealership pricing, online platforms often provide more attractive and competitive price structures. This cost-effectiveness can be attributed to several variables. The lack of a physical showroom when purchasing a car online saves dealership overhead. Buyers may benefit from this cost savings in the form of more affordable pricing or advantageous financing arrangements. Buyers can discover the greatest bargains by comparing features and pricing across various dealerships and models. Online platforms frequently come with tools that let users bid from several dealerships, encouraging competition and pricing transparency. Furthermore, finance calculators are a common element of online car buying platforms, which assist users in understanding the entire cost of ownership, which includes interest rates, monthly payments, and other costs. Individuals are able to choose financing solutions that fit their budgets due to this openness.

Online Car Buying Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the global, regional, and country levels for 2026-2034. Our report has categorized the market based on vehicle type, propulsion type, and category.

Breakup by Vehicle Type:

- Hatchback

- Sedan

- SUV

- Others

SUV accounts for the majority of the market share

The report has provided a detailed breakup and analysis of the market based on the vehicle type. This includes hatchback, sedan, SUV, and others. According to the report, SUV represented the largest segment.

SUVs have grown remarkably and are now a major player in the automobile industry. These cars are distinguished by their tough exterior, increased ground clearance, and usually available four- or all-wheel drive. SUVs are popular among buyers on account of their adaptability. They provide plenty of room for both passengers and goods, which makes them perfect for families, outdoor enthusiasts, and anyone looking to take command of the road. Compact, medium, and full-size SUVs are among the more diverse models available in the SUV market, each of which meets a certain set of requirements and tastes. According to IMARC group predictions from 2023, the market value of SUVs was estimated to be US$ 826.2 billion, with a compound annual growth rate (CAGR) of 4.5% from 2024 to 2032.

Hatchbacks constitute a significant segment in the automotive market, known for their compact size and versatile design. They are characterized by a rear door that opens upward, providing access to the cargo area, which is typically integrated with the passenger compartment. Hatchbacks are popular among urban dwellers and young drivers due to their practicality, maneuverability, and affordability. In recent years, the hatchback segment has witnessed a shift towards more fuel-efficient and eco-friendly options, with hybrid and electric hatchbacks gaining traction.

Sedans have long been a staple in the automotive market, known for their elegant and traditional design with a separate trunk compartment. They offer a comfortable and spacious interior, making them a preferred choice for families and commuters. Sedans are available in various sizes, from compact to full-size, catering to a wide range of consumer preferences. The sedan segment has evolved to incorporate advanced technology and safety features, including advanced driver-assistance systems (ADAS) and infotainment systems. While the SUV segment has gained popularity in recent years, sedans still hold a substantial market share, especially among those seeking a smooth and refined driving experience.

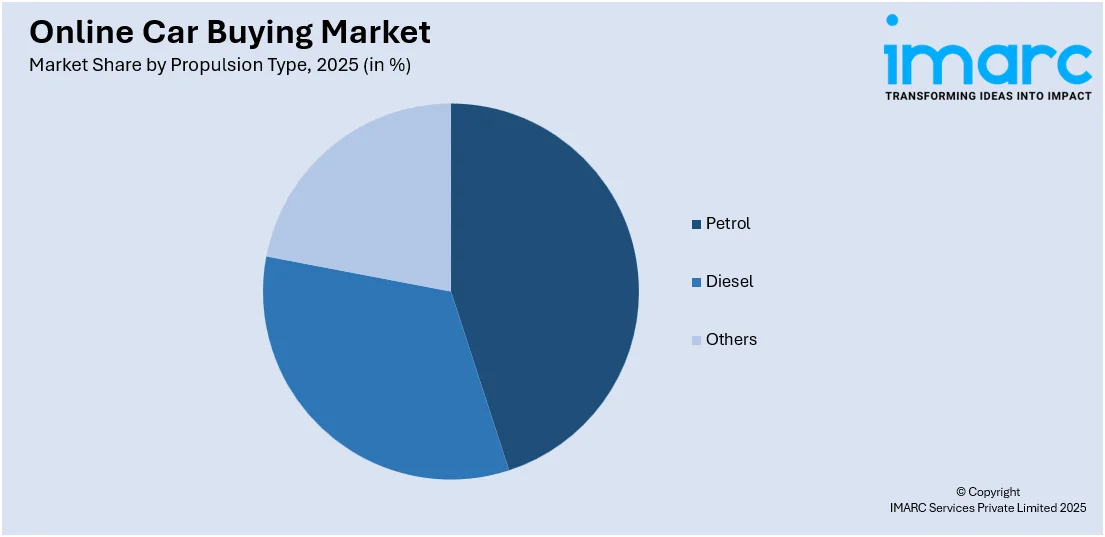

Breakup by Propulsion Type:

Access the comprehensive market breakdown Request Sample

- Petrol

- Diesel

- Others

Petrol holds the largest share in the industry

A detailed breakup and analysis of the market based on the propulsion type have also been provided in the report. This includes petrol, diesel, and others. According to the report, petrol accounted for the largest market share.

Petrol-powered vehicles have long been a dominant force in the automotive market. These vehicles are equipped with internal combustion engines that run on gasoline, a readily available and widely distributed fuel source. Petrol vehicles offer several advantages that contribute to their market presence. Petrol engines are known for their smooth and responsive performance. They provide quick acceleration, making them suitable for a wide range of driving conditions, from city commuting to highway cruising. This versatility has endeared petrol-powered cars to a broad spectrum of consumers. These vehicles tend to have lower upfront purchase costs compared to some alternative propulsion technologies, such as electric vehicles (EVs). This affordability attracts budget-conscious consumers who may not be ready to invest in more expensive options. As per the data provided by the US Energy Information Administration (EIA) in 2022, approximately 57% of the energy employed in the transportation sector and 16% of the total energy utilized in the United States in 2022 came from the use of gasoline, which accounted for 45% of the total usage of petroleum. In addition, about 91% of all gasoline use in the US is attributed to light-duty vehicles, which include automobiles, sport utility vehicles, and compact trucks.

Diesel-powered vehicles represent another segment of the automotive market, albeit with distinct characteristics and consumer preferences. These vehicles utilize diesel fuel and diesel engines, which differ from petrol engines in several ways. One significant advantage of diesel-powered vehicles is their fuel efficiency. Diesel engines typically offer higher miles per gallon (MPG) compared to their petrol counterparts. This fuel efficiency makes them particularly attractive for long-haul trucking, commercial vehicles, and consumers who prioritize fuel savings. Moreover, 2023 saw a US$ 229.0 billion growth in the worldwide diesel engine industry. The market is anticipating a compound annual growth rate of 3.2% from 2024 to 2032, according to the IMARC Group.Additionally, diesel engines generate more torque at lower RPMs, providing robust towing capabilities. This strength makes diesel-powered trucks and SUVs popular choices for those who require heavy-duty performance, such as towing trailers or boats.

Breakup by Category:

- Pre-Owned Vehicle

- New Vehicle

Pre-owned vehicle represents the leading market segment

The report has provided a detailed breakup and analysis of the market based on the category. This includes pre-owned vehicle and new vehicle. According to the report, pre-owned vehicle represented the largest segment.

The pre-owned vehicle segment of the online car buying market has witnessed significant growth in recent years. One of the primary reasons for this growth is the appeal of cost savings. Pre-owned vehicles are generally more affordable than their new counterparts, making them an attractive option for budget-conscious buyers. Online platforms have made it easier than ever to access a wide range of pre-owned vehicles, with detailed listings and extensive information about the vehicle's history, condition, and mileage. Transparency plays a crucial role in the pre-owned vehicle segment. Online platforms provide tools for customers to access vehicle history reports, including accident records, service history, and ownership details. This transparency builds trust between buyers and sellers, mitigating concerns about hidden issues or undisclosed information. Additionally, online marketplaces often include user-generated reviews and ratings, further assisting buyers in making informed decisions.

The segment for new vehicles in the online car buying market has also experienced substantial growth, driven by various factors. One of the primary advantages of buying a new vehicle online is the ability to access the latest models and technologies. Online platforms allow customers to explore the entire lineup of new vehicles from automakers, including detailed specifications, features, and pricing information. Convenience is another key driver for the new vehicle segment. Online car buying enables customers to configure their ideal new vehicle, choose options and accessories, and even customize the color and trim level—all from the comfort of their homes. This eliminates the need for multiple visits to physical dealerships and simplifies the purchasing process.

Breakup by Region:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

North America leads the market, accounting for the largest online car buying market share

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, North America accounted for the largest market share.

North America, comprising the United States and Canada as its major markets, represents a substantial share of the global online car buying market. The region has witnessed significant growth in online car purchasing, driven by tech-savvy consumers who value convenience and transparency. In the U.S., online platforms offer extensive selections of new and used vehicles, and consumers have embraced digital tools for vehicle research and purchases. The presence of well-established automotive e-commerce platforms and the availability of home delivery options have contributed to the region's online car buying boom. Additionally, the COVID-19 pandemic accelerated the adoption of online car buying as consumers sought safer alternatives to traditional dealership visits.

Europe is another major player in the global online car buying market. Countries like Germany, the United Kingdom, and France have seen substantial growth in online car sales. European consumers are known for their interest in eco-friendly vehicles, and online platforms cater to this demand by offering a wide range of electric and hybrid options.

Furthermore, the European Union's push for digitalization and e-commerce regulations has provided a conducive environment for online car buying. In addition to new vehicles, Europe has a thriving market for used cars, with online platforms offering certified pre-owned options. The European online car buying market is characterized by a competitive landscape, with established automotive manufacturers and startups competing to provide a seamless digital experience to consumers.

The Asia Pacific region, including countries like China, India, Japan, and South Korea, has experienced rapid online car buying market growth. Factors driving this growth include the region's vast population, increasing disposable incomes, and a growing middle class. Chinese consumers, in particular, have shown a strong inclination towards online car purchases, with numerous digital platforms offering a wide variety of vehicles, including electric cars and luxury brands. In India, online car buying is gaining momentum, especially among urban consumers seeking convenient solutions for their transportation needs. South Korea and Japan are also witnessing a shift towards digital car purchases, with automakers and online platforms expanding their presence in these markets. The ongoing online car buying market developments presents immense opportunities for online car buying due to its diverse and dynamic consumer base.

Latin America is gradually embracing online car buying, albeit at a somewhat slower pace compared to other regions. Countries like Brazil and Mexico have seen increased interest in digital car purchases, driven by improving internet accessibility and a growing e-commerce culture. In Brazil, for instance, online platforms offer a wide range of vehicles, and the ease of comparing prices and features has appealed to consumers. However, challenges such as concerns over security and trust still exist in some Latin American markets, hindering the full potential of online car buying. Nevertheless, as internet infrastructure continues to improve and consumers become more accustomed to online transactions, the Latin American market is expected to experience strong growth in the coming years.

The Middle East and Africa region are gradually warming up to online car buying, with Varying levels of adoption across countries. In the Middle East, countries like the United Arab Emirates and Saudi Arabia have shown more interest in digital car purchases due to their relatively high-income levels and tech-savvy populations. In contrast, online car buying is in its nascent stages in many African nations, primarily due to infrastructure challenges and lower internet penetration rates. However, with the expansion of internet access and the growth of e-commerce, particularly in urban areas, there is potential for increased adoption of online car buying in the Middle East and Africa. The region presents unique opportunities for digital platforms to cater to specific consumer needs and preferences.

Leading Key Players in the Online Car Buying Industry:

The online car buying market companies are actively pursuing strategies to establish their dominance and enhance the customer experience. Established automakers, such as Toyota, Ford, and Volkswagen have ventured into the digital realm by creating their online platforms or partnering with existing e-commerce platforms. They aim to leverage their brand recognition, extensive vehicle offerings, and dealership networks to attract online buyers. Simultaneously, specialized online marketplaces are focusing on providing comprehensive vehicle listings, price transparency, and user-friendly interfaces to cater to the growing demand for convenient online car purchases. Many of these platforms have incorporated features like virtual showrooms, augmented reality tools, and AI-driven chatbots to engage customers effectively.

The market research report has provided a comprehensive analysis of the competitive landscape. Detailed profiles of all major companies have also been provided. Some of the key players in the market include:

- Asbury Automotive Group

- AutoNation

- CarGurus, Inc.

- CarMax Enterprise Services, LLC

- Cars and Bids LLC

- Cars.com

- CarsDirect.com

- Carvana

- Group 1 Automotive, Inc.

- Hendrick Automotive Group

- Lithia Motors

- Miami Lakes Automall

- TrueCar, Inc

(Please note that this is only a partial list of the key players, and the complete list is provided in the report.)

Latest News:

- December 2, 2020: Asbury Automotive Group Inc. has unveiled Clicklane, a comprehensive communication technology ecosystem, designed to facilitate a complete online car purchasing and selling experience. Asbury has collaborated with Gubagoo to develop this digital platform, providing them with the means to elevate the car buying process within their existing store network.

- November 15, 2022: AutoNation Inc. has unveiled its recent acquisition of approximately 6.1% of TrueCar. TrueCar stands as a prominent digital marketplace within the automotive industry, facilitating connections between car buyers and sellers through its extensive network of Certified Dealers nationwide. AutoNation's decision to invest in TrueCar underscores its unwavering dedication to emerging technologies and its persistent commitment to delivering unparalleled customer experiences.

- November 7, 2023: CarGurus Inc. has reached an agreement to complete the acquisition of CarOffer in its entirety. This strategic move underscores CarGurus' commitment to expanding its presence and capabilities within the automotive market. CarOffer, a notable player in the industry, specializes in providing innovative technology solutions that facilitate vehicle buying and selling processes.

Online Car Buying Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Vehicle Types Covered | Hatchback, Sedan, SUV, Others |

| Propulsion types Covered | Petrol, Diesel, Others |

| Categories Covered | Pre-Owned Vehicle, New Vehicle |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Asbury Automotive Group, AutoNation, CarGurus, Inc., CarMax Enterprise Services, LLC, Cars and Bids LLC, Cars.com, CarsDirect.com, Carvana, Group 1 Automotive, Inc., Hendrick Automotive Group, Lithia Motors, Miami Lakes Automall, TrueCar, Inc, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the online car buying market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global online car buying market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the online car buying industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

The global online car buying market was valued at USD 390.4 Billion in 2025.

We expect the global online car buying market to exhibit a CAGR of 8.80% during 2026-2034.

The increasing internet accessibility, along with the rising number of exclusive car deals offered online by numerous automotive companies, is primarily driving the global online car buying market.

The sudden outbreak of the COVID-19 pandemic had led to the implementation of stringent lockdown regulations across several nations resulting in the demand fluctuations for purchasing cars, thereby negatively impacting the online car buying market.

Based on the vehicle type, the global online car buying market can be segmented into hatchback, sedan, SUV, and others. Currently, SUV holds the majority of the total market share.

Based on the propulsion type, the global online car buying market has been divided into petrol, diesel, and others. Among these, petrol currently exhibits a clear dominance in the market.

Based on the category, the global online car buying market can be categorized into pre-owned vehicle and new vehicle. Currently, pre-owned vehicle accounts for the largest market share.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, where North America currently dominates the global market.

Some of the major players in the global online car buying market include Asbury Automotive Group, AutoNation, CarGurus, Inc., CarMax Enterprise Services, LLC, Cars and Bids LLC, Cars.com, CarsDirect.com, Carvana, Group 1 Automotive, Inc., Hendrick Automotive Group, Lithia Motors, Miami Lakes Automall, and TrueCar, Inc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)