Online Grocery Market Size, Share, Trends and Forecast by Product Type, Business Model, Platform, Purchase Type, and Region, 2026-2034

Online Grocery Market Size and Share:

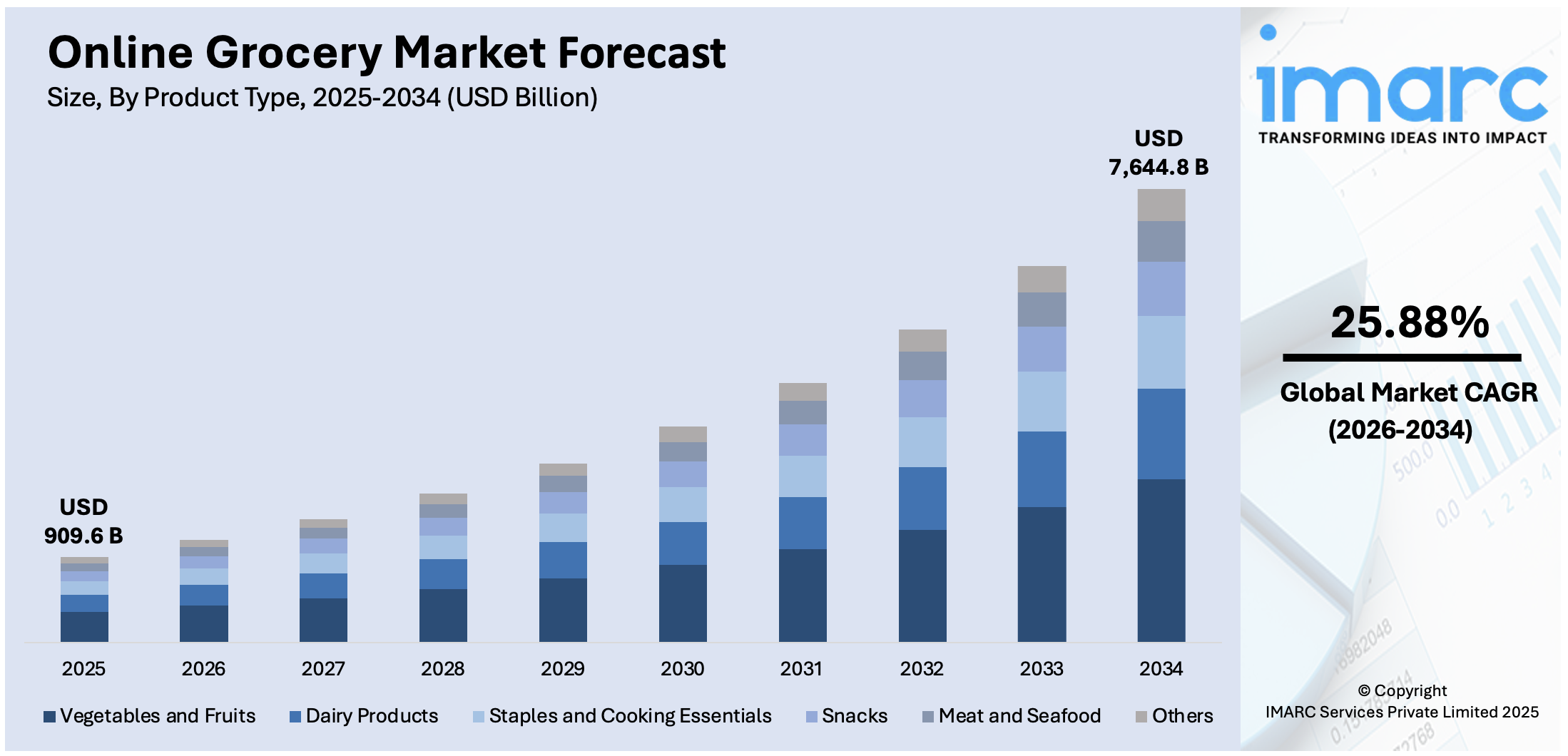

The global online grocery market size was valued at USD 909.6 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 7,644.8 Billion by 2034, exhibiting a CAGR of 25.88% from 2026-2034. Asia Pacific currently dominates the market, holding a market share of over 58.3% in 2025. The market is experiencing robust growth driven by the growing reliance on smartphones to browse the internet and shop from online platforms and increasing need for convenience. This trend is significantly contributing to the expansion of the online grocery market share, as consumers increasingly prefer digital solutions for their everyday shopping needs.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 909.6 Billion |

|

Market Forecast in 2034

|

USD 7,644.8 Billion |

| Market Growth Rate (2026-2034) | 25.88% |

The online grocery market in recent years is changing due to a multitude of technological developments along with changes in consumer and retail landscapes. Perhaps the single most important factor driving demand in the market is consumers' increasing demand for more convenient and time-saving alternatives. As people live increasingly fast-paced lives the appeal of shopping for groceries without leaving home or on one's way can be realized. Traditional grocery shopping is very time-consuming. Customers have to travel to stores, wait in long lines and carry heavy items home. Online grocery shopping eliminates all these problems and offers consumers the convenience of placing orders online and having them delivered directly to their doorstep.

To get more information on this market Request Sample

The United States has become a prominent region in the online grocery market due to a variety of reasons. Delivery service expansion is a dominant trend in the market. The traditional supermarkets are forming partnerships with third-party delivery platforms and ecommerce companies have also ventured into the grocery sector increasing their delivery capabilities. This development is allowing more people to buy groceries online. Last-mile delivery solutions have also evolved with retailers using a range of strategies to improve speed and reduce costs. Some retailers have opted for the dark store model where warehouses are used only to fulfill online orders rather than to serve walk-in customers. Advanced technologies including autonomous delivery vehicles, drones and robotic fulfillment centers can make the process even more efficient in the online grocery delivery sector. According to the forecasts by the IMARC Group, the US Online grocery market has reached USD 615.9 billion in 2032.

Online Grocery Market Trends:

Advancements in Technology and Logistics

The growth in online food retailing is mainly seen due to technological and logistically advancements. According to an industry report, the driven by changing consumer demand, higher competition and technological innovation online sales could stand for 18 to 30 percent of the food at home market in some the leading European countries. The sophisticated ecommerce platforms together with the mobile applications have come up with easily accessible user interfaces. Groceries are now shopped easily from one's home incorporating features like personalized recommendations to ease navigation and secure means of payment making one's overall shopping experience even much better. The advancement also goes further in logistics into streamlining the supply chain while delivering things faster and at an easier rate. This includes the use of AI for inventory management, predictive analytics for demand forecasting and route optimization for delivery vehicles. These improvements are greatly reducing delivery times thereby making online grocery shopping more convenient for individuals. Last-mile delivery solutions including local fulfillment centers and drones have been on the rise which is contributing to the online grocery market growth.

Changing Buyer Behaviors and Preferences

The shift towards online grocery shopping is a reflection of changing buyer behaviors and preferences. According to an industry report, from March 2020 to February 2022, American consumers spent a total of USD 1.7 Trillion in online purchases, which means an increase of USD 609 Billion as compared to their total spending in the years 2018 and 2019. Today, with busy lives, everyone is looking to save time, and online grocery shopping is becoming a convenient means to save time. A high number of people will appreciate the ability to shop anytime and anywhere without the need to visit a physical store, especially among those with demanding schedules. Increased health and safety concerns have encouraged people to opt for online shopping as a means to minimize contact and exposure. Furthermore, online stores have more extensive offerings, including specialty and international items, which may not be found in physical stores. This variety, together with the ease of price comparison and product reviews, is making online grocery shopping an attractive choice for people seeking quality and value. Many online grocery sites also emphasize offering discounts, cash backs, and coupon codes to enhance the shopping experience of people and attract a large number of buyers on a regular basis. Online grocery market revenue is growing at a good rate due to changing habits and technological advancements.

Convenience and Timesaving

One of the primary drivers of the online grocery market is the heightened need for convenience. It allows people to shop from anywhere at any time without having to physically visit a store. This is most appealing for those with busy lifestyles, families, or mobility challenges. Online shopping eliminates time spent in traffic, searching for parking, navigating aisles, and waiting in checkout lines. Convenience and time saving are main drivers, particularly for customers whose time is highly constrained. Other delivery options such as same-day delivery, delivery within scheduled slots, or even click-and-collect services are a convenience boost. Online grocery demand increases as people look for convenience and different delivery options. According to an industry report, retail e-commerce sales of this world are projected to rise higher than USD 4.1 Trillion by the year 2024. This is also said to increase further in the next years.

Technological Advancements

Technological innovations are playing a crucial role in the growth of the online grocery market. Enhanced e-commerce platforms with user-friendly interfaces make the shopping experience seamless. The integration of artificial intelligence (AI) and machine learning (ML) for personalized recommendations and predictive analytics in inventory management ensures product availability and timely restocking. As per an industry report, more than 50% of eCommerce companies have integrated AI into their operations. Advanced logistics and supply chain technologies facilitate efficient and faster delivery services, improving the overall customer experience. Online grocery market value is increasing with technological innovations enhancing shopping, personalization, and supply chain efficiency.

Online Grocery Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global online grocery market, along with forecast at the global, regional, and country levels from 2026-2034. The market has been categorized based on product type, business model, platform, and purchase type.

Analysis by Product Type:

- Vegetables and Fruits

- Dairy Products

- Staples and Cooking Essentials

- Snacks

- Meat and Seafood

- Others

Staples and cooking essentials lead the market with around 28.9% of market share in 2025. According to the report, staples and cooking essentials represented the largest segment. Staples and cooking include grains, flour, oils, spices and other essential cooking ingredients. The popularity of this segment stems from the universal need for these products in everyday cooking coupled with the convenience of bulk purchases and regular replenishment. Online platforms often provide a variety of brands and price points catering to a wide range of culinary needs and preferences. This segment caters to a broad consumer base as it includes basic items required by almost every household. Unlike niche products staples and cooking essentials appeal to a wide range of customers regardless of their dietary preferences or cooking habits. Products in this category often have a high repeat purchase rate due to their regular use and consumption. This creates opportunities for online grocers to establish long-term relationships with customers through subscription models or automated replenishment services.

Analysis by Business Model:

- Pure Marketplace

- Hybrid Marketplace

- Others

According to the report, pure marketplace accounted for the largest market share. The pure marketplace acts as a facilitator connecting sellers with buyers without owning any inventory. This approach allows for a vast assortment of products as the marketplace can host multiple sellers including local vendors, big brands and specialty stores. The key advantages of this model are its flexibility in product offerings and scalability as it does not require the platform to maintain physical stock. The success of this model hinges on the ability of the platform to maintain a robust network of sellers and ensure a seamless and reliable shopping experience for customers. The hybrid marketplace model combines elements of the pure marketplace with traditional retail operations. In this model, the online platform may own some inventory especially of high-demand or staple products while also allowing third-party sellers to offer their products. This approach provides greater control over inventory ensuring consistent quality and availability of key items.

Analysis by Platform:

- Web-Based

- App-Based

Web-based platforms, a key focus of online grocery market research, are accessible through internet browsers on various devices, such as computers, laptops, and smartphones. These platforms are particularly popular among users who prefer a larger display for browsing and comparing products or those hesitant to download additional applications. Web-based grocery platforms often provide a comprehensive view of products, detailed descriptions, and easy navigation. They are essential for users conducting research or comparing prices across multiple sites, offering valuable insights into consumer behavior and preferences in the online grocery market. As highlighted by online grocery market research, these platforms play a pivotal role in enhancing customer experience and driving market growth.

App-based platforms require users to download an application on their smartphones or tablets. This segment has seen substantial growth due to the convenience and speed it offers, especially for repeat purchases and regular users. Grocery shopping apps often provide a more personalized experience, with features like push notifications for deals, personalized recommendations, and the ability to quickly reorder favorite items. The app-based platform is particularly appealing to a tech-savvy, younger demographic that values the convenience of shopping on-the-go. Moreover, apps can utilize smartphone features like location services for more efficient delivery.

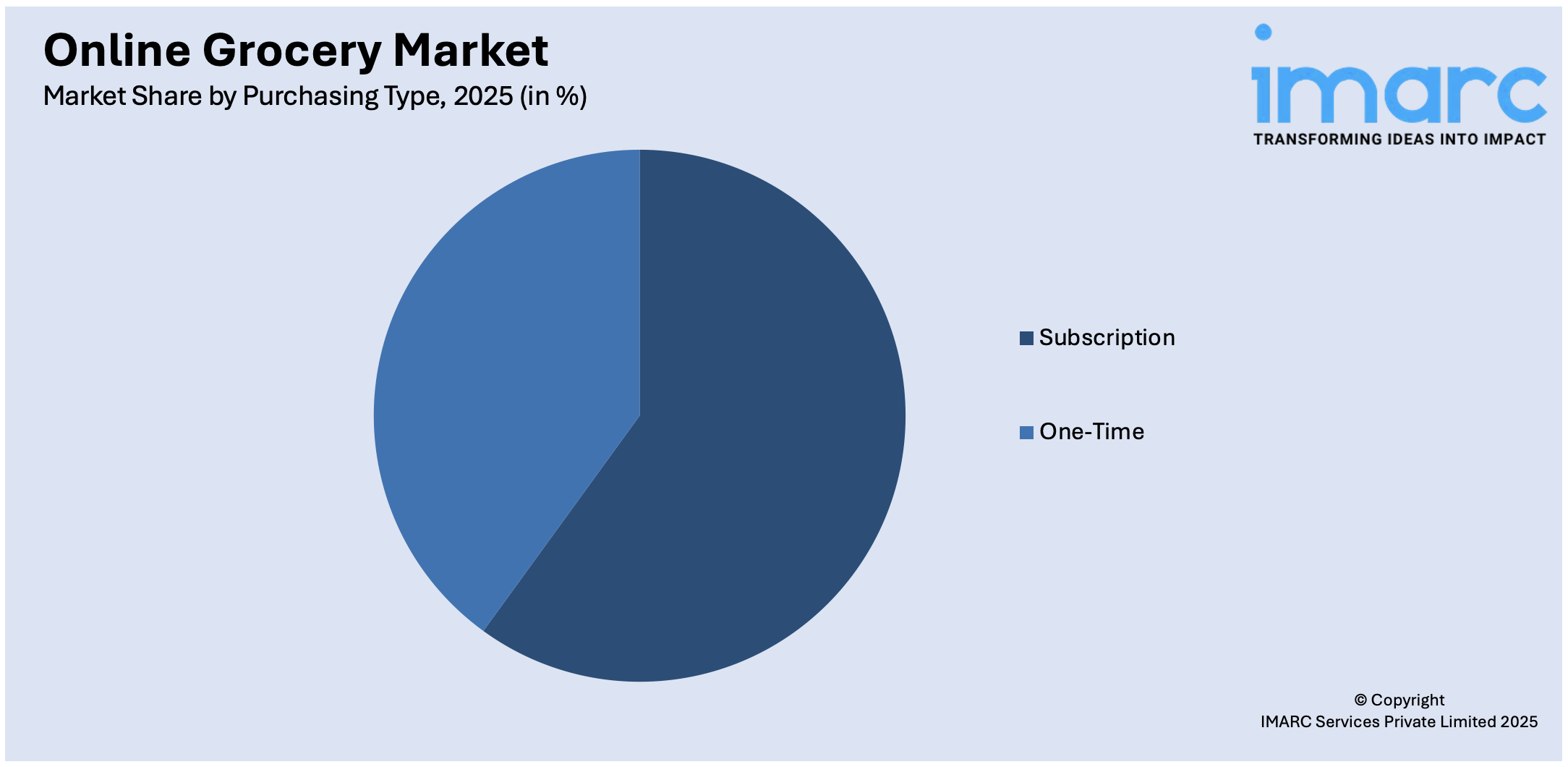

Analysis by Purchasing Type:

Access the comprehensive market breakdown Request Sample

- One-Time

- Subscription

Subscription leads the market with around 58.0% of market share in 2025. The subscription-based purchase segment is gaining traction in the online grocery market, particularly for staple items and regularly used products. In this model, people subscribe to receive certain products at predetermined intervals, such as weekly or monthly. This segment is convenient for individuals who wish to automate the replenishment of essentials, saving time and effort in repeated ordering. It is ideal for products that have predictable usage rates, like dairy products, baby care items, or even specialty coffee. Subscription models often offer benefits, such as discounted pricing, free delivery, or exclusive access to certain products. Another major benefit of subscription services is the level of personalization they provide. Many subscription models are based on consumer preferences and behaviors, allowing for highly customized experiences.

Regional Analysis:

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

- Turkey

- Saudi Arabia

- Others

In 2025, Asia Pacific accounted for the largest market share of over 58.3%. The online grocery industry analysis highlights significant growth in the Asia Pacific driven by shifting consumer preferences, increasing digital adoption, and expanding product availability through innovative e-commerce platforms and delivery models. Smartphones and mobile applications have revolutionized the way people shop for groceries online. Mobile apps provide a user-friendly platform that allows customers to browse products, add items to their carts, and complete their purchases with just a few taps. The popularity of mobile shopping is rising in recent years, with many people preferring the flexibility to shop for groceries while on the move. The integration of e-commerce with traditional brick-and-mortar retail is another important trend. Major grocery chains have significantly ramped up their online offerings and have invested heavily in e-commerce platforms. These retailers are adopting omnichannel strategies that allow customers to shop online and pick up their groceries in-store or choose home delivery options. In addition to large chains, local and independent grocery stores are also embracing e-commerce. Some smaller retailers have partnered with third-party platforms or developed their own online shopping services to remain competitive in the digital age. This trend of e-commerce integration is crucial for expanding the reach of grocery retailers and meeting the demand for online grocery shopping. In 2024, OLA announced its plan to launch grocery delivery services via the government backed Open Network for Digital Commerce (ONDC). Ola manages more than 30% of ONDC food orders in Bengaluru and Delhi-NCR.

Key Regional Takeaways:

United States Online Grocery Market Analysis

The United States to hold 82.50% of the market share in North America. According to an industry report, in 2023, more than 90% of Americans had internet access, and approximately 90% of people owned a smartphone, which will propel the US online grocery business. Online grocery purchases have increased dramatically as a result of shifting consumer habits, with around 50% of Gen Z and millennials favoring convenience shopping. The COVID-19 epidemic has speeded up change. Since 2019, the percent of US families that buy groceries online has risen 116%. Two examples of subscription-based business models gaining increasing traction are Amazon Fresh and Walmart+. By 2023, 30% of consumers have subscribed to or have access to a Walmart+ subscriptions, as per industry reports. In addition, same-day delivery services have gained popularity; in 2023, they will account for a significant percentage of all online grocery orders. With a significant rise in the use of meal kits in 2023 alone, the diffusion of meal kits such as Blue Apron and HelloFresh appeals to busy households. In addition, retailers are using cutting-edge technology such as voice-activated shopping through smart speakers and AI-driven recommendations, which are used by several households.

Europe Online Grocery Market Analysis

The high internet penetration rate in Europe—that averages at about 90% (as per an industry report) and the increased use of e-commerce platforms are pushing the online grocery business. More than 60% of families place buying some of their groceries online in the UK, which takes the top spot. Online grocery share in the grocery retail business is also seeing notable uptake in France and Germany. Demand for sustainable and organic products has risen; according to reports, in 2023, 45% of German consumers have stated that they would rather prefer eco-friendly shopping options. Given that more than 74% of Europeans live in cities according to the European Commission data, urbanization is another key factor that is driving up the demand for home delivery services. Real-time delivery tracking and AI-based inventory management are some examples of recent technological innovations that are causing productivity to soar and creating customer happiness. In other words, the click-and-collect technique is a very-widely-used technique online for grocery ordering in nations like France. Growth prospect is further bolstered in the region by government measures supporting digital transformation, as well as green logistics.

Asia Pacific Online Grocery Market Analysis

The online grocery market is growing rapidly in Asia-Pacific because of the region's large population and increasing use of smartphones, which reportedly reached 78% by 2023. By 2030, the middle-class population in the region will increase to 3.8 billion people, said the Asian Development Bank figures, making them a large online grocery buying base. Reports show that over 30% of urban households in China are purchased through Online-to-Offline (O2O) platforms. As per Goldman Sachs, April 2024 saw the company reporting $5 billion in quick delivery, or 45% of the USD11 Billion Indian online grocery business at the time. It is estimated that rapid commerce will comprise 70% of the online grocery business, which will reach USD 60 Billion by 2030. Consumers across the region are happy to pay more for speed and convenience. The government program that encourages digital payments is making online transactions easy for consumers, like India's Unified Payments Interface (UPI). Online grocery delivery services such as GrabMart and HappyFresh deliver to city people in South East Asia, where their orders are growing at high rates. Subscription services as well as partnerships with local farmers bring fresh products. In cities, quick-commerce models where delivery takes 30 minutes are also gaining popularity in metro areas.

Latin America Online Grocery Market Analysis

Growing smartphone usage and internet penetration, which reached over 72% in 2023 according to reports are driving the online grocery business in Latin America. Brazil and Mexico are the two biggest markets; in 2023, with companies in both countries expanding their business. For instance, media outlets report that Diferente, a Brazilian online grocery delivery business, has collected USD 3 Million to increase the availability of healthier food for its clients. As per the data by UN, 156 million young people between the ages of 15 and 29 in Latin America and the Caribbean, and they like digital platforms since they are more convenient and economical. Retailers such as Rappi and Mercado Libre have extended their offerings by utilizing AI to optimise last-mile deliveries and provide personalized recommendations. Over 40% of consumers have adopted mobile payment systems which simplify transactions and drive business growth.

Middle East and Africa Online Grocery Market Analysis

Smartphone penetration in GCC countries has risen to over 70% in 2023 according to studies, while Sub-Saharan Africa has reached 50%, the market of the MEA region is growing at a phenomenal rate. The fact that over 50% of the population within the region resides in an urban environment makes urbanization a relevant factor. Online grocery market share is held by Saudi Arabia and the United Arab Emirates alone, wherein 40% of customers habitually go online for grocery shopping. Technological advancements in terms of digital payment systems and mobile wallets are giving rise to easier transactions at a yearly growth rate of 30%. Fresh fruits and basic commodities are being accessed more readily in Africa by collaborating with local vendors and international e-commerce sites, Jumia.

Competitive Landscape:

Key players in the online grocery market are actively engaging in various strategies to strengthen their market positions and cater to evolving consumer demands. They are heavily investing in advanced technologies like artificial intelligence (AI) and machine learning (ML) to enhance customer experience through personalized recommendations and efficient logistics. Top companies are expanding their product range to include a wider array of items, including organic and specialty foods, to appeal to diverse consumer preferences. Partnerships with local suppliers and the integration of sustainable practices are also a focus, aiming to attract environmentally conscious consumers. Furthermore, leading companies are exploring innovative delivery options, such as drones and autonomous vehicles, to improve delivery efficiency and reduce costs. These efforts demonstrate their commitment to innovation, customer satisfaction, and sustainable growth in the competitive online grocery landscape. In 2024, Instacart, the leading online grocery platform in North America, declared a novel Supplemental Nutrition Access Program (SNAP) eligibility screener present on Instacart’s EBT SNAP information page. This new tool enables people nationwide spontaneously and anonymously check whether they are eligible for SNAP benefits in less than sixty seconds and effortlessly search resources to streamline enrolment.

The report provides a comprehensive analysis of the competitive landscape in the online grocery market with detailed profiles of all major companies, including:

- Amazon.com, Inc.

- Carrefour

- Costco Wholesale Corporation

- Edeka Group

- HappyFresh

- Koninklijke Ahold Delhaize N.V.

- Reliance Retail Limited (Reliance Industries Limited)

- Safeway Inc. (Albertsons Companies, Inc.)

- Schwan’s Home Delivery

- ShopFoodEx

- Tesco PLC

- The Kroger Co.

- Walmart Inc.

- Wm Morrison Supermarkets Limited

Latest News and Developments:

- October 2025: Amazon introduced its latest private-label brand, Amazon Grocery, featuring more than 1,000 food products, with numerous items priced below $5, to attract cost-sensitive shoppers. The selection features fresh fruits and vegetables, dairy products, meats, and essential pantry items. It can be found online and in Amazon Fresh locations.

- October 2025: The Indonesian eCommerce leader Blibli introduced BlibliFresh, an online grocery service emphasizing freshness, quick delivery, and dependability. The platform tackles typical consumer problems such as late deliveries and low product quality, offering one-hour delivery and easy returns.

- September 2025: Amazon UK revealed intentions to enhance its online grocery delivery by strengthening collaborations with Morrisons, Co-op, Iceland, and Gopuff. The company will increase Prime members’ access to grocery delivery by more than twofold and launch Same-Day Delivery for fresh products in 2026.

- September 2025: Naver and Kurly introduced Kurly N Mart, a high-end online grocery service in the Naver Plus Store. It offers unique and carefully selected fresh food products, including Kurly's own brand items, with next-morning delivery through Kurly's cold-chain system. The initiative aims to challenge Coupang’s supremacy in the online grocery sector of Korea.

- August 2025: Amazon introduced same-day fresh grocery delivery in 1,000 cities across the US, such as Phoenix, Orlando, and Kansas City. The firm intends to extend this service to 2,300 cities by the end of the year. Complimentary shipping for Prime users seeks to increase sales and rival Walmart.

- May 2025: The Portuguese supermarket chain Pingo Doce introduced its own online grocery service, Pingo Doce Online, in Lisbon and Porto. The updated platform combines in-store promotions with its loyalty program to provide a more uniform and managed customer experience.

- January 2025: KIKO Live launched its ONDC Buyer app, aimed at transforming online shopping with features like grocery list search, nearby store suggestions, and quick commerce services. The app enables faster, more efficient delivery from local stores, targeting areas like Delhi, and plans to expand to other cities. Kiko Live's goal is to partner with 10,000 stores by 2025, enhancing the home delivery business for small retailers.

Online Grocery Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Vegetables and Fruits, Dairy Products, Staples and Cooking Essentials, Snacks, Meat and Seafood, Others |

| Business Models Covered | Pure Marketplace, Hybrid Marketplace, Others |

| Platforms Covered | App-based, Web-based |

| Purchase Types Covered | One-time, Subscription |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Amazon.com, Inc., Carrefour, Costco Wholesale Corporation, Edeka Group, HappyFresh, Koninklijke Ahold Delhaize N.V., Reliance Retail Limited (Reliance Industries Limited), Safeway Inc. (Albertsons Companies, Inc.), Schwan’s Home Delivery, ShopFoodEx, Tesco PLC, The Kroger Co., Walmart Inc., Wm Morrison Supermarkets Limited, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the online grocery market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global online grocery market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the online grocery industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Online grocery refers to the practice of purchasing groceries through digital platforms, such as websites or mobile apps. Consumers can browse, select, and order food and household products, which are then delivered directly to their doorsteps, providing a convenient alternative to traditional in-store shopping.

The global online grocery market was valued at USD 909.6 Billion in 2025.

IMARC estimates the global online grocery market to exhibit a CAGR of 25.88% during 2026-2034.

The key factors driving the global online grocery market include the growing reliance on smartphones, the increasing need for convenience, technological advancements, improved logistics, and evolving consumer behavior that prioritizes time-saving and contactless shopping.

In 2025, staples and cooking essentials represented the largest segment by market share, driven by the universal need for basic cooking ingredients and the convenience of regular replenishment.

Pure marketplace leads the market by share owing to its flexibility in product offerings and scalability, as it connects various sellers without maintaining inventory.

The app-based platform is the leading segment by market share, driven by the convenience and personalized experiences it offers, especially for repeat purchases.

The subscription model is the leading segment by market share, driven by the growing demand for automated replenishment of essentials and personalized shopping experiences.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and the Middle East and Africa, wherein Asia Pacific currently dominates the global market, driven by widespread smartphone use and the integration of e-commerce with traditional retail.

Some of the major players in the global online grocery market include Amazon.com, Inc., Carrefour, Costco Wholesale Corporation, Edeka Group, HappyFresh, Koninklijke Ahold Delhaize N.V., Reliance Retail Limited (Reliance Industries Limited), Safeway Inc. (Albertsons Companies, Inc.), Schwan’s Home Delivery, ShopFoodEx, Tesco PLC, The Kroger Co., Walmart Inc., Wm Morrison Supermarkets Limited, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)