Online Trading Platform Market Size, Share, Trends and Forecast by Component, Type, Deployment Mode, Application, and Region, 2025-2033

Online Trading Platform Market Size and Share:

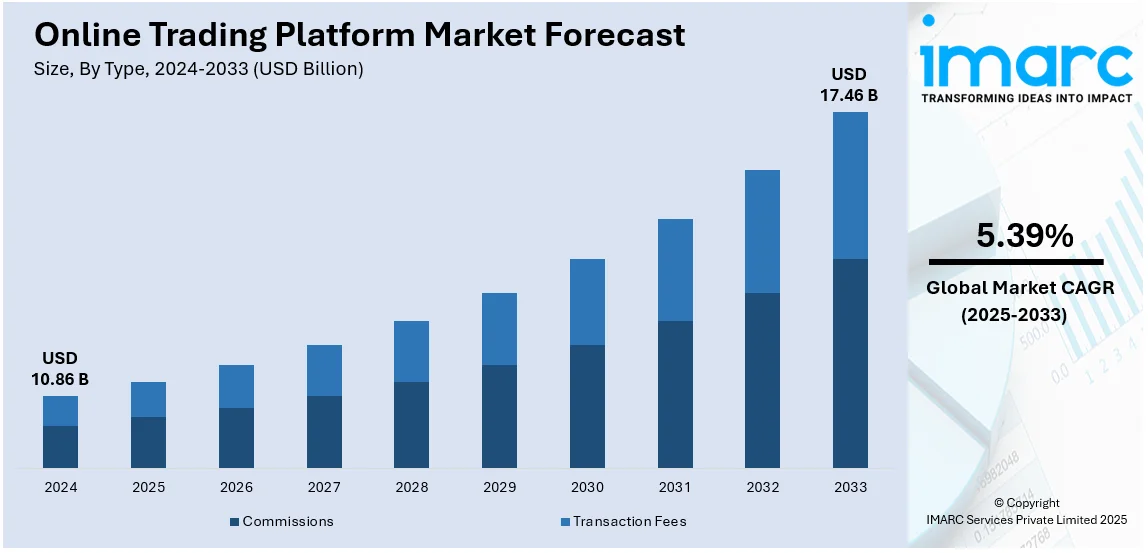

The global online trading platform market size was valued at USD 10.86 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 17.46 Billion by 2033, exhibiting a CAGR of 5.39% from 2025-2033. North America currently dominates the market, holding a market share of over 36.8% in 2024. The growth of the North American region is driven by advanced technology adoption, robust financial infrastructure, and increasing retail investor participation.

|

Report Attribute

|

Key Statistics |

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 10.86 Billion |

| Market Forecast in 2033 | USD 17.46 Billion |

| Market Growth Rate (2025-2033) | 5.39% |

With internet penetration reaching even remote areas and smartphones becoming more affordable, online trading platforms are accessible to a broader audience. The capacity to conduct trades and oversee portfolios on mobile devices is enhancing convenience for users, promoting active engagement from a varied array of investors worldwide. In addition to this, cutting-edge technologies such as artificial intelligence (AI), machine learning (ML), and blockchain are revolutionizing online trading platforms. These technologies offer real-time analysis, predictive insights, and improved security features, enabling users to make quicker and more precise trading choices. Algorithmic trading and automation enhance trading strategies, increasing the attractiveness of platforms for both retail and institutional investors. Additionally, the increasing fascination with digital assets such as cryptocurrencies, exchange-traded funds (ETFs), and foreign exchange trading is fostering the use of online trading platforms. These platforms offer smooth and affordable alternatives for investing in these assets, drawing in tech-savvy individuals and novice investors.

The United States is a major market, supported by the launch of groundbreaking platforms with sophisticated capabilities. New players emphasizing ultra-rapid execution speeds, improved security features, and intuitive interfaces draw in a varied group of traders. These platforms provide a wide range of trading tools and customizable features, catering to the changing demands of contemporary investors while establishing new standards in trading excellence. For instance, in 2024, Tshan Markets, an online trading platform regulated in the US, was officially launched with innovative features such as rapid execution speeds, swap-free trading, and improved security. The platform provides more than 250 trading tools, serving international users with an easy-to-use interface and customizable application. Tshan Markets seeks to reshape trading norms through clear communication and effectiveness. Apart from this, the increasing adoption of mobile trading applications and cloud-based platforms enables users to trade anytime and anywhere, providing flexibility and boosting engagement across all demographics in the market.

Online Trading Platform Market Trends:

Increasing Demand for Customized Trading Platforms

The increasing need for tailored trading platforms from diverse end-users like governmental and non-profit banks is driving the demand for online trading platforms. Furthermore, the increasing need for personalized trading platforms that can be adjusted to meet local regulatory standards and investor protection policies, such as risk management systems, account supervision, and reporting features, is driving the market ahead. Moreover, tailored trading platforms offer various benefits like user-friendliness, cost-effectiveness, and reduced error rates, which, consequently, fosters a favorable perspective for online trading platform market share. Additionally, the increasing number of retail investors aspiring to handle their investments independently has boosted the need for personalized trading platforms. For example, in September 2024, CBOE declared a collaboration with a UK technology company, Globacap, to develop a US trading platform for private company shares. The CBOE Private Markets platform is now in its pilot phase after registering with FINRA as a broker-dealer. Private markets are becoming more popular, as notable startups are remaining private for an extended period. CBOE's action signifies a pattern among major financial firms to take advantage of the growing interest in alternative assets aside from conventional stocks and bonds.

Technological Advancements

Technological progress is acting as one of the significant online trading platform market drivers. As digital technology rapidly evolves, online trading platforms have grown increasingly advanced, easy to use, and packed with features. Alongside this, improvements in internet connectivity, mobile technology, and trading applications are offering profitable growth prospects for the market. In addition to this, the increasing use of artificial intelligence and blockchain technology in trading platforms to enhance their efficiency and precision is aiding the market expansion. Additionally, the rising trends in electronic trading have led to the incorporation of automation, algorithmic, and high-frequency trading to expedite trade execution, enhance efficiency, and allow for sophisticated trading strategies, thereby supporting the market growth. These technological innovations, such as the incorporation of artificial intelligence, blockchain, automation, and high-frequency trading, are transforming the dynamics of the online trading platform market by boosting efficiency, facilitating intricate strategies, and improving user experience. For instance, in March 2024, Options Technology partnered with Trader Evolution to offer enhanced API connectivity and trading software solutions. This collaboration aims to provide clients with access to advanced software and bespoke API connectivity, along with comprehensive multi-asset class market data. The partnership will leverage Trader Evolution's expertise in financial software solutions and emphasize on a backend-centric platform to deliver cutting-edge, scalable strategies tailored to evolving client requirements.

Rising Number of Retail Investors

Retail investors are increasingly turning to easy to use platforms, such as online trading, which can be accessed from anywhere to manage their investments. Moreover, retail investors now account for a significant portion of equities trading volume, which represents one of the prime factors strengthening the market growth. For instance, in just 5 years, from FY20 to FY24, the number of demat accounts in India has skyrocketed from 4 crore to 15 crore and counting. It is nearly a fourfold increase in the number of people actively participating in the stock market, as per industrial report. Moreover, the increasing adoption of these products is driven by their lower transaction costs and decreased brokerage fees relative to traditional methods, making them appealing to retail investors with limited capital or smaller investment amounts. Additionally, these platforms provide retail investors with real-time market information, news, charts, and research tools, improving transparency and enabling retail investors to actively handle their portfolios, thereby positively influencing market growth. The increase in retail trading activity, fueled by the convenience and affordability of these platforms, has greatly enhanced the demand for online trading platforms in multiple areas. Moreover, the ongoing developments in technology and the incorporation of AI-driven tools on these platforms are improving user experience, aiding in the ongoing increase in global online trading platform market demand. For example, in April 2024, uTrade Solutions introduced uTrade Algos, a trading platform designed for retail investors, in Goa. The platform offers in-built and back-tested investment strategies, aiming to assist equity traders in planning, strategizing, and automating trades using artificial intelligence. According to uTrade Solutions, the platform enables traders to make informed investment decisions and assess financial returns in real-time through fully automated Algo-based trading.

Online Trading Platform Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global online trading platform market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on component, type, deployment mode, and application.

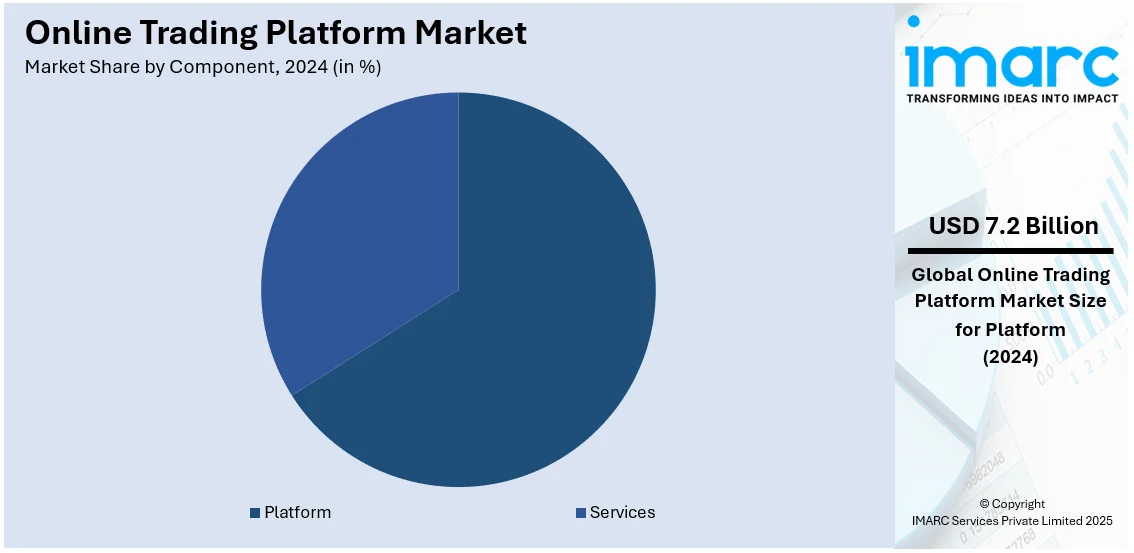

Analysis by Component:

- Platform

- Services

Platform leads the market with 65.8% of market share in 2024. Platform is the largest by segment, driven by its crucial function in facilitating smooth trading experiences for users. Contemporary platforms offer intuitive interfaces, real-time data analysis, and adjustable features, appealing to both new and seasoned traders. They facilitate multi-asset trading in international markets, providing efficiency and flexibility. Sophisticated features like algorithmic trading, AI-based insights, and risk management resources enable users to make precise, informed choices. Cloud-based integration improves accessibility and scalability, guaranteeing optimal performance during busy trading periods. The ongoing updates and integration of advanced technologies ensure platforms remain pertinent in a rapidly changing market. By offering extensive tools for managing portfolios, tracking performance, and facilitating secure transactions, platform is becoming an essential for investors aiming for efficiency and control. This strong demand propels ongoing innovation, reinforcing the platform segment’s leadership position in the online trading market.

Analysis by Type:

- Commissions

- Transaction Fees

Commissions segment is the largest by type, reflecting its critical role in the revenue models of online trading platforms. This segment benefits from its alignment with personalized services and value-added features that attract a broad user base, including active traders and institutional investors. By tying fees to the volume or value of trades, commissions create a scalable structure that supports platform sustainability while providing incentives for enhanced service quality. Platforms leveraging this model often offer advanced analytics, educational resources, and superior customer support, further increasing user satisfaction. Additionally, the transparency of commission-based pricing builds trust among users, encouraging higher engagement. This model also allows platforms to cater to diverse trading needs across various asset classes, ensuring widespread adoption. The adaptability and profitability of the commissions segment position it as a cornerstone in the trading industry, driving continuous innovation to meet evolving user expectations and market demands.

Analysis by Deployment Mode:

- On-Premises

- Cloud

Cloud holds the biggest share of the market, driven by its unparalleled adaptability, scalability, and economical efficiency. Cloud-based platforms enable users to utilize trading services from any location, providing a smooth experience across various devices. The capability to adjust resources flexibly allows platforms to manage increased trading volumes during busy times, sustaining performance without incurring extra infrastructure expenses. Sophisticated security protocols, including encryption and multi-factor authentication, boost user trust in cloud services. Ongoing updates and maintenance, overseen by service providers, guarantee that platforms stay current without interrupting user engagement. Moreover, cloud platforms enhance connectivity with sophisticated analytics and external tools, equipping users with immediate data and insights for informed decision-making. The cost-effectiveness of cloud solutions, along with their capacity to serve traders at every skill level, makes them a popular option in the market. The extensive adoption persists in fostering innovation, reinforcing the cloud segment’s leadership in the trading platform sector.

Analysis by Application:

- Institutional Investors

- Retail Investors

Institutional investors dominate the market with 37.6% of market share in 2024. Institutional investors lead the market due to their significant trading volumes, reliance on sophisticated analytical tools, and preference for advanced trading platforms tailored to their complex needs. These investors, including hedge funds, pension funds, and mutual funds, leverage the robust capabilities of online trading platforms for portfolio diversification, risk management, and real-time decision-making. The segment benefits from platforms offering algorithmic trading, customizable dashboards, and high-speed execution, ensuring efficiency and precision in handling large-scale transactions. According to the online trading platform industry insights, the growing emphasis on seamless integration with financial data systems and enhanced security features further strengthens the appeal of these platforms for institutional clients. Additionally, the ability to access global markets and execute trades across various asset classes positions online trading platforms as indispensable tools for institutional investors. This strong demand drives continuous innovation, enabling platforms to meet the evolving expectations of this key market segment and maintain their competitive edge.

Regional Analysis:

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for a market share of 36.8%. North America accounts for the majority of the market share attributed to technological innovation, fast internet access, and widespread use of digital technologies. The area's tech-oriented residents drive the need for efficient, easy-to-use, and advanced trading platforms, which in turn positively influences market expansion. Furthermore, the existence of a sizable and well-established financial sector, featuring prominent stock exchanges, brokerage companies, and institutional investors in the area is creating a profitable online trading platform market outlook. For instance, in 2024, CRA International, Inc. introduced an upgraded NFX trading platform for the Natural Fibre Exchange. The platform currently facilitates global transactions of wool and seeks to draw in additional international sellers and buyers.

Key Regional Takeaways:

United States Online Trading Platform Market Analysis

United States accounted for 87.80% of the total North American market share. Due to its strong financial system and widespread use of digital services, the US dominates the market for online trading platforms. Online trading has increased because of retail investors' growing use of technology; after 2020, platforms such as Robinhood, E*TRADE, and TD Ameritrade reported millions of new account sign-ups. Since almost 60% of American adults invest in the stock market, these sites have a sizable user base. As almost 60% of American people invest in the stock market, these platforms have a large user base. Another factor driving the growth is the rising number of internet users. According to the results of the most recent National Telecommunications Information Administration (NTIA) Internet Use Survey, 13 million more Americans utilized the Internet in 2023 than they did only two years prior, marking a substantial step towards the goal of Internet for All. In 2023, 83 percent of Americans aged 3 and older accessed the Internet in some capacity.

With zero-commission trading models becoming the standard, the market gains a great deal from trading's affordability and accessibility. Millennials and Gen Z customers are also drawn to advanced features like algorithmic trading, AI-driven trading insights, and user-friendly interfaces. Furthermore, the rise of cryptocurrency trading has increased market potential thanks to websites like Coinbase and Kraken. Investor confidence is fostered by the U.S. Securities and Exchange Commission's (SEC) supportive regulations, which guarantee security and transparency. Smooth trading experiences are also made possible by the deployment of 5G and mobile-based trading applications.

Europe Online Trading Platform Market Analysis

The European Union's regulatory harmonization and sophisticated financial infrastructure are the main drivers of the online trading platform business in Europe. Owing to their strong fintech ecosystems and high rates of financial literacy, nations like the UK, Germany, and France control a large portion of the industry. Another important factor is the growth of retail trading, especially among younger investors, which has led to a surge in the use of platforms like eToro and IG Group. Furthermore, as per Eurostat statistics, in 2023, 95% of households in EU urban areas enjoyed internet access, in contrast to 93% in towns and suburbs and 91% in rural regions. With European consumers demonstrating a preference for Environmental, Social, and Governance (ESG)-compliant assets, the online trading platform market revenue also gains from the growing interest in ethical investing. Additionally, the implementation of the Markets in Financial Instruments Directive II (MiFID II) guarantees security and transparency, promoting involvement in online trading. Along with developments in mobile trading apps and AI-powered tools, the market is further driven by the adoption of cryptocurrencies and contracts for difference (CFDs). Prominent players in the European online trading platform market include eToro, Interactive Brokers, Plus500, and Saxo Group. Europe held around a quarter of the world market for internet trading platforms as of 2023.

Asia Pacific Online Trading Platform Market Analysis

The market for online trading platforms is expanding quickly in the Asia-Pacific area due to rising smartphone adoption and financial inclusion. With rising participation from retail investors and government programs supporting digital finance, China, India, and Japan are major contributors. Platforms such as Huobi and Futu Holdings are growing in China because of the growth of stock trading and cryptocurrencies. Due to a youthful population and pro-business government initiatives like Digital India, the Indian market is supported by apps like Groww and Zerodha. As of October 2024, India boasts 179 million demat accounts, while new account openings have dropped to 3.5 million. Furthermore, the National Stock Exchange (NSE) announced that, for the first time, there were 80 Million (8 crore) unique direct investors, or around 17% of all Indian households. This illustrates how much potential India has for online trading platforms. The growth of the business is further supported by the popularity of forex and derivatives trading, especially in Southeast Asia and Japan. Technological developments like robo-advisors and blockchain-based trading increase the region's allure and make it a hub for market expansion.

Latin America Online Trading Platform Market Analysis

The market for online trading platforms in Latin America is expanding because of rising internet usage and rising financial literacy in the region. According to the Latin America Digital Transformation 2023 Report by Atlantico, Latin America's internet penetration rate increased from 43% in 2012 to 78% in 2022. This is also a factor strengthening the market growth. With growing interest in forex and cryptocurrency trading, nations like Brazil, Mexico, and Argentina are in the forefront. Retail investors are increasingly using platforms such as Bitso in Mexico and Mercado Bitcoin in Brazil. People are looking for alternative investment opportunities because of inflationary pressures and the expansion of digital payment infrastructure. Market expansion is further supported by government programs that encourage financial literacy and the entry of international companies into the fintech industry in the region. With rising use among younger demographics, the industry is anticipated to expand steadily.

Middle East and Africa Online Trading Platform Market Analysis

Growing smartphone usage and growing interest in currency and commodity trading are driving the market for online trading platforms in the Middle East and Africa (MEA) region. According to an industrial report, the monthly smartphone data traffic per smartphone in the Middle East and North Africa is expected to reach 28.34 exabytes (EB) per active device by 2029. In 2024, the typical data usage per active smartphone reached 10.36 EB monthly. With the help of sophisticated financial centers and regulatory advancements, South Africa and the United Arab Emirates are important markets. Trading cryptocurrencies is very common, and sites like Binance are becoming more and more well-known. Government programs that encourage financial innovation, like Dubai's Blockchain Strategy, also help the market expand. Market momentum is anticipated to be maintained by the growing middle class and increased knowledge of alternative assets.

Competitive Landscape:

The global online trading platform industry is highly competitive, with multiple players vying for market share and striving to differentiate themselves in terms of features, services, user experience, and technological advancements. In addition to this, the market is characterized by the presence of established financial institutions, such as banks and brokerage firms, the proliferation of numerous independent online trading platforms, and the increasing number of FinTech startups. Competition within the online trading platform market is driven by factors such as platform functionality, trading features, pricing models, customer service, regulatory compliance, and technological innovations. Players in the market constantly strive to enhance their platforms, introduce new features, improve user experiences, and adapt to changing customer demands to gain a competitive edge and attract a larger user base. In 2024, Zerodha introduced a new feature called ATO (Alert Trigger Orders) on its Kite trading platform. ATO allows users to set pre-determined alerts that can result in actual trades when specific conditions are met, enhancing trading efficiency. The feature will soon be available on Zerodha's Kite mobile platform. ATO enables users to link a basket of orders to an alert, saving time and ensuring they don't miss out on opportunities.

The report provides a comprehensive analysis of the competitive landscape in the online trading platform market with detailed profiles of all major companies, including:

- Ally Financial Inc.

- Cboe Global Markets Inc.

- Charles Schwab & Co. Inc.

- Chetu Inc.

- Devexperts LLC

- E-Trade Financial Corporation (Morgan Stanley)

- FMR LLC

- Interactive Brokers LLC

- MarketAxess Holdings Inc.

- Plus500 Ltd

- Tradestation Group Inc. (Monex Group Inc.)

Latest News and Developments:

- September 2024: Swiss Stock Exchange SIX announced its plans to launch a crypto trading platform for institutional investors, leveraging Switzerland's supportive regulatory stance on cryptocurrencies. The platform would target institutional clients and expand to Europe, Singapore, and beyond. This move reflects the growing acceptance of cryptocurrencies as a legitimate asset class. While the details are still evolving, the potential entry of the Zurich Stock Exchange into the cryptocurrency world could open up new opportunities for institutional investors.

- February 2024: Revolut, known for its financial technology services, launched new trading features that enables investment in fractional shares of stocks and ETFs. Revolut's continuous attempts to improve its investment platform and give users more trading possibilities include this expansion. By providing simple access to international markets, the company hopes to make investing easier for its customers.

- January 2024: Leading online trading platform eToro announced that it is now offering cryptocurrency trading to its European customers. The goal of this action is to meet the increasing demand from retail traders for cryptocurrency investments. A greater variety of digital assets are now supported by eToro's upgraded platform, which reflects the company's desire to broaden its services and draw in more customers in the highly competitive trading environment.

Online Trading Platform Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Platform, Services |

| Types Covered | Commissions, Transaction Fees |

| Deployment Modes Covered | On-premises, Cloud |

| Applications Covered | Institutional Investors, Retail Investors |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Ally Financial Inc., Cboe Global Markets Inc., Charles Schwab & Co. Inc., Chetu Inc., Devexperts LLC, E-Trade Financial Corporation (Morgan Stanley), FMR LLC, Interactive Brokers LLC, MarketAxess Holdings Inc., Plus500 Ltd, Tradestation Group Inc. (Monex Group Inc.), etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the online trading platform market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global online trading platform market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the online trading platform industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

The online trading platform market was valued at USD 10.86 Billion in 2024.

The online trading platform market is projected to exhibit a CAGR of 5.39% during 2025-2033, reaching a value of USD 17.46 Billion by 2033.

The market is primarily driven by rising internet penetration, affordable smartphones, advanced technologies like AI and blockchain, growing retail investor participation, increased demand for cryptocurrencies and alternative assets, and innovative trading tools that enhance user experience, transparency, and efficiency.

North America currently dominates the online trading platform market, accounting for a share exceeding 36.8%. This dominance is fueled by ongoing technological innovation, a robust financial infrastructure, and high retail investor engagement.

Some of the major players in the online trading platform market include Ally Financial Inc., Cboe Global Markets Inc., Charles Schwab & Co. Inc., Chetu Inc., Devexperts LLC, E-Trade Financial Corporation (Morgan Stanley), FMR LLC, Interactive Brokers LLC, MarketAxess Holdings Inc., Plus500 Ltd, and Tradestation Group Inc. (Monex Group Inc.), among others.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)