Online Travel Market Size, Share, Trends and Forecast by Service Type, Platform, Mode of Booking, Age Group, and Region, 2026-2034

Online Travel Market Size and Share:

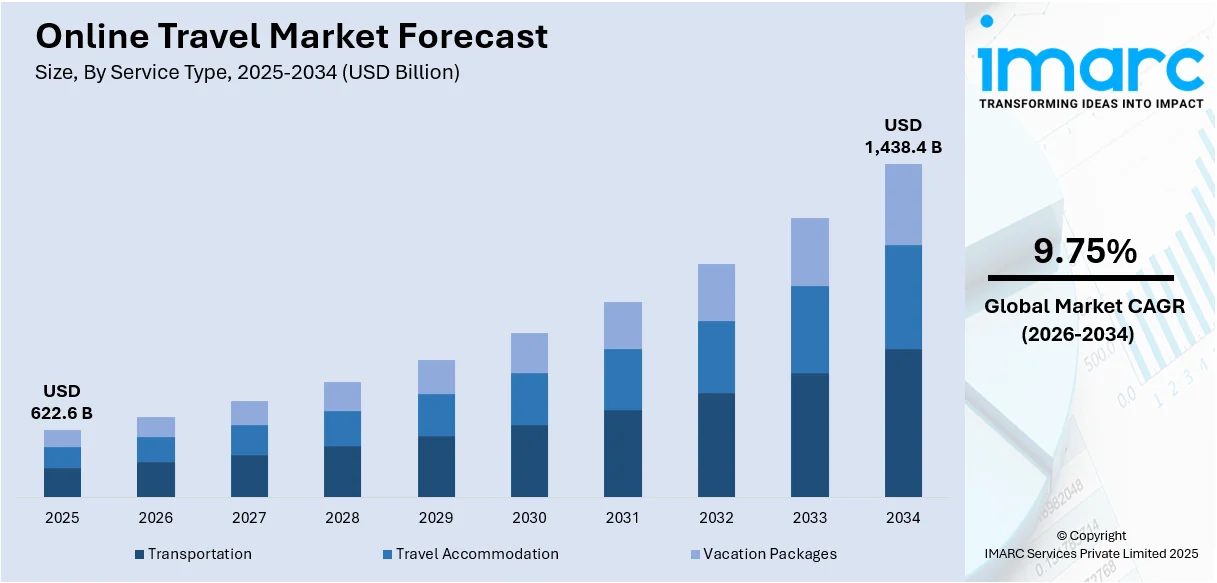

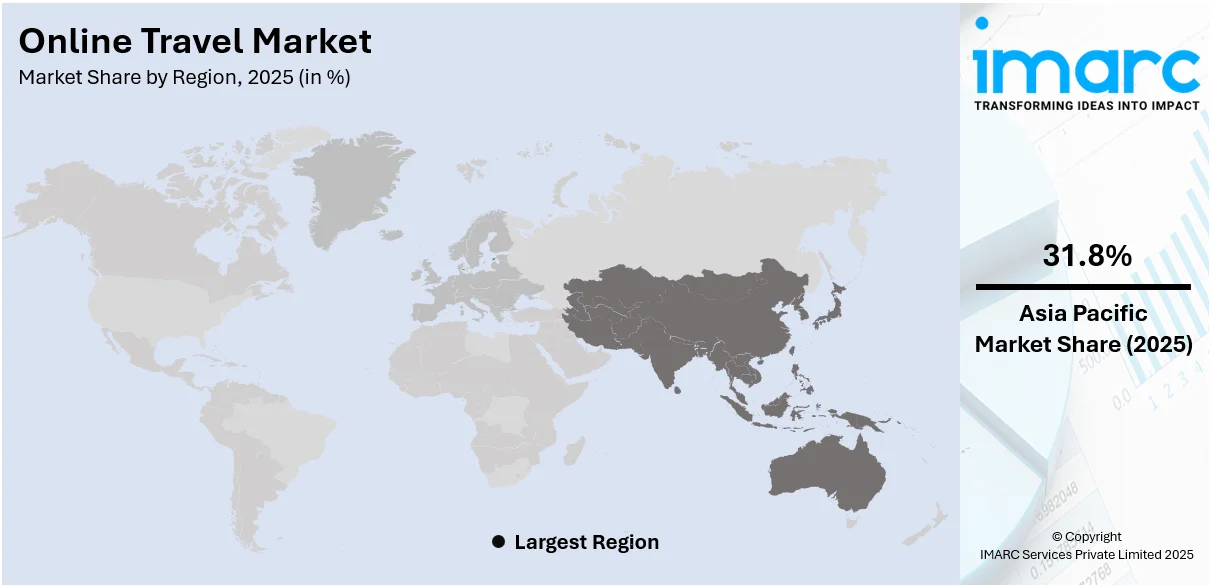

The global online travel market size was valued at USD 622.6 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 1,438.4 Billion by 2034, exhibiting a CAGR of 9.75% during 2026-2034. Asia Pacific currently dominates the market, holding a significant market share of over 31.8% in 2025. Easy access to high-speed internet connectivity, escalating penetration of smart devices, an increasing number of business travelers, and the rising popularity of solo travel are some of the major factors fueling the online travel market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034 |

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 622.6 Billion |

| Market Forecast in 2034 | USD 1,438.4 Billion |

| Market Growth Rate 2026-2034 | 9.75% |

The market for online travel is driven by several key factors, including increasing internet penetration, mobile app adoption, and the rise of digital payment solutions. Consumers now prefer the convenience of online bookings, real-time price comparisons, and AI-driven personalized recommendations, fueling the growth of online travel agencies (OTAs) and direct booking platforms. The impact of social media and influencer-driven travel trends has also significantly influenced consumer preferences, making destination discovery and trip planning easier. Additionally, the demand for flexible travel options, last-minute deals, and seamless user experiences has led to innovations like virtual reality (VR) tours and AI chatbots. Rising disposable incomes and increased global travel aspirations further contribute to the expansion of the online travel sector worldwide.

To get more information on this market Request Sample

The online travel market in the United States is driven by high internet penetration, mobile booking adoption, and the rise of AI-powered personalized travel experiences. Consumers prefer seamless, flexible, and real-time travel solutions, increasing demand for digital payments, last-minute deals, and loyalty programs. The influence of social media, influencer marketing, and user-generated reviews plays a crucial role in travel decisions. Additionally, the demand for luxury, adventure, and eco-tourism experiences has led to innovations in virtual tours and AI-driven recommendations. Strong competition among OTAs, direct airline and hotel bookings, and emerging travel tech startups continues to shape the industry’s dynamic growth. For instance, in March 2024, Despegar.com, Corp., the top travel technology firm in Latin America, revealed the introduction of SOFIA, the first Generative AI Travel Assistant in the region, representing a major improvement to the company’s customer value offer. This groundbreaking advancement enables users to experience quick, along with more tailored, and convenient travel planning via cutting-edge technology.

Online Travel Market Trends:

Increasing Desire for Education in International Universities

One of the key trends driving online travel market revenue is the growing inclination to study abroad. This can be attributed to the quest for quality education, enhanced employability, and cultural enrichment, which attract students seeking global experiences and language proficiency. According to Homeland Security, in 2023-2024, a record high of 1.1 Million students from around the world studied in the United States, reflecting a 7% increase from 2022-2023. For example, China and India, the two most populated countries in the world, have the largest populations of students studying abroad. As per information released by UNESCO, over 1 Million Chinese students were pursuing studies overseas in 2021. India's total was nearly half of this, with approximately 508,000 students residing abroad. Online travel agencies take advantage of this trend by providing customized packages and adaptable booking choices to meet the requirements of student travelers. Moreover, the worldwide presence of international universities draws a varied group of students, boosting the online travel market's demand for cross-border travel services and cultural experiences.

Increase in Internet and Mobile Penetration

The widespread adoption of the internet and mobile technology has been a key factor influencing the market. As more individuals have access to the internet and possess smartphones, the capacity to organize and reserve travel online has become progressively more reachable. In addition, numerous travel agencies are heavily investing in establishing an online presence through social media platforms to broaden their reach, creating a positive online travel market outlook. As of April 2024, there were 5.44 billion users of the internet globally, representing 67.1% of the total world population. Out of the total, 5.07 billion individuals, equating to 62.6% of the global population, were users of social media. Furthermore, in the third quarter of 2023, users worldwide dedicated nearly 60% of their online time using their mobile phones to browse the internet. The growing accessibility of the internet enables travelers to effortlessly explore destinations, compare costs, and secure reservations via online services, enhancing convenience and efficiency in the process

Competitive Pricing and Deals

The market's competitive dynamics are leading to fierce pricing and appealing offers. Travel reservation companies are making efforts to draw in customers by providing special promotions, reduced packages, and last-minute offers. Additionally, the option to book online enables travelers to evaluate prices on various platforms to identify the best available choices and obtain the most economical deals. According to the Bureau of Transportation Statistics, the average U.S. domestic airfare decreased in the second quarter of 2024 to USD 382, making air travel more accessible and affordable. Moreover, loyalty programs and reward schemes provided by these platforms further motivate travelers to make bookings through their services, improving customer loyalty and involvement. For example, in July 2023, the Expedia Group updated its loyalty program, enabling members to earn and redeem rewards among its three top brands: Expedia, Hotels.com, and Vrbo. This straightforward loyalty initiative gives members 2% OneKeyCash for each dollar spent, and grants elite status for every travel segment reserved. Additionally, several financial institutions are providing incentives and discounts for online travel reservations to boost the use of their financial products, such as credit cards, which are expected to enhance the share of the online travel market. For example, in March 2024, Wells Fargo introduced a transferable travel rewards initiative, allowing cardholders to transfer Wells Fargo Rewards points to six different travel loyalty programs. Additionally, in April 2023, Expedia introduced a new feature driven by ChatGPT to assist in travel planning. This creative collaboration seeks to improve the travel planning experience for Expedia users by offering them a tailored and interactive method for organizing their trips. This new feature allows users to have natural language dialogues with the ChatGPT system, akin to conversing with a virtual assistant.

Online Travel Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global online travel market, along with forecasts at the global, regional, and country levels from 2026-2034. The market has been categorized based on service type, platform, mode of booking, and age group.

Analysis by Service Type:

- Transportation

- Travel Accommodation

- Vacation Packages

Travel accommodation stands as the largest component in 2025, holding around 41.4% of the market. The prevalence of travel accommodations as the leading service category in the market is influenced by various important factors. The extensive availability of online travel sites has simplified the process for travelers to find various lodging choices, which is favorably affecting the recent pricing in the online travel market. In a similar fashion, online travel platforms are facilitating hotels and resorts in showcasing and promoting their listings, helping them reach a broader audience of consumers. For example, in April 2024, Spree Hospitality, part of EaseMyTrip, revealed the launch of its latest establishment, ZiP by Spree Hotels Bella Heights, located in the scenic hill station of McLeod Ganj, Himachal Pradesh, India. In addition, the travel accommodations sector of online travel platforms provides a thorough range of hotels, resorts, vacation rentals, and various other types of lodging, granting travelers numerous options and ease. In addition to this, the capacity to compare prices, read feedback, and see images of accommodations that enables travelers to make well-informed choices is aiding the market expansion.

Analysis by Platform:

- Mobile

- Desktop

Desktop leads the market with around 67.3% of the market share in 2025. The desktop platform typically involves accessing travel websites through web browsers installed on desktop computers, which offer larger screens, full-sized keyboards, and a mouse or trackpad for navigation. Desktop platforms provide travelers with a robust and comprehensive online experience for researching, planning, and booking their travel arrangements. Moreover, various online travel agencies install desktops on a large scale for their employees to easily navigate clients’ travel bookings. In addition to this, desktop platforms provide greater processing power and stability, enabling faster loading times and smoother functionality for complex booking processes, thereby accelerating the product adoption rate.

Analysis by Mode of Booking:

- Online Travel Agencies (OTAs)

- Direct Travel Suppliers

Direct travel suppliers lead the market with around 53.7% of the market share in 2025. Direct booking allows travelers to have a direct relationship with the travel supplier, whether it's an airline, hotel, or car rental company. The online travel market overview by IMARC indicates that this direct interaction gives travelers more control and the ability to personalize their travel experience, including selecting specific preferences, customizing packages, and accessing loyalty programs or exclusive offers. For instance, according to a data report by Statista Consumer Insights 2023, 72% of travelers prefer booking directly from online platforms, whereas only 12% favor booking through a travel agency.

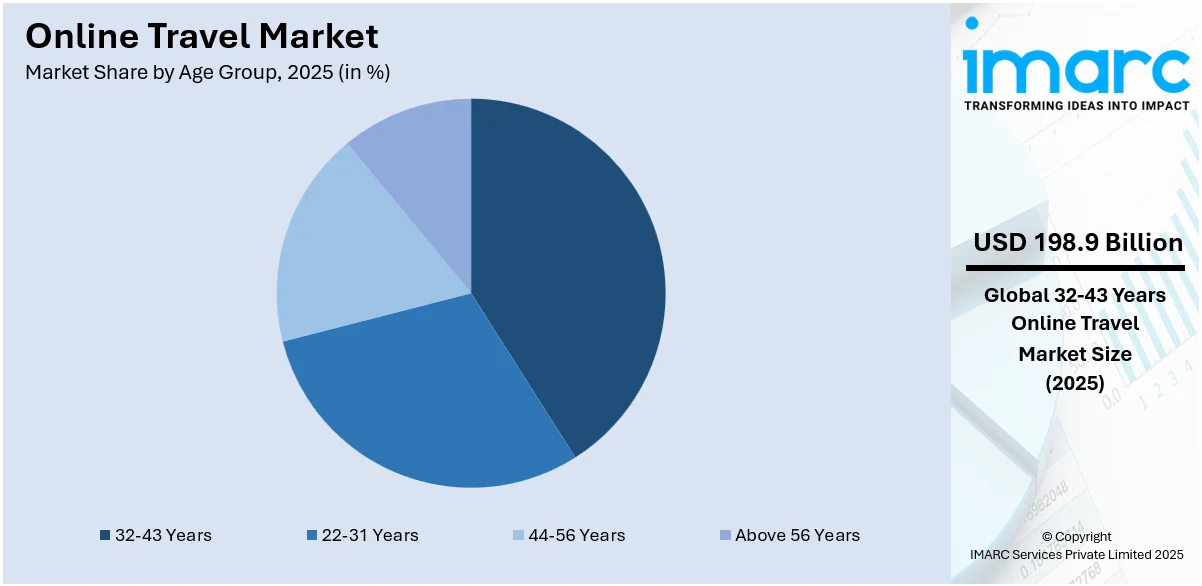

Analysis by Age Group:

Access the comprehensive market breakdown Request Sample

- 22-31 Years

- 32-43 Years

- 44-56 Years

- Above 56 Years

32-43 years leads the market with around 35.1% of the market share in 2025. The dominance of the 32-43 years age group in the market is driven by several key factors. This age group represents individuals in their prime working and earning years, typically with more disposable income to spend on travel. They are often at a stage in their lives where they have fewer family responsibilities and greater flexibility to plan and embark on trips. Moreover, online travel market statistics by IMARC indicate that the 32-43-year-old age group is tech-savvy and comfortable with using digital platforms for various activities, including travel planning, and booking, thereby accelerating the product adoption rate.

Regional Analysis:

To get more information on the regional analysis of this market Request Sample

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2025, Asia Pacific accounted for the largest market share of over 31.8%. The Asia Pacific online travel market is expanding rapidly, driven by rising internet penetration, increasing disposable income, and growing tourism activities. The widespread use of smartphones and digital payment methods is encouraging consumers to book travel services online. Countries like China, India, and Japan are witnessing significant growth in online travel bookings, supported by the rising popularity of domestic and international travel. According to reports, China's reopening has boosted international travel, with an 80% surge in outbound travel expected in 2024 and 2025. The increasing preference for budget travel, solo trips, and customized tour packages is fueling market demand. The integration of AI, chatbots, and data analytics is further improving service offerings and customer engagement. With the rising trend of digitalization and growing travel aspirations, the Asia Pacific online travel market is expected to expand significantly in the coming years.

Key Regional Takeaways:

North America Online Travel Market Analysis

The dominance of North America as the leading region in the market is driven by several key factors. North America has a highly developed and digitally advanced economy, with a large population of tech-savvy consumers. The region has widespread internet access and a high level of smartphone penetration, making it conducive for online travel activities. Moreover, familiarity and adoption of online platforms for various transactions, including travel bookings, are contributing to the dominance of North America in the market. In addition to this, the presence of prominent market players in the region is also contributing to the market growth. Furthermore, these market leaders are increasingly investing in online booking platforms to make them more personalized and user-friendly. For instance, in July 2023, TripAdvisor partnered with OpenAI on a travel itinerary generator. The AI-powered planning tool will create personalized day-by-day trip itineraries using traveler reviews.

United States Online Travel Market Analysis

In 2025, the United States accounted for over 86.30% of the online travel market in North America. The United States online travel market is witnessing substantial growth, driven by the escalating penetration of digital platforms and the rising preference for online booking services. Consumers increasingly opt for online travel agencies (OTAs), mobile apps, and websites to book flights, hotels, and vacation packages due to convenience, cost transparency, and personalized recommendations. The widespread use of smartphones and high internet penetration are further accelerating market expansion. The growing trend of solo travel, adventure tourism, and luxury travel packages is boosting demand for customized online travel services. Additionally, the integration of artificial intelligence, big data, and virtual assistants is enhancing customer experience by offering tailored travel solutions. Sentiment toward upcoming leisure travel in 2024 has reportedly grown with 93% of travelers currently having plans to travel within the next six months, up from 92% in December. This rising spending on travel services is expected to positively influence the online travel market. The market is expected to expand due to technological advancements, customer preference for hassle-free travel planning, and market players offering loyalty programs and payment options.

Europe Online Travel Market Analysis

The Europe online travel market is experiencing significant growth, driven by the rising preference for digital travel booking platforms and escalating internet penetration. Consumers are increasingly turning to online travel agencies, mobile apps, and direct hotel booking websites for convenient and cost-effective travel arrangements. The growing trend of personalized and experiential travel is further fueling the demand for customized travel packages. According to reports, in Q1 2024, the EU witnessed a 28.3% increase in short-term rental accommodation spending, with 123.7 Million nights spent by guests. This surge highlights the growing popularity of online platforms for booking vacation stays and short-term rentals across the region. The presence of popular tourist destinations across countries like France, Italy, and Spain is boosting the demand for online travel services. The market is expected to continue growing due to the rise in eco-tourism, adventure tourism, and luxury travel experiences, bolstered by advanced technologies.

Latin America Online Travel Market Analysis

The Latin America online travel market is witnessing steady growth, driven by inflating internet penetration and the rising preference for digital travel booking platforms. Consumers increasingly opt for online travel agencies and mobile apps to book flights, hotels, and vacation packages. The growing popularity of adventure tourism, eco-tourism, and budget travel is boosting demand for personalized travel services. According to the Presidency of the Republic, in 2024, Brazilian tourism earnings hit a high of USD 7.341 Billion, supported by expenditures from international visitors, underscoring the increasing impact of tourism on the area’s economy. With increasing smartphone adoption, digital payment infrastructure, and attractive promotional offers, the Latin America online travel market is expected to expand steadily in the coming years.

Middle East and Africa Online Travel Market Analysis

The Middle East and Africa online travel market is experiencing gradual growth, influenced by rising consumer preference for digital booking services and increasing internet penetration. The growing popularity of religious tourism, business travel, and luxury tourism is boosting demand for online travel platforms. According to the Ministry, The Kingdom of Saudi Arabia secured the third position worldwide in the increase of international tourist arrivals, achieving more than 61% growth from January to August or September 2024, emphasizing the area's burgeoning travel sector. The market is expected to experience steady growth due to the rise in digital transformation and consumer preferences, resulting in customized travel packages and mobile booking apps.

Competitive Landscape:

The online travel market is highly competitive, dominated by major players like Booking Holdings, Expedia Group, Trip.com, and Airbnb, alongside emerging startups and regional platforms. Companies compete on pricing, personalized recommendations, AI-driven services, and seamless user experiences. Mobile app optimization, loyalty programs, and dynamic pricing strategies enhance customer retention. Google Travel and meta-search engines like Kayak further intensify competition by offering price comparisons. Additionally, social media and influencer-driven travel trends impact market dynamics. The rise of direct airline and hotel bookings through enhanced digital platforms challenges OTAs (Online Travel Agencies), pushing them to innovate with VR tours, flexible cancellations, and exclusive travel deals.

The report provides a comprehensive analysis of the competitive landscape in the online travel market with detailed profiles of all major companies, including:

- Expedia Group Inc.

- Fareportal Inc.

- Hostelworld Group plc

- HRS

- Hurb

- MakeMyTrip Pvt. Ltd.

- priceline.com LLC (Booking Holdings Inc.)

- Thomas Cook India Ltd. (Fairfax Financial Holdings Limited)

- Tripadvisor Inc.

- Yatra.com

Latest News and Developments:

- April 2024: The online travel agency MakeMyTrip introduced a new exclusive charter service connecting Mumbai and Bhutan. This service is included in its holiday packages, and the private charter will leave once a week. The service was introduced because of the growing appeal of Bhutan to Indian tourists.

- April 2024: Expedia Group launched Destination Climate Champions and Destination Giveback Initiative to promote sustainable travel and support local communities. The programs provided climate action training for DMOs and donations to local causes, aligning with Expedia's commitment to Net Zero emissions by 2040.

- February 2024: Cleartrip, an online travel aggregator owned by Flipkart, launched a new offering, Out of Office (OOO), aimed at business travelers. Cleartrip stated that, “OOO is a corporate travel reservation solution created for small, medium, and large businesses.” The platform hosts approximately 300 SMEs and 10 major corporations as engaged transactors. The new product asserts its capability to manage a monthly business volume of INR 20 crore.

- February 2024: Fareportal launched a new article series, Travel Briefs, on its brands' blogs, CheapOair and OneTravel. The series provided travel tips on destinations, including best travel times, booking advice, and money-saving tips, aiming to simplify customer travel planning.

Online Travel Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Service Types Covered | Transportation, Travel Accommodation, Vacation Packages |

| Platforms Covered | Mobile, Desktop |

| Modes of Bookings Covered | Online Travel Agencies (OTAs), Direct Travel Suppliers |

| Age Groups Covered | 22-31 Years, 32-43 Years, 44-56 Years, Above 56 Years |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Expedia Group Inc., Fareportal Inc., Hostelworld Group plc, HRS, Hurb, MakeMyTrip Pvt. Ltd., priceline.com LLC (Booking Holdings Inc.), Thomas Cook India Ltd. (Fairfax Financial Holdings Limited), Tripadvisor Inc., Yatra.com, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the online travel market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global online travel market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the online travel industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The online travel market was valued at USD 622.6 Billion in 2025.

The online travel market is projected to exhibit a CAGR of 9.75% during 2026-2034, reaching a value of USD 1,438.4 Billion by 2034

The online travel market is driven by increasing internet penetration, mobile app adoption, digital payment growth, and AI-driven personalization. Rising disposable incomes, demand for budget-friendly and luxury travel, and the influence of social media and online reviews further boost growth. Enhanced virtual tours and flexible booking options also contribute.

Asia Pacific currently dominates the online travel market due to high internet penetration, mobile bookings, digital payments, AI personalization, social media influence, flexible cancellations, and rising demand for luxury travel.

Some of the major players in the online travel market include Expedia Group Inc., Fareportal Inc., Hostelworld Group plc, HRS, Hurb, MakeMyTrip Pvt. Ltd., priceline.com LLC (Booking Holdings Inc.), Thomas Cook India Ltd. (Fairfax Financial Holdings Limited), Tripadvisor Inc., Yatra.com, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)