Oral Proteins and Peptides Market Size, Share, Trends, and Forecast by Drug Type, Applications, and Region, 2025-2033

Oral Proteins and Peptides Market Size and Share:

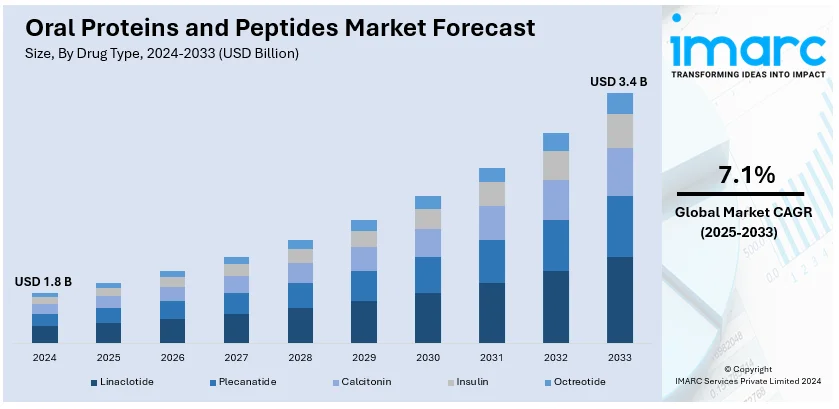

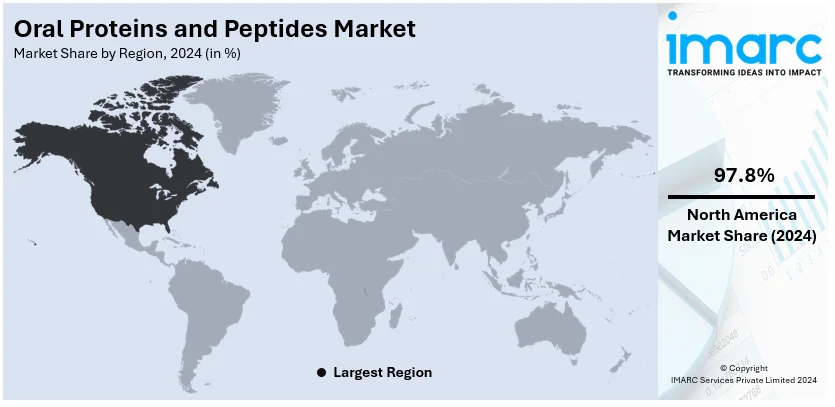

The global oral proteins and peptides market size was valued at USD 1.8 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 3.4 Billion by 2033, exhibiting a CAGR of 7.13% from 2025-2033. North America currently dominates the market, holding a market share of over 97.8% in 2024. Continual advancements in drug delivery technologies, the rising demand for non-invasive treatments, increasing prevalence of chronic diseases like diabetes and cancer are some of the factors positively impacting the oral protein and peptides market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 1.8 Billion |

|

Market Forecast in 2033

|

USD 3.4 Billion |

| Market Growth Rate 2025-2033 | 7.13% |

The growing prevalence of chronic diseases, such as diabetes and cancer, necessitating advanced therapeutic options is one of the primary factors influencing the market growth. According to the International Diabetes Federation, approximately 537 million adults globally were living with diabetes in 2021, with projections reaching 783 million by 2045. Oral peptide therapies, such as GLP-1 receptor agonists, offer effective and patient-friendly alternatives to injectable treatments. Additionally, the global cancer burden, as reported by the World Health Organization (WHO), is expected to rise by 47% by 2040. This is boosting the need for novel, non-invasive drug delivery methods and propelling the development of oral protein and peptide formulations.

The United States dominates the oral proteins and peptides market due to its advanced healthcare infrastructure and high prevalence of chronic diseases. The Centers for Disease Control and Prevention (CDC) reports over 37 million Americans have diabetes, with rising demand for oral GLP-1 receptor agonists like semaglutide to improve patient compliance. Additionally, cancer incidence in the U.S. is projected to surpass 1.9 million new cases annually, according to the American Cancer Society. These figures highlight the growing need for innovative oral therapeutic solutions. Substantial investments in research and development (R&D) and robust regulatory frameworks further support the development and commercialization of advanced oral protein and peptide therapies in the U.S.

Oral Proteins and Peptides Market Trends:

Technological Advancements in Drug Delivery

Technological advancements in drug delivery, particularly through nanotechnology and genetic engineering, are enhancing the oral proteins and peptides market outlook. For instance, Novo Nordisk has employed nanoparticle technology to improve the bioavailability of oral semaglutide (Rybelsus), its GLP-1 receptor agonist for type 2 diabetes. The innovative delivery system ensures the peptide survives the harsh gastrointestinal environment, allowing efficient absorption in the intestine. Similarly, Pfizer scientists are delving into nanotechnology to develop a method for targeting tumors using nanoparticles. These particles deliver drugs precisely to tumors at a controlled rate, potentially minimizing side effects and sparing healthy cells. These innovations improve stability and bioavailability, overcoming barriers to oral administration. By enabling oral proteins and peptides to withstand digestive processes, these technologies expand their therapeutic potential, making non-invasive oral therapies viable for a broader range of conditions.

Rising Demand for Non-Invasive Treatments

The increasing demand for non-invasive treatments is driving oral proteins and peptides market growth, particularly for chronic conditions requiring long-term management. These treatments offer a significant advantage by eliminating the discomfort and inconvenience associated with frequent injections. Oral administration enhances patient compliance and comfort, making it easier for patients to adhere to their therapeutic regimens. In October 2023, GE HealthCare and Novo Nordisk collaborated to advance a non-invasive treatment for type 2 diabetes and obesity using ultrasound technology. Personalized peripheral-focused ultrasound therapy aims to offer a non-pharmacological alternative for managing chronic diseases. This collaboration combines GE HealthCare's expertise in ultrasound technology with Novo Nordisk's experience in metabolic disease treatment to develop solutions for improving patient care. The technology has shown promising results in pre-clinical and early clinical data, with potential use for people with type 2 diabetes. The shift towards non-invasive options is particularly transformative for managing diseases such as diabetes, where regular medication intake is crucial for effective management.

Rising Prevalence of Chronic Diseases

As chronic diseases like diabetes, heart disease, and autoimmune disorders become more prevalent globally there is a growing oral proteins and peptides market demand which is effective and user-friendly. According to WHO data, non-communicable diseases (NCDs) kill 41 million people each year, equivalent to 74% of all deaths globally. Each year, 17 million people die from NCD before age 70; 86% of these premature deaths occur in low- and middle-income countries. Furthermore, according to the data published by Centers for Diseases Prevention and Control, an estimated 129 million people in the United States suffer from at least one chronic disease. This rising demand is driving significant growth in the oral proteins and peptides market. These treatments are highly appealing because they offer a convenient alternative to traditional methods, such as injections, enhancing patient adherence and overall treatment experience. This trend is especially crucial as the global population ages and more individuals require ongoing treatment regimens for chronic conditions.

Oral Proteins and Peptides Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global oral proteins and peptides market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on drug type, application and region.

Analysis by Drug Type:

- Linaclotide

- Plecanatide

- Calcitonin

- Insulin

- Octreotide

Linaclotide dominates the oral proteins and peptides market, accounting for a significant 77.6% market share, due to its proven efficacy in treating gastrointestinal disorders like irritable bowel syndrome with constipation (IBS-C) and chronic idiopathic constipation (CIC). Developed by Ironwood Pharmaceuticals and Allergan, linaclotide works as a guanylate cyclase-C agonist, enhancing fluid secretion in the intestines and alleviating symptoms. Its oral administration offers a convenient alternative to invasive treatments, significantly improving patient compliance. The drug's widespread adoption is also fueled by strong clinical evidence and consistent therapeutic outcomes. Furthermore, regulatory approvals across major markets, including the United States, Europe, and Asia, have solidified its global presence. Continuous promotional efforts, increasing healthcare recommendations, and escalating awareness among patients have further expanded its usage, driving growth within the oral proteins and peptides market.

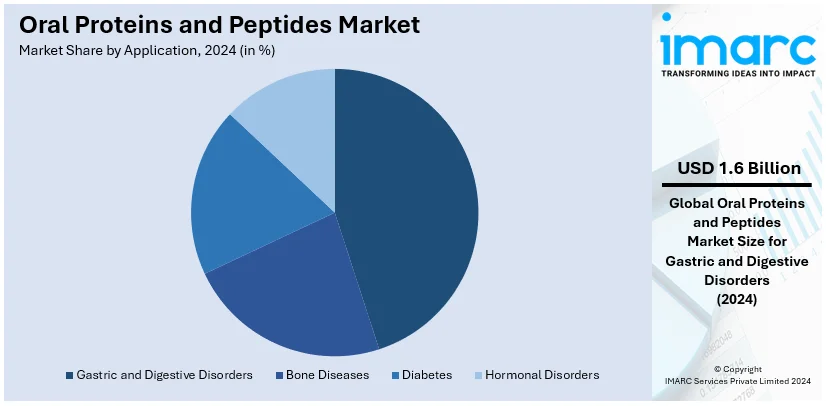

Analysis by Application:

- Gastric and Digestive Disorders

- Bone Diseases

- Diabetes

- Hormonal Disorders

Gastric and digestive disorders account for a dominant 87.0% share of the oral proteins and peptides market, driven by the high prevalence of conditions such as irritable bowel syndrome (IBS), chronic idiopathic constipation (CIC), and inflammatory bowel diseases (IBD). These disorders necessitate long-term management. Oral formulations offer a convenient and non-invasive alternative to injectable treatments, improving patient compliance and quality of life. Medications like linaclotide and plecanatide have significantly contributed to this segment's growth, providing targeted relief by regulating fluid secretion and intestinal motility. Rising awareness of these therapies among patients and healthcare providers has boosted adoption rates. The segment's growth is further supported by increasing investments in research and development (R&D) to enhance bioavailability and stability in the gastrointestinal environment. With regulatory approvals and expanding access to treatment options, the gastric and digestive disorders application continues to be a pivotal driver in the oral proteins and peptides market.

Regional Analysis:

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

North America dominates the oral proteins and peptides market, holding an impressive 97.8% share, driven by advanced healthcare infrastructure, high healthcare expenditure, and significant investments in innovative drug delivery systems. The region's well-established pharmaceutical sector is actively developing and commercializing oral formulations of proteins and peptides, addressing the increasing prevalence of chronic diseases such as diabetes, inflammatory bowel disease, and cardiovascular disorders. Regulatory support from agencies like the U.S. FDA expedites product approvals, enabling faster market access for cutting-edge therapies like oral semaglutide for diabetes. Moreover, the growing preference for non-invasive treatments among patients and healthcare providers boosts demand for oral proteins and peptides in the region. Apart from this, growing awareness, accessibility to advanced therapeutics, and the presence of key players like Novo Nordisk and Pfizer further strengthen North America's leadership in the market.

Key Regional Takeaways:

United States Oral Proteins and Peptides Market Analysis

The United States has emerged as a leading region, holding 99.8% of the market share, spurred by advances in drug delivery technologies and substantial healthcare expenditures. In 2023, the country spent an estimated 40% of pharmaceutical R&D globally, an amount of USD 120 billion, which spurs new and exciting formulations in oral drugs. Due to the continued impact of chronic diseases such as diabetes, which have reached 38.4 million people in the United States, there is an increased demand for peptide therapy. At the same time, regulatory approvals for oral proteins are further strengthened, for example, greenlight by the FDA for innovative orally administered GLP-1 receptor agonists for diabetes management. Also, key market players such as Novo Nordisk and Eli Lilly operate in the U.S. while constantly expanding their portfolios of products. With the national health expenditures predicted to increase to USD 7.7 trillion by 2032 from USD 4.8 trillion in 2023, there is an immense need for developing cost-effective oral peptide therapies soon.

Europe Oral Proteins and Peptides Market Analysis

The European oral proteins and peptides market forecast highlights that the strong biopharmaceutical sector and favorable regulatory conditions significantly influence the market. According to an industrial report, in 2023, the Europe pharmaceuticals market had an approximate valuation of USD 289 billion, with biologics and peptide-based treatments playing a huge part in this figure. Germany, UK, and France spearhead the development of these biopharmaceuticals, thus propelling the growth in the market. Chronic conditions such as diabetes now pose a menace to over 60 million Europeans. Oral peptide drugs are becoming highly sought after because of the growing prevalence of chronic illnesses. The EMA's PRIME scheme ensures that innovative treatments are approved, thereby improving market growth. AstraZeneca and Sanofi, among other companies, are investing in partnerships for advancing oral peptide formulations and further strengthen the market.

Asia Pacific Oral Proteins and Peptides Market Analysis

Asia-Pacific is growing rapidly for the oral proteins and peptides market because of the increasing prevalence of diabetes and cancer, increased health care access, and rising investments in R&D. China and India dominate due to their large patient pools and government initiatives supporting pharmaceutical innovations. Moreover, non-communicable diseases (NCDs), principally cardiovascular diseases (CVD), cancer, diabetes and chronic respiratory diseases, impose a major and growing burden on health and development in the South-East Asia region, according to WHO data. In the region, 62% of all deaths are due to NCDs accounting for 9 million persons. Of particular concern is the high proportion of premature mortality from NCDs (deaths before 70 years of age). Besides, in 2024, Gan & Lee Pharmaceuticals initiated trials for an oral insulin formulation in China. The well-developed pharmaceutical sector in Japan encourages growth, where companies such as Takeda are evaluating oral biologics for potential oral delivery in gastrointestinal disorders. Improved regulatory changes, for example, in India that provide accelerated approval pathway, also add momentum to market growth. Regional associations, for instance, South Korea's collaboration with global biotech companies, also aid the advancement of advanced oral peptide delivery systems. Significant demand for non-invasive treatments as well as healthcare cost propels the oral protein and peptides market share in the region.

Latin America Oral Proteins and Peptides Market Analysis

Oral proteins and peptides market in Latin America will be driven by increasing diabetic population and awareness of non-invasive treatments. Brazil and Mexico lead the region due to an expansion of health care infrastructure and government programs that support chronic disease management. Companies like Biomm Pharmaceuticals in Brazil are looking to oral biologics as a means of regional demand in patient-friendly therapies. The regulatory body of Mexico, COFEPRIS, has helped drive the uptake of biosimilars. One of the significant oral proteins and peptides market trends is the strategic partnerships between multinationals and local firms, which make it easier to transfer knowledge and improve technology.

Middle East and Africa Oral Proteins and Peptides Market Analysis

The Middle East and Africa (MEA) region is an emerging market for oral proteins and peptides, driven by an increasing prevalence of diabetes and investments in healthcare infrastructure. Chronic diseases also have initiatives forward from Gulf Cooperation Council (GCC) countries, specifically Saudi Arabia and the UAE. In 2024, Novo Nordisk expanded its availability of Rybelsus in the UAE, reflecting the region's growing acceptance of oral peptide therapies. South Africa also holds promise, with local companies working together to develop novel drug delivery solutions. Regulatory guidelines are maturing to support advanced therapies. Challenges of low healthcare access in the rural areas limit the market, but the governments' move to strengthen chronic disease management programs is creating growth opportunities in this market. The region is taking great efforts to improve patient compliance through non-invasive drug delivery methods, which supports oral protein and peptide-based drug therapies.

Competitive Landscape:

The oral proteins and peptides industry insights indicate that the competitive landscape of the is characterized by intense innovation and strategic collaborations among key players. Pharmaceutical companies are focusing on overcoming challenges related to oral bioavailability and stability, investing heavily in research and development. Partnerships between biotech firms and academic institutions are accelerating advancements in delivery systems, including enteric coatings and nanoparticle technologies. Market leaders are leveraging proprietary technologies to differentiate their products, while emerging players are exploring niche therapeutic areas, such as diabetes and oncology. Regulatory approvals and patent protection are pivotal in maintaining competitive advantages. Additionally, rising consumer demand for non-invasive drug delivery methods and the shift towards biologics in personalized medicine are driving competition in this rapidly evolving market.

The report provides a comprehensive analysis of the competitive landscape in the oral proteins and peptides market with detailed profiles of all major companies, including:

- Amryt Pharma Plc

- AstraZeneca PLC

- Biocon Limited

- Novo Nordisk A/S

- Oramed Ltd

- Proxima Concepts Limited

Latest News and Developments:

- In October 2024, Novo Nordisk announced the headline results from the SOUL cardiovascular outcomes trial. The double-blinded, randomised trial compared oral semaglutide (oral peptide medication) to placebo as an adjunct to the standard of care for the prevention of major adverse cardiovascular events (MACE).

- In May 2024, Biocon Limited entered into an exclusive licensing and supply agreement with Handok, a specialty pharmaceutical company in South Korea, for the commercialization of Synthetic Liraglutide. Under this agreement, Biocon will handle the development, manufacturing, and supply of the drug product, while Handok will be responsible for obtaining regulatory approval and commercializing it in the South Korean market. This strategic partnership aims to address the unmet needs of patients dealing with weight management in South Korea.

- In November 2023, AstraZeneca and Eccogene entered into an exclusive licence agreement for ECC5004, an investigational oral once-daily glucagon-like peptide 1 receptor agonist (GLP-1RA) for the treatment of obesity, type-2 diabetes and other cardiometabolic conditions. Preliminary results from the Phase I trial have shown a differentiating clinical profile for ECC5004, with good tolerability and encouraging glucose and body weight reduction across the dose levels tested compared to placebo.

- In April 2023, Chiesi Farmaceutici S.p.A. successfully acquired Amryt Pharma Plc, a global biopharmaceutical company focusing on rare diseases. The acquisition will enable Chiesi to broaden access to approved treatments and progress in developing new therapies. With this partnership, Chiesi aims to expand patient reach and strengthen its position in the rare diseases space. Chiesi's commitment to patient centric and sustainable care aligns with Amryt's innovative products, fostering hope for those in need.

- In January 2023, Oramed announced that its Phase 3 oral insulin trial for type 2 diabetes did not meet its primary or secondary endpoints. However, Oramed found that certain patient subpopulations responded well to oral insulin. Oramed is now initiating a second Phase 3 study to evaluate its oral insulin capsule in patients with different conditions.

Oral Proteins and Peptides Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Drug Types Covered | Linaclotide, Plecanatide, Calcitonin, Insulin, Octreotide |

| Applications Covered | Gastric and Digestive Disorders, Bone Diseases, Diabetes, Hormonal Disorders |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Amryt Pharma Plc, AstraZeneca PLC, Biocon Limited, Novo Nordisk A/S, Oramed Ltd, Proxima Concepts Limited, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the oral proteins and peptides market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global oral proteins and peptides market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the oral proteins and peptides industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

The oral proteins and peptides market was valued at USD 1.8 Billion in 2024.

The oral proteins and peptides market is projected to exhibit a CAGR of 7.13% during 2025-2033, reaching a value of USD 3.4 Billion by 2033.

The global market is driven by ongoing advancements in drug delivery technologies, rising prevalence of chronic diseases, increasing demand for non-invasive treatments, enhanced patient compliance, expanding therapeutic applications, and growing investments in research.

North America currently dominates the market, accounting for a share of over 97.8%, driven by its robust healthcare infrastructure, significant investment in pharmaceutical R&D, rising prevalence of chronic diseases, and favorable regulatory policies supporting innovative therapeutic advancements.

Some of the major players in the oral proteins and peptides market include Amryt Pharma Plc, AstraZeneca PLC, Biocon Limited, Novo Nordisk A/S, Oramed Ltd, and Proxima Concepts Limited, among others.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)