Paints and Coatings Market Size, Share, Trends and Forecast by Product, Material, Application, and Region, 2026-2034

Paints and Coatings Market Size and Share:

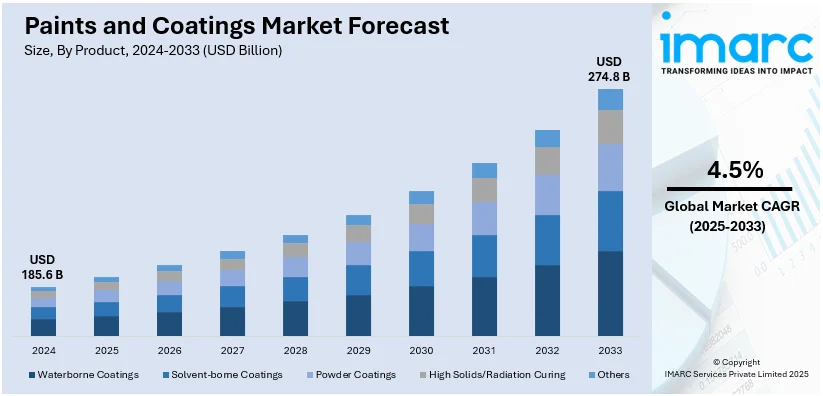

The global paints and coatings market size was valued at USD 185.6 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 274.8 Billion by 2034, exhibiting a CAGR of 4.5% from 2026-2034. Asia Pacific currently dominates the market, holding a market share of over 34.8% in 2024. The market is experiencing steady growth driven by the increasing awareness and stringent regulations regarding environmental impact, the rising global urbanization and industrialization, particularly in emerging economies, and the significant growth in the construction and automotive industries.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 185.6 Billion |

|

Market Forecast in 2034

|

USD 274.8 Billion |

| Market Growth Rate 2026-2034 | 4.5% |

A key factor driving growth in the paints and coatings market is the increasing demand for eco-friendly and sustainable products. Rising consumer awareness about environmental impacts has led to increased adoption of low-volatile organic compounds (VOC) and water-based coatings. Governments worldwide are enforcing stricter environmental regulations, encouraging manufacturers to innovate eco-friendly solutions. These coatings help minimize air pollution and improve indoor air quality, making them perfect for both residential and commercial use. Besides this, the shift towards green buildings and sustainable construction practices further boosts demand for such products, positioning sustainability as a central factor driving growth in the paints and coatings market.

To get more information on this market, Request Sample

The United States leads the global paints and coatings market, driven by robust demand from the construction, automotive, and industrial sectors. Increasing demand for residential and commercial constructions will drive the requirement for architectural coatings, especially environmental friendly and low VOC products. There is an advancement in automobile coatings, offering durability and appearance to the coatings. This reflects growth in car manufacturing and aftermarkets services. Severe environmental requirements and consumers' preferences for sustainability push manufacturers to develop water-based and bio-based coatings. Significant investment in infrastructure works has also kept the U.S. a significant participant in the global paints and coatings market.

Paints and Coatings Market Trends:

Increasing demand in construction and automotive industries

The significant growth in the construction and automotive sectors is driving the demand for paints and coatings. In the construction sector, paints and coatings are required for both protective and aesthetic purposes, fulfilling residential, commercial, and industrial needs. Apart from this, the introduction of advanced and innovative formulations like environment friendly alternatives to align with heightened focus on sustainability and durability in various building materials is propelling the growth of the market. Moreover, in the automotive industry, there is a consistent need for high quality coating solutions to improve vehicle appearance and performance. According to reports, paints and coatings comprise approximately 30% of the automobile production expenses. Along with this, the creation of novel technologies like UV-curable coatings and waterborne formulations is catalyzing the demand by providing more advanced and eco-friendly alternatives. The paints and coatings market value is indicative of industry growth and driven by increasing demand in construction and automotive sectors, alongside innovative product developments.

Technological innovations and product advancements

Technological improvements to enhance the quality of paints and coatings are supporting the market growth. It includes the creation of various novel materials and formulations that fulfill certain needs like increased durability, improved aesthetics, and environmental sustainability. In addition, the increasing availability of nano coatings, green coatings, and smart coatings are reshaping the market dynamics. Nippon Paint Marine recently introduced a state-of-the-art antifouling paint that utilizes NANO-Technologies. This creative approach ensures accurate and long-lasting antifouling performance by fusing hydrophilic and hydrophobic qualities in a nanostructure. The paints and coatings market overview highlights industry growth, driven by advancements in formulation technology.

Rising awareness and regulations concerning environmental impact

At present, governments are implementing various strict regulations associated with the usage of VOCs and other harmful substances in paints and coating formulations. This is encouraging manufacturers to invest in research operations to develop environment friendly alternative like water and bio-based coatings. The research report of the IMARC Group states that the global green coatings market reached USD 93.4 Billion in 2024. These products often comply with environmental standards and appeal to environmentally conscious users. There are further innovations on recycling and waste reduction in paints and coatings manufacturing with the thrust for sustainability. These eco friendly practices are not just a result of regulatory pressure by governing agencies but have emerged as a decisive differentiator and competitor for brands, and hence their success, while consumers and markets will determine it. The paints and coatings market revenue is growing upwards as it is being driven by demand for durable and environmentally sustainable products. Synaqua® 4804 was prepared by Arkema Coating Resins in the year 2022, without ammonia and APEO. Synaqua has been designed and developed for wide range of applications of coatings and meets their particular needs. With low VOC substituent, these resins produce high gloss materials with a quality feel that remains comparable to typical solvent-based alkyds in an application.

Paints and Coatings Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global paints and coatings market, along with forecast at the global, regional, and country levels from 2026-2034. The market has been categorized based on product, material, and application.

Analysis by Product:

- Waterborne Coatings

- Solvent-borne Coatings

- Powder Coatings

- High Solids/Radiation Curing

- Others

Waterborne coatings stand as the largest component in 2024, holding around 40.6% of the market due to their eco-friendly and low-VOC characteristics. These coatings are formulated with water as the primary solvent, reducing environmental impact and adhering to stringent regulations aimed at curbing air pollution. Their excellent performance attributes, including durability, corrosion resistance, and ease of application, make them ideal for architectural, automotive, and industrial applications. The growing demand for sustainable solutions in the construction and automotive industries is driving the rapid adoption of these coatings. Furthermore, ongoing technological advancements have enhanced the quality and versatility of waterborne coatings, enabling them to meet diverse industry requirements and maintain their leading position in the global market.

Analysis by Material:

- Acrylic

- Alkyd

- Polyurethane

- Epoxy

- Polyester

- Others

Acrylic leads the market with around 46.98% of market share in 2024 due to their versatile performance and wide-ranging applications. These coatings improve aesthetic value while offering protection against environmental elements such as moisture, UV rays, and abrasion. Acrylic’s adaptability to various formulations, including waterborne and solvent-based systems, supports its widespread adoption. The increasing demand for eco-friendly products aligns with advancements in acrylic-based waterborne coatings, which offer low-VOC and environmentally sustainable solutions. Their quick-drying properties and compatibility with diverse substrates further enhance their appeal. This strong combination of functional and environmental benefits secures acrylic’s leading position in the global paints and coatings market.

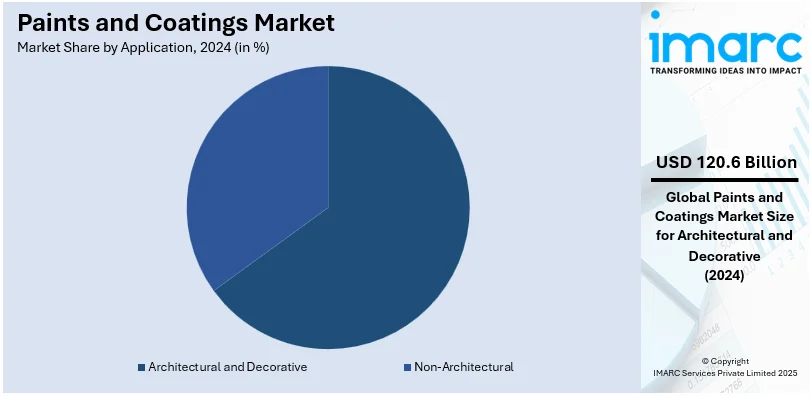

Analysis by Application:

- Architectural and Decorative

- Non-Architectural

- Automotive and Transportation

- Wood

- General Industrial

- Marine

- Protective

- Others

In 2024, architectural & decorative accounts for the majority of the market at around 65.0% driven by robust demand from residential, commercial, and infrastructure construction projects worldwide. These coatings enhance the aesthetic appeal and provide protection against environmental factors like moisture, UV rays, and wear. The growing trend of urbanization, coupled with remodeling and renovation activities, further propels demand for decorative paints. Eco-friendly and low-VOC coatings gain traction due to stricter environmental regulations and consumer preferences for sustainable products. Innovations in textures, colors, and features like stain resistance and self-cleaning properties also play a key role in driving the segment's substantial market share and growth momentum.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Asia Pacific accounted for the largest market share of over 34.8% driven by rapid urbanization, industrialization, and economic growth. The growing construction industry in countries such as China, India, and Southeast Asian nations drives significant demand for architectural coatings. Infrastructure development, along with residential and commercial construction, supports this growth. Moreover, the region's thriving automotive and manufacturing industries fuel demand for industrial and protective coatings. Increasing disposable incomes and growing consumer awareness of sustainable and decorative coatings are also key factors driving market expansion. The presence of large-scale manufacturing facilities, cost-effective production, and easy access to raw materials solidify Asia Pacific’s position as a dominant force in the global market.

Key Regional Takeaways:

North America Paints and Coatings Market Analysis

In the North American paints and coatings market, construction, automotive, and industrial sectors primarily boost the market with healthy demand. The construction sector, with a focus on residential, commercial, and infrastructure projects, has fueled the growth of architectural coatings. There has been growing adoption of eco-friendly, low-VOC, and water-based paints because these serve stringent environmental regulations and are gradually being picked by consumers based on the idea of sustainability. Besides, the automotive industry in the region demands strong coatings that are both durable and corrosion resistant with an aesthetic appeal. Industrial applications involving protective and functional coatings used on machineries and equipment further accelerate market growth. Innovation characterizes the market as producers focus on developing sustainable products, including bio-based products and recyclable products to meet regulatory and consumer demands. Further, urbanization and renovation activities create considerable demand for decorative coatings. The United States dominates the regional market, supported by a strong economy, high disposable income, and government investments in infrastructure, impelling the North America’s position as a key player in the global paints and coatings industry.

United States Paints and Coatings Market Analysis

The United States paints and coatings market is influenced by several factors, which align with the evolving demands of consumers, technological advancement, and industry trends. One of the major drivers is the increasing construction and infrastructure sector. In 2023, the construction industry accounted for 4.3% of the U.S. gross domestic product (GDP). In conjunction with accelerated urbanization and an increase in commercial and residential property investment, demand for decorative paints and coatings on interior and exterior applications has skyrocketed. Infrastructural projects such as bridge construction, highway development, and public buildings further fuel the growth of protective coatings that guarantee strength and longevity. Environmental regulations, coupled with an increasing need to adopt more environmentally friendly solutions, drive the demand forward. There is growing knowledge among people as to the urgency of environmental-related issues, fueling the use of eco-friendly and low-volatile organic compounds paints and coatings. Moreover, producers are concentrating on water-based, powder and bio-based technologies, which do not only abate the enforcement of strict legislative conditions but help satisfy consumer sensitivities toward non-polluting material products. Besides this, technological advancements further drive the market, with innovations in performance coatings that offer enhanced durability, weather resistance, and corrosion protection. These coatings are vital for automotive, aerospace, and industrial applications, where durability and long-lasting performance are crucial. Besides this, smart coatings with self-healing and anti-microbial properties are gaining traction in healthcare and other sensitive environments.

Europe Paints and Coatings Market Analysis

The Europe paints and coatings market is driven by several key factors that reflect the region's economic, environmental, and technological dynamics. The strong growth in construction and infrastructure activities has been the prime driver. Increasing urbanization and redevelopment activities result in increasing demands for architectural coatings, such as decorative and protective paints, in order to provide aesthetic and functional value to buildings. Energy efficiency and low emission targets by the new government policies increase the demand for eco-friendly coatings, hence improving the consumption of water-based solutions. Automobiles and the transport sector drive up the market; the development and expansion of more units require sophisticated products that meet such requirements in addition to protection through corrosion, together with esthetical characteristics. The International Council on Clean Transportation estimated that approximately 10.6 Million new cars were registered in the 27 Member States of EU in 2023. Additionally, industrial applications such as machinery, equipment, and metal protection are expected to enhance the performance-based coatings market. The use of advanced materials, nanotechnology, and smart coatings presents opportunities for manufacturers to create products with improved properties, including self-cleaning, anti-microbial, and heat-reflective capabilities. In line with changes in consumer needs and the dynamic industry, the innovations being introduced into this market support its growth.

Asia Pacific Paints and Coatings Market Analysis

The market is propelled by a dynamic interplay of economic growth, urbanization, industrialization, and increasing consumer awareness. A major driver is the rapid urbanization occurring in countries such as China, India, and Southeast Asian nations. As per the CIA, urban population in China was 64.6% of total population in 2023. This trend is increasing significant demand for paints and coatings in the construction industry, particularly for residential, commercial, and infrastructure development projects. In line with this, the rising demand for decorative paints and coatings as individuals are seeking to enhance aesthetics and durability in their living spaces is bolstering the market growth. Moreover, the expanding middle-class population and their rising aspirations for enhanced lifestyles further strengthen this segment. The industrial sector in the region also plays a significant role in driving demand for paints and coatings. Industries like automotive, aerospace, and electronics depend on advanced coatings for corrosion resistance, durability, and aesthetic value. The rapidly growing automotive industry, especially in countries such as China, Japan, and South Korea, is fueling market growth. Another important factor is the growing emphasis on sustainability and the implementation of stricter environmental regulations. Manufacturers are investing in research and development (R&D) activities to produce eco-friendly, low-VOC products, catering to both regulatory requirements and consumer preferences for greener alternatives. In addition, the growth of e-commerce platforms is making paints and coatings more accessible to both consumers and small businesses.

Latin America Paints and Coatings Market Analysis

The Latin American paints and coatings market is being driven by rapid urbanization, infrastructure development, and the growth of the construction industry throughout the region. The rise in residential and commercial construction projects is boosting the demand for decorative paints. In addition, there is a rise in the demand for industrial coatings due to the thriving automotive sector in the region. According to the CEIC, Brazil motor vehicle production was reported at 2,324,838.000 Unit in December 2023. Moreover, shifting consumer preferences toward aesthetically appealing and durable products further support the market growth. Furthermore, environmental regulations are prompting manufacturers to develop eco-friendly and low-VOC coatings, aligning with growing sustainability trends. Technological advancements, such as smart coatings and nanotechnology-based products, enhance performance and expand applications, driving market innovation. The region's rising population and favorable government investments in housing and infrastructure development, particularly in emerging economies like Brazil and Mexico, is strengthening the market growth.

Middle East and Africa Paints and Coatings Market Analysis

The paints and coatings market in the Middle East and Africa is driven by rapid urbanization and the growing construction industry. The construction sector in the Middle East and North Africa (MENA) region has demonstrated impressive resilience, with a remarkable USD 101 billion worth of projects awarded in the first half of 2023, according to a research report. In addition, governing agencies in the region are investing in large-scale projects, such as smart cities, residential complexes, and commercial buildings, creating a surge in demand for architectural paints. Besides this, the growing automotive and industrial sectors are catalyzing the need for protective and specialty coatings to enhance durability and aesthetics. Additionally, increasing investments in the oil and gas sector, along with industrialization in countries such as Saudi Arabia, UAE, and South Africa, are driving the demand for industrial coatings. Innovations in product offerings, such as antimicrobial and heat-reflective paints, cater to the region's unique environmental challenges.

Competitive Landscape:

The paints and coatings market is characterized by intense competition, with both established and emerging players striving to innovate and capture market share. Companies are prioritizing the development of innovative, sustainable, and high-performance products to address evolving consumer needs and meet regulatory standards. Considerable investment is being made in research and development to create eco-friendly formulations, such as water-based and bio-based coatings, in response to growing environmental concerns. Strategic collaborations, mergers, and acquisitions are prevalent, allowing market players to broaden their geographical reach and diversify their product offerings. The market also witnesses competitive pricing strategies, with players leveraging economies of scale and efficient production processes. Customization, quality enhancement, and strong distribution networks further define the competitive dynamics in this evolving industry.

The report provides a comprehensive analysis of the competitive landscape in the paints and coatings market with detailed profiles of all major companies, including:

- Akzo Nobel N.V.

- Asian Paints Ltd

- Axalta Coating Systems, LLC

- Berger Paints India Ltd

- Indigo Paints Limited

- Jotun

- Kansai Paint Co., Ltd

- National Paints Factories Co. Ltd.

- Nippon Paint Holdings Co., Ltd

- PPG Industries, Inc.

- RPM International Inc.

- The Sherwin-Williams Company

Latest News and Developments

- August 2025: AkzoNobel introduced its well-known Structura collection of Interpon D powder coatings, featuring sought-after colors and sophisticated textures that merged with exceptional durability to leave a lasting impact. Interpon D2525 Structura’s smooth texture provided aluminum and steel surfaces with a captivating quality and depth, offering notably enhanced gloss retention and robust resistance to color alteration.

- June 2025: Kamdhenu Paints unveiled an extensive premium wood coating collection suitable for interior and exterior uses. The assortment featured high-performance options, such as Kamwood 2K PU for a luxurious matte or glossy finish, Kamwood 1K PU for transparency and stain resistance, and the Kamwood Melamyne system for a sleek, long-lasting finish.

- March 2025: Uchihamakasei Corp. and Nippon Paint Automotive Coatings Co., Ltd. revealed the successful collaborative creation of Japan's inaugural in-mold coating technology (IMC) for large thermoplastic automotive exterior uses. This cutting-edge technology merged resin molding and surface coating into one cohesive process.

- February 2025: Researchers at AkzoNobel created an innovative water-based wood coating that contained 20% bio-based material, promoting the use of renewable resources while maintaining performance standards. Introduced by the Sikkens Wood Coatings division, RUBBOL WF 3350 was a sprayable opaque finish that highlighted AkzoNobel’s innovation and dedication to creating more sustainable products while ensuring top quality and durability for customers.

Paints and Coatings Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Waterborne Coatings, Solvent-borne Coatings, Powder Coatings, High Solids/Radiation Curing, Others |

| Materials Covered | Acrylic, Alkyd, Polyurethane, Epoxy, Polyester, Others |

| Applications Covered |

|

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Akzo Nobel N.V., Asian Paints Ltd, Axalta Coating Systems, LLC, Berger Paints India Ltd, Indigo Paints Limited, Jotun, Kansai Paint Co., Ltd, National Paints Factories Co. Ltd., Nippon Paint Holdings Co., Ltd, PPG Industries, Inc., RPM International Inc., The Sherwin-Williams Company, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the paints and coatings market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global paints and coatings market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the paints and coatings industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Paints and coatings are protective or decorative layers applied to surfaces like walls, metals, wood, and plastics. They enhance aesthetics, durability, and functionality by offering features such as corrosion resistance, UV protection, and color retention. Used across construction, automotive, and industrial sectors, they range from decorative paints to specialized coatings.

The global paints and coatings market was valued at USD 185.6 Billion in 2024.

IMARC estimates the global paints and coatings market to exhibit a CAGR of 4.5% during 2025-2033.

Key factors driving the global paints and coatings market include growing demand for eco-friendly and sustainable products, increasing construction and infrastructure development, automotive industry growth, and advancements in coating technologies.

In 2024, waterborne coatings represented the largest segment by product, driven by their eco-friendly properties, low-VOC content, durability, and widespread application across industries.

Acrylic leads the market by material owing to its versatility, excellent durability, UV resistance, and color retention, making it ideal for various applications.

The architectural & decorative is the leading segment by application, driven by high demand in residential, commercial, and infrastructure projects for aesthetic and protective coatings.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein Asia Pacific currently dominates the global market.

Some of the major players in the global paints and coatings market include Akzo Nobel N.V., Asian Paints Ltd, Axalta Coating Systems, LLC, Berger Paints India Ltd, Indigo Paints Limited, Jotun, Kansai Paint Co., Ltd, National Paints Factories Co. Ltd., Nippon Paint Holdings Co., Ltd, PPG Industries, Inc., RPM International Inc., The Sherwin-Williams Company, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)