Global Paints and Coatings Market Expected to Reach USD 274.8 Billion by 2033 - IMARC Group

Global Paints and Coatings Market Statistics, Outlook and Regional Analysis 2025-2033

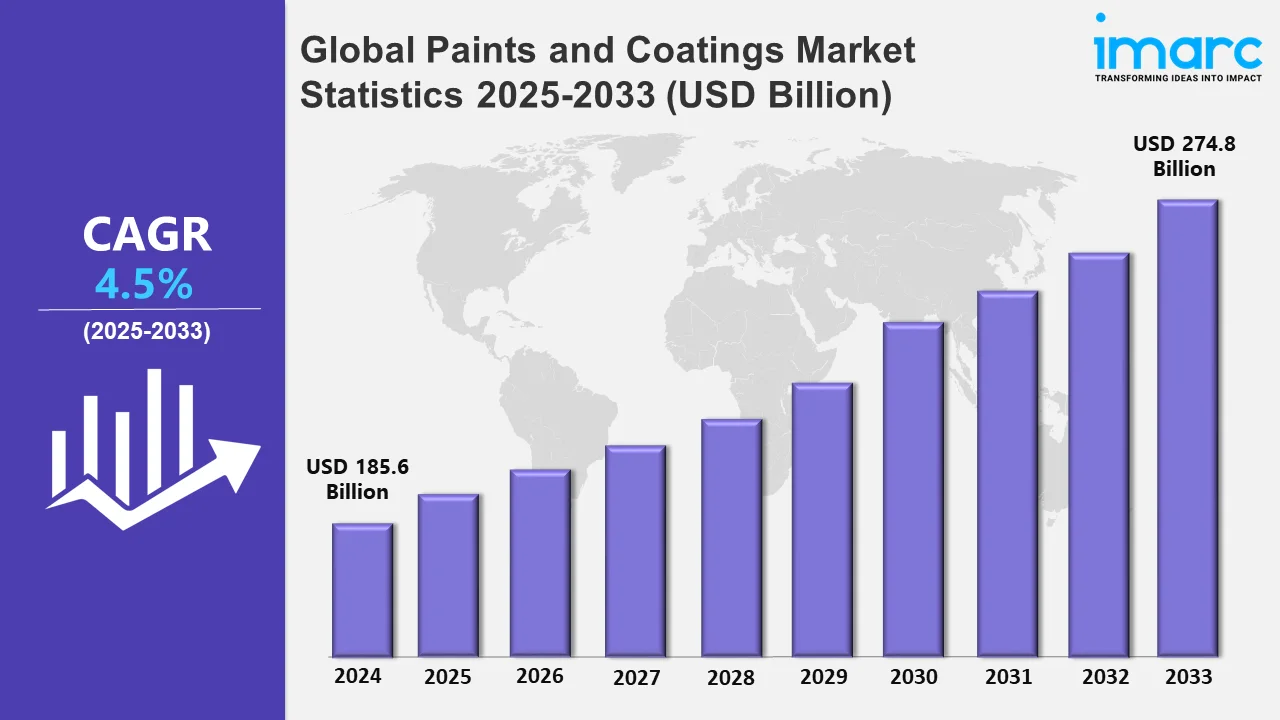

The global paints and coatings market size was valued at USD 185.6 Billion in 2024, and it is expected to reach USD 274.8 Billion by 2033, exhibiting a growth rate (CAGR) of 4.5% from 2025 to 2033.

To get more information on this market, Request Sample

The rapidly expanding construction and infrastructure sector is one of the major driving factors, wherein paints and coatings are a basic requirement for both residential and commercial buildings. Along with rising demand for surfaces that are aesthetically pleasing and durable, the increasing need to protect against natural environmental agents such as corrosion, UV rays, and moisture has increased the need for advanced coatings. The requirement of the high-performance paints and coatings becomes high for increasing the longevity of vehicles with a stylish look. Since demand is rising due to automobile companies in order to manufacture and maintain more automobiles, in this field, too, water-based paints will also have high adoption due to in line environmental laws and sustainability criteria. For example, in April 2024, BASF's Coatings division launched its new family of environment-friendly clearcoats and undercoats. These have better quality and higher productivity than old products. BASF hopes to help body shops become more sustainable and profitable with this extensive portfolio. Prominent automakers have approved these new items, proving their technological and sustainable attributes.

There are also technological advancements in coatings, for example nanocoatings and the development of self-healing materials, which significantly contribute to the market growth. These innovations provide enhanced functionalities such as anti-microbial, scratch resistant and better thermal conductivity among others hence growing the markets scope. This has been as a result of the increasing concern on the environment since there is a demand for low-VOC (volatile organic compound) and environment friendly coatings to meet the ever stringent environmental standards. For instance, in August 2024, Axalta Coating Systems subsidiary Axalta Building Products introduced CeruleanTM, their newest line of aqueous industrial wood paints. With its opulent finish and solvent-based solution feel, CeruleanTM, Zenith's successor, provides distributors and OEMs with the "best of both worlds." This satisfies consumer demands as they look for ways to enhance their environmental profiles, including by using low-VOC products, without compromising functionality. The construction sector’s focus on green buildings and energy-efficient solutions has further boosted demand for environmentally friendly coatings.

Global Paints and Coatings Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia-Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, Asia Pacific accounted for the largest market share because of rapid urbanization, expanding infrastructure, rising demand in the automotive and industrial sectors, and a shift toward environmentally friendly coatings.

North America Paints and Coatings Market Trends:

North America’s paints and coatings market is driven by strong demand in the construction, automotive, and industrial sectors. Growing preference for eco-friendly, low-VOC coatings and advancements in coating technologies, including energy-efficient solutions and sustainable materials, are key factors. Regulatory support for environmental compliance further accelerates market growth.

Asia-Pacific Paints and Coatings Market Trends:

Asia Pacific is driven by amplifying urbanization, increase in infrastructure ventures, and heightening need in industrial and automotive sectors. The inclination towards water-based and eco-friendly products, and increased construction and renovation activities, fuels market growth across China, India, and Southeast Asia. For example, in September 2024, the wholly-owned subsidiary of Kamdhenu Paints, Kamdhenu Colour and Coatings Limited, announced new wood coatings line to be introduced into the premium lines which shall maintain international quality standards. The product was announced to launch in October of the same 2024 and will further enable the firm to increase its market strength as a leader in premium, innovative coatings solutions.

Europe Paints and Coatings Market Trends:

In Europe, the paints and coatings market is driven by the demand for eco-friendly and sustainable products, stringent environmental regulations, and advancements in technology. Growth in the automotive and construction sectors, alongside renovation trends and energy-efficient building initiatives, also contributes. Increasing consumer preference for premium, decorative coatings and industrial applications further bolster the market in the region.

Latin America Paints and Coatings Market Trends:

The emerging construction development and infrastructure projects are fueling the growth of the Latin America paintings and coatings market, especially in Brazil and Mexico. Demand for automotive coatings, urbanization, housing projects, and increased projects are some propelling factors in the growth of the market. Further marching towards sustainable and eco-friendly coatings resonates with recent trends in the global market at large and strengthens this further.

Middle East and Africa Paints and Coatings Market Trends:

The paints and coatings market in the Middle East and Africa is driven by mega infrastructure projects in the construction and oil and gas industries. There have been rising demands for durable and anti-corrosive coatings in harsh conditions. Energy-efficient solutions also drive this market growth across the region.

Top Companies Leading in the Paints and Coatings Market

Some of the leading paints and coatings market companies include Akzo Nobel N.V., Asian Paints Ltd, Axalta Coating Systems, LLC, Berger Paints India Ltd, Indigo Paints Limited, Jotun, Kansai Paint Co., Ltd, National Paints Factories Co. Ltd., Nippon Paint Holdings Co., Ltd, PPG Industries, Inc., RPM International Inc., The Sherwin-Williams Company, among many others.

In October 2024, a leading paint, coating, and specialty materials company PPG announced that it had finalized a strategic deal to sell its architectural coatings division in Canada and the United States to American Industrial Partners (AIP), and industrial investor, for USD 550 million.

Global Paints and Coatings Market Segmentation Coverage

- On the basis of the product, the market has been categorized into waterborne coatings, solvent-borne coatings, powder coatings, high solids/radiation curing, and others, wherein waterborne coatings represent the leading segment. This dominance is attributed to their low VOC content, environmental friendliness, and compliance with stringent regulations. They offer excellent durability, easy application, and reduced toxicity, making them ideal for architectural, automotive, and industrial uses. Growing consumer demand for sustainable solutions further drives their adoption across various applications.

- Based on the materials, the market is classified into acrylic, alkyd, polyurethane, epoxy, polyester, and others, amongst which acrylic dominates the market. Because of their exceptional durability, weather resistance, and versatility, acrylic coatings currently occupy the biggest market share in the paints and coatings industry. They are perfect for a variety of uses in the industrial, automotive, and construction sectors since they have fast drying times and excellent color retention. Their demand is further increased by their low-VOC, environmentally beneficial qualities.

- On the basis of the application, the market has been divided into architectural and decorative, and non-architectural (automotive and transportation, wood, general industrial, marine, protective, and others). Among these, architectural and decorative accounts for the majority of the market share. Architectural and decorative applications hold the highest share of the paints and coatings market, as demand for residential and commercial construction projects is exponentially high. The paints provide aesthetic appeal, good surface protection, and durability against weathering. Rapid urbanization, infrastructure development, and renovation activities further drive growth, as consumers prioritize appealing finishes and functional performance for walls, exteriors, and interiors in modern spaces.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 185.6 Billion |

| Market Forecast in 2033 | USD 274.8 Billion |

| Market Growth Rate 2025-2033 | 4.5% |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Waterborne Coatings, Solvent-borne Coatings, Powder Coatings, High Solids/Radiation Curing, Others |

| Materials Covered | Acrylic, Alkyd, Polyurethane, Epoxy, Polyester, Others |

| Applications Covered |

|

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Akzo Nobel N.V., Asian Paints Ltd, Axalta Coating Systems, LLC, Berger Paints India Ltd, Indigo Paints Limited, Jotun, Kansai Paint Co., Ltd, National Paints Factories Co. Ltd., Nippon Paint Holdings Co., Ltd, PPG Industries, Inc., RPM International Inc., The Sherwin-Williams Company, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Browse IMARC Related Reports on Paints and Coatings Market :

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

.webp)

.webp)