Patch Cable Market Size, Share, Trends and Forecast by Product Type, Cable Type, Application, End Use, and Region, 2025-2033

Patch Cable Market Size and Share:

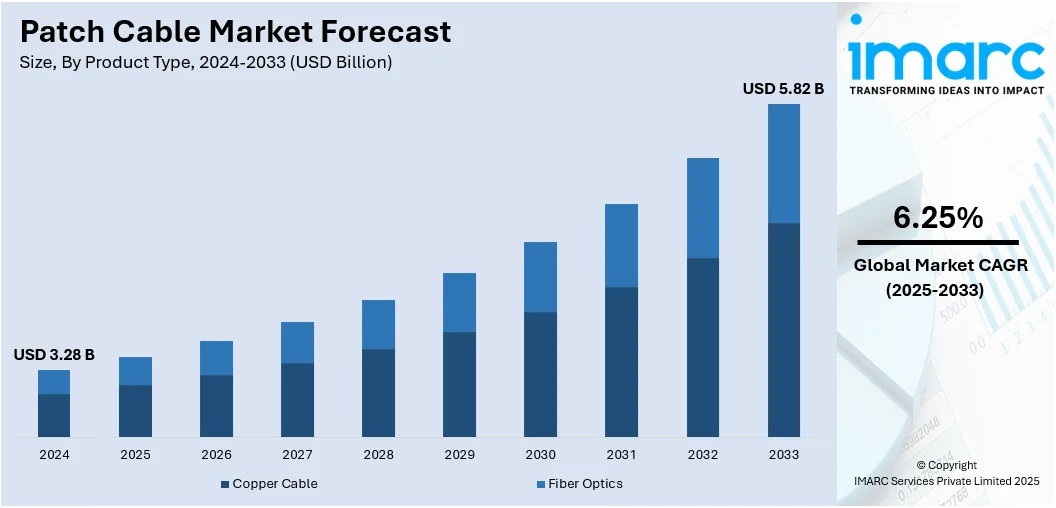

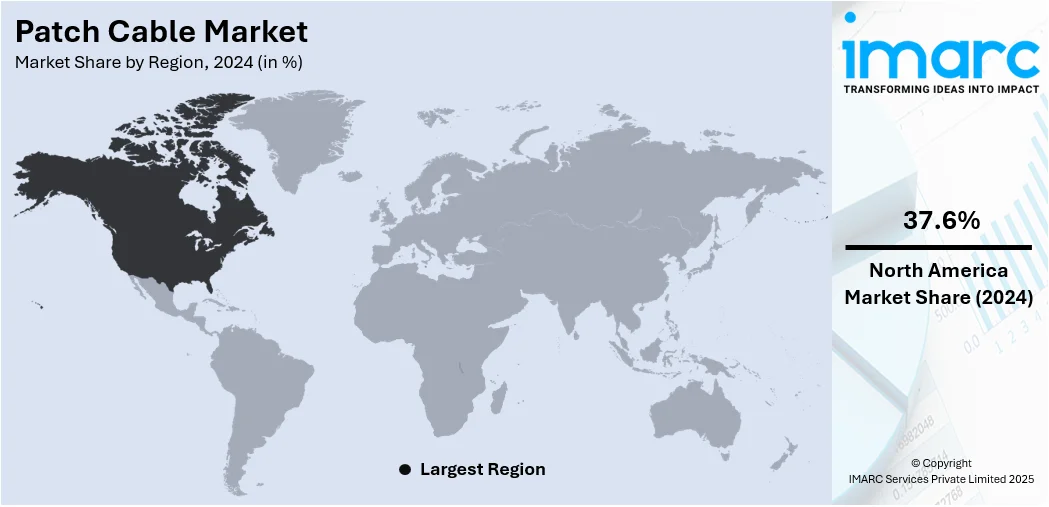

The global patch cable market size was valued at USD 3.28 Billion in 2024. The market is projected to reach USD 5.82 Billion by 2033, exhibiting a CAGR of 6.25% from 2025-2033. North America currently dominates the market, holding a market share of 37.6% in 2024. As companies are upgrading infrastructure to accommodate digital demands, long-lasting and high-performance patch cables are becoming essential to provide effective and trustworthy network functioning. Besides this, the ongoing expansion of data centers is fueling the patch cable market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 3.28 Billion |

|

Market Forecast in 2033

|

USD 5.82 Billion |

| Market Growth Rate 2025-2033 | 6.25% |

High demand for high-speed and dependable data transmission in sectors like information technology (IT), telecommunications, and data centers is propelling the market growth. Rise in internet access, increasing adoption of cloud computing, and the expansion of broadband infrastructure are driving the demand for effective connectivity solutions. Rising investments in fiber-optic networks and 5G rollout are fueling the market expansion, since these technologies depend on sophisticated cabling for peak efficiency. Moreover, the growing trend of remote employment, online learning, and digital transformation in companies is speeding up the use of high-quality patch cables to guarantee reliable connections, rendering them vital in both commercial and home network settings.

To get more information on this market, Request Sample

The United States has emerged as a major region in the patch cable market owing to many factors. Increasing adoption of smart home devices is fueling the patch cable market growth. Rising demand for high-speed internet to facilitate cloud computing, the Internet of Things (IoT), and streaming services is benefiting the market. The swift deployment of 5G networks is creating the need for superior cabling solutions to guarantee quick and dependable connectivity. The continuous transition to remote work, online learning, and virtual collaboration tools is driving the demand for reliable wired connections in residential and commercial environments. As per the US Bureau of Labor Statistics, by March 2025, 22.8% of employees in the US were engaged in remote work at least in part, totaling 36.07 Million individuals.

Patch Cable Market Trends:

Growing Demand for High-Speed Connectivity

Increasing need for high-speed internet and reliable connectivity is offering a favorable patch cable market outlook. As businesses continue to adopt streaming services and IoT devices, the demand for fast and stable network connections has surged. It has been reported that worldwide cloud service spending is anticipated to grow by 19% in 2025. High-speed patch cables, such as Cat 6 and Cat 7 Ethernet cables, are essential for supporting these applications, ensuring minimal latency and high data transfer rates. Additionally, with the rise of remote work and online collaboration tools, organizations are investing in robust networking solutions to maintain productivity. This trend is encouraging companies to upgrade their existing infrastructure, leading to greater demand for quality patch cables.

Expansion of Data Centers and Cloud Services

The rapid broadening of data centers and cloud services is among the major patch cable market trends. As of March 2025, the United States had the most data centers (5,426), with Germany coming next at 529. As more businesses are migrating to cloud-based solutions, the need for efficient data storage and management is rising. Data centers require extensive networking infrastructure, and patch cables play a critical role in facilitating connections between servers, switches, and other networking equipment. The trend of hyper-converged infrastructure and the adoption of virtualized services are further driving the demand for high-quality patch cables that can handle increased data throughput. Additionally, the growing reliance on big data analytics is necessitating robust and reliable networking solutions.

Technological Advancements and Innovations

The introduction of new cable standards, such as Category 8 cables, which support higher bandwidths and faster speeds, is pushing the market forward. These advancements are enabling businesses to upgrade their infrastructure for accommodating increasing data demands, particularly in environments like data centers and enterprise networks. Furthermore, developments in materials and manufacturing techniques are improving cable performance, durability, and flexibility, leading to more efficient installations and longer-lasting products. Innovations in fiber optic technology, such as multi-mode and single-mode fibers, are also expanding the applications for patch cables, allowing higher data rates over longer distances. Additionally, the rising adoption of artificial intelligence (AI) is creating the demand for high-quality connectivity solutions, where advanced patch cables play an important role in ensuring seamless and low-latency communication. As reported, in 2024, in the EU, 13.5% of businesses employing 10 or more staff utilized AI technologies for their operations, reflecting a growth of 5.5 percentage points (pp) from 8.0% in 2023.

Patch Cable Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global patch cable market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on product type, cable type, application, and end use.

Anaysis by Product Type:

- Copper Cable

- Fiber Optics

Copper cable represented the largest market share in 2024, fueled by its widespread use in local area networks (LANs), data centers, and enterprise IT infrastructure. Copper patch cable is universally used due to its ease of installation, affordability, and sufficient performance for short- to medium-length data transmission. With the growing worldwide demand for high-speed internet connectivity and increasing digitalization of offices, copper cable continues to be one of the most popular choices for structured cabling. Advancements in technology like improved shielding, greater bandwidth capability, and better insulation materials have also enhanced the functionality and longevity of copper cables. Additionally, for applications in industrial settings and corporate offices where electromagnetic interference (EMI) and signal integrity are issues, copper patch cable provides consistent transmission with minimal delay. Its support for existing Ethernet infrastructure is further solidifying its market dominance.

Analysis by Cable Type:

- CAT 3

- CAT 5

- CAT 5E

- CAT 6

- CAT 6A

- CAT 7

- Multimode Optical Fiber

- Others

CAT 5 accounts for the biggest market share because of its well-established presence and low cost in small-sized network deployments. CAT 5 cable remains widely used in homes, small businesses, and settings that prioritize cost-effective networking solutions. It can handle data transmission of up to 100 Mbps and frequencies up to 100 MHz, making it capable of handling simple internet use, voice-over-IP (VoIP), and typical data transmission. Its low installation price and backward compatibility with existing network hardware also render CAT 5 an economic option during infrastructure development when ultra-high-speed connections are not required. Furthermore, its simplicity in short-distance usage and non-critical systems guarantees ongoing utilization. Overall, CAT 5 continues to be applicable in budget-constrained and low-bandwidth environments, establishing its dominance.

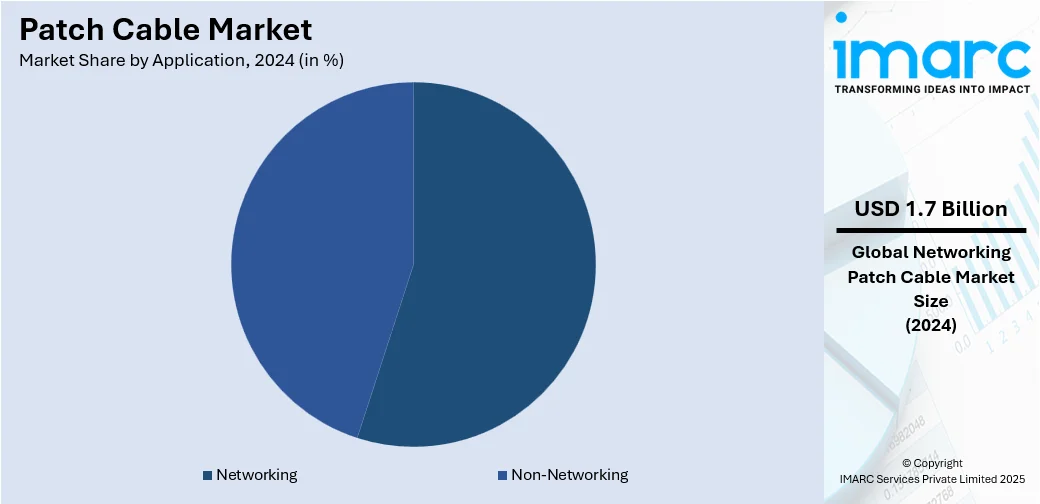

Analysis by Application:

- Networking

- Non-Networking

Networking holds 52.1% of the market share. To establish reliable, high-speed, and stable connections in numerous networking environments, inculcating enterprise networks, data centers, and telecommunication setups, patch cables are required. They enable efficient transmission of data, voice, and video signals with minimal latency, which is critical for modern business operations and internet-based services. The rise of cloud computing, IoT, and 5G technologies has further intensified the demand for robust networking infrastructure, where patch cables play a central role. Additionally, their ease of installation, flexibility in connecting different devices, and compatibility with various networking hardware make them indispensable in both wired LAN and WAN setups. Networking applications require high-performance cabling to ensure seamless connectivity, security, and scalability, catalyzing consistent demand. As per the patch cable market forecast, with organizations expanding their digital infrastructure, networking will continue to remain the dominant application.

Analysis by End Use:

- Industrial

- Enterprise

- IT and Network Security

- Others

Industrial holds a significant share of the market. In industrial settings, patch cables play a critical role in interconnecting control systems, sensors, and equipment. Their robust design withstands electromagnetic interference, vibration, and temperature fluctuations. As manufacturers are implementing Industry 4.0 adoption, the demand for patch cables in factory automation and process control systems keeps growing.

Enterprise is utilizing patch cables widely in office structured cabling, conference rooms, and server rooms. These cables carry voice, data, and video communication within internal networks. The transition to hybrid workplaces and higher bandwidth demands is increasing the significance of dependable cabling to provide smooth operations in enterprises.

IT and network security accounts for a substantial portion of the market. IT and network security applications depend on patch cables for high-speed, secure connections between switches, firewalls, surveillance systems, and servers. With expanding cybersecurity threats, organizations are looking for physically hardened cabling to ensure seamless data transmission and safeguard mission-critical equipment from attacks or data loss.

Regional Analysis:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

North America, accounting for a share of 37.6%, enjoys the leading position in the market. The region is noted for its highly developed IT infrastructure, widespread broadband penetration, and strong presence of major technology companies. The region’s rapid adoption of advanced networking solutions in data centers, enterprises, and industrial facilities is driving consistent demand for high-performance patch cables. Strong investments in cloud computing, 5G deployment, and IoT integration are further creating the need for reliable and high-speed connectivity. The presence of leading manufacturers and continuous innovations in cable technology is also contributing to the region’s dominance. Additionally, the rising adoption of home automation systems is boosting the requirement for efficient cabling solutions in residential networks. As per the IMARC Group, the North America home automation systems market size reached USD 33.8 Billion in 2024. North America’s focus on network security and minimal downtime is catalyzing the demand for premium patch cables with enhanced durability and shielding.

Key Regional Takeaways:

United States Patch Cable Market Analysis

The United States patch cable market is strongly developed, fueled by ongoing developments in telecommunications, cloud computing, and corporate networking. For instance, in early 2025, there were 411 Million active cellular mobile connections in the United States, representing 119% of the total population. The country boasts a large pool of data centers, hyperscale computing centers, and interconnected digital ecosystems, which require dependable high-speed patch cabling. Among the key market trends in the United States are the widespread deployment of structured cabling systems and the growing preferences for higher-specification cables like Cat6A and Cat7, which offer enhanced bandwidth and resistance to electromagnetic interference. In addition, the increased adoption of smart homes, high-definition content streaming, and 5G connectivity is catalyzing the demand for low-latency and efficient cable infrastructure. Schools and large industrial automation networks also rely on premium patch cables to provide seamless network operations. Rising investments in edge computing and AI-based systems, especially in urban technology corridors, are positively influencing the market. Structured cabling systems are the backbone of contemporary IT infrastructure in industries, with fiber optic and Cat6A/7 becoming increasingly popular.

Europe Patch Cable Market Analysis

The patch cable market outlook in Europe is growing continuously based on high levels of widespread IT infrastructure modernization, business digital transformation, and high broadband service penetration. For instance, IT expenditures in Europe are expected to reach USD 1.28 Trillion in 2025, marking an 8.7% rise from 2024, according to the latest industry forecast. Nations, such as Germany, the UK, France, and the Netherlands, are leaders in network innovations, creating huge demand for high-performance patch cables. Mass deployment of gigabit broadband and fiber-to-the-home (FTTH) initiatives, along with investments in green and sustainable data centers, is boosting dependency on structured cabling systems. Patch cables are also a key element in linking components in energy-saving, high-density IT environments. Public sector digitalization, smart manufacturing activities, and the creation of smart transportation systems are further catalyzing the adoption of patch cables. Europe's emphasis on cybersecurity and data sovereignty is driving the modernization of cable infrastructures for highly regulated industries like banking, healthcare, and government.

Asia-Pacific Patch Cable Market Analysis

The Asia Pacific patch cable market size is growing at a strong pace, propelled by increasing urbanization activities, expanding internet infrastructure, and high government attention towards digital connectivity. For instance, there were 806 Million individuals utilizing the internet in India at the start of 2025, when online penetration reached 55.3%. The growing installation of fiber-optic networks across nations like China, India, South Korea, and Japan is significantly driving the demand. With the ubiquity of smart cities, data centers, and broadband high-speed services, patch cables, and particularly fiber-based and Cat6/Cat7 types, are critical elements in facilitating rich network topologies. The growth in cloud computing usage and IoT-infused infrastructure in the region is also fueling increasing adoption in enterprise, telecom, and residential markets. The market is favored by affordable local production and a high demand for low-latency, high-bandwidth connectivity. Deep mobile penetration and constant 5G rollouts within the region continue to make patch cables strategically vital.

Latin America Patch Cable Market Analysis

The patch cable market in Latin America is expanding with increasing internet penetration, digital transformation for businesses, and increased adoption of cloud-based services. For instance, 53% of mobile connections in Latin America is anticipated to be 5G by 2030. Brazil, Mexico, Argentina, and Chile are some of the countries where investments in telecom infrastructure and data centers are on the rise, hence driving more demand for structured cabling and good quality patch cables. The area is experiencing an upsurge in mobile connectivity and broadband access due to urbanization and young, technologically adept populations. Patch cables play an important role in the creation of strong back-end networks for small and medium businesses, government services, and educational institutions that are experiencing digital transformations. The use of fiber optic technology and the growth of smart city programs in metropolitan regions are prime drivers for the market expansion.

Middle East and Africa Patch Cable Market Analysis

In the Middle East and Africa region, the market is experiencing upward momentum as nations are driving digital transformation in the public and private sectors. For instance, data from GSMA Intelligence showed that there were 21.9 Million cellular mobile connections in the United Arab Emirates at the beginning of 2025. Gulf governments are investing in smart cities, e-governance, and 5G infrastructure, catalyzing the demand for patch cables with high performance. Fiber-to-the-home (FTTH) and fiber-to-the-premises (FTTP) infrastructures are increasing, particularly in the UAE, Saudi Arabia, and Qatar. Such deployments are based on state-of-the-art patch cabling to provide seamless connectivity between core systems. At the same time, increasing enterprise-level connectivity requirements in the developing regions of Africa are driving the deployments of structured cabling.

Competitive Landscape:

Key players are innovating product designs, improving cable performance, and offering a wide range of options, including fiber-optic and high-speed Ethernet cables, to meet diverse customer needs. They are investing heavily in research and development (R&D) activities to enhance durability, signal quality, and compatibility with emerging technologies like 5G and advanced networking systems. Strategic partnerships with telecom operators, data center providers, and IT infrastructure companies are enabling these manufacturers to expand their market reach. In addition, competitive pricing tactics, effective supply chain oversight, and global distribution networks help ensure product availability. By focusing on sustainability and eco-friendly materials, key players also cater to the growing environmental concerns, thereby strengthening their market position and fueling the overall expansion of the patch cable industry. For instance, in April 2025, PureLink GmbH introduced the FlexInstall series patch cable, which boasted ultra-flexible jackets infused with graphene and EMI-resistant shielding, ideal for high-performance AV setups in confined areas. The patch cable line was also launched with space-saving connectors and environment friendly InstallerPack packaging to enhance cable organization and minimize waste.

The report provides a comprehensive analysis of the competitive landscape in the patch cable market with detailed profiles of all major companies, including:

- Belden Inc.

- Black Box

- CommScope

- Corning Incorporated

- CP Technologies

- Graybar Electric Company, Inc.

- Legrand North America, LLC

- NAI Group, LLC

- Panduit Corp

- Prysmian Group

- Quabbin Wire & Cable Co., Inc.

Latest News and Developments:

- July 2025: Lightware enhanced its cable offerings by launching the Cable-PopUp and two new USB-C cables. The patch cable options improved cable organization and connection solutions in workspaces and meeting settings.

- June 2025: CommScope unveiled its FiberREACH solution and CableGuide 360 platform, incorporated into the SYSTIMAX portfolio. The platform was designed to improve network edge connectivity and cable management. The CableGuide 360 platform facilitated patch cable organization for more compact and quicker installations while safeguarding both copper and fiber cables.

- June 2025: Cleerline introduced a web-based tool that allowed users to create and order fiber patch cables customized for specific project requirements. The tool enabled the choice of cable type, length, connectors, and optional features, ensuring all patch cables were tested to surpass industry standards prior to shipment.

- May 2025: Belden launched its 10GXM13 Category 6A patch cable, boasting a compact 0.230” diameter and TIA compliance for improved 10 Gigabit performance. The patch cable facilitated simpler installation in cramped areas, lowered conduit expenses, and promoted eco-friendly setups with a filler-free design.

Patch Cable Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

xploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Copper Cable, Fiber Optics |

| Cable Types Covered | CAT 3, CAT 5, CAT 5E, CAT 6, CAT 6A, CAT 7, Multimode Optical Fiber, Others |

| Applications Covered | Networking, Non-Networking |

| End Uses Covered | Industrial, Enterprise, IT and Network Security, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Belden Inc., Black Box, CommScope, Corning Incorporated, CP Technologies, Graybar Electric Company, Inc., Legrand North America, LLC, NAI Group, LLC, Panduit Corp, Prysmian Group, Quabbin Wire & Cable Co., Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the patch cable market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global patch cable market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the patch cable industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The patch cable market was valued at USD 3.28 Billion in 2024.

The patch cable market is projected to exhibit a CAGR of 6.25% during 2025-2033, reaching a value of USD 5.82 Billion by 2033.

Rising adoption of 5G networks and the need for reliable wired connections in enterprise and residential settings are driving the demand for patch cables. The surge in video conferencing, online gaming, and streaming services has heightened the requirement for stable, low-latency connections, where patch cables excel. Additionally, the proliferation of smart homes, industrial automation, and advanced networking equipment is supporting the market growth.

North America currently dominates the patch cable market, accounting for a share of 37.6% in 2024, due to its advanced digital infrastructure, high-speed internet adoption, and strong presence of data centers. The growing demand from technology-oriented industries and the rapid deployment of 5G and smart networking solutions are further strengthening the market.

Some of the major players in the patch cable market include Belden Inc., Black Box, CommScope, Corning Incorporated, CP Technologies, Graybar Electric Company, Inc., Legrand North America, LLC, NAI Group, LLC, Panduit Corp, Prysmian Group, Quabbin Wire & Cable Co., Inc., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)