Pearlescent Pigment Market Size, Share, Trends and Forecast by Product, Form, Application, and Region, 2025-2033

Pearlescent Pigment Market Size and Share:

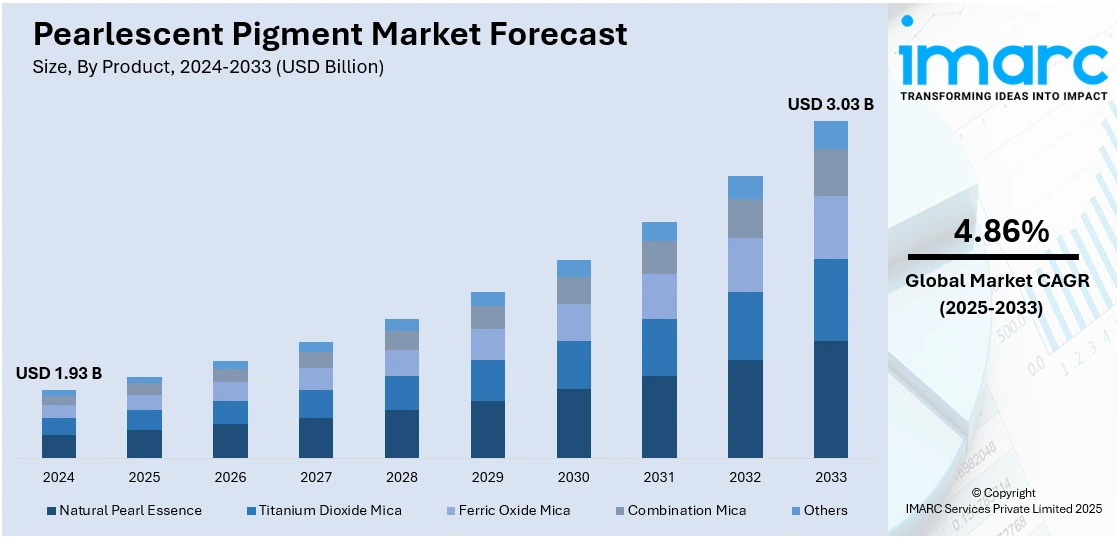

The global pearlescent pigment market size was valued at USD 1.93 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 3.03 Billion by 2033, exhibiting a CAGR of 4.86% during 2025-2033. North America currently dominates the market, holding a significant market share of over 35.0% in 2024. The market is witnessing steady growth, driven by increasing demand across the automotive, cosmetics, and packaging industries. At present, North America dominates the market due to its advanced automotive sector, rising consumer demand for premium products, and technological advancements in pigment applications, enhancing product aesthetics and performance.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 1.93 Billion |

|

Market Forecast in 2033

|

USD 3.03 Billion |

| Market Growth Rate (2025-2033) | 4.86% |

The automotive industry is increasingly incorporating pearlescent pigments into vehicle coatings to enhance surface appearance and create unique color-shifting effects. These pigments offer a refined and luxurious finish, making them ideal for high-end and customized vehicles. Manufacturers are expanding their use in both OEM and aftermarket applications. In recent product launches, carmakers have introduced special finishes that rely on these pigments for their eye-catching appeal. Their adaptability to different coating systems, including solvent-based and waterborne types, makes them a preferred choice across regions where vehicle personalization and premium aesthetics are gaining popularity.

Pearlescent pigments are seeing higher usage in cosmetics due to their ability to provide shimmer and a radiant finish across various product categories. Their reflective quality enhances the appearance of items like eyeshadows, highlighters, and skincare formulations. Cosmetic companies have introduced new collections that feature plant-based or biodegradable pearlescent materials to align with clean beauty trends. This shift is especially strong in regions where demand for visual enhancement and ingredient transparency continues to rise. The increased focus on presentation, along with innovation in color effects, is further supporting their role in personal care and beauty product formulations.

Pearlescent Pigment Market Trends:

Focus on High-Purity Color Effects

The pearlescent pigment market is witnessing strong demand for pigments that deliver precise, vivid, and stable color effects across diverse surfaces. End-users, especially in cosmetics, automotive coatings, and packaging, are placing increasing value on visual consistency and richness, even under varying lighting conditions. As product design becomes more refined, there is a rising need for pigments that offer sharp color definition and brilliant optical depth without creating unwanted undertones or excessive layering. Manufacturers are responding by engineering pigments with controlled particle structures and improved reflectivity, capable of delivering high-purity visual output with minimal formulation adjustments. In September 2024, Pritty introduced its ChromaPura line of pearlescent pigments made using thicker borosilicate platelets. This breakthrough enabled the creation of true single-color interference effects with laser-like clarity, eliminating the multi-tonal shifts typically seen in conventional interference pigments. Even at low concentrations, the pigments achieved striking sparkle, especially on dark backgrounds, enhancing visual aesthetics while reducing dosage levels. This development highlighted the shift toward formulation efficiency combined with advanced optical appeal. As more industries adopt decorative pigments for branding, packaging, and product finishes, demand for such high-performance, color-pure solutions is expected to grow, supporting the pearlescent pigment market growth.

Strengthening Supply and Regional Access

A parallel trend shaping the pearlescent pigment market is the focus on improving pigment availability and distribution in key regions, particularly for applications that demand quality consistency and regulatory compliance. As industries such as personal care and home care become more competitive, pigment users seek reliable partners who can provide timely supply, technical support, and high-quality ingredients. Regional distribution agreements and partnerships have become an effective way to address these needs, allowing manufacturers to maintain product standards while ensuring speed and flexibility in the supply chain. In July 2024, LBB Specialties announced an exclusive partnership with Sudarshan Chemical Industries to distribute Sudarshan’s effect pigment lines including Prestige, Sumicos, and Sudacos across the U.S. and Canada. These pigments were designed for use in color cosmetics, skincare, and home care formulations, offering advanced performance with excellent color stability and safety. The agreement gave formulators easier access to high-quality pigments backed by local support, reducing lead times and strengthening the overall supply framework. This move reflects a broader market push toward regionally anchored pigment networks, where manufacturers and distributors collaborate to ensure consistent availability of advanced products. It also signals how the pearlescent pigment market is evolving—not just through product innovation but by building responsive supply systems that support faster and safer formulation development in high-growth industries.

Rising Multi-Sector Pigment Demand

Pearlescent pigments are increasingly replacing metallic alternatives in the automotive sector due to their strong resistance to weathering. Their ability to withstand harsh environmental conditions has made them a reliable choice for automotive coatings. This shift aligns with the global rise in vehicle sales, with passenger car sales reaching 65.3 Million units in 2023—an increase of 11.3% from the previous year. Beyond automotive use, these pigments are widely incorporated in cosmetics such as blush, eyeshadow, highlighters, lip gloss, and bronzers, where they enhance color effects and provide a matte or shimmering finish. The cosmetics segment is also benefiting from the growing popularity of unisex products. Online platforms offering customizable and eco-friendly formulations have made these products more accessible, especially among Gen Z consumers, around 40% of whom now prefer gender-neutral cosmetic options. This is notably higher compared to 30% in older demographics. Pearlescent pigments are also gaining traction in the food packaging industry due to their stability in light, temperature, acidic and alkaline conditions. Urbanization, higher disposable incomes, and changing consumption patterns are increasing the demand for packaged foods, creating new avenues for pigment use. These combined drivers are expanding the market scope across multiple end-user industries.

Pearlescent Pigment Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global pearlescent pigment market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on product, form, and application.

Analysis by Product:

- Natural Pearl Essence

- Titanium Dioxide Mica

- Ferric Oxide Mica

- Combination Mica

- Others

In 2024, the titanium dioxide mica segment led the pearlescent pigment market, holding 35.7% of the market share. As per the pearlescent pigment market research report, titanium dioxide mica is the most extensively utilized product, generally known for its brilliant luster and high refractive index. It is increasingly being adopted across various industries due to its ability to create iridescent and shimmering effects. Moreover, this product type is particularly favored in cosmetics, automotive, and packaging applications, offering an aesthetic appeal that enhances visual impact. In addition, the high demand for titanium dioxide mica stems from its versatility in providing long-lasting, vibrant colors, making it a dominant segment in the pearlescent pigment market.

Analysis by Form:

- Powder

- Dispersion and Paste

In 2024, the powder segment led the pearlescent pigment market, holding 53.4% of the market share. According to the pearlescent pigment market forecast, powder is anticipated to sustain its dominance as the most preferred form of the pigment, driven by its ease of use in manufacturing processes across industries. This form is preferred for its flexibility in application, allowing it to be easily incorporated into paints, coatings, plastics, and cosmetics. Furthermore, the lightweight and fine texture of powder pearlescent pigments enhance blending and dispersal, ensuring uniformity in color and luster. Additionally, its dominance in the market is further supported by cost-efficiency in production and transport compared to liquid and paste forms.

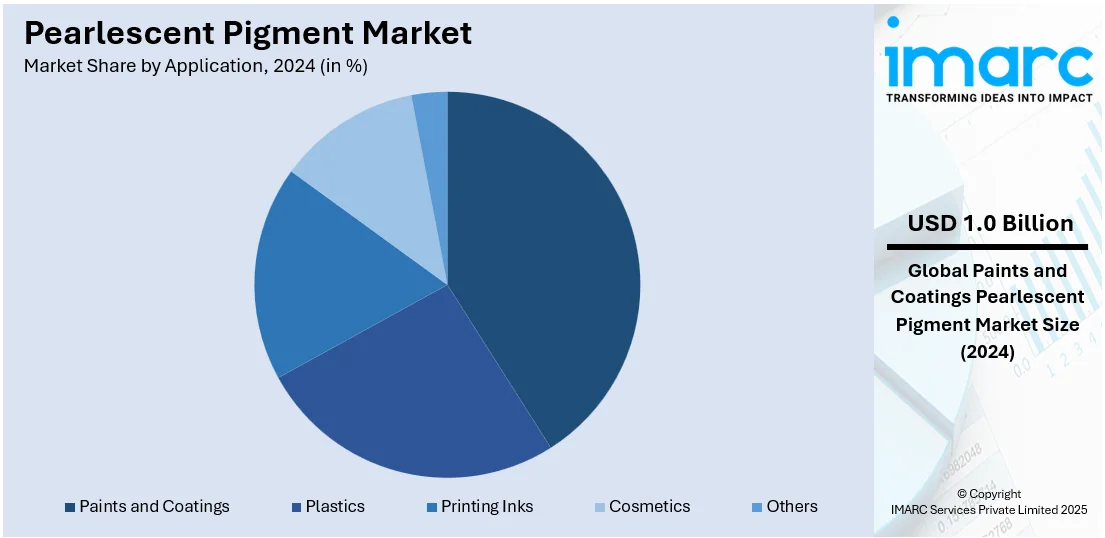

Analysis by Application:

- Paints and Coatings

- Plastics

- Printing Inks

- Cosmetics

- Others

In 2024, the paints and coatings led the pearlescent pigment market, holding 40.8% of the market share. The paints and coatings segment represents the largest application market for pearlescent pigments, particularly in the automotive, construction, and consumer goods industries. These pigments are used to achieve unique color effects, including metallic and iridescent finishes, which enhance the aesthetic appeal of surfaces. Moreover, the growing demand for high-performance coatings in both decorative and protective applications is a major driver for the pearlescent pigment market. Additionally, environmental advancements in low-VOC coatings have increased the use of such pigments in this sector, consequently contributing to a positive pearlescent pigment market outlook.

Regional Analysis:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, the North America led the market, holding 35.0% of the pearlescent pigment market share. North America has emerged as the leading regional market for pearlescent pigment, predominantly driven by robust requirement from major sectors like packaging, automotive, and cosmetics. The region's leading-edge manufacturing abilities, combined with escalating customer need for premium and visually appealing products, have fueled the widespread utilization of pearlescent pigments. In addition, the accelerating trend of environmentally friendly pigments and advancements in product formulations further improve market expansion in the region. Moreover, North America’s advancing infrastructure and growing emphasis on research and development projects also solidifies its dominance in this evolving market. For instance, in July 2024, LBB Specialties, a leading specialty chemicals company in North America, announced a strategic partnership with Sudarshan Chemical Industries, a major pearlescent pigments producer. As per the agreement, LBB will distribute Sudarshan’s Lake lines, fillers, oxides, and effect pigments in Canada and United States. These products are particularly tailored for use in home care, color cosmetics, and personal care applications.

Key Regional Takeaways:

United States Pearlescent Pigment Market Analysis

In 2024, United States accounted for 87.8% of the market share in North America. The United States pearlescent pigment market is primarily driven by the rising demand for high-performance pigments in automotive coatings, especially for luxury and custom finishes. In line with this, increased investments in decorative and industrial paints, along with continual advancements in UV-resistant pigment formulations, are supporting broader application scopes in the market. For instance, in May 2024, PPG Industries announced a USD 300 Million investment to boost automotive coatings manufacturing in North America, including a new 250,000 sq. ft. facility in Tennessee. The growing popularity of pearlescent effects in consumer electronics casings and accessories is also fueling market demand. Similarly, expansion of the plastics sector, particularly in premium packaging solutions, is another notable market driver. The ongoing shift toward sustainable and non-toxic pigment alternatives encouraging innovation in mica-based and synthetic pearlescent pigments, is significantly bolstering market expansion. Furthermore, enhanced product visibility through digital retail channels improving accessibility and awareness among end-users, is propelling market growth. Apart from this, regulatory support for safer cosmetic ingredients leading to greater integration of pearlescent pigments in personal care products, is stimulating market appeal.

Europe Pearlescent Pigment Market Analysis

The Europe pearlescent pigment market is majorly propelled by heightened demand for premium aesthetic finishes in architectural coatings. Similarly, expansion of the luxury packaging industry, particularly in France, Germany, and Italy, is creating new avenues for high-quality decorative pigments in the market. The increased use in sustainable paints and coatings aligning with the region’s strict environmental standards and green building certifications, is fostering market expansion. Furthermore, rapid advancements in eco-friendly printing inks supporting pigment adoption in the publishing and labeling sectors, are impelling the market. The automotive aftermarket’s increasing preference for custom detailing solutions augmenting the use in refinishing applications, is strengthening market demand. Additionally, growth in the personal care segment, especially in clean-label cosmetics, is also enhancing the market accessibility. According to a recent report, 68% of consumers now prioritize skincare products formulated with clean ingredients, while 35% are dedicating more time to their skincare routines and making environmentally responsible purchasing decisions. Moreover, emerging design trends in high-end consumer goods emphasizing shimmering effects, while ongoing advancements in dispersion technologies improving compatibility across various mediums, are creating lucrative opportunities in the market.

Asia Pacific Pearlescent Pigment Market Analysis

The market in Asia Pacific is being driven by rapid urbanization and infrastructure development. In addition to this, the rise of electric vehicles and sustainable mobility solutions increasing the use of specialized pigments in automotive exteriors and interiors, is impelling the market development. The expanding middle-class populations across countries like China and India fueling consumption of premium cosmetics and personal care products, are encouraging the higher product uptake. An industry report states that between April and September 2023, Indians purchased over 100 Million cosmetic products, spending more than INR 5,000 Crore. Furthermore, growth in flexible packaging for food and personal care goods is fostering expansion in the market. The region’s robust electronics manufacturing sector utilizing pearlescent pigments for high-end casings and component finishes, is bolstering market reach. Moreover, favorable government initiatives promoting domestic manufacturing stimulating local demand for industrial coatings and plastic goods, are providing an impetus to the market.

Latin America Pearlescent Pigment Market Analysis

In Latin America, the market is progressing due to expanding demand for value-added plastic products in sectors such as packaging and home appliances. In accordance with this, the cosmetics industry's increasing focus on regionally tailored formulations driving the use of vibrant, high-clarity pigments, is propelling market expansion. Additionally, growth in decorative paints, fueled by residential renovation and commercial construction, is another key market growth factor. An industry report highlights that Brazil’s demand for paint and coatings materials rose by 6% in 2024, nearly twice the national GDP growth rate. Decorative paints performed strongly, reaching a record volume of 1.49 Billion liters, marking a 5.9% year-on-year increase. Furthermore, rising brand investments in premium personal care and beauty packaging encouraging the use of pearlescent effects to enhance visual differentiation, are impacting the market trends.

Middle East and Africa Pearlescent Pigment Market Analysis

The Middle East and Africa pearlescent pigment market is advancing attributed to growing investments in luxury real estate and architectural coatings. An industry report notes that luxury real estate in the UAE is seeing record investment, with Dubai alone recording USD 64 Billion in transactions in 2023. Furthermore, rising consumer interest in premium personal care products, particularly in Gulf countries, fueling the adoption of specialty pigments in cosmetics, is escalating the market appeal. The automotive sector’s gradual recovery, supported by import substitution and regional assembly initiatives, is contributing to pigment demand for vehicle coatings in the market. Besides this, expanding regional packaging material manufacturing is promoting the product use to elevate shelf appeal and strengthen brand identity, thereby positively influencing the market.

Competitive Landscape:

The market is shaped by continuous innovation in formulation technologies, application techniques, and aesthetic enhancements. Companies are focusing on improving color intensity, durability, and compatibility with diverse end-use industries such as automotive, cosmetics, and packaging. Market players compete by offering high-performance, eco-friendly products that meet evolving customer expectations. Strategic collaborations, regional market penetration, and industry-specific pigment solutions are helping firms expand their reach. According to the pearlescent pigment market forecast, demand is expected to grow as more sectors prioritize premium finishes and product differentiation, driving further investment in research, new product development, and supply chain integration.

The report provides a comprehensive analysis of the competitive landscape in the pearlescent pigment market with detailed profiles of all major companies, including:

- Aal Chem

- Altana AG

- BASF SE

- Brenntag SE

- Geotech International B.V.

- L’Arca Srl

- Merck KGaA

- Pritty Pearlescent Pigments Co. Ltd.

- RIKA Technology Co. Ltd.

- Sinoparst Science and Technology Co. Ltd.

- Smarol Industry Co. Ltd.

- Sudarshan Chemical Industries Limited

Latest News and Developments:

- March 2025: Sudarshan Chemical Industries Ltd. (SCIL) completed its acquisition of Germany-based Heubach Group via Sudarshan Europe B.V. The merger expands SCIL’s global footprint to 19 sites and strengthens its pigment portfolio.

- March 2025: ECKART unveiled advanced pigment innovations at ECS 2025 in Germany. Highlights included corrosion-resistant zinc pigments, radar-transparent coatings for autonomous vehicles, metallic rainbow and chrome dispersions, eco-friendly printing inks, and low-carbon aluminum pigments.

- September 2024: Pritty launched ChromaPura, a new pearlescent pigment line delivering pure, laser-like single-color interference effects using thick borosilicate platelets. Available in white, gold, red, purple, blue, and green, ChromaPura offers intense sparkle even at low dosages, with particle sizes ranging from 30–250 µm across the Iridesium series.

- July 2024: Merck agreed to sell its Surface Solutions pigments business to China’s Global New Material International (GNMI) for EUR 665 Million.

- July 2024: Eckart launched Syncrystal Garnet, a high-chroma red pigment with a bluish undertone, ideal for creating red and purple shades. Carmine-free and based on synthetic fluorphlogopite, it offers strong pearlescence, brilliance, and skin feel, while meeting EU, U.S. (21 CFR), and NMPA cosmetic regulations.

Pearlescent Pigment Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Natural Pearl Essence, Titanium Dioxide Mica, Ferric Oxide Mica, Combination Mica, Others |

| Forms Covered | Powder, Dispersion and Paste |

| Applications Covered | Paints and Coatings, Plastics, Printing Inks, Cosmetics, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Aal Chem, Altana AG, BASF SE, Brenntag SE, Geotech International B.V., L’Arca Srl, Merck KGaA, Pritty Pearlescent Pigments Co. Ltd., RIKA Technology Co. Ltd., Sinoparst Science and Technology Co. Ltd., Smarol Industry Co. Ltd., Sudarshan Chemical Industries Limited., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the pearlescent pigment market from 2019-2033.

- The pearlescent pigment market research report provides the latest information on the market drivers, challenges, and opportunities in the global market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the pearlescent pigment industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The pearlescent pigment market was valued at USD 1.93 Billion in 2024.

The pearlescent pigment market is projected to exhibit a CAGR of 4.86% during 2025-2033, reaching a value of USD 3.03 Billion by 2033.

Key factors driving the pearlescent pigment market include rising demand from the automotive, cosmetics, and packaging industries, growing consumer preference for aesthetic and luxury products, advancements in pigment technologies, expanding applications in plastics and coatings, and increasing investments in innovative, eco-friendly formulations to meet evolving regulatory and sustainability requirements.

In 2024, North America dominated the pearlescent pigment market, accounting for the largest market share of 35.0%. The growth is driven by strong demand from the automotive, cosmetics, and packaging industries, increasing consumer preference for premium products, technological advancements in pigment manufacturing, and rising investments in innovative product formulations.

Some of the major players in the pearlescent pigment market include Aal Chem, Altana AG, BASF SE, Brenntag SE, Geotech International B.V., L’Arca Srl, Merck KGaA, Pritty Pearlescent Pigments Co. Ltd., RIKA Technology Co. Ltd., Sinoparst Science and Technology Co. Ltd., Smarol Industry Co. Ltd., Sudarshan Chemical Industries Limited., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)