Pectin Market Size, Share, Trends and Forecast by Raw Material, End Use, and Region, 2026-2034

Pectin Market Size and Share:

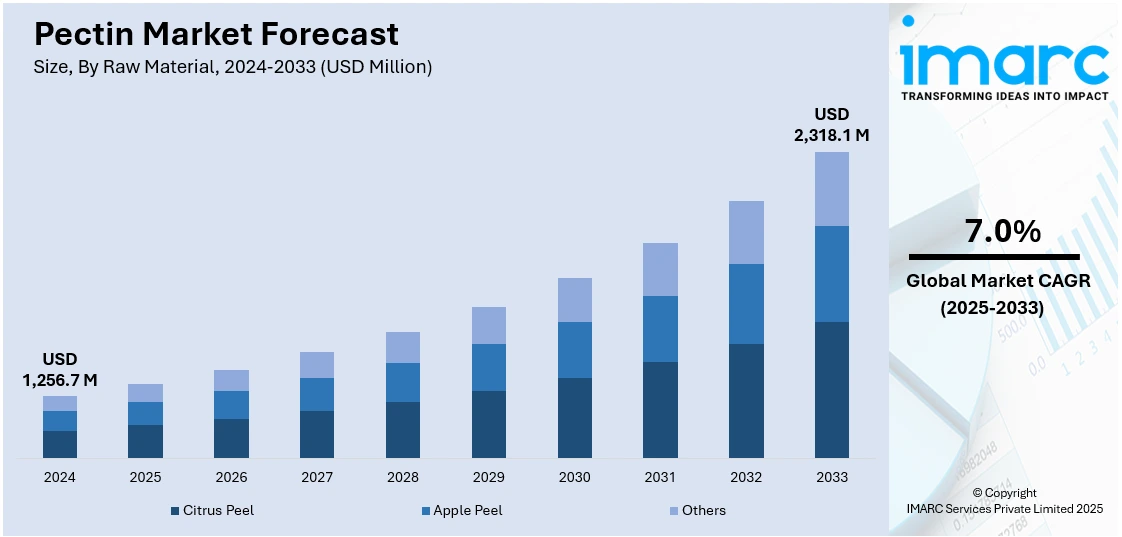

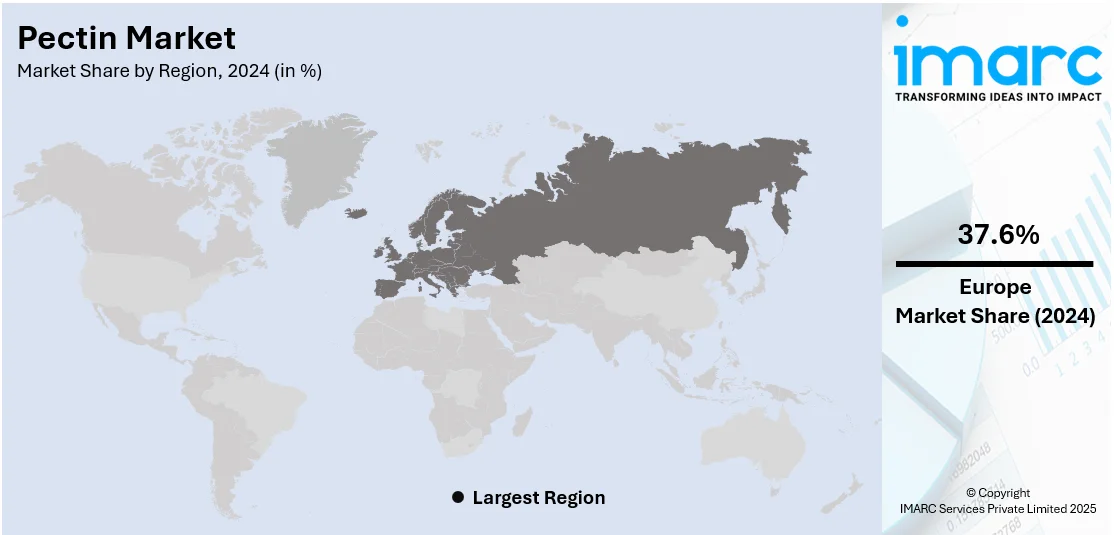

The global pectin market size was valued at USD 1,256.7 Million in 2025. Looking forward, IMARC Group estimates the market to reach USD 2,318.1 Million by 2034, exhibiting a CAGR of 7.0% during 2026-2034. Europe currently dominates the market, holding a significant market share of over 37.6% in 2024. The increasing product application across the thriving F&B industry due to its favorable physical and chemical characteristics, the rising demand for ready-to-eat (RTE) and packaged food products, and the growing demand for natural and clean labeled products due to escalating consumer concerns about the adverse health effect of synthetic additives represent some of the key factors driving the pectin market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 1,256.7 Million |

|

Market Forecast in 2034

|

USD 2,318.1 Million |

| Market Growth Rate 2026-2034 | 7.0% |

The international pectin market is witnessing strong growth driven by the growing consumer interest in natural and clean-label food ingredients. As a plant-based polysaccharide, pectin aligns with such a trend and finds application as a gelling agent and stabilizer in jams, jellies, and dairy products. Moreover, growing consumer awareness about health has led to a heightened demand for pectin, which is considered beneficial for digestive health as well as cholesterol management. Increased popularity for vegan and vegetarian diets also supports pectin's popularity since it is a substitute for gelatin in a range of products. Improved technology for pectin extraction and processing has enabled better production efficiency and quality of the products, facilitating greater market growth. In addition to this, growing food and drink industry in the emerging markets as well as improving urbanization and disposable incomes drives the pectin market even further.

To get more information on this market, Request Sample

The United States stands out as a key market disruptor, driven by its innovative methods and market forces. The country's intense focus on clean-label products has raised the demand for natural products such as pectin dramatically. This phenomenon is more common in the food and beverage sector, where pectin serves as a gelling agent and stabilizer for numerous products. The American market for clean-label pectin is growing rapidly, fueled by consumer demand for natural food ingredients and regulatory pressure to remove artificial additives. Furthermore, the U.S. has seen significant investment in pectin-related innovations. For example, Tate & Lyle's acquisition of CP Kelco, an American pectin and other natural ingredients supplier, reflects the strategic value of pectin to the American food industry. This shift is to expand product lines with natural ingredients that provide better food textures, consistent with the increasing consumers' need for healthy foods. The strong food processing infrastructure in the United States also guarantees a steady supply of raw materials like citrus and apple peels that contain plenty of pectin. This availability enables high-quality pectin production and asserts the nation's leadership in the international pectin market outlook.

Pectin Market Trends

Increasing Demand for Natural and Organic Products

Consumers are increasingly seeking natural and organic food products, along with a growing emphasis on health and wellness which represents one of the major factors driving the market growth. According to a report by the IMARC Group, the global organic food market is projected to reach USD 587.0 Billion by 2033, growing at a CAGR of 10.42% during 2025-2033. This shift is reflected in their preference for clean-label ingredients, which are perceived as healthier alternatives to synthetic additives. Pectin, a naturally occurring substance extracted from fruits, particularly citrus and apples, aligns perfectly with this trend. It serves as a natural gelling agent, thickener, and stabilizer, making it ideal for a wide range of applications, including jams, jellies, and fruit preserves. As more consumers opt for products with fewer artificial ingredients, the demand for pectin is expected to rise, further bolstering its market growth.

Expanding Applications in the Food and Beverage Industry

The processed food and beverage industry’s expansion is significantly boosting the demand for pectin, which is used as a stabilizer, thickener, and emulsifier in various products. For instance, in India, processed food accounted for 23.4% of total agricultural exports in the country during 2023-24, as per recent industry reports. Pectin is not limited to traditional uses in fruit preserves; its versatility has led to its adoption in various food products, including dairy items, bakery goods, and confectionery. In line with this, ready-to-eat foods, beverages, and dairy products benefit from pectin’s ability to improve texture, extend shelf life, and enhance mouthfeel. As urbanization and busy lifestyles drive demand for convenience foods, pectin’s versatile applications in functional and nutritious products make it an attractive ingredient for manufacturers. This growing industry, particularly in developing economies, provides substantial growth opportunities for the pectin market globally.

Growing Utilization in Pharmaceuticals and Nutraceuticals

Pectin’s functional properties, including its role as a stabilizer and texturizer, lead to its increased application in the pharmaceutical and personal care industries, which is acting as a major growth-inducing factor in the market across the globe. In pharmaceuticals, pectin is used in wound healing products and drug delivery systems, and it is an excipient in various formulations. In personal care products, it enhances texture and consistency, especially in lotions and creams. Its natural, hypoallergenic properties appeal to consumers seeking safer, more natural skincare ingredients, making it a valuable component. According to a study, more than 40% of consumers give natural ingredients top priority when purchasing cosmetics and personal care items. This diversification of pectin’s applications outside the food industry is significantly contributing to its market growth.

Pectin Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global pectin market, along with forecasts at the global, and regional levels from 2026-2034. The market has been categorized based on raw material, and end use.

Analysis by Raw Material:

- Citrus Peel

- Apple Peel

- Others

Citrus Peel stands as the largest component in 2024, holding around 75.0% of the market. According to the report, citrus peel represented the largest segment since it contains a larger percentage of pectin than other raw materials, thus guaranteeing a much higher yield. Besides this, the rising demand for natural and clean-label ingredients as gelling agents, thickeners, and stabilizers in various food and beverage products is presenting remunerative growth opportunities for the market. Moreover, widespread utilization of citrus peel as an active ingredient in drug formulations in the pharmaceutical industry and escalating awareness about potential health benefits, including cholesterol-lowering effects, immune system support, and anti-inflammatory properties, are contributing to the pectin market growth.

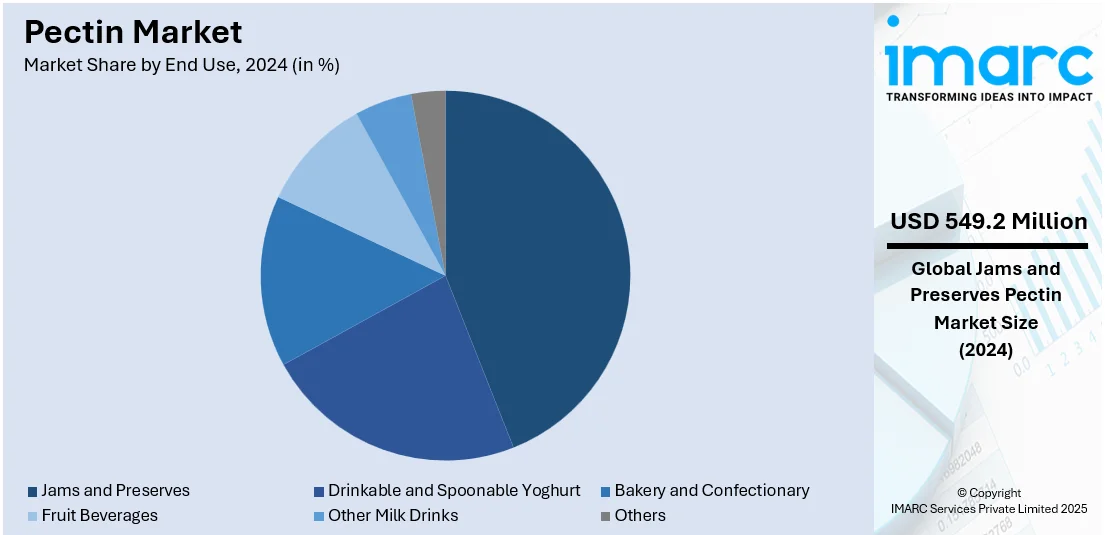

Analysis by End Use:

- Jams and Preserves

- Drinkable and Spoonable Yoghurt

- Bakery and Confectionary

- Fruit Beverages

- Other Milk Drinks

- Others

Jams and Preserves lead the market with around 43.7% of market share in 2024. According to the report, jams and preserves represented the largest segment due to the rising product utilization as a gelling agent, stabilizer, and thickener in jams and preserves. The use of pectin provides the desired consistency and texture to these food products, increasing their marketability and shelf life. The increasing consumer trend for natural, clean-label food ingredients has also supported the demand for pectin in jams and preserves, as it provides a plant-based option for replacing synthetic additives. Also, the growth in home cooking and home food preparation has helped drive greater pectin use, as consumers want to make commercial-grade spreads at home. All these factors together highlight the dominance of jams and preserves as a major use for pectin, mirroring wider trends in the food industry's move toward natural and wholesome ingredients.

Regional Analysis:

- Europe

- Asia

- North America

- Latin America

- Others

In 2024, Europe accounted for the largest market share of over 37.6%. Some of the factors driving the Europe pectin market included the well-developed food processing sector and consumer demand for organic and natural products. Major contributors include Germany, France, and the United Kingdom, using their advanced food manufacturing technology to develop diverse pectin-based products such as jams, jellies, and dairy products. The strict food safety standards of the region and focus on clean-label ingredients further support the use of pectin as a natural gelling agent and stabilizer. The trend toward diets that are plant-based and health-focused among European consumers is also driving the demand for pectin, in line with the trend toward vegan and vegetarian food. These reasons together make Europe a primary catalyst in the growth and innovation of the world pectin market.

Key Regional Takeaways:

United States Pectin Market Analysis

In 2024, the United States accounted for over 80.50% of the pectin market in North America. The United States pectin market is primarily driven by a combination of health-conscious consumer trends, technological advancements in food processing, and the growing demand for natural and clean-label ingredients. As consumers become increasingly aware of the health risks associated with synthetic additives, there is a rising preference for plant-based, non-GMO, and organic ingredients, which has significantly boosted the demand for pectin, a naturally occurring polysaccharide primarily derived from citrus fruits and apples. For instance, in 2021, organic retail sales accounted for approximately 5.5% of all retail food sales in the United States, exceeding USD 52 Billion, according to the United States Economic Research Service. Moreover, ranches and farms in the country sold almost USD 11 Billion worth of organic products in the same year. The expanding market for fruit-based products such as jams, jellies, fruit spreads, and beverages, where pectin serves as a gelling agent and stabilizer, further supports market growth. Additionally, the functional benefits of pectin, such as its role in improving digestive health due to its soluble fiber content, are aligning well with the broader wellness movement in the U.S. Regulatory support for natural additives and increased consumer demand for sustainable and traceable sourcing is also creating a favorable industry outlook overall.

Asia Pacific Pectin Market Analysis

The Asia Pacific pectin market forecast facilitates rapid urbanization, changing dietary habits, and a growing demand for processed and convenience foods. As per estimates by Worldometers, 53.6% of the population of Asia lives in urban areas in 2025, equating to 2,589,655,469 individuals. As the middle-class population expands in countries such as China, India, and Southeast Asian nations, there is an increased consumption of fruit-based products, dairy items, and beverages, where pectin is commonly used as a gelling, thickening, and stabilizing agent. The region’s rising health consciousness is also propelling the demand for natural, plant-based ingredients, with pectin gaining popularity due to its fiber content and digestive health benefits. Additionally, expanding pharmaceutical and personal care industries in Asia Pacific further contribute to market growth, as pectin is increasingly used in drug delivery systems and cosmetic products. Local production of citrus fruits and apples also provides a cost-effective source for pectin extraction.

Europe Pectin Market Analysis

The Europe pectin market is experiencing significant growth fueled by rising consumer demand for clean-label, plant-based, and functional food products. European consumers are increasingly prioritizing health, sustainability, and transparency in their food choices, which has led to a growing preference for natural additives such as pectin over synthetic thickeners and stabilizers. Pectin, primarily extracted from citrus peels and apple pomace, aligns well with these trends due to its natural origin, biodegradability, and health benefits, particularly its role in promoting digestive health and lowering cholesterol. Moreover, the increasing geriatric population in Europe is also contributing substantially to industry expansion, as older consumers seek functional foods that aid in digestion and cardiovascular health, all areas where pectin's soluble fiber content plays a beneficial role. In January 2024, 21.6% of the population in the European Union was aged 65 years and above. The expanding vegan and vegetarian population across Europe is also prompting food manufacturers to replace animal-derived ingredients such as gelatin with plant-based alternatives such as pectin. According to recent industry reports, 3.2% of the population in Europe is vegan. Other than this, Europe's focus on reducing food waste also supports pectin production through the valorization of fruit byproducts, making it both an economically and environmentally sustainable ingredient for the future.

Latin America Pectin Market Analysis

The Latin America pectin market is significantly influenced by the region's abundant availability of raw materials, particularly citrus fruits, which serve as a key source for pectin extraction. Countries such as Brazil and Mexico are major citrus producers, supporting both domestic production and export opportunities. Additionally, the growing food and beverage industry, particularly in processed fruit products, dairy, and confectionery, is increasing the demand for natural thickeners such as pectin. For instance, in 2020, the food and beverage sector in Brazil brought in USD 152 Billion in sales annually, recording a growth of 12.7% in nominal terms and 3.3% in real terms. Besides this, rising consumer awareness about health and wellness trends is also contributing to a shift toward clean-label and plant-based ingredients, further supporting market growth.

Middle East and Africa Pectin Market Analysis

The Middle East and Africa pectin market is being increasingly propelled by the rising demand for processed and convenience foods, fueled by rapid urbanization, population growth, and changing consumer lifestyles. According to reports, the population of Africa is estimated to be growing at an annual rate of 2.29% in 2025. As awareness about health and wellness increases, there is a growing preference for natural and clean-label ingredients, positioning pectin as a desirable alternative to synthetic additives. The expanding dairy, confectionery, and beverage sectors in countries such as South Africa, the UAE, and Saudi Arabia are also contributing to the uptake of pectin for its thickening, stabilizing, and gelling properties. Moreover, the rise in dietary concerns such as diabetes and obesity is boosting demand for low-sugar and fiber-rich products, further supporting pectin usage.

Competitive Landscape:

Major players in the pectin industry are emphasizing innovation, sustainability, and increasing production capacity to address increasing global demand. These initiatives involve the development of pectin types with enhanced functionality for targeted applications such as dairy, confectionery, and beverages. Several companies are also focusing on sustainability by streamlining extraction processes, employing green technology, and acquiring raw materials in a responsible manner, commonly citrus peels and apple pomace. Strategic alliances, joint ventures, and takeovers are further enhancing their position in the marketplace and facilitating new geographies' access. Along with this, these participants are improving their supply chain flexibility and operational efficiency for ensuring steady product quality and accessibility. Their active collaboration with regulatory authorities and involvement in international forums on food ingredients contribute to framing industry standards and upholding the value of natural hydrocolloids such as pectin. Together, these initiatives by market leaders are fueling market growth while framing consumer attitudes toward health, transparency, and sustainability in food production, making pectin an ingredient of choice for the future of functional and clean-label foods.

The report provides a comprehensive analysis of the competitive landscape in the pectin market with detailed profiles of all major companies, including:

- Cargill, Incorporated

- Ceamsa

- dsm-firmenich

- Foodchem International Corporation

- Herbstreith & Fox GmbH & Co. KG

- Ingredion Incorporated

- International Flavors & Fragrances Inc.

- Kraft Heinz

- Pacific Pectin Inc.

- Silvateam S.p.a

- Tate & Lyle PLC

Latest News and Developments:

- December 2024: Candy Pros, a leading manufacturer of candy and gummy bases, launched its newest invention, the Naked Gold Pectin Gummy Base. This novel product is intended to take the place of conventional gelatin-based alternatives and address frequent problems that operators encounter when using pectin or alternative vegan gelling compounds. The Naked Gold Pectin Gummy Base has quicker set times, improved heat stability, and a flavorless format, making it suitable for high-volume manufacturing without compromising quality.

- July 2024: Scientists from the U.S. Department of Agriculture (USDA)’s Agricultural Research Service (ARS) revealed that they have created a cost-effective and high-quality pectin that can effectively gel in low-sugar products and is also suitable for large-scale commercial production.

- September 2023: Cargill revealed the introduction of a new series of LM conventional (LMC) pectins created using proprietary technology to provide unique textures, which are suitable for products promoted with 'organic' labels.

Pectin Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD, Tons |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Raw Materials Covered | Citrus Peel, Apple Peel, Others |

| End Uses Covered | Jams and Preserves, Drinkable and Spoonable Yoghurt, Bakery and Confectionary, Fruit Beverages, Other Milk Drinks, Others |

| Regions Covered | Europe, Asia, North America, Latin America, Others |

| Companies Covered | Cargill, Incorporated, Ceamsa, dsm-firmenich, Foodchem International Corporation, Herbstreith & Fox GmbH & Co. KG, Ingredion Incorporated, International Flavors & Fragrances Inc., Kraft Heinz, Pacific Pectin Inc., Silvateam S.p.a, Tate & Lyle PLC, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the pectin market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global pectin market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the pectin industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The pectin market was valued at USD 1,256.7 Million in 2024.

The pectin market is projected to exhibit a CAGR of 7.0% during 2025-2033, reaching a value of USD 2,318.1 Million by 2033.

The pectin market is driven by rising demand for natural, clean-label food ingredients, increasing health awareness, and the growing popularity of plant-based diets. Its use in jams, dairy, and beverages, along with technological advancements in extraction and processing, further fuels market expansion across food, pharmaceutical, and cosmetic industries.

Europe currently dominates the pectin market, driven by demand for clean-label, low-sugar, and plant-based foods, alongside strong food processing industries and consumer preference for natural, vegan-friendly ingredients.

Some of the major manufacturers in the pectin market include Cargill, Incorporated, Ceamsa, dsm-firmenich, Foodchem International Corporation, Herbstreith & Fox GmbH & Co. KG, Ingredion Incorporated, International Flavors & Fragrances Inc., Kraft Heinz, Pacific Pectin Inc., Silvateam S.p.a, Tate & Lyle PLC, etc.

In 2024, the United States accounted for 80.50% of the pectin market in North America.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)