Periods Panties Market Size, Share, Trends and Forecast by Type, Style, Size, Distribution Channel, and Region, 2025-2033

Periods Panties Market Size and Share:

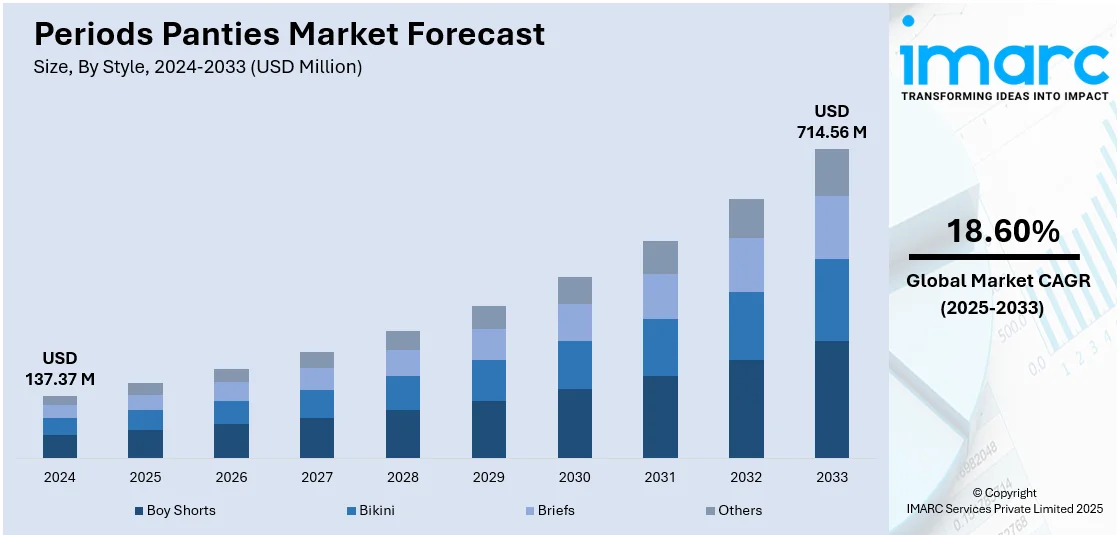

The global periods panties market size was valued at USD 137.37 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 714.56 Million by 2033, exhibiting a CAGR of 18.60% from 2025-2033. North America currently dominates the market, holding a market share of 40.5% in 2024. The shift toward eco-friendly alternatives to traditional menstrual products and rising consumer awareness are increasing the demand for period panties. In addition to this, the growing understanding regarding menstrual hygiene, product innovations in absorbent technology, expanding retail availability, and increasing focus on comfort and convenience are some of the major factors augmenting periods panties market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 137.37 Million |

| Market Forecast in 2033 | USD 714.56 Million |

| Market Growth Rate 2025-2033 | 18.60% |

The market is driven by increasing investments in sustainable textile innovations, leading to improved performance and comfort. Additionally, the market demand is supported by the expansion of premium hygiene products in emerging economies, driven by rising income levels and a greater willingness to spend on sustainable personal care. Moreover, the normalization of conversations around menstruation through online advocacy is contributing to wider product visibility. In addition to this, educational campaigns promoting menstrual hygiene management are promoting the adoption of alternative solutions like period panties. For instance, personal hygiene brand Pee Safe launched a comprehensive 360-degree marketing campaign for its disposable period panty, which has achieved nearly one million units sold since its introduction in April 2024.

The market in the United States is experiencing significant growth, driven by heightened consumer scrutiny of ingredient transparency and product certifications. Besides this, in alignment with sustainability goals, King County, Washington, adopted a policy targeting Zero Waste of Resources by 2030, aiming to prevent materials with economic value, whether reusable, resalable, or recyclable, from entering landfills. This policy reflects a broader cultural shift toward waste reduction, which is gaining significant traction among younger demographics. Within this context, the market is witnessing widespread adoption as consumers seek reusable menstrual products that align with their environmental values. Apart from this, direct-to-consumer (DTC) sales models and subscription services have enhanced brand loyalty and repeat purchase behavior. Moreover, the rise of femtech platforms offering personalized menstrual care recommendations has widened product exposure.

Periods Panties Market Trends:

Growing Penetration of E-Commerce

The expanding reach of e-commerce platforms is significantly transforming how consumers access menstrual hygiene products, including period panties. According to the International Trade Administration, global B2C e-commerce sales are projected to reach USD 5.5 Trillion by 2027, growing at a steady compound annual growth rate of 14.4%. The increasing normalization of personal care purchases online is opening space for menstrual hygiene products to gain visibility and traction. Period panties, in particular, benefit from this shift as consumers increasingly seek detailed product information, customer reviews, and convenient purchasing options, which are all readily available through online channels. The rise of targeted marketing, social media awareness, and influencer-driven endorsements further allows brands to build trust and educate new users about the benefits of reusable menstrual wear, thereby facilitating periods panties market growth. Additionally, these channels enable consumers to explore a wide range of styles, absorbency levels, and brand philosophies that may not be available in traditional retail outlets. Furthermore, the convenience of home delivery makes these products more accessible to rural and semi-urban populations, especially in regions with underdeveloped retail infrastructure.

Increasing Female Workforce Participation

The rise in female workforce participation is directly shaping demand for menstrual hygiene products that prioritize comfort, discretion, and practicality. In India, for example, women's involvement in employment and related activities increased from 21.8% in 2019 to 25% in 2024, indicating a steady shift toward greater workforce engagement. As more women enter industries that demand long working hours or physically active roles, there is a growing need for reliable solutions that minimize disruption during menstruation. Period panties, which combine absorbency with regular underwear styling, offer an all-in-one solution, reducing the need for frequent changes and backup products. This is especially valuable in workplaces where access to restrooms may be limited. Moreover, with professional attire in mind, many brands now offer period underwear with seamless designs, moisture-wicking fabrics, and odor-controlling properties to suit office and activewear. Furthermore, market demand is especially notable in regions undergoing social change, including parts of Asia-Pacific, Latin America, and the Middle East, where labor market reforms and gender parity initiatives are encouraging more women to join the workforce and seek modern menstrual products.

Increased Focus on Sustainability and Reusability

One of the emerging periods panties market tends is the rising environmental concerns and growing awareness around the ecological impact of disposable sanitary products. According to industry reports, about 80% of menstruation products in Europe and the US end up in landfills, with the disposable pads taking up to 500–800 years to decompose. This is prompting a shift in consumer behavior toward more sustainable alternatives that reduce waste generation. Period panties are reusable, machine-washable, and designed to last multiple cycles, which significantly reduces the volume of waste generated. Consumers, especially Millennials and Gen Z, are increasingly prioritizing eco-conscious brands and products that align with their values. Many companies now emphasize the use of organic cotton, bamboo, or other biodegradable textiles, along with transparent sourcing and ethical labor practices. Additionally, marketing campaigns frequently highlight the life-cycle savings of period panties, appealing to cost-conscious consumers looking to reduce long-term expenditure. As climate change discourse becomes more mainstream, the appeal of period underwear as a waste-reducing, zero-toxin alternative is expected to grow, especially among urban, environmentally aware buyers across North America and Europe.

Periods Panties Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global periods panties market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on type, style, size, and distribution channel.

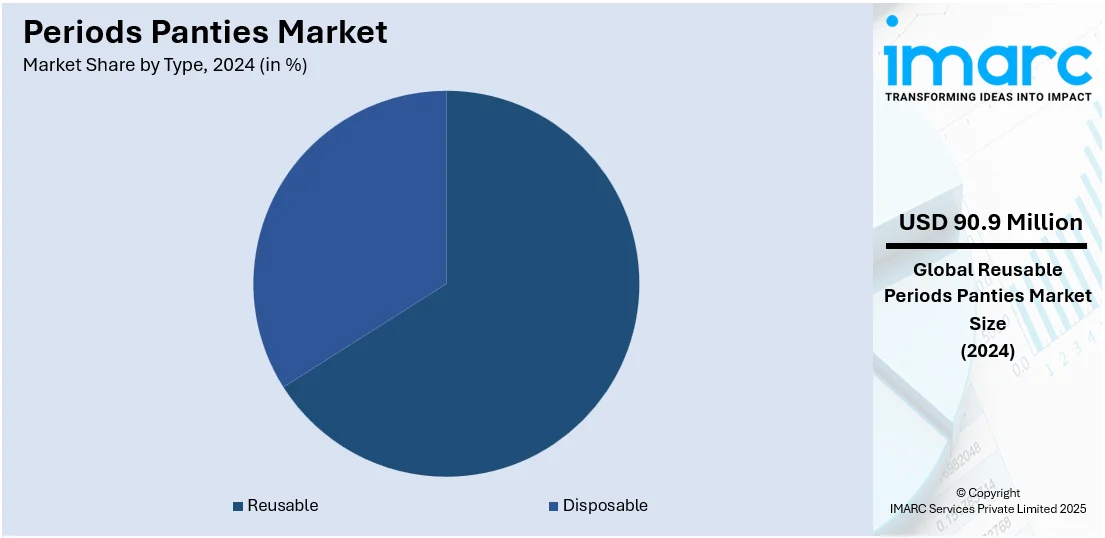

Analysis by Type:

- Reusable

- Disposable

Reusable leads the market with around 66.2% of market share in 2024. The segment is driven by the growing consumer preference for sustainable and cost-effective menstrual products. These panties are designed with absorbent, leak-proof layers that can be washed and worn multiple times, offering an eco-friendly alternative to disposable pads and tampons. Their popularity is rising among environmentally conscious consumers seeking to reduce single-use waste and lower long-term expenses. In addition, brands often highlight the health benefits of reusable options, which are typically free from harsh chemicals that are found in some disposable products. As menstrual equity gains attention, reusable period panties are also promoted as an accessible and dignified solution in both developed and underserved regions. With advancements in fabric technology improving comfort and absorption, the reusable segment continues to expand its market share, supported by awareness campaigns and broader discussions around sustainable menstrual hygiene practices.

Analysis by Style:

- Boy Shorts

- Bikini

- Briefs

- Others

Briefs lead the market with around 30.2% of market share in 2024. Briefs hold a strong presence in the market due to their familiar, full-coverage design and comfort, making them a preferred choice for users across age groups. Their high-rise fit and secure structure offer enhanced protection against leaks, especially during heavy flow days or overnight use. Many consumers favor briefs for their body-hugging shape, which keeps absorbent layers in place and provides a sense of security. Brands often promote briefs as a dependable everyday option, combining functionality with discreet wear under clothing. The style appeals particularly to first-time users and teenagers transitioning from traditional menstrual products, as it resembles standard underwear but with added benefits. With rising demand for practical, comfortable period solutions, briefs remain one of the top-selling styles, forming a core offering in most product lines and supporting inclusive sizing and varying absorbency levels for different needs.

Analysis by Size:

- Small

- Medium

- Large

Medium leads the market in 2024. Medium size segment often represents the standard or most in-demand fit across product lines. It caters to a broad segment of the consumer base, including individuals with average waist and hip measurements, and typically serves as the reference point for sizing guides. As it aligns with the most common body proportions, medium size is usually the first to sell out and the most frequently restocked. Brands often use medium-sized models in marketing to reflect relatability and ensure fit accuracy for a wide audience. Its demand also provides key feedback for manufacturers when refining fit, comfort, and absorbency levels. In product development and inventory planning, medium size drives production volume and helps balance cost-efficiency. Its prominence reflects broader consumer patterns and plays a key role in the accessibility and effectiveness of menstrual underwear across markets.

Analysis by Distribution Channel:

- Supermarkets/ Hypermarkets

- Convenience Stores

- Retail Stores

- Online Stores

- Others

Supermarkets/hypermarkets lead the market with around 38.5% of market share in 2024. Supermarkets and hypermarkets are known for their wide consumer reach and ability to offer diverse product ranges under one roof. These large-format stores provide strong visibility for brands, allowing consumers to compare multiple offerings based on price, comfort, absorbency, and sustainability. Their high footfall ensures that period panties are discovered not just by intentional buyers but also by impulse shoppers, which can drive trial and adoption. Additionally, supermarkets and hypermarkets often collaborate with brands for in-store promotions, discounts, and exclusive launches, making them influential in driving volume sales. The ability to physically examine the product, especially in a category associated with comfort and intimate wear helps build trust and encourage conversion. As affordability and convenience remain key consumer priorities, the shelf presence in these channels supports market expansion across both urban and semi-urban regions.

Regional Analysis:

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East

- Africa

In 2024, North America accounted for the largest market share of over 40.5% driven by increasing consumer awareness around menstrual hygiene, sustainability, and comfort. The region has witnessed growing acceptance of reusable menstrual products, driven by rising environmental concerns and the desire to reduce single-use plastic waste. Consumers in the United States and Canada, particularly millennials and Gen Z, are shifting toward eco-friendly alternatives, supporting demand for period panties. High levels of disposable income, a strong presence of innovative brands, and a well-established e-commerce ecosystem further support market expansion. Additionally, educational campaigns and influencer-led promotions have normalized discussions around menstruation, encouraging product trials and adoption. The region also benefits from advancements in textile technology, allowing manufacturers to offer high-performance, leak-proof, and comfortable designs tailored to diverse body types. North America serves as both a major consumer base and an innovation hub in the global market.

Key Regional Takeaways:

United States Periods Panties Market Analysis

The market in the United States is significantly expanding due to rising awareness regarding sustainable menstrual hygiene products and increasing conversations around body positivity and menstrual health. Younger demographics, particularly Gen Z and Millennials, are driving this shift as they prioritize comfort, convenience, and eco-friendliness. According to industry reports, one in four teens and one in three adults in the United States struggle to afford period products, with the issue being especially pronounced among teens of color and individuals from lower-income households. In response, government bodies and leading brands are initiating efforts to make menstrual products more accessible by offering affordable yet high-quality options. This push for inclusivity and affordability is influencing the growth of the market, which is gaining popularity as a cost-effective and reusable alternative to disposable products. Moreover, regulatory clarity around FDA classifications and safety standards is contributing to consumer trust. Also, continual product innovations such as antimicrobial fabrics, moisture-wicking layers, and odor-control technologies are enhancing the periods panties market outlook. Furthermore, retail partnerships with large stores are extending market reach. In addition to this, insurance coverage and workplace menstrual equity policies are opening new avenues for institutional adoption.

Europe Market Periods Panties Analysis

The market in Europe reflects a mix of environmental awareness, progressive menstrual education, and supportive government policies. Countries like Germany, France, and the UK are at the forefront, where consumers are increasingly shifting away from disposable sanitary products. Moreover, European manufacturers are strengthening their foothold by offering locally produced, ethically sourced options. The market is also supported by a growing emphasis on product customization for teens, postpartum users, and perimenopausal women. Furthermore, industry reports show that in the country, 94% of individuals aged 16 to 74 used the internet in 2024, with 77% of them purchasing goods or services online. This strong digital engagement is significantly supporting the growth of the periods panties market in Europe, where online platforms serve as a key distribution channel. Consumers are increasingly discovering and purchasing period underwear through brand websites and e-commerce marketplaces, drawn by the convenience of home delivery, detailed product information, and peer reviews. While online sales remain dominant, premium period panties are also gaining shelf space in specialty stores and pharmacies for consumers who prefer in-person shopping. The widespread use of digital media for health and sustainability education further reinforces demand as consumers become more informed about the environmental and long-term cost advantages of reusable menstrual products.

Asia Pacific Periods Panties Market Analysis

The market in the Asia Pacific is expanding steadily, propelled by rising urbanization, increasing female workforce participation, and growing interest in sustainable lifestyle choices. Emerging economies, including India and China, are showing promise due to rising menstrual hygiene awareness and improvements in disposable incomes. The region also benefits from a strong textile manufacturing base, which facilitates local production and affordability. According to industry reports, 84% of secondary schools in Central and Southern Asia provide menstrual education, compared to just 34% at the primary school level. This growing emphasis on menstrual awareness, particularly among adolescents, is helping to break taboos and encourage informed choices about menstrual hygiene products. As a result, interest in alternatives such as period panties are gradually rising across parts of Asia, especially in urban centers where education and accessibility are improving. In addition to this, online retail platforms are crucial in market penetration, especially for new or niche brands. As the market matures, localization, affordability, and partnerships with schools or community programs are becoming significant factors propelling the growth of the market across the region.

Latin America Periods Panties Market Analysis

In Latin America, the market for period panties is gaining traction, especially among urban, environmentally conscious consumers. The penetration of international brands and the rise of local start-ups are both contributing to category visibility. Additionally, distribution across Latin America is primarily digital-first, with social media platforms emerging as key channels for customer education and brand discovery. This is especially relevant in countries like Mexico, where digital engagement is high. For instance, as per industry data, the country had around 90.20 million social media users as of January 2024, which represents 70.0% of the total population. The widespread usage of social platforms in the region offers brands an effective route to build awareness, share product benefits, and connect directly with consumers. Moreover, local brands that emphasize ethical sourcing, biodegradable packaging, and community empowerment are gaining credibility. The market outlook remains positive due to a growing focus on gender equality, sustainability, and public health awareness across the region. Furthermore, the affordability of period panties compared to disposable alternatives is still debated, but consumers are increasingly willing to invest in reusable solutions due to long-term cost savings.

Middle East and Africa Periods Panties Market Analysis

The market in the Middle East and Africa shows growth potential driven by evolving consumer attitudes, international exposure, and health campaigns. In many parts of the Middle East and rural Africa, cultural norms around menstruation are gradually beginning to shift, creating space for more open discussion and improved access to menstrual products. In sub-Saharan Africa, for example, schools are increasingly recognizing the importance of menstrual support, with 12% already offering products for free or purchase, which is a foundational step toward broader change. This evolving landscape is opening new avenues for innovative solutions like period panties, which offer a discreet, comfortable, and sustainable option well-suited to the needs of young women in these regions. In addition to this, NGOs and health organizations working on menstrual hygiene projects are introducing these products in low-income areas. Furthermore, brands offering modest designs, antibacterial fabrics, and inclusive sizing are likely to see better reception. Besides this, strategic partnerships with schools, health clinics, and women’s cooperatives help boost education and access, making this a gradually emerging segment with long-term promise.

Competitive Landscape:

The market is characterized by high competition, fueled by increasing awareness about menstrual health, sustainability, and convenience. Companies compete based on highlighting distinct absorbency technologies, skin-friendly materials, and leak-resistant designs for varying flow levels. Furthermore, innovation in moisture-wicking, odor management, and seamless construction is a major differentiator in the market. Consumer loyalty tends to be driven by brand comfort, transparency, and environmental awareness, which creates value-based positioning as a key market driver. New entrants frequently disrupt the space through aggressive digital marketing and influencer outreach. In contrast, major players are venturing into their product offerings by introducing inclusive sizes and green materials. As per the periods panties market forecast, the market will experience a consistent demand in regions such as North America, Europe, and select countries in Asia-Pacific in the upcoming years. This is driven by price consciousness among consumers, the ease of online purchases, and subscription-based services, which further shape market dynamics.

The report provides a comprehensive analysis of the competitive landscape in the periods panties market with detailed profiles of all major companies, including:

- Clovia

- Anigan (Ourgoodbrands)

- Dear Kate

- Neione

- Ruby Love

- Proof

- Knix Wear, Inc.

- Get Rael

- Saalt, LLC

- Victoria's Secret

- FANNYPANTS

- The Period Company

- Thinx, Inc.

- Modibodi

Latest News and Developments:

- On March 7, 2025, Eve Essentials announced its partnership with Sasmira's Business Incubation Centre to launch sustainable period panties aimed at revolutionizing menstrual hygiene in India. The initiative focuses on providing eco-friendly, reusable alternatives to conventional menstrual products, addressing both environmental and health concerns. This collaboration also emphasizes promoting menstrual awareness and empowering women through sustainable innovation.

- On December 3, 2024, INTIMINA, a Swedish women's health brand, introduced its Bloom Period Underwear, designed to provide a sustainable and comfortable alternative to menstrual care. The product is crafted from 95% organic cotton and 5% spandex. It features a super-absorbent, breathable gusset capable of holding up to 20 ml of liquid equivalent to four regular tampons without the use of harmful chemicals like PFAS and is OEKO-TEX certified. This launch aligns with the growing demand for eco-friendly menstrual products, aiming to reduce the environmental impact of disposable items.

- On March 27, 2024, Eicher Goodearth Private Limited officially launched Mahina, a reusable, leak-proof period underwear brand designed to eliminate the need for pads, tampons, or menstrual cups. Mahina's products feature a three-layered gusset made from natural materials, offering up to 12 hours of protection and are engineered using advanced bonding technology to ensure leak-proof seams. The product is available in four absorbency levels. These durable undergarments are designed to last up to two years or 100 washes, setting a new standard in sustainable menstrual hygiene in India.

Periods Panties Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Reusable, Disposable |

| Styles Covered | Boy Shorts, Bikini, Briefs, Others |

| Sizes Covered | Small, Medium, Large |

| Distribution Channels Covered | Supermarkets/Hypermarkets, Convenience Stores, Retail Stores, Online Stores, Others |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East, Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Clovia, Anigan (Ourgoodbrands), Dear Kate, Neione, Ruby Love, Proof, Knix Wear, Inc., Get Rael, Saalt, LLC, Victoria's Secret, FANNYPANTS, The Period Company, Thinx, Inc., Modibodi, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the periods panties market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global periods panties market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the periods panties industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The periods panties market was valued at USD 137.37 Million in 2024.

The periods panties market is projected to exhibit a CAGR of 18.60% during 2025-2033, reaching a value of USD 714.56 Million by 2033.

The market is driven by growing awareness regarding menstrual hygiene, increasing demand for eco-friendly and reusable alternatives to disposable sanitary products, and rising comfort and leak-proof innovations. Expanding female workforce participation and lifestyle changes are also increasing the adoption of convenient menstrual wear solutions.

North America currently dominates the periods panties market, accounting for a share of 40.5% in 2024. The dominance is fueled by high consumer awareness, strong presence of sustainable brands, rising environmental concerns, and early adoption of innovative feminine hygiene products, alongside higher disposable incomes and proactive marketing strategies.

Some of the major players in the periods panties market include Clovia, Anigan (Ourgoodbrands), Dear Kate, Neione, Ruby Love, Proof, Knix Wear, Inc., Get Rael, Saalt, LLC, Victoria's Secret, FANNYPANTS, The Period Company, Thinx, Inc., and Modibodi, among others.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)