Pet Accessories Market Size, Share, Trends, and Forecast by Product Type, Pet Type, Distribution Channel, and Region, 2025-2033

Pet Accessories Market Size and Share:

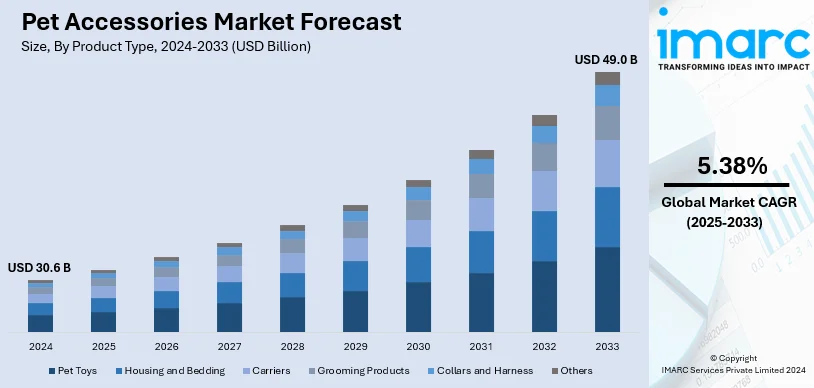

The global pet accessories market size was valued at USD 30.6 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 49.0 Billion by 2033, exhibiting a CAGR of 5.38% from 2025-2033. North America currently dominates the market, holding a market share of over 41.4% in 2024. The increasing pet ownership, rapid technological advancements in pet care products, heightened awareness about pet health and wellness, the expansion of online retail platforms, and the rising disposable incomes among consumers, are some of the major factors driving the market growth in this region.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 30.6 Billion |

| Market Forecast in 2033 | USD 49.0 Billion |

| Market Growth Rate (2025-2033) | 5.38% |

The global market for pet accessories is experiencing growth in demand due to increased pet ownership and humanization of pets where animals are treated as family members. Moreover, increased disposable income leads consumers to invest in premium and innovative products like smart pet gadgets and eco-friendly accessories. E-commerce websites enhance pet accessories products accessibility as well as availability at affordable price options with a range, and this contributes significantly towards the market growth. Pet well-being awareness has driven the demand for products like orthopedic beds, activity trackers, and grooming tools. Seasonal and festive-themed accessories are also boosting the market, as consumers have an affinity to celebrate pets in novel and personalized ways.

The COVID-19 pandemic has also significantly impacted the pet accessories market. There was an initial burst of pent-up demand following more adoptions during the lockdowns, driving up the purchase of several pet accessories, such as grooming products, bedding items, and toys. Despite the supply chain disruptions due to manufacturing and shipping delays, such high purchasing behavior seen by pet parents amidst the economic downturn fueled significant growth in sales of pet accessories.

The last two years saw an increasing trend in pet ownership contributing to significant growth in the market for pet accessories. Consumers now are more aware about purchasing high-quality, functional, and fashionable pet accessories - including grooming tools, fashion accessories, and medical products for their pet animals. Furthermore, the readily available information through social networking and social media influencers is helping to create awareness about innovative pet products, further driving the market growth.

The United States is also emerging as a prominent market, holding 83.4% market share. The prime factor driving market expansion is the increasing rate of pet ownership. As of 2023, 66% of American households, or 86.9 million homes, own a pet. With an increased rate of owning a pet, there is high spending on pet-related products and services. In 2023, Americans spent $147 billion on their pets, and according to projections, this is expected to reach $150.6 billion in 2024. Pet humanization, whereby pets are considered part of the family, has driven demand for premium and personalized accessories. Apart from this, the rise in e-commerce sites has exposed consumers to a wide variety of pet accessories, thereby propelling market growth.

Pet Accessories Market Trends:

Increasing Pet Ownership and Humanization of Pets

There is an increased number of households owning pets, including dogs, cats, birds, and small mammals. Such an increase is because of several factors such as lifestyle changes, a population aged and seeking companionship, and an increasing awareness of the benefits that pets provide for mental and physical well-being. As people are opening up their homes to welcome pets, the demand for pet accessories, such as beds, toys, grooming products, and apparel, rises. For instance, according to an industrial report, around 66% of U.S. households own a pet. In 2022, Americans spent nearly USD 136.8 Billion on their pets, 11% up as compared to 2021. In line with this, dogs are the most popular pet in the U.S. Nearly 65.1 million U.S. households own a dog. These factors are adding to the pet accessories market demand. Furthermore, pets are increasingly regarded as part of the family. They are no longer viewed as mere animals. The humanization of pets has resulted in changes in consumer behavior and preferences. For instance, 97% of people treat their pets to be part of their family. These pet accessories trends are further increasing the market demand. Moreover, pet owners are willing to invest more in their pets' comfort, health, and happiness, driving demand for high-quality, aesthetically pleasing, and functional accessories. For instance, the amount spent on pets in the United States rose from USD 90.5 Billion to USD 136.8 Billion between 2018 and 2022, a 51.16% rise. In line with this, Americans spent around USD 58.1 Billion on treats and food for their pets, USD 31.5 Billion on supplies, live animals, and over-the-counter drugs, USD 35.9 Billion on veterinary care, and USD 11.4 Billion on other services (all services other than veterinary care such as boarding, grooming, pet insurance, and training) in 2022.

Rapid Advancements in Technology and Product Innovation

Technology has transformed the pet accessories market by introducing smart and connected devices that are meant to make the lives of pets and their owners better. According to an industrial report on IOT, at the end of 2023, there were 16.6 Billion connected IoT devices, which grew by 15% from 2022. Some examples are smart pet feeders, which can dispense food on a schedule or controlled remotely via a smartphone app, automated litter boxes, which self-clean, and pet cameras that allow owners to monitor and interact with pets while away from home. Recently, for example, PETLIBRO, a smart pet supply brand in U.S., debuted the One RFID Pet Feeder in January 2024. This cutting-edge pet feeder integrates RFID pet recognition technology, meaning that before the One RFID Pet Feeder actually opens the food bowl lid to serve food, the identity of a pet attached with an RFID tag will have already been verified. Besides addressing common problems in multi-pet households, such as food theft, food aggression, weight control, and the need to separate prescription food, this ensures that each pet gets the right nutrition at the right time. These innovative products offer convenience, peace of mind, and new ways for pet owners to care for and bond with their pets, further stimulating the industry growth. In addition, pet accessories that feature interactive technology and enrichment capabilities have gained popularity with pet owners who want to keep their pets mentally stimulated and engaged. Interactive toys featuring sensors, lights, sounds, and motion detectors can offer hours of entertainment and exercise for pets, thus reducing boredom and behavioral problems like excessive chewing or scratching. These factors are also expected to drive the revenue of the pet accessories market.

Growing E-Commerce Platforms and Product Innovation

According to an industrial report, in 2023, global retail e-commerce sales reached an estimated USD 5.8 trillion. The convenience and accessibility offered by the online retail and e-commerce platforms to pet owners with respect to browsing and purchasing their pet accessories from the comforts of their homes is unparalleled. The convenience factor has actually added to the overall growth of the pet accessories market online as consumers can easily find the product and make a purchase without visiting the physical stores for it. In fact, in June 2022, PetKonnect-a leader in online aggregation of pet products and services in India, launched an online prescription medication delivery service and an e-commerce platform for pet-related merchandise to provide the best offerings and medications to customers to keep their furry friends from their homes anywhere in India. Furthermore, e-commerce platforms offer easy access to a wide variety of pet accessories from brands that are well-known and even small, independent designers. This broader product selection allows the pet owner to explore and compare prices and features between different products to find just the right accessories for their pet. Apart from this, several organizations are hosting pet-specific events and activities, which is further boosting the demand for pet-related items.

Pet Accessories Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global pet accessories market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on product type, pet type, distribution channel, and region.

Analysis by Product Type:

- Pet Toys

- Housing and Bedding

- Carriers

- Grooming Products

- Collars and Harness

- Others

Housing and bedding leads the market with around 30.2% of market share in 2024. According to the pet accessories market overview, housing and bedding represent the largest market share, as it encompasses a variety of products tailored to provide comfort and security for pets. It includes various items like beds, cushions, crates, and indoor kennels. Moreover, the growing prevalence of pet humanization, encouraging owners to seek products that provide comfort and align with their home decor and lifestyle choices, is boosting the market growth. In addition to this, the development of orthopedic and hypoallergenic bedding options, temperature-controlled beds, and aesthetically pleasing and space-efficient designs are strengthening the market growth. For instance, in March 2023, Discover NIGHT, a beauty textiles company, launched its first-to-market Silk Pet Bed. The Discover NIGHT Silk Pet Bed is intended to provide anti-shedding, allergy, and skin irritation protection to pets of all breeds. The ultra-comfortable pet bed is made of 90% Mulberry Silk and 10% Spandex, which has been lab-certified to meet the strictest durability standards for pet beds.

Analysis by Pet Type:

- Dogs

- Cats

- Horse

- Rabbits

- Others

Dogs lead the market with around 55.3% of the market share in 2024. As per the pet accessories market outlook, dogs hold the largest market share as their products in the segment include several items that are designed to cater to the diverse needs of dogs. They include a variety of toys, bedding, grooming products, food and water bowls, leashes, collars, and health care items. Furthermore, rapid innovation in dog accessories that focus on enhancing the health, comfort, and safety of dogs, such as orthopedic beds for older dogs, smart collars with health monitoring features, and ergonomic harnesses, is acting as a growth-inducing market. Moreover, the inclusion of specialized products for training and behavior modification is also positively impacting the pet accessories market forecast. For instance, in February 2024, PawCo Foods, a plant-based pet nutrition business dedicated to providing high-quality, sustainable, and scientifically developed food for dogs, announced a USD 2 Million seed investment by Elevate Ventures and several angel investors, including Dropbox.

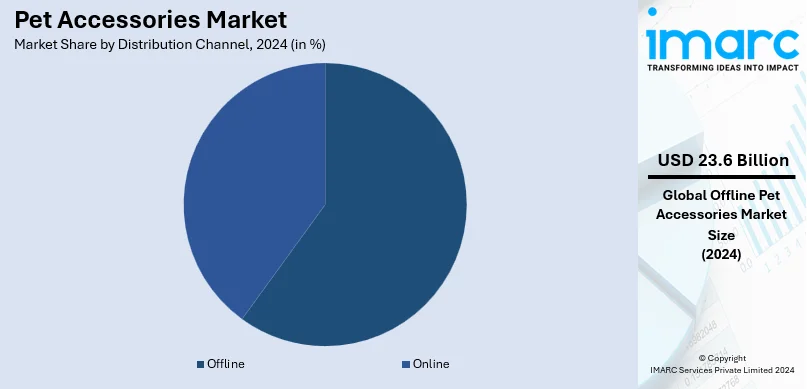

Analysis by Distribution Channel:

- Offline

- Online

Offline leads the market with around 77.2% of market share in 2024. Offline channels represent the largest share of the market, encompassing various retail channels such as pet stores, supermarkets, and specialty stores. Moreover, the increasing popularity of offline channels due to the tactile nature of shopping for pet accessories, as consumers prefer to physically examine products before purchasing, is contributing to the market growth. Pet owners value the ability to assess the size, quality, and suitability of items like beds, collars, and toys in person. Additionally, offline channels provide immediate gratification with no waiting time for delivery. Along with this, specialist pet stores provide the added advantage of expert advice and a wider range of products specifically tailored to pets.

Regional Analysis:

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of over 41.4%. According to the pet accessories market statistics, North America represents the largest market share, driven by high pet ownership rates, substantial spending on pet care, and a strong presence of pet accessory manufacturers and brands. Moreover, the increasing humanization of pets in the region, leading to higher expenditure on premium and luxury pet products, is fostering the market growth. Additionally, the market is characterized by the availability of a wide range of products, including advanced technological items like global positioning system (GPS) trackers and automated feeders, along with health-focused products, such as organic foods and wellness supplements. For instance, in December 2023, PE-backed Thrive Foods acquired Canature, a pet food company based in Canada.

Key Regional Takeaways:

United States Pet Accessories Market Analysis

The U.S. pet accessories market is at a driven stage due to the high rate of pet ownership, increasing pet humanization trends, and demand for more innovative and premium products. Smart feeders, GPS collars, and ergonomic beds are gaining popularity as pet owners focus on convenience and pet wellness. Sustainability is another significant trend, as the use of eco-friendly toys and biodegradable accessories rise. The e-commerce platforms also include Chewy and Amazon, which are growing and increasing access to pet accessories. According to world animal foundation, a total of 66% of U.S. households, or 86.9 million homes, had a pet in 2023. Among dog owners, 81% purchased gifts for their dogs during the holiday season, while 36% marked the birthday of their pet with gifts. The percentage of pet owners who prefer smart pet accessories saw an 18% year-over-year growth in 2023, evidencing growing demand for technology-driven products. In addition, 45% of dogs frequently wear accessories such as harnesses, collars, or sweaters.

Europe Pet Accessories Market Analysis

In Europe, the drivers for the pet accessories market are seen as rising in relation to pet humanization, sustainability, and premiumization. Pet owners are looking more and more toward accessories made from environmentally friendly materials, such as hemp leashes and bamboo feeding bowls. Technological advancements in the region also saw the development of smart pet gadgets, which include trackers and feeders, and are gaining traction today. Countries with high rates of pet ownership, such as Germany, France, and the UK, demonstrate strong demand for innovative pet products.

The UK alone accounts for around 13.5 million pet dogs and 12.5 million pet cats. According to dogster (pet industry statistics 2024), more than 42% of dog and cat owners in Europe spend on premium pet accessories. About 25% of pet owners in Germany utilize technology-driven accessories, such as GPS collars and activity trackers, to monitor the pets. Sustainability has also become a trend with a 30% increase in sales of eco-friendly pet products from 2022 to 2023.

Asia Pacific Pet Accessories Market Analysis

Asia Pacific's pet accessories market is quite fast-paced due to growing pet humanization, increasing disposable incomes, and urbanization. Owners seek premium and innovative products, such as designer pet clothing, multifunctional carriers, and smart feeders. Since single households are increasingly seen in urban cities, expenses associated with pets increase, with online sales from e-commerce sites such as JD.com and Flipkart further propelling the market for pet accessories. According to financial times, China is poised to have more pets in cities than children under the age of four by 2024, and by 2030, urban pets might be twice that of young children. Currently, India has the fastest growing pet population. Estimated in 2023, 32 million dogs are pet-owned in the country. Among all the pet owners in the region, 55% buy accessories such as harnesses, toys, and feeders. Technological advancements have been strong growth areas; 20% of China's pet owners use smart pet devices.

Latin America Pet Accessories Market Analysis

Latin American pet accessories market is driven by rising pet ownership, urbanization, and an increasing middle-class population. Affordable yet high-quality accessories, including collapsible bowls, climate-adapted clothing, and multifunctional leashes, are attracting more interest from pet owners. Another growth driver in the region comes in the form of rising e-commerce adoption, improving access to a wider range of products. In the Brazil 2023 study, some 46 percent of households owned a pet, with dogs as the most common. Mexico is not far behind, with a 38 percent pet ownership rate. About 60 percent of pet owners in the region buy at least one accessory per year, with 25 percent spending on premium items like orthopedic beds or GPS collars. Medical tourism destinations like Costa Rica have also encouraged demand for travel-friendly pet accessories, so this also contributes to regional growth.

Middle East and Africa Pet Accessories Market Analysis

The middle East and Africa pet accessories market is propelled by the growth in disposable incomes, shift in cultural beliefs, and urbanization. Pet owners are increasingly making purchases of accessories to ensure pet comfort, such as cooling vests, hydration solutions, and luxury carriers. Sustainability is emerging as an important trend. Regional manufacturers are offering regional biodegradable products.

According to world animal foundation, 7.4 million households in South Africa owned a pet in 2023, with dogs being the most common. In the UAE, 55% of owners reported spending on accessories climate-specific items like cooling mats. Saudi Vision 2030 encourages the growth of pet-friendly spaces, contributing to a 12% annual increase in travel or outdoor accessory sales for pets. The growth of e-commerce in the region has also been contributed to online accessory sales, at 24% of revenue in 2023.

Competitive Landscape:

Major players in the market are engaging in a variety of strategic activities to maintain and enhance their market positions. They are investing in research and development (R&D) to innovate technologically advanced products that cater to the evolving needs of pet owners. Moreover, some companies are focusing on creating smarter, connected products that integrate with mobile technology, such as global positioning system (GPS) trackers for pets, automated feeders, and health monitoring devices. Besides this, several players are expanding their product ranges to include eco-friendly and sustainable options, responding to the heightened consumer demand for environmentally responsible products.

The report provides a comprehensive analysis of the competitive landscape in the pet accessories market with detailed profiles of all major companies, including:

- Ancol Pet Products Limited

- Bed Bath & Beyond Inc.

- Blueberry Pet

- Cycle Dog LLC

- Designer Pet Products

- Ferplast S.p.A.

- Honest Pet Products

- Inter IKEA Systems B.V.

- Muttluks Inc.

- Platinum Pets LLC

- Radio Systems Corporation

- Rolf C. Hagen Inc.

- Rosewood Pet Products Ltd.

- Simply Fido LLC

- The Hartz Mountain Corporation (Unicharm Corporation)

Latest News and Developments:

- November 2024: Louis Vuitton, a French fashion house, announced the launch of its latest pet accessory- a lavish genuine leather kennel trunk.

- August 2024: Dolce & Gabbana, Italian luxury brand, announced expansion of its opulent product line to cater to a new clientele- dogs. They launched alcohol free scented mist-dog perfume.

- April 2024: Honda launched a new range of pet-friendly travel accessories for Honda WR-V. These accessories are designed to elevate the travel comforts for pets.

- March 2024: Enami signed an agreement to invest Rs 1.95 crore in Cannis Lupus Services India, which is engaged in the business of services for pets.

- December 2023: Celine launched a new collection of luxury dog accessories to upscale the overall look of the pet. This range showcases supple suedes and smooth calfskin.

Pet Accessories Market Report Scope:

| Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Pet Toys, Housing and Bedding, Carriers, Grooming Products, Collars and Harness, Others |

| Pet Types Covered | Dogs, Cats, Horse, Rabbits, Others |

| Distribution Channels Covered | Offline, Online |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Ancol Pet Products Limited, Bed Bath & Beyond Inc., Blueberry Pet, Cycle Dog LLC, Designer Pet Products, Ferplast S.p.A., Honest Pet Products, Inter IKEA Systems B.V., Muttluks Inc., Platinum Pets LLC, Radio Systems Corporation, Rolf C. Hagen Inc., Rosewood Pet Products Ltd., Simply Fido LLC, The Hartz Mountain Corporation (Unicharm Corporation), etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the pet accessories market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global pet accessories market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the pet accessories industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

Pet accessories are non-essential products designed to enhance the comfort, health, safety, and enjoyment of pets. These items include toys, beds, collars, grooming tools, carriers, and apparel, catering to various pet types like dogs, cats, and other small animals.

The pet accessories market was valued at USD 30.6 Billion in 2024.

IMARC estimates the global pet accessories market to exhibit a CAGR of 5.38% during 2025-2033.

The market is driven by increasing pet ownership, rising disposable incomes, growing e-commerce accessibility, and trends like pet humanization and technological innovation in pet care products.

In 2024, housing and bedding represented the largest segment by market share, driven by growing demand for comfortable and functional pet accommodations.

Dogs lead the market by segment share owing to high ownership rates and demand for diverse, specialized products.

The offline segment is the leading channel by market share, driven by consumers’ preference to assess products in person.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein North America currently dominates the global market.

Some of the major players in the global pet accessories market include Ancol Pet Products Limited, Bed Bath & Beyond Inc., Blueberry Pet, Cycle Dog LLC, Designer Pet Products, Ferplast S.p.A., Honest Pet Products, Inter IKEA Systems B.V., Muttluks Inc., Platinum Pets LLC, Radio Systems Corporation, Rolf C. Hagen Inc., Rosewood Pet Products Ltd., Simply Fido LLC, The Hartz Mountain Corporation (Unicharm Corporation), etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)