Pet Food Market Size, Share, Trends and Forecast by Pet Type, Product Type, Pricing Type, Ingredient Type, Distribution Channel, and Region, 2026-2034

Pet Food Market Size, Share And Growth:

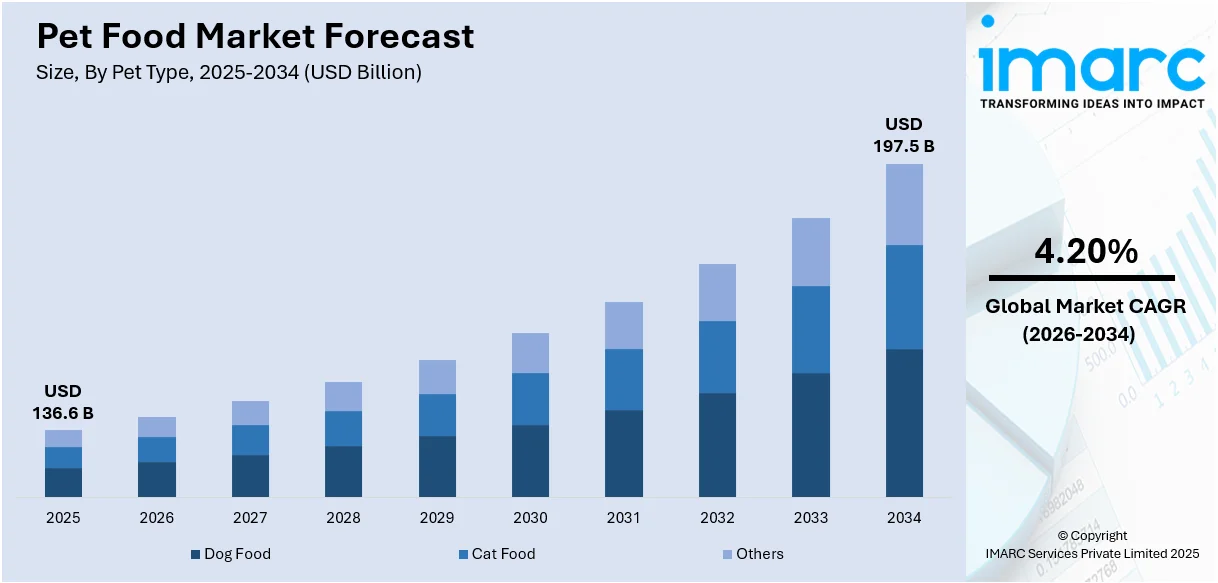

The global pet food market size was valued at USD 136.6 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 197.5 Billion by 2034, exhibiting a CAGR of 4.20% from 2026-2034. North America currently dominates the pet food market share holding over 42.5 % in 2025. The market is primarily driven by the increasing adoption of specialized diets, technological advancements to improve product quality, increased distribution networks, growing consumer concern about sustainability, increasing disposable income, changing lifestyles with an emphasis on pet care, and increased awareness of the need for pet diet-related to specific health issues.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 136.6 Billion |

| Market Forecast in 2034 | USD 197.5 Billion |

| Market Growth Rate (2026-2034) | 4.20% |

The global pet food market trends are majorly influenced by the increasing trend of pet humanization, where owners treat pets as family members, which is raising demand for premium and specialized pet food products. Moreover, the growing awareness regarding pet health and nutrition has led to a rise in demand for organic, natural, and high-protein pet food options. Furthermore, inflating disposable incomes allows pet owners to purchase better food items, particularly in developing nations. In addition to this, continuous developments in pet food formulation and packaging technology introduce new products, such as grain-free and functional food items targeting specific health issues like joint support or digestive health. For example, according to an industry report, Meatly, a British company, received regulatory approval in the United Kingdom to sell pet food containing lab-grown meat, marking a global first. Meatly aims to launch its product in the first half of 2025, targeting the premium market segment, though current production costs remain high.

To get more information on this market Request Sample

The rising pet ownership, particularly among millennials, is expanding the customer base and driving the demand for convenient and innovative pet food products. Furthermore, the growing awareness of sustainable and ethical practices has encouraged the adoption of eco-friendly and organic pet food brands. Besides this, the growing e-commerce sector has made pet food more accessible, with consumers benefitting from a wider variety of choices and convenient delivery options. Additionally, marketing strategies, including influencer collaborations and digital campaigns, are significantly enhancing consumer engagement and trust in brands. For instance, according to an industry report, on September 5, 2024, Cargill announced the acquisition of two U.S. feed mills from Compana Pet Brands, located in Denver, Colorado, and Kansas City, Kansas, to improve its capacity to produce and distribute animal nutrition. This strategic move aims to support a diverse customer base, from large-scale farmers and ranchers to local retailers specializing in pet food and equine products. Also, regulatory standards emphasizing food safety and transparency are compelling manufacturers to innovate and improve product quality, ensuring sustained growth in the United States pet food market.

Global Pet Food Market Trends:

Increasing Pet Ownership

The global pet food market share is heavily influenced by the trend of cat humanization, where pets are treated like family members. This move has led to a massive increase in pet ownership throughout the world. Dogs are the major pets that are being adopted globally. Dogs held the most market share in the global pet food industry in 2022, with a market value of USD 80.03 billion. Several pet owners are changing from home-cooked food to commercial food, which contains high dietary needs for dogs compared to other pets. Pet owners are more conscious about their pets' health and well-being, which automatically means a greater demand for quality pet food.

Rising Awareness Among Individuals

Growing health-conscious attitudes among pet owners is one of the major factors expanding the pet food market demand. Pet parents invest most of their pet expenditure in pet food as they are concerned about their pet's well-being and are seeking products that cater to specific health concerns like obesity, diabetes, and food allergies in pets. For example, the United States pet food made up 42.4% of the expenditures related to pets in 2022. The United States had 40% of pet parents buying premium pet food in 2022, and Hong Kong's cat food market was also dominated by premium pet food, as it covered 75% of the overall sales of pet food in 2022. Manufacturers are investing more in expanding their operations in a wide variety of specialized products, including functional benefits like immune system improvement, digestive health, and coat condition. For example, in October 2023, Nestle announced the commissioning of two new production lines of its Purina pet food facility in Hungary, raising the level of production by 66%. The capacity increase led to an increase in the annual capacities of the plant from about 150,000 metric tons to 250,000 metric tons.

Technological Advancements

Advancements in technology in pet food production and packaging also play a significant role in enhancing the pet food market outlook. The application of modern technologies in the manufacturing processes also enables wider varieties of improved nutrition and shelf-life of pet food. For instance, BrightPet Nutrition Group unveiled a refreshed brand presence for its Blackwood pet nutrition portfolio at Global Pet Expo 2024, held March 20–22 in Orlando. The rebrand precedes several new product launches planned for the brand later this year, including new meal toppers, freeze-dried single-ingredient treats, and granola treats, as well as a new branding for Blackwood’s Oven Baked Bites. The new Blackwood portfolio package designs focus on communicating freshness, quality, and health benefits to the consumer through enhanced formulations.

Expanding Retail and E-Commerce Channels

The escalating number of online and offline retail channels for the easy distribution of pet food is another factor bolstering the market growth. Various key companies are expanding their offline retail stores in order to expand their customer base. For instance, Durkha Dog Chew announced will soon open its first commercial-scale production facility for yak cheese chews in Nepal. The facility is expected to be open in April 2024, producing 50 tons of yak cheese chews within the first six months of production. It is also projected to double the production capacity to 100 tons per month within 12 months of opening. The growth of online retail stores is another factor contributing to the market expansion. For instance, in the United States, online sales of pet care, including food, increased from 32% in 2020 to 40% in 2022.

Pet Food Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the global and regional levels for 2026-2034. Our report has categorized the market based on pet type, product type, pricing type, ingredient type, and distribution channel.

Analysis by Pet Type:

- Dog Food

- Cat Food

- Others

Dog food leads the market with around 42.0% of market share in 2025. The dog food segment leads the pet food market with the largest share due to the massive population of dogs worldwide and their diet requirements. Dogs had a larger percentage of pet spending, accounting for 39.4% in 2022, primarily due to the higher consumption of pet food compared to cats. Premium pet food is the most frequently chosen food for dogs. Consumers care about the health and well-being of their pet dogs, thus demanding a variety of dog food products.

Analysis by Product Type:

- Dry Pet Food

- Wet and Canned Pet Food

- Snacks and Treats

Dry pet food type leads the market with around 57.1% of market share in 2025. It offers several advantages, including lower cost, ease of storage, and longer shelf life. For example, in India, dry dog food under the economy range boasted the highest market value amounting to more than USD 238 Million in 2021. This accounted for a share of nearly 40 percent of the overall market value for dry dog foods in India during the measured period. Dry pet food is preferred by pet owners who are looking for an economical and balanced form of nutrition for their pets' daily diet.

Analysis by Pricing Type:

- Mass Products

- Premium Products

Mass products lead the market in 2025. The mass products segment of the global pet food market holds the largest consumer base of budget-friendly and widely available pet food. Mass-produced pet food brands offer a variety of products, such as dry kibble and canned food that cater to the basic dietary needs of pets. Mass products, in mass quantities, are very largely available in supermarkets and even in convenience stores, coupled with online platforms. Such facilities are easily accessible to these pet owners, increasing mass adoption. This segment serves pet owners who look for affordability while ensuring their pets get the necessary nutrition.

Analysis by Ingredient Type:

- Animal Derived

- Plant Derived

Animal derived leads the market in 2025. The animal-derived segment of the pet food market has a considerable market share due to pet owners increasingly opting for the traditional meat-based diets of their pets. Ingredients such as chicken, beef, and fish are often preferred by pet owners because they consider them a source of necessary proteins and nutrients for their pets. Recent research into two novel protein sources intended for use in pet food by scientists from Portugal and Germany has now been published in Frontiers in Veterinary Science. The study concluded that the squid meal and shrimp hydrolysate hold promise as protein sources in dog food.

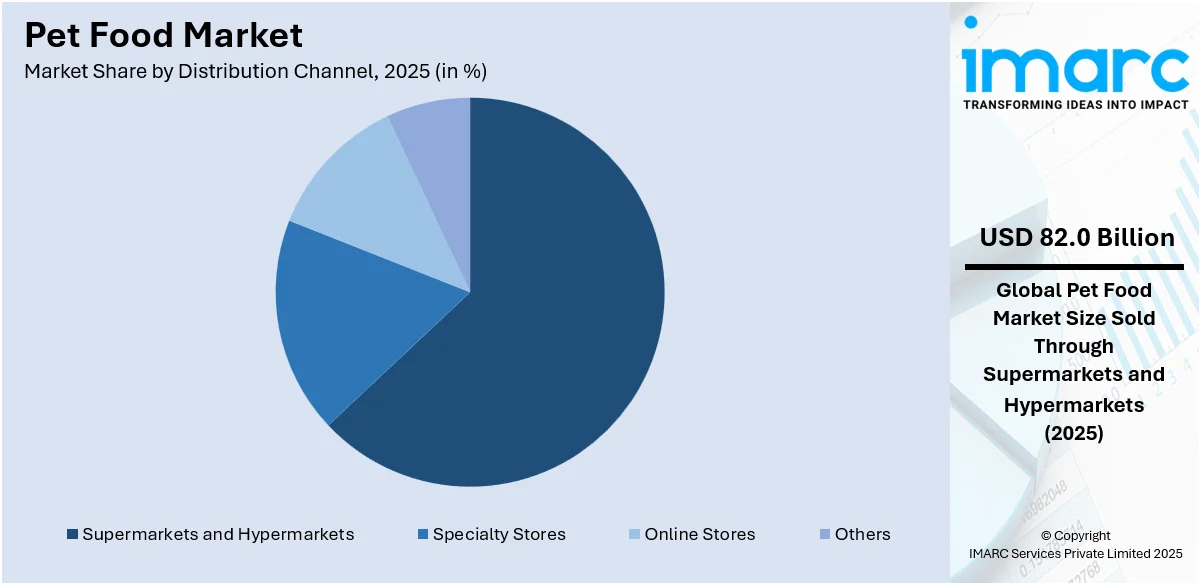

Analysis by Distribution Channel:

Access the comprehensive market breakdown Request Sample

- Supermarkets and Hypermarkets

- Specialty Stores

- Online Stores

- Others

Supermarkets and hypermarkets lead the market with around 62.7% of market share in 2025. For instance, in terms of store count, PetSmart was the largest pet specialty retail chain in North America as of March 2022 with a total of 1,669 stores. Retail giants like these offer a wide variety of pet food brands, making them convenient one-stop shops for pet owners. Their large networks and convenient central locations make them accessible to a wide consumer base and, thereby, increase the visibility and convenience of the product. These retail outlets often carry a range of pet food brands and can accommodate different price levels and dietary requirements, making them appealing to a broader cross-section of consumers. Promotions, discounts, and loyalty programs further increase the purchase of bulk quantities, which in turn increases the sales volume. Also, supermarkets and hypermarkets allow the customers to touch and feel the products, thus increasing trust in the quality and suitability. Their ability to stock a large inventory ensures consistent product availability, making these channels indispensable for both consumers and manufacturers.

Regional Analysis

To get more information on the regional analysis of this market Request Sample

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

In 2025, North America accounted for the largest market share of over 42.5%. North America is a very important region in the pet food market, driven by high pet ownership rates, product innovations, ready availability, and marketing. In 2022, North America emerged to be the largest regional market across the global pet food markets. According to pet food market size by country, the United States and Mexico are the major contributors to the North American pet food market growth, driven by the high pet ownership rates in these countries. The trend of pet parents giving more importance to their pet’s health and nutrition is propelling demand for premium and specialized pet food options. Strong economic stability in the region supports consumer spending on high-quality pet food products.

Key Regional Takeaways:

United States Pet Food Market Analysis

The United States pet food market is witnessing robust growth with the market share of 84.30%. According to the American Pet Products Association (APPA), in 2023, U.S. pet food sales have been recorded at USD 64.4 Billion with steady consumer spending on premium and natural pet food. It is also influenced by the change in consumer preferences for organic, grain-free, and protein-rich formulas. As per an industrial repot, online retail channels continue growing, and e-commerce makes up 27 percent of total pet food sales in 2023. The company remains dominated by the leader firms, such as Nestlé Purina Petcare, and Mars Petcare while encouraging small innovative brands seeking to offer organic and natural sustainability. Pet owners like these millennials will continue requiring pet food that is great. As awareness of pet health increases, the demand for functional foods with added nutrients and supplements is also growing.

Europe Pet Food Market Analysis

The pet food market is increasing in Europe due to increasing adoption rates and humanization of pets. The leading markets are in the U.K., Germany, and France, as consumers spend more on premium, sustainable, and organic pet food. According to FEDIAF, trade body for European Pet Food Industry, exports of pet food from the EU stood at EUR 4.8 Billion (USD 5.04 Billion) in 2022, signifying a rise in demand compared to the rest of the world. Sustainability is an important aspect, as brands provide environmentally friendly packaging and protein substitutes. Healthy pet owners choose natural, grain-free, and specialized diets for pets with sensitivities. Retail chains and online stores are also changing; big companies such as Mars Petcare and Nestlé have developed large portfolios that feature high-quality innovative products.

Asia Pacific Pet Food Market Analysis

The pet food market in Asia Pacific is expanding at a fast pace due to increased disposable incomes and lifestyle changes. Industrial reports have it that, in China, the pet consumer market was at USD 41.9 Billion in 2024, showing an increase of 7.5% from 2023, with pet food taking the largest share at 52.8% of all consumption related to pets. The growth factor for this market is primarily because of the increasing pet owners, especially in China and Japan. Premium and special products, like natural and organic products, are surging in demand in China. Urbanization and the pressure of smaller living spaces have pushed pet ownership; thus, international pet food companies are capitalizing on such an opportunity by forming local collaborations and introducing region-specific products to cater to different consumer needs.

Latin America Pet Food Market Analysis

The pet food market in Latin America is growing, driven by the increasing percentage of pet ownership and the rising expenditure on pets. According to an industry report, in 2023, the pet food market in Brazil alone was valued at USD 7.4 Billion. Brazil dominates the regional market share, with a high middle class driving demand for premium pet food products. There are about 60 million dogs and cats in Mexico (2021), and according to industrial reports, the pet population in Mexico increased by 5.5% from 2016 to 2021. This, of course will increase demand for quality pet food. Also, trending are natural and organic ingredients, as well as alternative protein sources. E-commerce is increasing the footprints of pet food products within the region because online sales are gaining more market share. Leading players like Mars Petcare and Nestle Purina are now planning to increase market presence by opening local manufacturing units and strategizing partnerships.

Middle East and Africa Pet Food Market Analysis

The pet food market in the Middle East and Africa is developing due to inflating disposable incomes and the growing number of pet owners. According to GlobalPets, over 2 million pets live in the United Arab Emirates (UAE), and there are about 1.5 million pet owners. The number of pets in the UAE is continuously increasing, and today the pet care industry stands over USD 300 million. Incomes have increased with a further turn towards premium pet food thereby encouraging further market growth. With ever-increasing urbanization as well as an increasingly pets-loving culture in the region, international and local brands can see the writing on the wall and come up with high-quality specialized pet foods which compete at the high end while also online sales are surging, and e-commerce networks can reach out in the area.

Competitive Landscape:

The competitive landscape of pet food is marked by strong competition among manufacturers focusing on innovation, quality, and pricing strategies to capture consumer loyalty. Companies are in the development of premium, organic, as well as specialized products to meet the pet owners' demand for tailored nutritional wellness solutions. Strategic partnerships help retail and e-commerce outlets enhance market reach. Aggressive marketing targets affordability and premium value platforms. Also, regional players and global brands compete on product differentiation, unique formulations, and packaging. The dynamic nature of the market continues to drive research and development (R&D) investment to address changing consumer preferences.

The report provides a comprehensive analysis of the competitive landscape in the pet food market with detailed profiles of all major companies, including:

- Mars Petcare Inc.

- Nestlé Purina Pet Care (Nestlé SA)

- Hill's Pet Nutrition

- The J.M. Smucker Company

Recent Developments:

- October 2024: Mars Petcare plans to spend USD 1 Billion in the next three years to increase its digital presence and employ 300 tech workers. Of that investment, 70% will go into hiring, upskilling, and third parties, while the rest goes to AI, data management, and e-commerce.

- March 2024: The Crump Group Inc. announced plans to invest USD 85 Million in its existing premium dog treat manufacturing facility in Nashville, NC.

- March 2024: Tropikal Pet A.S., a Turkish pet food producer, shared that it has established a USD 9 Million funding agreement with Eminova Holdings International. The funding will be used to expand the company's production capabilities and enter into the US pet food industry.

- January 2024: Hill's Pet Nutrition unveiled its new Prescription Diet line focused on the pet's preference for taste. New launches between March and June 2024 include z/d Low Fat Hydrolyzed Soy Canine, c/d Multicare Low Fat Canine, and Gastrointestinal Biome Stress Feline. The company also made known several weight management tools and initiatives aimed at promoting health for pets.

- August 2023: Pet food major Mars Inc. invested INR 800 crore (USD 94.17 Million) on the expansion of its manufacturing facility in Telangana, entering the second phase.

Pet Food Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD, Million Tons |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Pet Types Covered | Dog Food, Cat Food, Others |

| Product Types Covered | Dry Pet Food, Wet and Canned Pet Food, Snacks and Treats |

| Pricing Types Covered | Mass Products, Premium Products |

| Ingredient Types Covered | Animal Derived, Plant Derived |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Specialty Stores, Online Stores, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Companies Covered | Mars Petcare Inc., Nestlé Purina Pet Care (Nestlé SA), Hill's Pet Nutrition, The J.M. Smucker Company, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the pet food market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global pet food market.

- The study maps the leading, as well as the fastest-growing, regional markets.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the pet food industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

Pet food refers to specially formulated products designed to meet the nutritional requirements of domesticated animals, such as dogs, cats, and other pets. These foods include wet, dry, and semi-moist options, tailored for specific dietary needs, pet types, and life stages.

The pet food market was valued at USD 136.6 Billion in 2025.

IMARC estimates the global pet food market to exhibit a CAGR of 4.20% during 2026-2034.

The global pet food market is driven by increasing pet ownership rates, rising awareness among individuals, ongoing technological advancement, and expanding retail and e-commerce channels.

According to the report, dog food represented the largest segment by pet type, driven by the widespread ownership of dogs and their higher dietary requirements compared to other pets.

According to the report, dry pet food represented the largest segment by product type, driven by its convenience, longer shelf life, and cost-effectiveness for pet owners.

According to the report, mass products represented the largest segment by pricing type, driven by affordability and widespread availability catering to the majority of pet owners.

According to the report, animal derivatives represented the largest segment by ingredient type, driven by their high protein content and essential nutrients, supporting pet health.

According to the report, supermarkets and hypermarkets represent the largest segment by distribution channel, driven by their extensive reach, diverse product offerings, and competitive pricing.

North America currently dominates the pet food market, accounting for a share exceeding 42.5% in 2025. This dominance is fueled by the rising demand for pet adoption, growing awareness of pet health, and a demand for premium, organic pet food products.

Some of the major players in the global pet food market include Mars Petcare Inc., Nestlé Purina Pet Care (Nestlé SA), Hill's Pet Nutrition, and The J.M. Smucker Company, among others.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)