Pet Supplement Market Size, Share, Trends and Forecast by Pet Type, Distribution Channel, Source, Application, and Region, 2025-2033

Pet Supplement Market Size and Share:

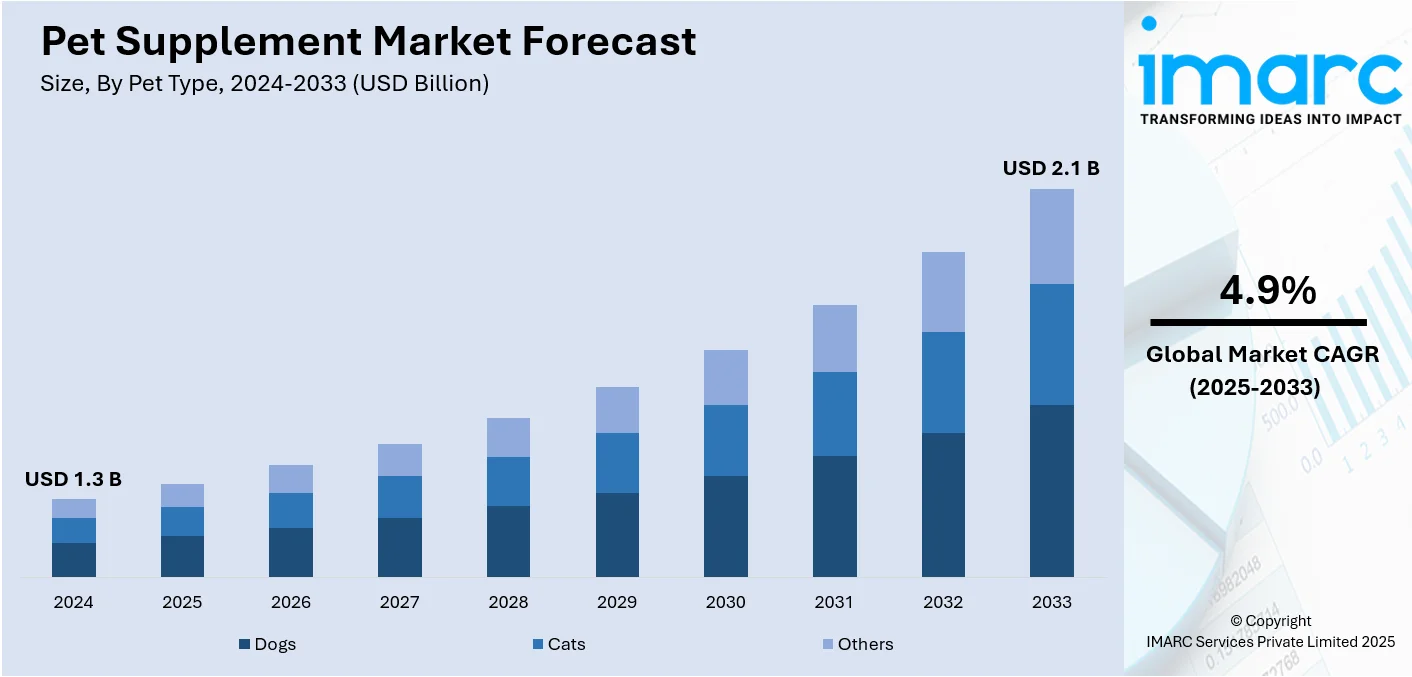

The global pet supplement market size was valued at USD 1.3 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 2.1 Billion by 2033, exhibiting a CAGR of 4.9% during 2025-2033. North America currently dominates the market, holding a significant market share of 49.1% in 2024. The growing trend of humanizing pets, increased pet ownership, advancements in veterinary sciences, expanding educational initiatives, innovative developments in these supplements, rise of specialized retail outlets, and growing occurrence of pet health issues are boosting the pet supplement market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 1.3 Billion |

|

Market Forecast in 2033

|

USD 2.1 Billion |

| Market Growth Rate 2025-2033 | 4.9% |

Expansion in e-commerce has greatly pushed the growth of the pet supplement market by making the product more accessible and convenient to the consumer. The driving factors behind this rise are the increased adoption of pets, rapid technological advancements, and wider accessibility of the internet. In the United States, e-commerce constituted 22% of total retail sales in 2023. This was the biggest sale of e-commerce in the history of the United States. This trend is duplicated in the pet care space, where online sales of pet products have been ever-increasing. Convenience for consumers, combined with having a wider selection of products along with competitive pricing, results in more and more pet supplement purchases through digital channels. Besides that, the development of subscription-based services and auto-ship programs of online stores have added to the market growth. For example, Chewy's Autoship customer sales grew 6.4% year-over-year to $2.23 billion in a recent quarter. These services ensure that there is a steady supply of pet supplements, thereby improving customer retention and driving consistent market demand.

The United States stands out as a key market disruptor, according to the pet supplement market forecast. As of 2023, about 66% of U.S. households-86.9 million homes-have a pet, which translates into a huge consumer base for supplements. Pet owners are beginning to treat pets as more like family members, which brings more spending on health and wellness items. In 2023, Americans spent $147 billion on expenses related to pets, testifying to the significant monetary investment in their care. Elderly pets, living longer due to better care, increased the demand for supplements that cater to challenges such as joint health, cognitive function, and general wellbeing. Innovation in the industry introduced natural, organic, and targeted formulations, which catered to health-conscious customers. The convenience of e-commerce platforms, which have accounted for a significant amount of retail sales in the pet industry, has further propelled the market, making products more accessible nationwide.

Pet Supplement Market Trends:

Rising Humanization of Pets

The burgeoning trend of rising humanization of pets is a pivotal factor fueling the remarkable pet supplement market expansion. As pets become an integral member of the family, much attention is being given to enhance their lifestyles similar to their human counterparts. The U.S. pet industry was valued at USD 136.8 Billion in 2022, as per the APPA, with pet food and treats accounting for USD 50.2 Billion of this market. A significant portion of this value, around 12%, was driven by the demand for pet supplements. This cultural shift has translated into a growing demand for premium pet products, including specialized supplements that cater to various aspects of their well-being. Pet owners are increasingly inclined to invest in supplements that not only address basic nutritional needs but also support specific health concerns and enhance overall pet vitality. This shift in consumer behavior towards viewing pets as family members has led to a rise in innovative supplement formulations and diverse product offerings, fostering a robust market environment that continues to expand as the human-pet bond strengthens. The rising humanization of pets is thus a driving force behind the changing landscape and substantial growth witnessed in the industry.

Increasing Pet Ownership

The escalating trend of increasing pet ownership is a central driver behind the burgeoning pet supplement market growth. As more individuals embrace the companionship of pets, there is a parallel surge in the awareness and commitment toward ensuring the well-being of these furry companions. Pet owners, motivated by a desire to provide optimal care for their pets, are actively seeking nutritional supplements to support their pets' health and longevity. For instance, in the UAE, pet ownership increased by over 30% since the COVID-19 pandemic, an industrial article stated. This growing pet ownership demographic creates a substantial consumer base for these supplements, propelling the market forward. The sense of responsibility and emotional connection that comes with pet ownership further amplifies the demand for a diverse range of supplements, ranging from vitamins to specialized formulations addressing specific health needs. Consequently, the upward trajectory of pet ownership significantly contributes to the expansion and vitality of the market.

Growing Prevalence of Pet Health Issues

The rising occurrence of pet health problems acts as a major driver for the growing market. As pet owners become more aware of prevalent health issues like joint problems, allergies, and age-related conditions, there is greater focus on proactive pet healthcare. According to a study on clinical diseases and disorders in pet dogs, the highest prevalence was observed in arthropod infestations (22.62%), followed by internal parasites (14.80%), digestive disorders (10.22%), and musculoskeletal disorders (6.81%). This data highlights the growing concern for common health challenges that pets face, such as joint problems, allergies, and age-related issues. Pet owners are seeking supplementary solutions to address and mitigate these health concerns, driving the demand for a variety of specialized supplements. This trend is reinforced by a desire to enhance the overall quality of life for pets and to ensure they lead healthier, more comfortable lives. As veterinary care advances, and pet owners become more attuned to preventive measures, the market experiences substantial growth, driven by the imperative to address the growing prevalence of health issues in the pet population, which further transforms the pet supplement market outlook.

Pet Supplement Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global pet supplement market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on pet type, distribution channel, source, and application.

Analysis by Pet Type:

- Dogs

- Cats

- Others

Dogs stand as the largest component in 2024, holding around 51.2% of the market. Dogs have an overwhelming presence and influence in the market. The robust demand for canine-specific supplements can be attributed to the enduring companionship and close bond between humans and dogs. As important members of families, dogs get heightened care and attention, resulting in an increased focus on their overall well-being. Most owners who own dogs will often be on the lookout for supplements tailored for their dog's needs in joint health, skin and coat conditions, and even overall vitality. Given the vast range of dog lifestyles- from the diverse breed lines to different sizes and activities-different supplements meet unique needs.

Analysis by Distribution Channel:

- Online

- Offline

Offline leads the market with around 79.5% of market share in 2024. The offline segment dominates the market. Traditional brick-and-mortar retail outlets, including pet stores, veterinary clinics, and general retailers, play a vital role in meeting the requirements of the pet owner. The feel of browsing products in the flesh, consulting in-store experts, and the immediacy of purchasing explain why so many channels, including convenience stores, supermarkets, and hypermarkets, remain very popular. Most pet owners favor the facility of local shops so that they can preview the quality and suitability of supplements offered.

Analysis by Source:

- Organic

- Conventional

Conventional leads the market with around 73.6% of market share in 2024. The conventional source significantly dominates the market, reflecting the prevailing consumer preferences. While the organic segment has witnessed growth driven by a broader trend towards healthier and more natural products, conventional sources maintain a stronghold due to factors like cost-effectiveness and broader availability. Conventional supplements often leverage synthetic ingredients to ensure affordability and stable production, aligning with the price-conscious consumer base. The market's reliance on conventional sources underscores the ongoing balance between the desire for natural options and the practical considerations of cost and accessibility.

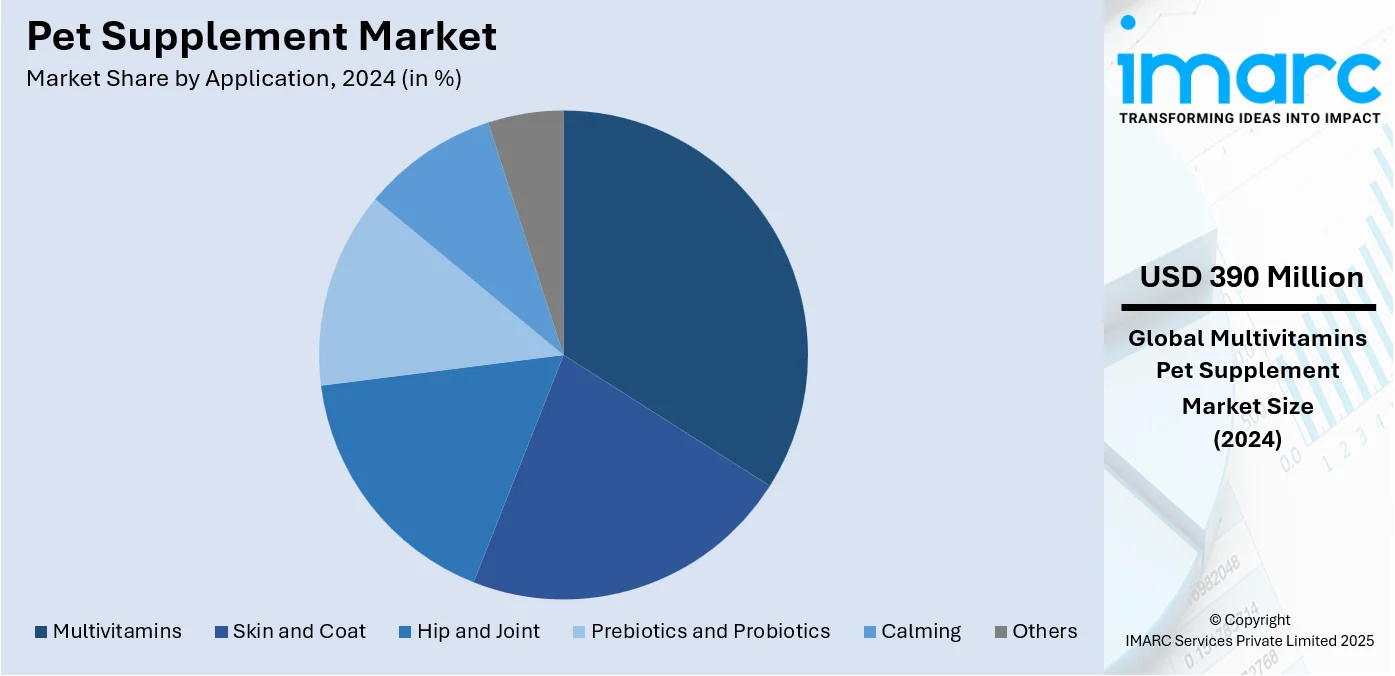

Analysis by Application:

- Multivitamins

- Skin and Coat

- Hip and Joint

- Prebiotics and Probiotics

- Calming

- Others

Multivitamins lead the market with around 29.4% of market share in 2024. As pets age or have specific health issues, pet owners find themselves thinking about joint health. Overall demand for supplements for hip and joint issues arises from the benefit of mobility and pain relief in pets, especially for older or activity-loving animals. This category ranges from potential applications involving glucosamine and chondroitin supplements popularly noted for their value in contributing to joint care. That hip and joint formulations rule the roost, indeed indicates that pet owners are moving away from being merely reactive preventive caretakers of their pets while also valuing the better well-being and mobility in general terms of their pets.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of over 49.1%. North America commands a strong market share, driven by one of the highest rates of pet ownership globally. Robust consumer spending power allows pet owners to allocate vast resources to pet care, especially premium supplements, that fuel growth in the market. North American pet owners also benefit from extensive information on their pets' health, so they are more alert to benefits of supplements. The fact that there are leading veterinary colleges in the region encourages use of supplements as part and parcel of proper care. North America houses leading supplement manufacturers for pets who remain in constant innovation and invention to meet every pet requirement. The region's legal framework ensures safety and efficacy standards, thereby instilling consumer confidence, which promotes further growth in the market.

Key Regional Takeaways:

United States Pet Supplement Market Analysis

In 2024, the United States accounted for over 93.30% of the pet supplement market in North America. The U.S. market for pet supplements is currently witnessing a stable growth level due to a rise in pet ownership as well as growing awareness related to pet health. According to the American Pet Products Association (APPA), in 2022, the U.S. pet industry reached a level of USD 136.8 billion, with the segment of supplements accounting for a considerable amount. The U.S. pet supplement market grew in 2023, driven primarily by the desire of the pet owners for natural, preventive care options for their animals. Among the most in-demand supplements are those for joint health, skin care, and digestive health. The market has been dominated by companies like Nestlé Purina and Mars Petcare, but they keep innovating by introducing new products. This factor is that the trend of humanizing pets is increasing, with many pet owners treating pets as family members and ready to spend more on their well-being. Moreover, U.S. manufacturers are also expanding internationally to capitalize on the growing pet ownership across the globe.

Asia Pacific Pet Supplement Market Analysis

The pet supplements market in the Asia Pacific region is expanding quickly due to rising pet ownership and an emphasis on pet wellness. For example, the Japanese pet product market was about USD 12.4 Billion in fiscal year 2023, showing an increase of 4.5% compared to the year 2022, according to an industrial research report. Despite the declining birth rate, Japanese pet owners are giving pets a family status, hence increasing spending on pet health and wellness. The trend of "humanizing" pets is driving the demand for high-quality products and services, such as automated feeders and pet health monitoring equipment. Pet-friendly establishments and travel accessories are also in demand, which shows that improving the quality of life of pets is important. This is opening the Japanese market for U.S. suppliers-mostly with high-tech pet products. This is reflective of the region at large: increasing investment and innovations in pet care products, most specifically in China and India.

Europe Pet Supplement Market Analysis

The European pet supplement market is steadily growing. Increased pet ownership and increasing awareness of pet health are the reasons behind this growth. For instance, Nestle Purina, in September 2024, announced that they are investing over Pound 150 Million (USD 167 Million) in its Wisbech factory in the UK for the production of popular pet food brands. This investment will introduce new technologies, improve energy efficiency, and hire 40 new workers to be in charge of the new advanced production processes. The upgrade for the factory will be done before early 2025 and indicates an emerging trend to increase pet care market, where in 2023, pet care comprised 20% of Nestle's sales. Companies have increased their investment in manufacturing because consumers are looking for premium products for pets. This would position Europe as a prominent player in the global pet supplement market.

Latin America Pet Supplement Market Analysis

The Latin American market for pet supplements is growing due to the growing adoption of e-commerce and strategic investment in the sector. One example was when, in 2020, Petlove, an e-commerce pet platform, secured a strategic investment by L Catterton to support its growth and expansion into Brazil. New subscriptions and customers have been experienced on the platform of Petlove as more pet owners turn online for pet products. The investment will further enrich Petlove's offerings, including digital content and services through its partnership with Vet Smart, and expand e-commerce capabilities in independent veterinary practices and brick-and-mortar pet stores. This is part of a larger trend in Latin America, where consumers are increasingly searching for online solutions for pet care products.

Middle East and Africa Pet Supplement Market Analysis

The pet supplements market in the Middle East and Africa is growing due to the increasing rate of pet ownership and the increasing disposable incomes, especially in the UAE, Saudi Arabia, and South Africa. According to an industrial article, in the UAE, since the COVID-19 pandemic, pet ownership has increased by more than 30%. The surge in pet ownership contributes to the demand for pet supplements because consumers want better nutrition for their pets. Major global players like Mars Petcare and domestic players are cashing in on this opportunity by increasing their product lines and distribution network in the region. Increasing pets as a family member is also resulting in increased spending on health care for pets, like supplements for skin care, weight management and joint health. In the end, the MEA pet supplements market will experience steady growth based on demographic shifts, economic development, and changing consumer attitudes toward pet care.

Competitive Landscape:

The key players in the market are driving growth through a combination of innovation, strategic partnerships, and a focus on consumer education. Renowned companies are investing significantly in research and development to introduce novel formulations that cater to specific pet health needs, expanding the range of available supplements. Collaborations with veterinary professionals and institutions strengthen their credibility, providing consumers with expert-endorsed products. Moreover, key players actively engage in marketing and educational initiatives to raise awareness about the benefits of pet supplements, influencing consumer preferences. Continuous efforts in quality assurance and adherence to regulatory standards instill trust among consumers, establishing these companies as reliable sources for pet care products. Additionally, strategic acquisitions and expansions into emerging markets enable key players to broaden their reach and tap into diverse consumer demographics. The dynamic approach of these industry leaders not only propels their individual success but also contributes significantly to the overall growth and development of the pet supplement market.

The report provides a comprehensive analysis of the competitive landscape in the pet supplement market with detailed profiles of all major companies, including:

- Ark Naturals Company

- Elanco Animal Health Incorporated

- Boehringer Ingelheim International GmbH

- FoodScience Corporation

- Kemin Industries Inc.

- Nestlé S.A.

- Novotech Nutraceuticals Inc.

- NOW Foods

- Nutramax Laboratories Inc.

- VetriScience Laboratories

- Virbac

- Zoetis Inc.

Latest News and Developments:

- April 2025: Fera Pets expanded its presence into over 175 Petco stores across the US, marking its first major move beyond e-commerce. The veterinarian-founded brand is also introducing a range of clean-label pet supplements, including Organic Probiotics with Prebiotics, Organic Mushroom Blend for Immune Support, Hip & Joint Support, and sustainably sourced Fish Oil.

- April 2025: Vermont-based pet supplement manufacturer FoodScience, LLC acquired North Carolina-based Natural Dog Company, a brand known for its premium dog care products, from skin care solutions to supplements. FoodScience, which has been a portfolio company of Morgan Stanley Capital Partners (MSCP) since November 2024, said this acquisition is an important step in its expansion in the pet wellness and supplements segment.

- February 2025: Pet Honesty unveiled the Cat Dental Powder, a dental supplement created especially for cats. The product offers a quick and easy method to fight tartar and plaque in cats to promote their gum health and eliminate foul breath without the inconvenience of brushing their teeth.

- February 2025: Elanco Animal Health launched Pet Protect, a new range of veterinarian-formulated supplements for cats and dogs. The product range includes offerings for joint health, multivitamins, Omega-3, calming support, allergy and immune support, and digestive health.

- January 2025: Pet Honesty introduced its Cat Urinary Tract Health chews, a dual-textured supplement designed to support feline urinary health. Formulated with cranberry extract, D-mannose, and glucosamine, the chews aim to prevent bacterial adhesion to the urinary tract and strengthen the bladder lining.

- November 2024: Morgan Stanley Capital Partners (MSCP) acquired FoodScience, a Vermont-based pet and human nutritional supplements provider, from Wind Point Partners. FoodScience, known for its Pet Naturals and VetriScience brands, offers a range of pet supplements targeting joint, digestive, and behavioral health.

- April 2024: Nestlé Purina PetCare announced a USD 195 million expansion of its Jefferson, Wisconsin, facility, aiming to increase pet product production by nearly 50%. The 35,000-square-foot addition is being designed to enhance the output of brands like Pro Plan, Fancy Feast, and Beneful IncrediBites.

- February 2024: Elanco Animal Health revealed the sale of its aquatic division to Merck Animal Health for around USD 1.3 billion. This strategic divestiture is aimed at enabling Elanco to concentrate on high-growth areas, such as pet health and livestock sustainability, including the development of pet supplements.

Pet Supplement Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Pet Types Covered | Dogs, Cats, Others |

| Distribution Channels Covered | Online, Offline |

| Sources Covered | Organic, Conventional |

| Applications Covered | Multivitamins, Skin and Coat, Hip and Joint, Prebiotics and Probiotics, Calming, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Ark Naturals Company, Elanco Animal Health Incorporated, Boehringer Ingelheim International GmbH, FoodScience Corporation, Kemin Industries Inc., Nestlé S.A., Novotech Nutraceuticals Inc., NOW Foods, Nutramax Laboratories Inc., VetriScience Laboratories, Virbac, Zoetis Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the pet supplement market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global pet supplement market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the pet supplement industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The pet supplement market was valued at USD 1.3 Billion in 2024.

The pet supplement market is projected to exhibit a CAGR of 4.9% during 2025-2033, reaching a value of USD 2.1 Billion by 2033.

The pet supplement market is driven by growing pet humanization, with owners prioritizing animal wellness through nutritional support. Demand for natural and organic products is rising, fueled by increased awareness of pet health. Veterinarian endorsements and higher pet ownership rates also contribute significantly to market expansion and product innovation.

North America currently dominates the pet supplement market, driven by factors such as the humanization of pets which has led owners to seek premium, health-focused products, including supplements that enhance their pets' well-being. Additionally, the increasing awareness about preventive healthcare among pet owners has resulted in a higher demand for supplements addressing various health concerns. The rise of e-commerce has further facilitated market expansion, providing consumers with convenient access to a wide range of pet supplements.

Some of the major players in the pet supplement market include Ark Naturals Company, Elanco Animal Health Incorporated, Boehringer Ingelheim International GmbH, FoodScience Corporation, Kemin Industries Inc., Nestlé S.A., Novotech Nutraceuticals Inc., NOW Foods, Nutramax Laboratories Inc., VetriScience Laboratories, Virbac, Zoetis Inc., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)