Pharmaceutical Drug Delivery Market Size, Share, Trends, and Forecast by Route of Administration, Application, End User, and Region, 2025-2033

Pharmaceutical Drug Delivery Market Size and Share:

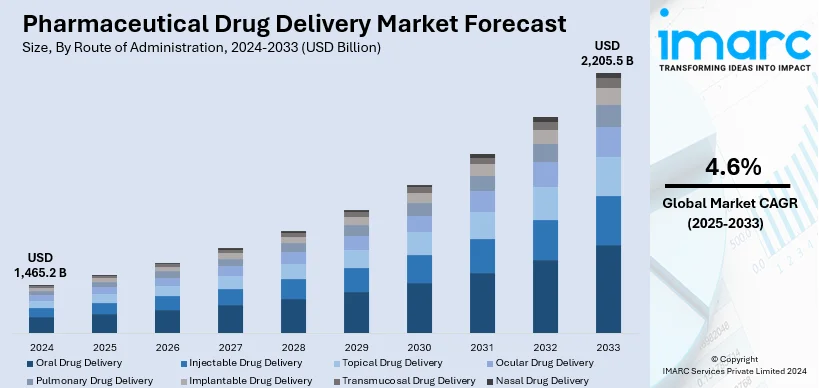

The global pharmaceutical drug delivery market size was valued at USD 1,465.2 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 2,205.5 Billion by 2033, exhibiting a CAGR of 4.6% during 2025-2033. North America currently dominates the market, holding a significant market share of 42.6% in 2024. The rising demand for targeted and efficient drug delivery systems, increasing focus on personalized medicine fostering drug delivery innovations, and numerous advancements in nanotechnology are some of the major factors propelling the market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1,465.2 Billion |

| Market Forecast in 2033 | USD 2,205.5 Billion |

| Market Growth Rate 2025-2033 | 4.6% |

The significant driving factors for the pharmaceutical drug delivery market include increasing incidence rates of chronic diseases such as diabetes, cardiovascular disorders, and cancer, which also require novel and effective therapeutic options. In addition to this, the growing global geriatric population who are more susceptible to experiencing chronic health conditions and requiring advanced drug delivery system is fueling the market. Besides this, continual technological advancements in nanotechnology, 3D printing, and precision medicine, increasing bioavailability, and greater patient compliance are also favoring the industry. The growing adoption of biologics, including monoclonal antibodies and gene therapies, is driving demand for advanced drug delivery systems capable of accommodating specific formulation and stability requirements. For example, regulatory guidelines that encourage the development of safer, more patient-friendly delivery methods propel market growth.

The United States has emerged as a key regional market for pharmaceutical drug delivery. The market in the U.S. is primarily propelled by the nation’s advanced healthcare infrastructure and robust investments in pharmaceutical research and development. Along with this, the rising prevalence of chronic conditions such as heart strokes, diabetes, asthma, and cancer is emphasizing the need for innovative drug delivery solutions that enhance therapeutic efficacy and patient adherence. According to the 2024 heart disease and stroke statistics by the American Heart Association, 46.7% of U.S. adults have high blood pressure. Of those diagnosed with high blood pressure, 38% remain unaware of their condition. Over the past decade, the age-adjusted mortality rate attributed to high blood pressure has risen by 65.6%, while the total number of related deaths has increased by 91.2%. Moreover, the increasing consumer demand for convenient and minimally invasive delivery systems, such as auto-injectors and transdermal patches, also drives market growth. Additionally, the U.S. market benefits from a strong regulatory framework that fosters innovation while ensuring patient safety. The rapid adoption of biologics, coupled with advancements in biotechnology, necessitates tailored delivery mechanisms that preserve the stability and potency of these complex therapies, further contributing to the expansion of the market.

Pharmaceutical Drug Delivery Market Trends:

Rising Demand for Targeted Therapies

The escalating demand for targeted therapies is one of the key growth drivers in the pharmaceutical drug delivery market. Off-target effects and adverse reactions are usually associated with traditional systemic drug administration, which further accelerates the need for targeted therapies and drug deliveries. Moreover, the growing prevalence of various life-threatening infections, such as COVID-19, has also forced manufacturers to introduce effective drug-delivery devices and techniques. This is anticipated to significantly contribute to the pharmaceutical drug delivery market growth in the coming years. For instance, in February 2022, Glenmark Pharmaceuticals Limited launched a nitric oxide nasal spray called FabiSpray in India for the treatment of adult patients with COVID-19 who had a high risk of progression of the disease. Driven by the strong sales growth of FabiSpray in India along with several other factors, the pharmaceutical company reported a 10.1% increase in consolidated net profit to approximately USD 31.3 Million, up from the previous year, alongside a 7.5% rise in net sales to around USD 380 Million for Q2 FY22 compared to Q2 FY21. Besides this, the article published by Frontiers in July 2020 mentioned that it is necessary to develop appropriate delivery systems and complete therapy strategies according to the nature of drugs in treating diabetes mellitus. As per the source, drug-delivery devices have shown significant potential in various aspects of diabetes treatment. They enhance the stability of drugs, overcome biological barriers to increase bioavailability, and act as a smart, automated system to mimic natural insulin delivery, reducing the risk of hypoglycemia.

Rapid Technological Advancements

Ongoing technological advancements in drug delivery devices and techniques to make them more patient-friendly, accessible, and accurate are further catalyzing the growth of the global pharmaceutical drug delivery market. In addition to this, various key market players are extensively investing in the development and innovation of advanced drug-delivery devices. For instance, in May 2021, Phillips-Medisize launched its Aria Smart Autoinjector platform, which unlocked innovation, differentiation, and sustainability in the pharmaceutical industry. This device features advanced technologies such as a modular drug delivery platform that supports a variety of drug formulations and viscosities and has built-in Bluetooth, which enables connectivity to smartphones, tablets, and mobile apps. Similarly, in June 2021, Roche developed a Port Delivery System with ranibizumab (PDS), a drug delivery implant, to free patients with wet age-related macular degeneration from the need to undergo frequent eye injections. Between 2021-2023, more than 136,000 patents have been filed and granted within the pharmaceutical industry, highlighting the sector's ongoing innovation and development. This surge in intellectual property filings underscores the industry's focus on advancing medical technologies, therapies, and treatments. Such innovations and technological advancements are anticipated to propel the pharmaceutical drug delivery market revenue in the coming years.

Increasing Prevalence of Chronic Diseases

The rising cases of various chronic ailments across the world are augmenting the demand for medicines and drugs. According to the World Health Organization (WHO), chronic diseases are the leading cause of death worldwide. Ischemic heart disease alone was responsible for about 8.89 Million deaths in 2019. Moreover, the increasing prevalence of cancer, respiratory disease, and diabetic patients across the world is further promoting the adoption of drug delivery devices. According to the data published by the International Agency for Research on Cancer 2020, globally, 1 in 5 people develop cancer during their lifetime, and 1 in 8 men and 1 in 11 women die. Breast, colorectal, lung, cervical, and thyroid cancers are common among women. Whereas lung and prostate cancer are the most common among men, accounting for nearly one-third of all male cancers. Furthermore, according to a report published by the National Institute of Health, India, on Prevalence and Potential Determinants of Chronic Diseases, 2022, about 21% of the elderly population in India reportedly have at least one chronic disease. The escalating cases of chronic ailments are projected to bolster the pharmaceutical drug delivery market demand.

Pharmaceutical Drug Delivery Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global pharmaceutical drug delivery market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on the route of administration, application, end user, and region.

Analysis by Route of Administration:

- Oral Drug Delivery

- Injectable Drug Delivery

- Topical Drug Delivery

- Ocular Drug Delivery

- Pulmonary Drug Delivery

- Implantable Drug Delivery

- Transmucosal Drug Delivery

- Nasal Drug Delivery

Oral drug delivery leads the market with around 34.8% of market share in 2024. Pharmaceutical drug delivery market forecast indicates that oral drug delivery is a prominent route of administration where pharmaceutical compounds are ingested through the mouth and absorbed in the gastrointestinal tract. Oral medications are convenient to administer, making it a preferred choice for various medications. Moreover, the rise in R&D activities and product launches are likely to positively impact the pharmaceutical drug delivery market outlook. For instance, in June 2021, Shilpa Medicare Ltd. launched Molshil, a pediatric dose of paracetamol oral thin film, in India. Furthermore, according to the WHO, in 2021, approximately 275 Million people used medications (drugs) at least once. Among them, approximately 62 Million people used opioids.

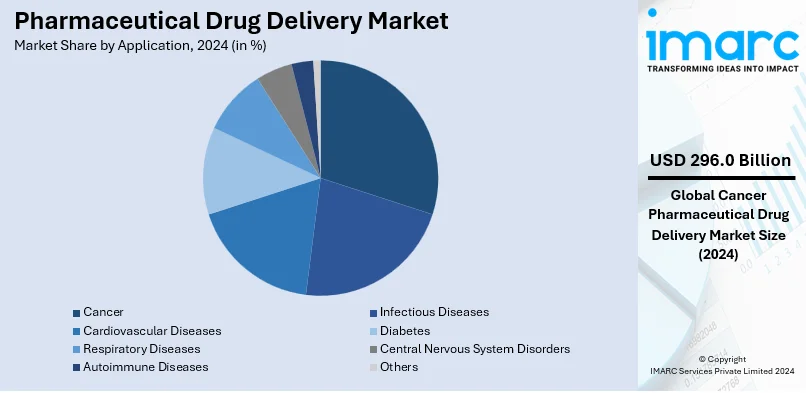

Analysis by Application:

- Infectious Diseases

- Cancer

- Cardiovascular Diseases

- Diabetes

- Respiratory Diseases

- Central Nervous System Disorders

- Autoimmune Diseases

- Others

Cancer leads the market with around 20.2% of the market share. Cancer is the largest application segment within the market. This can be supported by the increasing burden of the disease across the globe, combined with the escalating required effective, targeted treatment options. Advances in oncology therapy, notably biologics, immunotherapies, and precision medicines, are shaping the novel drug delivery systems with the purpose of increasing therapeutic benefits while reducing side effects. Techniques that involve the use of liposomal delivery, nanoparticle carriers, and implantable devices ensure medicines direct targeting of the cancer cell with increased accuracy and minimal systemic toxicity. Furthermore, the trend of combination therapy and the strong drive toward customized or personalized medicines also emphasizes the need for very highly specialized delivery technologies, which can be specific to the type of cancer and individual patient. The growth driver in this segment comes from supportive regulatory policies and a significant investment in oncology research, making this an area of importance for pharmaceutical companies that intend to fill the unmet needs of cancer patients worldwide.

Analysis by End User:

- Hospitals

- Ambulatory Surgery Centers

- Home Care Settings

- Diagnostic Centers

- Others

Hospitals lead the market with around 55.8% of market share in 2024. Hospitals are the most significant end-user segments in the market due to the critical role of institutions in handling complex treatments and providing advanced therapies. Through trained healthcare professionals and specialized equipment, hospitals are better equipped to administer intricate drug delivery methods, including intravenous infusions, implantable devices, and targeted therapies. Advances in chronic diseases, such as cancer and cardiovascular disorders, create an ever-increasing demand for innovative drug delivery technologies in a hospital to optimize treatment outcomes. Additionally, hospitals act as the primary site of care for acute interventions, surgical interventions, or specialized procedures for many patients, making delivery systems reliable and efficient. The growth of this segment is also sustained by an increasing trend in biologics and combination therapy-the hospital's relevance is critical as most of these treatments require expert administration.

Regional Analysis:

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of over 42.6%. As per the pharmaceutical drug delivery market statistics by IMARC, North America held the biggest share in the market since the region has a robust healthcare infrastructure, strong research and development (R&D) capabilities, and a high prevalence of chronic diseases. For instance, according to the American Cancer Society's 2022 report, approximately 1.9 Million new cancer cases were diagnosed in 2022 in the United States. Besides this, the presence of leading manufacturers in the region, along with the introduction of new products, is also bolstering the growth of the market in North America. For instance, in February 2022, the United States FDA approved the generic Apokyn (apomorphine hydrochloride injection) drug cartridges to treat hypomobility and other episodes associated with advanced Parkinson's disease.

Key Regional Takeaways:

United States Pharmaceutical Drug Delivery Market Analysis

In 2024, the US dominated the North America market with a market share of 92.6% . According to the estimates by Centre for Disease Control and Prevention (CDC), six out of ten persons in the US today have a chronic illness, such as diabetes, heart disease, or cancer and 4 out of 10 have two or more chronic illness. This is one of the main reasons driving the United States pharmaceutical drug delivery market. The market expansion is also being driven by the regional pharmaceutical drug delivery systems manufacturers' increasing investments and new launches. For example, West Pharmaceutical Services Inc. introduced the NovaPure 3ml cartridge in October 2019 to deliver injectable medications in larger volumes. Similarly, Becton, Dickinson, and Company declared in May 2021 that they would invest about USD 200.0 Million in a new facility in Zaragoza, Spain, which would aid in the expansion of the pre-filled drug delivery industry.

Strategic initiatives such as merger, acquisition, and expansion plans by the prominent players across the region are some of the prime factors estimated to augment the demand for pharmaceutical drug delivery market going forward. For instance, Kindeva Drug Delivery, formerly 3M Drug Delivery Systems, recently announced its launch as an independent company following the acquisition by Altaris Capital Partners in a transaction valued at USD 650 Million. Besides, Aptar Pharma commences global expansion for injectable drug delivery, which, in turn, is projected to uplift the market growth in the forthcoming years.

Europe Pharmaceutical Drug Delivery Market Analysis

Europeans represent about one-tenth of the global population, yet one in four of all cancer diagnoses occur in this region. In line with this, rising prevalence of chronic diseases such as cancer and diabetes across the region is majorly stimulating the market growth. In addition, growing product launches is impelling the market growth. For instance, Evonik launched an advanced oral drug delivery technology that provides enteric protection followed by rapid, homogeneous release for effective targeting of the upper small intestine. Increasing pace of investment is another prime factor driving the segment growth. For instance, with Novartis coming on board as an investor, the California-based company Credence MedSystems has reeled in USD 39.9 Million to boost production of injectable drug delivery systems.

Growing innovations and investments in the medical devices including drug delivery products accompanied by its allied products are expected to proliferate the market growth in Euope during the forecast years. For instance, Upperton Pharma Solutions launched a nasal delivery development platform, UpperNose, to make it easier for innovators to access the capabilities necessary for the development of nasal dosage formulations.

Asia Pacific Pharmaceutical Drug Delivery Market Analysis

Asia is emerging as a powerhouse of pharmaceutical R&D facilitated by the availability of a vast patient population, quality data, lower clinical trial costs relative to other nations such as the United States, and skilled manpower. Additionally, several drugs with different delivery means are launched in the region. For instance, Eisai introduced an intravenous (IV) version of its antiepileptic medication Fycompa® (perampanel hydrate) in Japan in January 2024. An important medical need is met by this injectable formulation, which is intended for individuals who are unable to take the drug orally. Additionally, Novo Nordisk introduced Wegovy, a medication for weight loss in China, aiming to reach the country's 180 Million obese citizens. The medication, which targets those with extreme obesity, is given by weekly injections.

Also, many top-notch western multinational companies have already moved their R&D operations to Asian countries including Glaxo Smith Kline, Pfizer and Novartis. Owing to these potential factors, the pharmaceutical drug delivery market in the region is gaining traction. The surge in number of merger and acquisition activities among pharmaceutical players across the region is expected to bolster the market growth in the coming years. For instance, Amneal Pharmaceuticals LLC, has completed its previously announced acquisition of a 98% interest in Kashiv Specialty Pharmaceuticals, LLC, a wholly-owned subsidiary of Kashiv focused on the development of complex generics, innovative drug delivery platforms and novel drugs.

Latin America Pharmaceutical Drug Delivery Market Analysis

The significant expansion of the pharmaceutical drug delivery market can be attributed to the cutting-edge advancements and innovations occurring in Latin American nations' pharmaceutical systems. Furthermore, the market is expanding due to the increased occurrence of chronic conditions like psoriasis, cancer, and asthma. Favorable government backing and a growing emphasis on increasing the manufacturing of medications and vaccines together with the devices used to administer them are also important factors driving the segment's significant expansion. For example, the European Union hopes to increase Latin America's production of pharmaceuticals and vaccines by sharing technologies and regulatory procedures and investing more in the region.

Middle East and Africa Pharmaceutical Drug Delivery Market Analysis

The Middle East and Africa's healthcare systems are undergoing significant change. The delivery of pharmaceutical drugs is expanding as the population ages and chronic illnesses become more prevalent. The market is also expanding throughout the Middle East and Africa due to an increase in merger and acquisition activity among companies seeking to increase their customer base. For example, G42 Healthcare, an AI-powered healthcare organization, and AstraZeneca, a science-led biopharmaceutical, inked a strategic cooperation deal to produce cutting-edge medications locally in Abu Dhabi.

Competitive Landscape:

The market research report has provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided. Some of the key players in the market include:

- AbbVie Inc.

- Amgen Inc.

- AstraZeneca plc

- Becton Dickinson and Company

- Eli Lilly and Company

- GSK plc

- Johnson & Johnson

- Merck KGaA

- Novartis AG

- Pfizer Inc.

- Sanofi S.A.

Latest News and Developments:

- March 2024: Johnson & Johnson completed the acquisition of Ambrx Biopharma, Inc., a clinical-stage biopharmaceutical company specializing in a proprietary synthetic biology technology platform for the design and development of next-generation antibody-drug conjugates (ADCs). The all-cash merger transaction, valued at approximately USD 2.0 Billion in total equity or USD 1.9 Billion net of estimated cash acquired, was originally announced on January 8, 2024. This acquisition was recorded as a business combination.

- January 2024: Berry Global Healthcare, a patient-centered package design company, showcased its latest range of standard and bespoke pharmaceutical packaging solutions at Pharmapack 2024. The exhibition witnessed the launch of the BerryHaler, an all-plastic, dual chamber, dry powder inhaler (DPI) designed to deliver combination drugs and separately store two medications for subsequent simultaneous inhalation.

- October 2023: Victrex plc, a pioneer in the development of PEEK biomaterial solutions launched a new product grade developed exclusively for Drug Delivery and Pharmaceutical Contact applications. VICTREX PC101 meets the highest levels of Industry biocompatibility certification for USP Class VI and also meets industry standards such as USP 661 for use in non-implantable pharmaceutical contact applications.

- July 2023: Viatris Inc., a global healthcare company, and Kindeva Drug Delivery L.P. announced the launch of Breyna (budesonide and formoterol fumarate dihydrate) Inhalation Aerosol, the first generic version of AstraZeneca's Symbicort. It comes with an Abbreviated New Drug Application (ANDA) and is approved by the U.S. Food and Drug Administration (FDA).

- July 2022: Novartis acquired Kedalion Therapeutics and its AcuStream technology, a device designed to ensure precise dosing and accurate delivery of certain topical ophthalmic medications. The financial terms of the transaction were not disclosed. The acquisition supported Novartis' goal of reimagining medicine by enhancing the delivery and patient experience of its therapies.

Pharmaceutical Drug Delivery Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Routes of Administrations Covered | Oral Drug Delivery, Injectable Drug Delivery, Topical Drug Delivery, Ocular Drug Delivery, Pulmonary Drug Delivery, Implantable Drug Delivery, Transmucosal Drug Delivery, Nasal Drug Delivery |

| Applications Covered | Infectious Diseases, Cancer, Cardiovascular Diseases, Diabetes, Respiratory Diseases, Central Nervous System Disorders, Autoimmune Diseases, Others |

| End Users Covered | Hospitals, Ambulatory Surgery Centers, Home Care Settings, Diagnostic Centers, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | AbbVie Inc., Amgen Inc., AstraZeneca plc, Becton Dickinson and Company, Eli Lilly and Company, GSK plc, Johnson & Johnson, Merck KGaA, Novartis AG, Pfizer Inc., Sanofi S.A., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the pharmaceutical drug delivery market from 2019-2033.

- The pharmaceutical drug delivery market research report provides the latest information on the market drivers, challenges, and opportunities in the global market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the pharmaceutical drug delivery industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Pharmaceutical drug delivery refers to the methods, technologies, and systems used to introduce therapeutic substances into the body to achieve a desired clinical effect. It ensures precise, efficient and targeted delivery of medications to optimize their therapeutic efficacy and minimize side effects.

The pharmaceutical drug delivery market was valued at USD 1,465.2 Billion in 2024.

IMARC estimates the global pharmaceutical drug delivery market to exhibit a CAGR of 4.6% during 2025-2033.

The increasing prevalence of chronic diseases such as cancer, diabetes, and cardiovascular disorders is driving the market. Advances in technology, including nanotechnology, 3D printing, and precision medicine are also favoring market growth. Additionally, the rising demand for targeted therapies and patient-centric delivery solutions is supporting the market.

Oral drug delivery represents the largest segment by the route of administration, driven by its ease of use, patient compliance, and the availability of diverse innovative solutions.

Cancer leads the market by application, fueled by the increasing need for effective and targeted oncology treatments, such as biologics and immunotherapies.

Hospitals are the leading segment by end user, driven by their capability to manage complex treatments and deliver advanced drug therapies.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein North America currently dominates the global market.

Some of the major players in the global pharmaceutical drug delivery market include AbbVie Inc., Amgen Inc., AstraZeneca plc, Becton Dickinson and Company, Eli Lilly and Company, GSK plc, Johnson & Johnson, Merck KGaA, Novartis AG, Pfizer Inc., and Sanofi S.A., among others.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)