Pharmacy Automation Market Size, Share, Trends and Forecast by Product Type, Application, End-User, and Region, 2025-2033

Pharmacy Automation Market 2024 Size, Share & Trends:

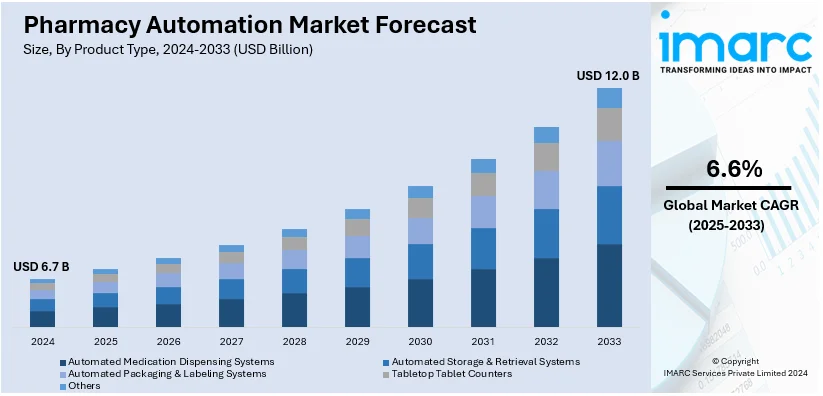

The global pharmacy automation market size was valued at USD 6.7 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 12.0 Billion by 2033, exhibiting a CAGR of 6.6% from 2025-2033. North America currently dominates the market, holding a market share of over 54.4% in 2024. The increasing need to reduce errors in medical processes, the growing prevalence of chronic diseases, and various advances in robotics, artificial intelligence, machine learning, and data analytics are some of the major factors propelling the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033 |

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 6.7 Billion |

|

Market Forecast in 2033

|

USD 12.0 Billion |

|

Market Growth Rate (2025-2033)

|

6.6% |

The occurrence of various chronic diseases is rising worldwide, which is also driving the demand for medicines. This, in turn, is further increasing the number of pharmacies, thereby catalyzing the need for pharmacy automation services. As the healthcare sector continues to evolve, pharmacy automation has emerged as a critical tool for addressing inefficiencies in traditional manual processes, enhancing accuracy, and improving patient outcomes. One of the other major trends includes the integration of Artificial Intelligence (AI) and Machine Learning (ML) in pharmacy automation systems. AI-powered solutions are enhancing the ability to predict medication demand, optimize inventory levels, and reduce waste. These technologies also contribute to patient safety by enabling more precise dose calculation and ensuring that prescriptions are free from potentially harmful errors. Additionally, the use of predictive analytics allows pharmacies to anticipate patient needs and streamline the medication fulfilment process, improving overall service delivery.

The United States has emerged as a major region in the pharmacy automation market because of the heightened advancements in healthcare technology. As the healthcare industry in the US evolves to address the challenges posed by workforce shortages, rising costs, and the increasing demand for medications, automation technologies have emerged as essential tools for modernizing pharmacy operations. Trends and drivers in the market reflect broader changes in the healthcare system, shaped by demographic factors, innovation, and policy developments. AI and ML technologies are increasingly being integrated into US pharmacy automation systems, further enhancing their capabilities. AI-powered tools enable pharmacies to optimize inventory management, predict medication demand, and personalize patient care. ML algorithms can analyze historical data to forecast future trends, helping pharmacies prevent stockouts or overstocking. Furthermore, AI plays a critical role in identifying potential medication interactions or errors in prescriptions, contributing to improved patient safety. The IMARC Group predicts that the US ML market is expected to reach USD 98.9 billion by 2033.

Pharmacy Automation Market Trends:

Increasing Need to Reduce Errors in Medical Processes

Medication errors can have severe consequences on patient safety and well-being. As a result, healthcare providers and pharmacies are increasingly adopting pharmacy automation solutions to reduce risk of errors as well as enhance patient outcomes. These systems, such as automated dispensing systems and barcode scanning technology, play a crucial role in reducing medication errors. They help ensure accurate medication dispensing, verify prescriptions, and cross-reference medication orders with patient profiles, minimizing the potential for human errors. The Institute of Medicine estimates that annually, medication errors harm at least 1.5 million people in the United States. Pharmacy automation systems, such as automated dispensing and barcode scanning, can help cut down medication errors by up to 50%. Moreover, regulatory bodies, such as the Joint Commission and the Food and Drug Administration (FDA), also place importance on medication safety and require healthcare providers to implement measures to reduce errors. This regulatory push further accelerates the adoption of pharmacy automation solutions to meet compliance standards.

Various Technological Advancements in Robotics, Artificial Intelligence and Data Analytics

Robotic dispensing systems can accurately count and package medications, reducing errors and enhancing efficiency. These robots can handle a high volume of prescriptions, ensuring faster and more precise medication dispensing. Robotic systems integrated with AI and ML algorithms can even learn from data patterns to optimize medication dispensing processes and adapt to changing pharmacy needs. Moreover, AI and ML algorithms are being utilized to improve various aspects of pharmacy automation. These technologies can analyze patient data, medication histories, and drug interactions to provide clinical decision support, helping pharmacists make informed decisions. Besides, data analytics tools can analyze medication usage patterns, identify trends, and optimize inventory levels. According to a report, data analytics can optimize inventory, leading to a 10-20% reduction in medication waste and improving operational efficiency, propelling market growth. These insights help pharmacies make data-driven decisions, such as adjusting stock levels, identifying medication dispensing patterns, and improving operational efficiency, thus propelling the market growth.

Growing Prevalence of Chronic Diseases

Chronic diseases often require long-term medication management, leading to a significant increase in prescription volumes. As per the World Health Organization (WHO), chronic diseases lead to 71% of deaths worldwide, driving higher prescription volumes. Pharmacy automation systems, such as robotic dispensing systems and prescription filling automation, enable pharmacies to handle larger prescription volumes efficiently. Automated systems ensure accurate and timely medication dispensing, reducing waiting times for patients and improving overall workflow in pharmacies. Moreover, pharmacy automation plays a crucial role in promoting medication adherence by providing automated prescription refill systems and medication packaging solutions. These systems help patients conveniently receive their medications, ensuring they have a sufficient supply and reducing the likelihood of missed doses, thus contributing to market growth.

Pharmacy Automation Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global pharmacy automation market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on product type, application and end-user.

Analysis by Product Type:

- Automated Medication Dispensing Systems

- Automated Storage & Retrieval Systems

- Automated Packaging & Labeling Systems

- Tabletop Tablet Counters

- Others

Automated medication dispensing systems leads the market with 24.8% of market share in 2024. Automated medication dispensing systems represent the largest segment due to various reasons. Automated medication dispensing systems ensure precise medication dosing and reduce the risk of human errors. These systems employ barcode scanning and verification, medication database integration, and robotic dispensing technology to accurately dispense medications. Moreover, these systems streamline the medication dispensing process, saving a lot of time and improving operational efficiency in pharmacies. They can handle a large volume of prescriptions quickly and accurately, reducing waiting times for patients and optimizing workflow for pharmacy staff. Besides, automated medication dispensing systems often include inventory management functionalities, enabling real-time tracking of medication stock levels, expiration dates, and batch numbers. This integration ensures efficient inventory control, reducing the risk of medication shortages or wastage.

Analysis by Application:

- Drug Dispensing and Packaging

- Drug Storage

- Inventory Management

Drug dispensing and packaging are essential steps in the medication workflow process within pharmacies. Automation solutions that focus on drug dispensing and packaging address the need for accurate and efficient medication management. These systems streamline the process by automating tasks such as counting pills, verifying prescriptions, labeling medications, and packaging them for individual patients. The ability to automate these critical steps significantly improves workflow efficiency and reduces the potential for errors, leading to increased demand for these automation solutions. Besides, these automation systems often incorporate barcode scanning, medication verification, and advanced algorithms to ensure accurate medication dispensing and packaging, enhancing patient safety and reducing adverse drug events. Technological advancements, such as the integration of AI, ML, and IoT, are expected to further transform the drug dispensing and packaging segment. AI and ML can enhance predictive analytics for inventory management, while IoT-enabled devices can provide real-time monitoring of packaging and dispensing systems. These innovations are likely to drive greater efficiency and accuracy in the coming years.

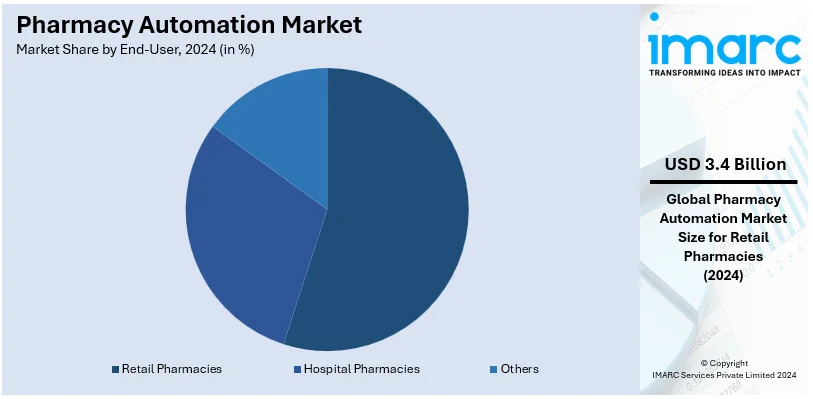

Analysis by End-User:

- Hospital Pharmacies

- Retail Pharmacies

- Others

Retail pharmacies stand as the largest component in 2024, holding 51.2% of the market. Retail pharmacies cater to a large volume of patients, serving as accessible points of care within communities. The high footfall and patient demand drive the need for efficient and streamlined pharmacy operations, making retail pharmacies a significant market segment for pharmacy automation solutions. Moreover, retail pharmacies often prioritize customer convenience and aim to differentiate themselves through superior service. Pharmacy automation solutions contribute to this goal by reducing waiting times, minimizing medication errors, and enhancing overall customer experience, thus accelerating the product adoption rate. Technology is playing a pivotal role in reshaping the operations and services of retail pharmacies. One of the most significant advancements is the adoption of pharmacy automation technologies, such as robotic prescription dispensing systems and automated inventory management tools. These technologies enhance efficiency, reduce human error, and allow pharmacists to spend more time on patient-facing services. Robotic systems can quickly and accurately fill prescriptions, enabling pharmacies to handle higher volumes with fewer errors, which is particularly important in high-traffic locations.

Regional Analysis:

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Chile

- Peru

- Others

- Middle East and Africa

- Turkey

- Saudi Arabia

- Iran

- United Arab Emirates

- Others

In 2024, North America represented the highest market share at 54.4%. North America has been at the forefront of technological advancements, including pharmacy automation. The region has a robust healthcare infrastructure and a high level of adoption and investment in advanced technologies. This has led to the development and deployment of innovative pharmacy automation solutions, making North America a leading market for these technologies. Moreover, the region has stringent regulatory standards for medication safety and quality control. Regulatory bodies like the US Food and Drug Administration (FDA) prioritize patient safety and require compliance with specific guidelines for medication dispensing and management. Pharmacy automation solutions help pharmacies meet these standards and ensure accurate and safe medication dispensing, making them highly sought after in the region. In 2024, Swisslog Healthcare collaborated with BD for mechanizing pharmacy inventory management in hospitals across the United States.

Key Regional Takeaways:

United States Pharmacy Automation Market Analysis

In North America, the United States accounted for 84.50% of the total market share. The US market is driven by increasing healthcare demands and the need for operational efficiency in pharmacies. According to the National Community Pharmacists Association, in 2023, the United States had over 19,400 independent pharmacies, where automation plays a critical role in reducing errors and improving workflow. Adoption by hospitals of automated dispensing systems is growing, partly as a result of increased patient safety attention, and retail pharmacies embrace robotic systems for medication dispensing. Some of the prominent companies that lead in the incorporation of such technologies as AI-driven inventory management include BD (Becton Dickinson) and Omnicell. With an estimation from industry figures that automation reduces dispensing errors up to 85%, adoption is likely to rise further. Federal incentives for the digitization of healthcare innovation have fueled this growth. As a result, the growing incidence of chronic diseases ensures that automated solutions remain in steady demand within the U.S. pharmacy market.

Europe Pharmacy Automation Market Analysis

Increased healthcare cost and stringent regulations on the security of medications are forcing the European market. Automation, according to Eurostat, is highly driven by an aging population in Europe and continuously increasing cases of chronic diseases, which facilitate medication demand. Germany takes the lead with major investments in robotic dispensing systems for hospitals and retail chains, supported by policies such as the "Digital Health Act." France and the UK focus more on automation in reducing the cost of labor and efficiency gains. Companies such as Swisslog and KUKA keep innovating in dose accuracy and inventory control through AI. According to Pharmaceutical Journal, for instance, a Danish study observed a 57% decrease in medication errors following the implementation of an automated system. Moreover, partnerships between governments and private firms in countries like Italy and Spain are accelerating implementation, making Europe a leader in the adoption of pharmacy technology.

Asia Pacific Pharmacy Automation Market Analysis

The Asia Pacific market is expanding with rapid growth in the health infrastructure and increasing adoption of technology. As reported by the Ministry of Health and Family Welfare, India's health expenditure has been increased to USD 10.75 Billion in 2023 with automation playing an important role in enhancing the pharmacy services. China's focus on upgrading hospitals and smart healthcare also supports its objective of automating 50% of its pharmacies by 2025. Retail pharmacies in Japan are also using robotic dispensing systems to deal with workforce shortages. Companies like Yuyama and Parata Systems are taking advantage of this trend by providing scalable solutions to meet regional requirements. A report by Frost & Sullivan stated that pharmacy automation in the region saves up to 60% in terms of efficiency in dispensing, appealing to private and public healthcare facilities. The Asia Pacific is becoming an emerging hub for competition and investment in innovative pharmacy automation technologies.

Latin America Pharmacy Automation Market Analysis

The Latin American market for pharmacy automation is growing constantly, driven by increased accessibility to healthcare and digitization. According to the Pan American Health Organization, health expenditure in Brazil reached an estimated USD 161 Billion for 2023, with investment in the automation of in-patient pharmacies to improve medicine safety. Mexico is likewise investing in automated dispensing systems of public hospitals, which are being complemented by government funding. Retail pharmacies in the region, such as Farmacias Similares, embrace robotics to serve customers better. Industry reports say automation reduces operational costs by up to 30%. Such savings make it appealing for cost-sensitive markets to invest in automation. Companies such as BD and Omnicell continue their expansion in Latin America with the help of local distributors. Moreover, telepharmacy is integrating automation to support efficient remote medication management. The momentum in the market, therefore, remains strong.

Middle East and Africa Pharmacy Automation Market Analysis

Healthcare modernization and new investments in digital health promote the Middle East and Africa market. For instance, the International Trade Administration estimates that healthcare spending in Saudi Arabia 2023 is around USD 50.4 Billion with high investment in the hospital automation aspect, which includes pharmacy systems; the United Arab Emirates already implements robotic dispensing systems of pharmacies to avoid errors on the patients. Private hospitals in Africa are witnessing an increased adoption of automated systems. Leaders such as Capsa Healthcare are collaborating with regional players to enhance their presence. WHO estimates that medication errors are one of the reasons for 8% hospital readmissions, thus driving demand for error-reducing technologies. Government-backed initiatives in Qatar and Egypt are further fostering pharmacy automation adoption, making the region a growing market for advanced pharmacy technologies.

Competitive Landscape:

The competitive landscape of the market is characterized by the presence of several key players competing for market share. These companies offer a range of pharmacy automation solutions and constantly innovate to stay ahead in the market. At present, key players are developing advanced pharmacy automation solutions that address the evolving needs of healthcare providers and pharmacies. This includes improving accuracy, expanding functionalities, integrating AI and ML capabilities, and enhancing user experience. For instance, in 2024, Omnicell announced the launch of Central Med Automation Service, which is a subscription-based solution created to assist health systems establish and optimize centralized medication management for consolidated pharmacy services centers (CPSCs). They are also collaborating with healthcare systems, retail pharmacy chains, and other industry stakeholders to integrate their automation solutions with existing healthcare infrastructure. Moreover, key players are expanding their presence in different geographic regions by targeting untapped markets.

The report provides a comprehensive analysis of the competitive landscape in the pharmacy automation market with detailed profiles of all major companies, including:

- Baxter International Inc.

- Becton Dickinson and Company

- Capsa Healthcare

- Cerner Corp.

- Kirby Lester LLC

- KUKA AG

- McKesson Corporation

- Omnicell Technologies

- RxSafe LLC

- Scriptpro LLC

- Swisslog Holding AG

- Takazono Corp.

- Talyst LLC

- TCGRx Pharmacy Workflow Solutions

- Yuyama Co. Ltd.

Latest News and Developments:

- October 2024: BD and Hamilton recently launched a new robotics solution designed to automate and standardize single-cell research. With the BD® OMICS-One XT WTA Assay and the Hamilton® Microlab™ NGS STAR liquid handling platform, workflows can be streamlined to improve consistency and accelerate genomic sequencing by automatically preparing DNA libraries and thereby reducing manual variability.

- April 2024: Capsa Healthcare launched the upgraded KL1Plus pharmacy automation system, which now operates on the Aura platform. The device boasts improved efficiency due to its redesigned interface, intuitive prompts, and over-the-air software updates for continuous performance. The innovation aims at pharmacy workflow enhancement in terms of compliance and safety.

Pharmacy Automation Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Automated Medication Dispensing Systems, Automated Storage & Retrieval Systems, Automated Packaging & Labeling Systems, Tabletop Tablet Counters, Others |

| Applications Covered | Drug Dispensing and Packaging, Drug Storage, Inventory Management |

| End-Users Covered | Hospital Pharmacies, Retail Pharmacies, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico, Argentina, Colombia, Chile, Peru, Turkey, Saudi Arabia, Iran, United Arab Emirates |

| Companies Covered | Baxter International Inc., Becton Dickinson and Company, Capsa Healthcare, Cerner Corp., Kirby Lester LLC, KUKA AG, McKesson Corporation, Omnicell Technologies, RxSafe LLC, Scriptpro LLC, Swisslog Holding AG, Takazono Corp., Talyst LLC, TCGRx Pharmacy Workflow Solutions, Yuyama Co. Ltd. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the pharmacy automation market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global pharmacy automation market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the pharmacy automation industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Pharmacy automation refers to the use of advanced technologies such as robotics, artificial intelligence, and data analytics to streamline medication dispensing, packaging, storage, and inventory management processes. These systems improve accuracy, reduce medication errors, enhance workflow efficiency, and ensure regulatory compliance.

The pharmacy automation market was valued at USD 6.7 Billion in 2024.

IMARC estimates the global pharmacy automation market to exhibit a CAGR of 6.6% during 2025-2033.

The key drivers include the increasing need to reduce medication errors, the growing prevalence of chronic diseases, advancements in robotics, artificial intelligence, and data analytics, and the rising demand for efficiency in pharmacy operations.

In 2024, automated medication dispensing systems represented the largest segment by product type, driven by their ability to ensure precise medication dosing and reduce human errors.

Drug dispensing and packaging lead the market by application owing to the need for efficient and accurate medication management and advancements in automation technologies.

The retail pharmacy segment is the leading end-user segment, driven by high patient volumes, demand for streamlined operations, and the adoption of advanced automation technologies.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and the Middle East and Africa, wherein North America currently dominates the global market.

Some of the major players in the global pharmacy automation market include Baxter International Inc., Becton Dickinson and Company, Capsa Healthcare, Cerner Corp., Kirby Lester LLC, KUKA AG, McKesson Corporation, Omnicell Technologies, RxSafe LLC, Scriptpro LLC, Swisslog Holding AG, Takazono Corp., Talyst LLC, TCGRx Pharmacy Workflow Solutions, Yuyama Co. Ltd., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)