Philippines Alcoholic Beverage Market Size, Share, Trends and Forecast by Category, Alcoholic Content, Flavour, Packaging Type, Distribution Channel, and Region, 2026-2034

Philippines Alcoholic Beverage Market Overview:

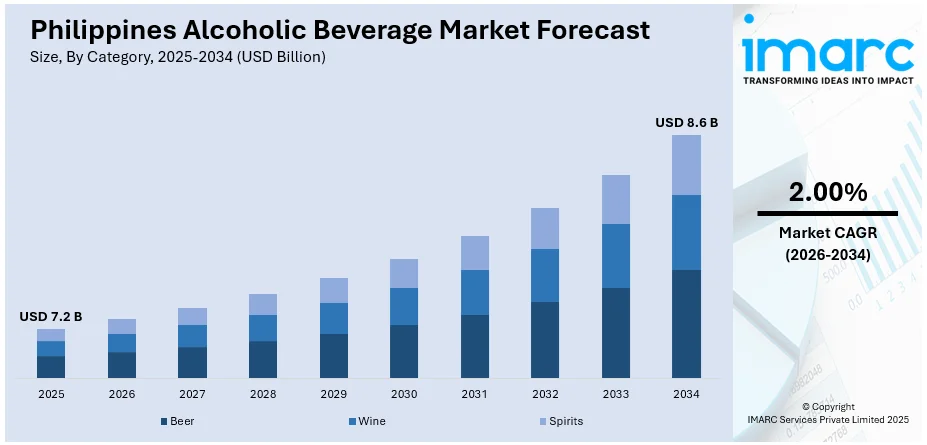

The Philippines alcoholic beverage market size reached USD 7.2 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 8.6 Billion by 2034, exhibiting a growth rate (CAGR) of 2.00% during 2026-2034. The Philippine alcoholic beverage market is driven by rising disposable incomes, shifting consumer preferences toward premium and craft products, and the growing popularity of ready-to-drink (RTD) options. Expanding e-commerce, social media influence, and innovative product offerings further support demand. Urbanization, tourism growth, and regulatory adaptations also contribute to market expansion.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 7.2 Billion |

| Market Forecast in 2034 | USD 8.6 Billion |

| Market Growth Rate 2026-2034 | 2.00% |

Philippines Alcoholic Beverage Market Trends:

Rising Popularity of Craft and Premium Alcoholic Beverages

The Philippine alcohol industry is experiencing heightened demand for premium and craft products as consumers increasingly look for high-quality and locally made beverages reflecting changing tastes for premium and craft products. The increasing number of middle-class consumers and growing disposable incomes are fueling demand for artisanal beers, small-batch spirits, and luxury wines. Consumers are looking for distinctive flavors and premium ingredients, which have driven local breweries and distilleries to launch new products. Furthermore, global brands are increasing their reach to serve the premiumization trend. This trend is also driven by younger consumers, including millennials and Gen Z, who value authenticity and craftsmanship in what they choose. Social media marketing and experiential consumption, including tasting events and brewery tours, also fuel the premiumization trend. As such, the beer is still the most commonly drunk alcoholic drink, standing at 72 % of overall alcohol consumption, around 2.1 billion liters per year.

To get more information on this market Request Sample

Expanding Market for Ready-to-Drink (RTD) Alcoholic Beverages

The ready-to-drink (RTD) alcoholic drink market in the Philippines is growing fast, fueled by convenience and changing consumption patterns. Although beer is still the most drunk alcoholic drink, with 27.3% of the alcohol consumed, RTDs are increasingly popular because they are easy to consume and contain less alcohol. Younger buyers, particularly city professionals, use canned cocktails, flavored malt drinks, and premixed spirits due to their portability and diverse flavor offerings and are suitable for social gatherings and informal occasions. Large beverage manufacturers are retaliating with innovation by launching region-inspired flavors and more health-oriented products, including low-calorie and low-sugar variants, in order to attract health-conscious consumers. The ready availability of RTDs in convenience stores, supermarkets, and online websites further enhances their visibility, making them a strong competitor to alcoholic drinks in the market.

Growth of Alcohol E-Commerce and Digital Marketing

The growth of e-commerce and online marketing is revolutionizing the sale and promotion of alcoholic drinks in the Philippines. Online liquor shops, delivery platforms, and direct-to-consumer sites have become very popular, especially after the pandemic, as customers prefer the convenience of buying alcohol online. Influencer marketing and social media are key drivers of purchasing decisions, with companies using digital promotions, virtual tastings, and interactive campaigns to win over consumers. Regulatory reforms enabling licensed alcohol delivery services have also facilitated growth. Additionally, AI-powered recommendations and customized online shopping experiences are further boosting customer interaction, positioning digital platforms as a key driver of growth for the Philippine alcoholic drinks market.

Philippines Alcoholic Beverage Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2026-2034. Our report has categorized the market based on category, alcoholic content, flavour, packaging type, and distribution channel.

Category Insights:

- Beer

- Wine

- Spirits

- Baijiu

- Vodka

- Whiskey

- Rum

- Liqueurs

- Gin

- Tequila

- Others

The report has provided a detailed breakup and analysis of the market based on the category. This includes beer, wine and spirits (Baijiu, vodka, whiskey, rum, liqueurs, gin, tequila, others).

Alcoholic Content Insights:

- High

- Medium

- Low

A detailed breakup and analysis of the market based on the alcoholic content have also been provided in the report. This includes high, medium and low.

Flavour Insights:

- Unflavoured

- Flavoured

The report has provided a detailed breakup and analysis of the market based on the flavour. This includes unflavoured and flavoured.

Packaging Type Insights:

- Glass Bottles

- Tins

- Plastic Bottles

- Others

A detailed breakup and analysis of the market based on the packaging type have also been provided in the report. This includes glass bottles, tins, plastic bottles, and others.

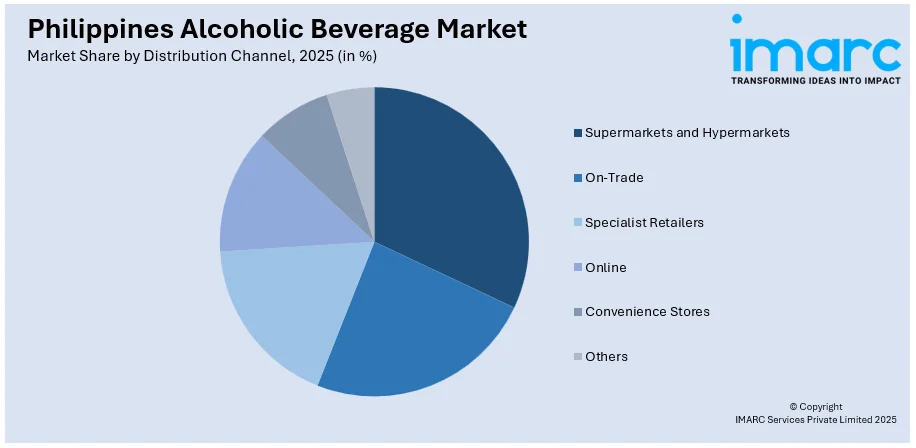

Distribution Channel Insights:

Access the Comprehensive Market Breakdown Request Sample

- Supermarkets and Hypermarkets

- On-Trade

- Specialist Retailers

- Online

- Convenience Stores

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes supermarkets and hypermarkets, on-trade, specialist retailers, online, convenience stores, others.

Regional Insights:

- Luzon

- Visayas

- Mindanao

The report has also provided a comprehensive analysis of all the major regional markets, which include Luzon, Visayas, Mindanao.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Philippines Alcoholic Beverage Market News:

- In November 2024, Leading alcohol producers and industry groups launched the Philippine Standards Coalition (PSC) to combat harmful alcohol use. Members, including Diageo, Pernod Ricard, and Bacardi, pledged to promote responsible sales and marketing, focusing on preventing underage drinking. The initiative is backed by APISWA and ABAPI to ensure safer alcohol consumption.

- In August 2024, PepsiCo launched HARD MOUNTAIN DEW in the Philippines, its first alcoholic beverage, featuring 5% ABV, zero caffeine, and no added sugar. This ready-to-drink innovation caters to evolving consumer preferences. Available in Original and Beach Blast flavors, it is sold in supermarkets, convenience stores, and bars across select cities.

Philippines Alcoholic Beverage Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Categories Covered |

|

| Alcohol Contents Covered | High, Medium Low. |

| Flavours Covered | Unflavoured, Flavoured |

| Packaging Types Covered | Glass Bottles, Tins, Plastic Bottles, Others |

| Distribution Channels Covered | Supermarkets and Hypermarkets, On-Trade, Specialist Retailers, Online, Convenience Stores, Others |

| Regions Covered | Luzon, Visayas, Mindanao |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Philippines alcoholic beverage market performed so far and how will it perform in the coming years?

- What is the breakup of the Philippines alcoholic beverage market on the basis of category?

- What is the breakup of the Philippines alcoholic beverage market on the basis of alcohol content?

- What is the breakup of the Philippines alcoholic beverage market on the basis of flavour?

- What is the breakup of the Philippines alcoholic beverage market on the basis of packaging type?

- What is the breakup of the Philippines alcoholic beverage market on the basis of distribution channel?

- What are the various stages in the value chain of the Philippines alcoholic beverage market?

- What are the key driving factors and challenges in the Philippines alcoholic beverage market?

- What is the structure of the Philippines alcoholic beverage market and who are the key players?

- What is the degree of competition in the Philippines alcoholic beverage market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Philippines alcoholic beverage market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Philippines alcoholic beverage market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Philippines alcoholic beverage industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)