Philippines ATM Market Size, Share, Trends and Forecast by Solution, Screen Size, Application, ATM Type, and Region, 2025-2033

Philippines ATM Market Size and Share:

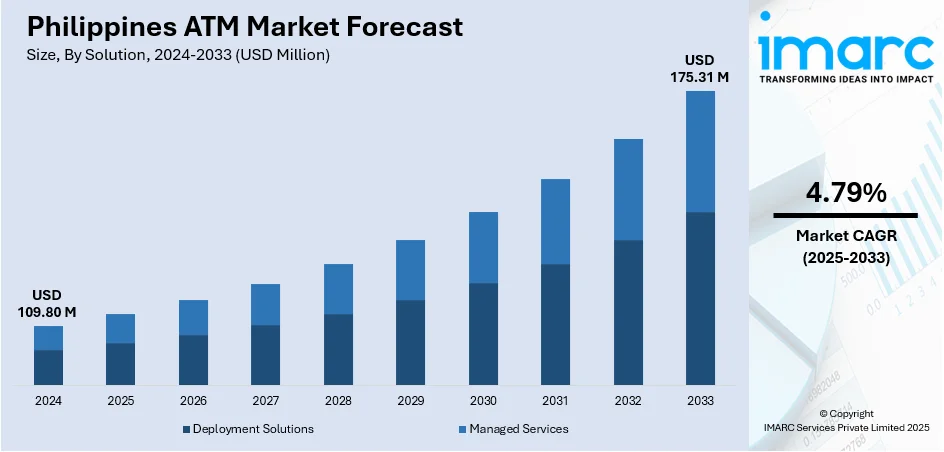

The Philippines ATM market size reached USD 109.80 Million in 2024. Looking forward, the market is expected to reach USD 175.31 Million by 2033, exhibiting a growth rate (CAGR) of 4.79% during 2025-2033. The market is growing steadily due to increased financial inclusion, rising demand for convenient banking access, and expansion by digital banks. Technological advancements, such as cash-recycling ATMs and biometric authentication, are also driving adoption. Urbanization and improved banking infrastructure further support this trend, contributing to a competitive and evolving landscape in the Philippines ATM market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 109.80 Million |

| Market Forecast in 2033 | USD 175.31 Million |

| Market Growth Rate 2025-2033 | 4.79% |

Key Trends of Philippines ATM Market:

Technological Advancements and Smart ATM Deployment

Technological innovation is transforming the functionality of ATMs in the Philippines. New generation machines have gone beyond just cash withdrawal services to provide services like biometric authentication, QR-authentication access, cardless transactions, and bill payments. A combination of cash-recycling features and multi-language interfaces also makes it easier to use and operate. These innovations are attractive both to the banks and to the users because they are less costly, and they enhance customer experience. Additionally, digital-first banks like GoTyme are leveraging smart ATMs as physical touchpoints, bridging the gap between online and offline banking. This shift toward multifunctional, secure, and user-friendly ATMs is a major growth driver, reflecting evolving consumer expectations and the need for flexible, around-the-clock banking solutions. For instance, in July 2023, NCR Corporation, a prominent provider of enterprise technology solutions, announced that Union Bank of the Philippines had chosen its ATM as a Service offering to transform, integrate, and enhance the efficiency of the bank’s self-service banking operations.

To get more information on this market, Request Sample

Expansion of Digital and Hybrid Banking Models

The rise of digital and hybrid banking models is fueling the Philippines ATM market growth. Digital banks, which primarily operate online, are now incorporating physical elements like ATMs and kiosks to increase customer trust, accessibility, and service capabilities. This strategy helps cater to a broader demographic, including users who still prefer cash transactions or need physical verification. Hybrid models that combine mobile apps with ATM infrastructure are becoming more common, offering users convenient, omnichannel banking experiences. The ability to offer real-time services, such as instant deposits or withdrawals, enhances customer satisfaction. This blend of digital efficiency with physical accessibility is significantly contributing to the sustained growth and evolution of the ATM market. For instance, in January 2023, Euronet Worldwide Inc., a global provider of financial technology and payment solutions, strengthened its presence in the Philippines by acquiring several off-site automated teller machines (ATMs) from the Bank of the Philippine Islands (BPI). This strategic move aims to significantly expand Euronet’s ATM network across the country, particularly in non-branch locations, to enhance accessibility for users.

Shift Toward Contactless and Cardless Transactions

The Philippine ATM market is also experiencing a significant shift toward cardless and contactless transactions, driven by the need for convenience, speed, and increased security levels. ATMs are now being installed with mobile banking and QR code scanning feature, allowing customers to make withdrawals or other transactions without a physical card. This change minimizes machine wear and tear and decreases the risk of card skimming and other forms of fraud. This shift is part of the nation's overall effort to encourage digital banking and cashless transactions, aimed at technology-savvy consumers and enhancing the overall efficiency of transactions. As banks upgrade their ATM infrastructure, this innovation is anticipated to further enhance Philippines ATM market demand.

Key Drivers of Philippines ATM Market:

Expanding Banking Network and Financial Inclusion Initiatives

The Philippines ATM market is gaining from the growth of banking networks and targeted financial inclusion efforts focused on rural and underserved areas. Financial institutions are increasing the number of ATMs in remote communities to offer essential services like cash withdrawals, deposits, and fund transfers. This approach aims to close the gap between urban and rural financial services, empowering individuals and small enterprises with improved monetary control. By incorporating ATMs into local settings, these initiatives enhance convenience, minimize travel time to banks, and promote economic engagement. This strategy broadens market reach and aligns with the country's long-term vision of providing inclusive and accessible financial services to all citizens.

Rising Demand for 24/7 Cash Access and Convenient Banking Services

As per Philippines ATM market analysis, there is a growing need for around-the-clock cash access and convenient banking options, acting as a key driver for the market. Consumers are more and more looking for flexible alternatives that fit around their timelines, making 24/7 ATM facilities essential. Whether for last-minute withdrawals, night-time transactions, or a way to skip long lines at bank outlets, ATMs offer unparalleled convenience. It is especially felt in busy city lives and in rural towns where ATMs are a main banking facility. Banking institutions are countering by deploying ATMs strategically in busy places like shopping malls, transportation stations, and community centers to maximize convenience and service effectiveness.

Growing Adoption of Multifunctional ATMs

The Philippines ATM market is witnessing a rise in the introduction of multifunctional ATMs that offer services beyond cash dispensing. These machines now facilitate bill payments, fund transfers, mobile phone top-ups, and even government-related transactions, creating a comprehensive self-service banking solution. This trend improves customer convenience, decreases reliance on bank branches, and efficiently manages the increasing transaction volumes. By utilizing user-friendly interfaces and quicker processing capabilities, multifunctional ATMs enhance the overall banking experience while boosting operational efficiency for financial institutions. The adaptability of these machines positions them as essential in the advancement of modern banking services in the country.

Philippines ATM Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on solution, screen size, application, and ATM type.

Solution Insights:

- Deployment Solutions

- Onsite ATMs

- Offsite ATMs

- Work Site ATMs

- Mobile ATMs

- Managed Services

The report has provided a detailed breakup and analysis of the market based on the solution. This includes deployment solutions (onsite ATMs, offsite ATMs, work site ATMs, and mobile ATMs) and managed services.

Screen Size Insights:

- 15" and Below

- Above 15"

A detailed breakup and analysis of the market based on the screen size have also been provided in the report. This includes 15" and below and above 15".

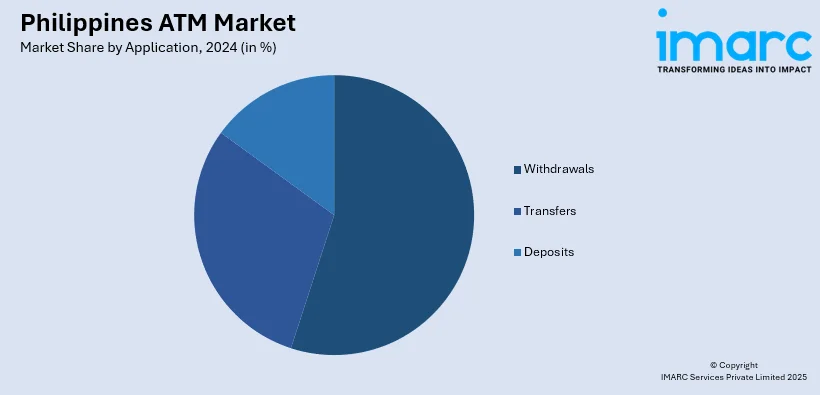

Application Insights:

- Withdrawals

- Transfers

- Deposits

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes withdrawals, transfers, and deposits.

ATM Type Insights:

- Conventional/Bank ATMs

- Brown Label ATMs

- White Label ATMs

- Smart ATMs

- Cash Dispensers

A detailed breakup and analysis of the market based on the ATM type have also been provided in the report. This includes conventional/bank ATMs, brown label ATMs, white label ATMs, smart ATMs, and cash dispensers.

Regional Insights:

- Luzon

- Visayas

- Mindanao

The report has also provided a comprehensive analysis of all the major regional markets, which include Luzon, Visayas, and Mindanao.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Philippines ATM Market News:

- In April 2025, Pito AxM Platform Inc. (PAPI), a fully owned subsidiary of Japan-based Seven Bank Ltd., revealed its collaboration with CTBC Bank Philippines Corp. PAPI manages a nationwide network of approximately 3,000 automated teller and cash-recycling machines (ATMs/CRMs), strategically located within 7-Eleven convenience stores across the Philippines.

- In February 2024, GoTyme Bank, backed by the Gokongwei Group, announced it to introduce automated teller machine (ATM) services in the Philippines this March, marking a first among the country’s digital banks to offer such functionality within their ecosystem. To roll out this cobranded ATM network for its customers, GoTyme has formed a partnership with U.S.-based payment solutions provider Euronet Technology Services Inc.

Philippines ATM Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Solutions Covered |

|

| Screen Sizes Covered | 15" and Below, Above 15" |

| Applications Covered | Withdrawals, Transfers, Deposits |

| ATM Types Covered | Conventional/Bank ATMs, Brown Label ATMs, White Label ATMs, Smart ATMs, Cash Dispensers |

| Regions Covered | Luzon, Visayas, Mindanao |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Philippines ATM market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Philippines ATM market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Philippines ATM industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The ATM market in Philippines was valued at USD 109.80 Million in 2024.

The Philippines ATM market is projected to exhibit a compound annual growth rate (CAGR) of 4.79% during 2025-2033.

The Philippines ATM market is expected to reach a value of USD 175.31 Million by 2033.

The Philippines ATM market is witnessing advancements such as AI-powered predictive maintenance, solar-powered ATMs for off-grid areas, and improved user interfaces for faster transactions. Increasing integration with fintech platforms and enhanced cross-bank interoperability are also shaping the market’s evolution, improving accessibility and customer satisfaction.

Growth in the Philippines ATM market is fueled by rising cash circulation, increased tourism boosting cash demand, and strategic ATM placements in high-footfall commercial zones. Enhanced safety measures, including anti-skimming technologies and real-time monitoring, along with growing demand for currency exchange-enabled ATMs, are further driving market expansion.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)