Philippines Baby Food Market Size, Share, Trends and Forecast by Product Type, Age Group, Distribution Channel, and Region, 2026-2034

Philippines Baby Food Market Size and Share:

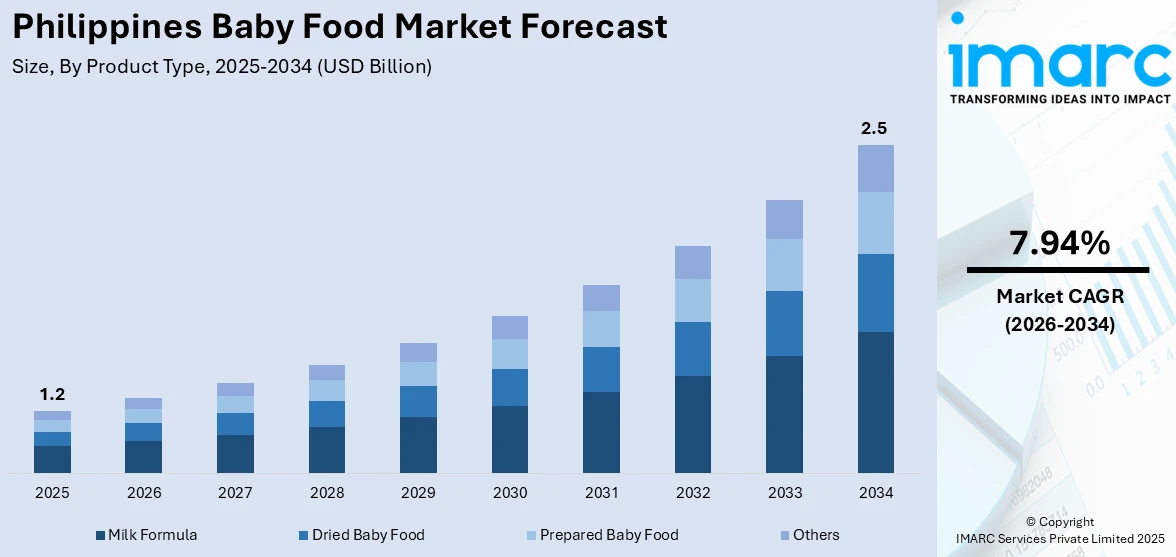

The Philippines baby food market size reached USD 1.2 Billion in 2025. Looking forward, the market is expected to reach USD 2.5 Billion by 2034, exhibiting a growth rate (CAGR) of 7.94% during 2026-2034. Rising birth rates, urbanization, higher disposable income, and growing awareness of newborn nutrition are propelling the growth of the market. Demand for organic and fortified food, rising e-commerce, and government measures encouraging child health further contribute to market development.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 1.2 Billion |

| Market Forecast in 2034 | USD 2.5 Billion |

| Market Growth Rate 2026-2034 | 7.94% |

Key Trends of Philippines Baby Food Market:

Rising Demand for Locally Sourced Baby Food

Locally made and nutrient-rich baby food is gaining popularity as communities stress child nutrition and agricultural sustainability. Efforts to make baby food from indigenous crops show the trend of minimizing reliance on imported components while helping local farmers. Sweet potatoes, which are abundant in vitamins, are becoming a popular foundation for fortified infant food, especially in self-sufficient regions. Government-backed programs and processing facilities play an important role in ensuring that these goods fulfil nutritional criteria and are affordable to households. This approach is consistent with wider aims of treating malnutrition through low-cost and locally accessible foods, promoting economic possibilities for small-scale farmers, and giving healthier alternatives for early childhood development. For example, in February 2024, Baybay City, Leyte, launched a program to make baby food and milk from sweet potatoes, therefore combating hunger and assisting farmers. It is managed by the Root Crops Processing Center and provides nutritional alternatives for children from 6 months to 3 years old, utilizing locally obtained sweet potatoes. These initiatives further contribute to the growth and development of Philippines baby food market share.

To get more information on this market Request Sample

Growing Demand for Infant Nutrition Products

The infant nutrition sector is growing steadily, owing to increased awareness of early childhood health and rising disposable incomes. Parents prefer high-quality and nutrient-dense infant milk and formula, driving market expansion. Consumer tastes are being influenced even more by formulation innovations, such as organic and hypoallergenic alternatives. Companies, bolstered by advances in product development and fortified ingredients, are concentrating on increasing nutritional value while maintaining safety. Regulatory support and changing dietary patterns both contribute to the sector's growth. The anticipated growth in sales reflects a move toward premium newborn feeding products, with increased demand in both urban and rural areas. This steady increase highlights the necessity of affordable and high-quality formula solutions for newborn health and development. In the Philippines, government efforts such as the First 1,000 Days Program focus on appropriate infant feeding, impacting parent decisions and stimulating demand for fortified formula products. The increasing trend of working mothers has also prompted greater dependence on infant formula as a convenient, healthy substitute for breastfeeding, which further increases the Philippines baby food market demand as well.

Rise in Digital and Direct-to-Consumer Baby Food Channels

Another trend in the Philippines market for baby food is the quick growth of digital and direct-to-consumer (D2C) platforms that are specific to the lifestyles of modern-day Filipinos. As more urban parents are restricted by time, yet keen to provide high-quality nutrition for the children, infant food companies are using e-commerce sites, subscription boxes, and mobile-based ordering in order to establish direct contact with caregivers. This transition responds to parents' need for ease, customization, and more control over what they eat themselves. Numerous regional enterprises have introduced online sites providing bundled packages of porridge, puree, and snacks—usually with rich ingredient narratives, cooking instructions, and customized diet plans. Certain brands also incorporate virtual consultations or support chat facilities, bringing parents into contact with nutrition specialists who advise them on the optimum combinations according to regional diets and developmental requirements. The trend takes advantage of the general availability of smartphones and increasing confidence in online shopping across the nation. In addition to this, brands are also utilizing social media and parent community groups on Facebook and messaging apps to create engagement, promote new launches, and collect feedback. The direct involvement approach gives firms a chance to source important consumer insights and build brand loyalty at the same time. The way infant food is promoted and consumed in the Philippines has changed as a result of this move toward digital-first delivery and customized contact.

Growth of Organic and Eco‑Friendly Baby Foods

Growing customer concern for the environment and young children is reflected in the market's growing demand for eco-friendly and organic products. Across the nation, parents are looking for baby food comprised of certified organic ingredients, pesticide‑ and synthetically fertilizer‑free, and sourced from sustainably farmed lands. This movement is especially prevalent in regions close to organic farming centers, including Benguet, Davao, and Palawan, where farmers are partnering with baby food companies to advance traceable, farm-to-table operations. Firms are embracing environmentally friendly packaging options like biodegradable pouches, glass jars, and recyclable cartons to reduce plastic usage and appeal to morally conscious consumers. A few brands take this a step ahead by backing fair‑trade and women‑empowered farming collectives, weaving social impact into the stories behind their products. Urban stores and specialty boutiques are highlighting these organic products prominently, and websites offer extensive information about farm origins, certification procedures, and environmental footprint. This movement is revolutionizing the market by combining health, sustainability, and social responsibility, elevating the premium baby food segment while cultivating local farmers and decreasing ecological footprints in the Philippines.

Growth Drivers of Philippines Baby Food Market:

Urbanization and Increasing Disposable Incomes

According to the Philippines baby food market analysis, urbanization serves as a key driver in transforming consumer behavior in the region, particularly among young families. As people move increasingly to urban areas such as Metro Manila, Cebu, and Davao, lifestyles are becoming more convenient and time efficient. Parents, particularly working mothers, are increasingly turning to store-bought baby food products as convenient substitutes for home-cooked traditional meals. This shift is aided by growing income levels among households, making them spend on a broader range of premium infant food brands. Increased awareness and spending on products that assure quality, safety, and nutrition for infants also arise from the rise in middle-income families. The availability of modern retail infrastructure such as supermarkets and digital shopping platforms has further made infant food widely available than ever. This availability, in addition to the requirements of urban life at a high pace, continues to propel consistent market expansion in different parts of the nation.

Shifts in Family and Cultural Attitudes

Among the major drivers of growth in the Philippine baby food market is the changing family structure of Filipinos and cultural attitudes towards raising children. Extended families traditionally took the lead in childcare, with grandparents and relatives helping feed and care for infants using home-based recipes. Yet with more nuclear families now becoming the standard—especially in urban and semi-urban areas—the need to rely on outside assistance is declining. This phenomenon puts additional pressure on parents, particularly working mothers, to take care of childcare on their own, creating a need for convenient, accessible baby food. Additionally, as cultural values shift, there is increasing popularity for formula feeding and commercially prepared foods, which previously were inferior to breastfeeding or conventional weaning foods. This shift in perception is facilitated by increased access to worldwide parenting trends via media and social platforms. As Filipino households become more modernized and take on more independent lifestyles, the baby food industry sees growing demand for products that enable independent parenting without sacrificing quality or nutrition.

Product Innovation, E-commerce, and Health Awareness

Product formulation and packaging innovation are among the key drivers of expansion in the baby food market in the Philippines. With growing health awareness among Filipino parents, there is greater demand for products containing no artificial additives, allergens, and excessive sugars. Brands are catering to this demand with organic, fortified, and functional baby food lines that benefit brain development, digestion, and immunity. Such products connect well in a market where childhood malnutrition and stunting remain high in some regions. In addition to this, the popularity of online platforms has revolutionized shopping for baby food among parents. Online portals, mobile applications, and social media make products easily available, while also offering information, reviews, and word-of-mouth recommendations that shape purchases. Online communities and parenting forums also contribute significantly towards spreading awareness on correct infant feeding. This blend of educated customers, online convenience, and ongoing development positions the Philippine baby food market among the most vibrant in Southeast Asia.

Philippines Baby Food Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2026-2034. Our report has categorized the market based on product type, age group, and distribution channel.

Product Type Insights:

- Milk Formula

- Dried Baby Food

- Prepared Baby Food

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes milk formula, dried baby food, prepared baby food, and others.

Age Group Insights:

- 0-6 Months

- 6-12 Months

- 12-24 Months

A detailed breakup and analysis of the market based on the age group have also been provided in the report. This includes 0-6 months, 6-12 months, and 12-24 months.

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Supermarkets/Hypermarkets

- Online

- Pharmacies

- Convenience Stores

- Others

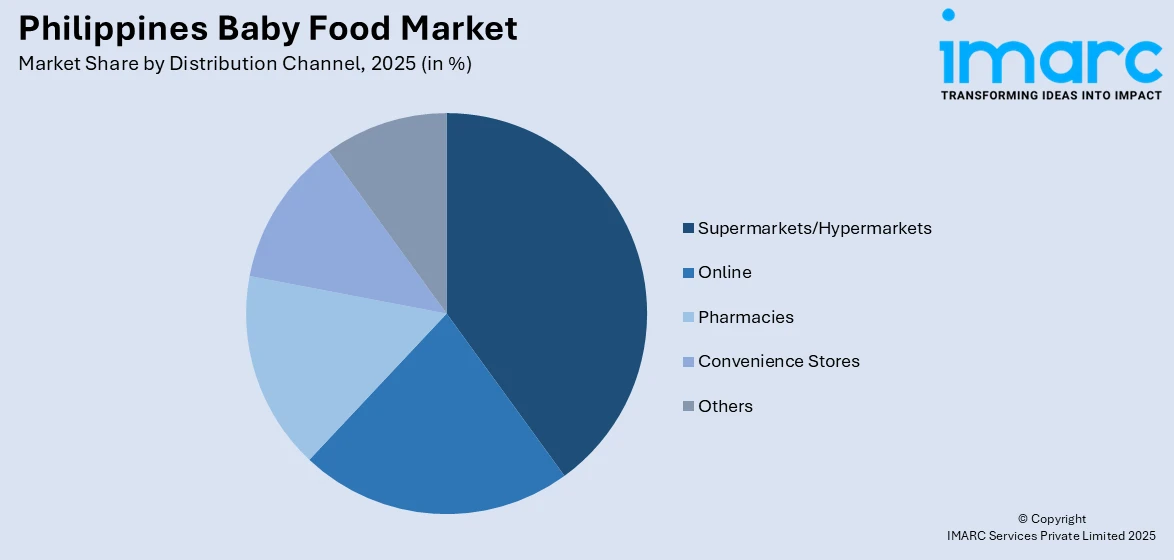

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes supermarkets/hypermarkets, online, pharmacies, convenience stores, and others.

Regional Insights:

- Luzon

- Visayas

- Mindanao

The report has also provided a comprehensive analysis of all the major regional markets, which include Luzon, Visayas, and Mindanao.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Philippines Baby Food Market News:

- In October 2024, Healthy Options introduced the "Be Kind to Future You" campaign, which encourages regular consumption of clean and natural components for long-term health advantages. Happy Baby's organic baby food tastings were highlighted at the event, demonstrating the company's dedication to offering nutritious alternatives for newborns. This project reflects a rising trend in the Philippines baby food market for organic and health-conscious options.

- In September 2024, UNICEF and the Consortium for Improving Complementary Foods in Southeast Asia (COMMIT) held a symposium in Manila to discuss the nutritional quality of commercially produced supplemental meals in the Philippines. The event raised concerns that more than one-third of packaged meals for children aged 6 months to 3 years include added sugars or sweeteners, which contribute to growing childhood obesity rates. Experts advocated for stricter regulations and greater enforcement to provide safer and healthier alternatives for young children.

Philippines Baby Food Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Milk Formula, Dried Baby Food, Prepared Baby Food, Others |

| Age Groups Covered | 0-6 Months, 6-12 Months, 12-24 Months |

| Distribution Channels Covered | Supermarkets/Hypermarkets, Online, Pharmacies, Convenience Stores, Others |

| Regions Covered | Luzon, Visayas, Mindanao |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Philippines baby food market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Philippines baby food market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Philippines baby food industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Philippines baby food market was valued at USD 1.2 Billion in 2025.

The Philippines baby food market is projected to exhibit a CAGR of 7.94% during 2026-2034.

The Philippines baby food market is expected to reach a value of USD 2.5 Billion by 2034.

The Philippines baby food market is driven by escalating birth rates, urbanization, heightened awareness about infant nutrition, and the trend towards convenience. Rising incomes among the middle class, increased female labor force participation, and bold advertising by international brands also stimulate demand. Government health measures also contribute to market growth and education among parents.

The Philippines baby food market is growing propelled by increasing demand for organic foods, functional nutrition, and local-sourced ingredients. Parents are opting for clean-label, fortified products that are customized to fit local diets. Online channels, sustainable packaging, and direct-to-consumer channels are also influencing contemporary buying habits and redefining consumption of baby food in the country.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)