Philippines Board Games Market Size, Share, Trends and Forecast by Product Type, Game Type, Age Group, Distribution Channel, and Region, 2025-2033

Philippines Board Games Market Size and Share:

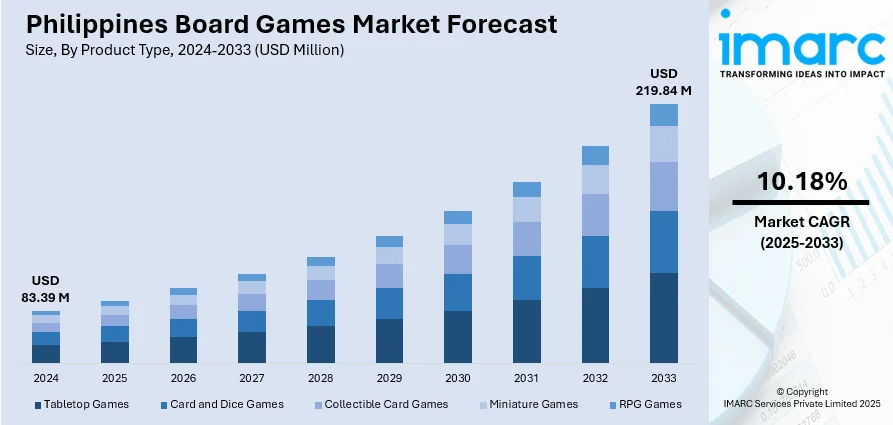

The Philippines board games market size reached USD 83.39 Million in 2024. Looking forward, the market is projected to reach USD 219.84 Million by 2033, exhibiting a growth rate (CAGR) of 10.18% during 2025-2033. A substantial youth population seeking cost-effective social activities, combined with the increasing use of board games for educational purposes, is driving the market in the Philippines. Social interaction, innovative learning tools, and organized community events sustain engagement, establishing board games as a lasting mainstream pastime, further contributing to the Philippines board games market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 83.39 Million |

| Market Forecast in 2033 | USD 219.84 Million |

| Market Growth Rate 2025-2033 | 10.18% |

Key Trends of Philippines Board Games Market:

Young Demographic with Time to Play

A significant portion of the growth in board games in the Philippines is attributed to its youthful population, as students and young professionals constantly seek affordable ways to socialize. Board games suit limited budgets and make long evenings enjoyable and social. Hobby cafés, dorm lounges, and community centers experience regular visits from this demographic, who enjoy variety and exploring new titles rather than repeating the same one consistently. Their enthusiasm sustains small clubs, campus organizations, and temporary game events, transforming casual gamers into regular buyers. Retailers and publishers are aware they can rely on this consistent foundation to sustain sales and maintain discussions. In the Philippines, 30 million individuals between the ages of 10 and 24 constitute 28% of the overall population. According to the forecasts from the Philippines Statistics Authority, this is expected to stay almost unchanged by 2055. This indicates that the influx of inquisitive new players will continue unabated for the foreseeable future, providing the market with a stable base to develop upon. These young athletes invite their friends, share their online discoveries, and build communities that expand with every game night. This transforms a basic hobby into a consistent, enduring aspect of how young people engage and relate to one another, supporting the Philippines board games market growth.

To get more information of this market, Request Sample

Gamified Learning Encourages Broader Engagement

Financial literacy games and similar educational tools are opening new opportunities for board game adoption in the Philippines. When trusted brands introduce interactive learning through games, people who might not normally try tabletop play get drawn in. These games break down serious topics into easy, enjoyable sessions, proving that board games are not only for kids or hobbyists. By combining practical lessons with entertainment, they make playing feel productive, which appeals to busy adults and professionals. Schools, companies, and community groups also pick up on this trend, using games to teach skills in a hands-on way that books and lectures cannot match. As more people see games as tools for self-improvement, demand spreads into new age groups and social circles. Businesses that tap into this format find a fresh way to reach people and build loyalty. Each new educational title expands the audience, sparks curiosity about other genres, and provides local creators with ideas for similar projects. This bridge between learning and leisure is helping the market grow by demonstrating that board games can have real-life value beyond entertainment, enabling people to build knowledge and confidence in areas that matter to their daily lives. In 2024, Sun Life Philippines launched Play for Life: A Game of Choices, an interactive financial literacy game available online and as a tabletop version in all branches nationwide. The game helped Filipinos make smart financial decisions through engaging real-life scenarios. Special editions for OFWs and professionals, plus promo prizes, highlighted Sun Life's push for inclusive financial education.

Increasing Demand for Locally Themed and Culturally Inspired Board Games

The board game market in the Philippines is witnessing a notable rise in interest for games that showcase local culture, traditions, and history. These games feature Filipino themes, languages, and familiar environments making them more engaging and relatable for players. They provide entertainment and foster cultural appreciation and storytelling appealing to both local audiences and tourists in search of unique souvenirs. Designers are increasingly emphasizing the integration of traditional folklore, historical events, and regional details into gameplay to deliver authentic experiences. This trend also nurtures local creativity and small-scale production enhancing market diversity. The rising demand for culturally relevant content plays a pivotal role in shaping Philippines board games market demand.

Growth Drivers of Philippines Board Games Market:

Rising Interest in Offline Social Entertainment and Group Activities

The Philippines board games market is thriving due to a growing inclination toward offline social entertainment as individuals seek meaningful screen-free interactions with friends and family. Board games present an interactive and engaging experience that promotes communication, teamwork, and friendly rivalry. This trend resonates particularly with millennials and Gen Z who prioritize shared experiences over solitary pursuits. Activities such as game nights, family gatherings, and corporate team-building sessions are increasingly incorporating board games as a main focus. The tactile nature of gameplay along with the wide range of genres and difficulty levels available, ensures that board games remain an adaptable choice for both casual players and enthusiasts, contributing to the market's consistent growth across the nation.

Growing Popularity of Board Game Cafés and Community Gaming Events

According to Philippines board games market analysis, the rising number of board game cafés and community gaming events significantly contributes to market growth. These places provide a diverse selection of games, expert guidance, and a friendly atmosphere for players of all ages and skill levels. Board game cafés have emerged as popular social hubs blending entertainment with food and drinks to create a distinct experience. Community events, tournaments, and workshops further promote involvement and awareness helping introduce a wider audience to contemporary board games beyond traditional favorites. This development of social gaming environments cultivates a vibrant player community enhances market engagement and boosts overall board game sales in the country.

Expanding Availability of Diverse Game Genres Catering to Different Age Groups

The Philippines board games market is experiencing substantial growth thanks to an increasing array of game genres designed to appeal to various interests and age groups. From educational games for children to intricate strategy and role-playing games for adults, the diverse offerings attract a wide customer base. Family-friendly games resonate with multi-generational households, while party games and trivia sets are popular at social events. Publishers and retailers are also releasing themed games inspired by films, pop culture, and local customs, broadening their appeal. This variety caters to diverse tastes and encourages repeat purchases, as consumers are more likely to build personal collections. The expanding range of choices continues to fuel market demand and reinforce customer loyalty.

Philippines Board Games Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product type, game type, age group, and distribution channel.

Product Type Insights:

- Tabletop Games

- Card and Dice Games

- Collectible Card Games

- Miniature Games

- RPG Games

The report has provided a detailed breakup and analysis of the market based on the product type. This includes tabletop games, card and dice games, collectible card games, miniature games, and RPG games.

Game Type Insights:

- Strategy and War Games

- Educational Games

- Fantasy Games

- Sport Games

- Others

A detailed breakup and analysis of the market based on the game type have also been provided in the report. This includes strategy and war games, educational games, fantasy games, sport games, and others.

Age Group Insights:

- 0-2 Years

- 2-5 Years

- 5-12 Years

- Above 12 Years

The report has provided a detailed breakup and analysis of the market based on the age group. This includes 0-2 years, 2-5 years, 5-12 years, and above 12 years.

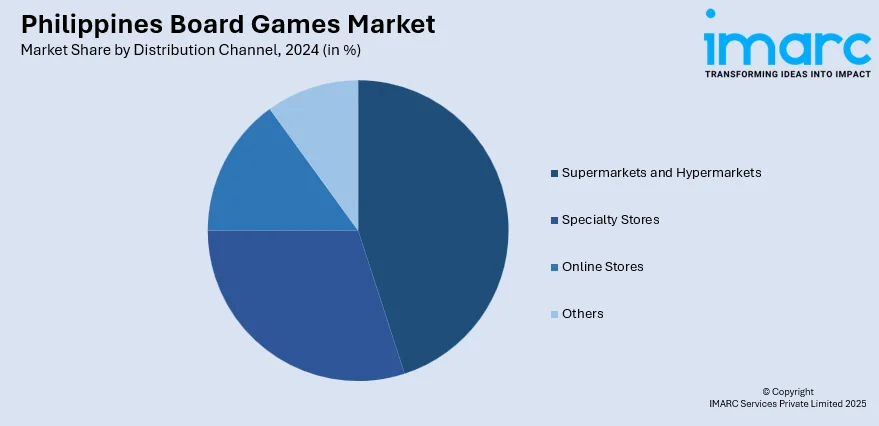

Distribution Channel Insights:

- Supermarkets and Hypermarkets

- Specialty Stores

- Online Stores

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes supermarkets and hypermarkets, specialty stores, online stores, and others.

Regional Insights:

- Luzon

- Visayas

- Mindanao

The report has also provided a comprehensive analysis of all the major regional markets, which include Luzon, Visayas, and Mindanao.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Philippines Board Games Market News:

- In May 2025, Quezon City in the Philippines hosted the All aBOARD 2025 Expo, a massive four-day celebration of board games and geek culture. With over 300 games, international guests, and local designers, the event aimed to establish the city as the board game capital of Southeast Asia.

- In January 2025, UPLB professor Mariyel Hiyas Liwanag was awarded P100,000 by the Komisyon ng Wikang Filipino for her board game Isabuhay, designed to teach students about the Philippines' native languages. The game promotes awareness of linguistic issues through interactive roles and storytelling. Liwanag aims to make it open-access for educators nationwide.

Philippines Board Games Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Tabletop Games, Card and Dice Games, Collectible Card Games, Miniature Games, RPG Games |

| Game Types Covered | Strategy and War Games, Educational Games, Fantasy Games, Sport Games, Others |

| Age Groups Covered | 0-2 Years, 2-5 Years, 5-12 Years, Above 12 Years |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Specialty Stores, Online Stores, Others |

| Regions Covered | Luzon, Visayas, Mindanao |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Philippines board games market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Philippines board games market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Philippines board games industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The board games market in Philippines was valued at USD 83.39 Million in 2024.

The Philippines board games market is projected to exhibit a compound annual growth rate (CAGR) of 10.18% during 2025-2033.

The Philippines board games market is expected to reach a value of USD 219.84 Million by 2033.

The Philippines board games market is witnessing trends such as the rise of cooperative and narrative-driven games, increasing adoption of hybrid board-digital formats, and growing interest in eco-friendly, sustainably produced games. Limited-edition releases and crowdfunding-backed game launches are also gaining traction among collectors and enthusiasts.

Growth in the Philippines board games market is driven by increasing participation in educational and skill-building games, rising tourism creating demand for locally themed souvenirs, and enhanced retail presence in specialty stores. The expansion of online marketplaces and improved distribution networks further support accessibility, boosting consumer engagement and purchase frequency.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)