Philippines Business Process Management Market Size, Share, Trends and Forecast by Deployment Type, Component, Business Function, Organization Size, Vertical, and Region, 2026-2034

Philippines Business Process Management Market Size and Share:

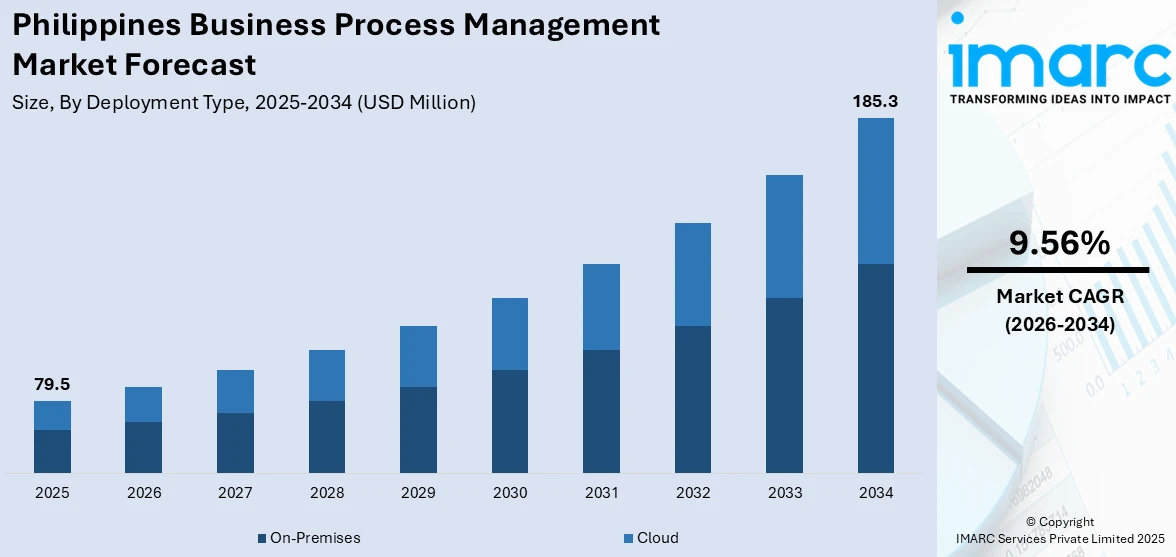

The Philippines business process management market size reached USD 79.5 Million in 2025. Looking forward, the market is projected to reach USD 185.3 Million by 2034, exhibiting a growth rate (CAGR) of 9.56% during 2026-2034. The government of the Philippines is working to promote the usage of business process automation tools through ongoing policy support, tax incentives, and regulatory changes. Moreover, the Philippines is constantly building a very qualified talent pool that is becoming more skilled in new technologies. Furthermore, increasing global demand for scalable, cost-efficient solutions is expanding the Philippines business process management market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 79.5 Million |

| Market Forecast in 2034 | USD 185.3 Million |

| Market Growth Rate 2026-2034 | 9.56% |

Key Trends of Philippines Business Process Management Market:

Rising Government Support and Incentives

The government of the Philippines is working to promote the usage of business process management (BPM) tools through ongoing policy support, tax incentives, and regulatory changes. Organizations such as the Board of Investments (BOI) and the Philippine Economic Zone Authority (PEZA) are providing tax holidays, ease in licensing, and investment benefits to BPM firms, making it a more desirable location for outsourcing. The government is also rolling out the Digital Cities 2025 program, which is taking BPM operations outside Metro Manila to growth cities like Iloilo, Davao, and Bacolod. This decentralization is bringing in talent and cost advantages. In addition, policies are being rolled out to retrain local talent on data analytics, artificial intelligence (AI), and cybersecurity so that the workforce is aligned with next-gen BPM needs. As the government keeps propelling digitalization and economic decentralization, these efforts are supporting the long-term competitiveness and sustainability of the BPM industry in the market for outsourcing.

To get more information on this market Request Sample

Talent Pool with Digital Competence Base

The Philippines is constantly building a very qualified and English-literate talent pool that is becoming more skilled in new technologies, thus fueling the Philippines business process management market growth. Universities and centers for training are expanding courses in emerging digital skills like robotic process automation (RPA), cloud computing, and data science to address the changing needs of clients. As businesses shift from conventional voice-based services to high-value activities like finance, human resources, and IT, Filipino professionals are proactively adjusting and migrating into these knowledge-based positions. BPM companies are also investing in building internal capabilities to improve staff competence in customer analytics, AI-driven decision-making, and digital service delivery. With a median age of only 25, the workforce is young and receptive to innovation. These ongoing upskilling and digital preparedness of Filipino BPM employees are keeping the industry competitive globally, particularly with clients increasingly looking for end-to-end digital transformation partners and not just pure outsourcing vendors. As per the report of Curran Daly & Associates, in 2025, Hiring in the Philippines is rapidly changing, with a 38% increase in activity and escalating turnover prompting HR leaders to update their recruitment approaches.

Increasing Global Demand for Scalable, Cost-Efficient Solutions

Multinational corporations are increasingly demanding scalable, cost-efficient BPM solutions, and the Philippines is strategically positioned to meet this need due to its competitive labor costs, strong infrastructure, and cultural alignment with Western markets. Amid global economic uncertainties, businesses are optimizing operations and reducing overhead by outsourcing complex processes such as financial services, healthcare support, and legal processing to Philippine providers. Companies are prioritizing service providers who can offer high-quality support while managing budgets, and the Philippines continues to deliver favorable cost-to-quality ratios. Simultaneously, Filipino BPM firms are expanding their technology stack, offering automation, cloud-based CRM platforms, and 24/7 support, ensuring that services remain agile and scalable. Clients from the US, Australia, and Europe are increasingly partnering with Philippine BPM firms to handle both front-end and back-end operations, thus reinforcing the country’s position as a preferred outsourcing destination amid a globally shifting business environment. The IMARC Group predicts that the Philippines IT services market is projected to attain USD 9.83 Billion by 2033. This will further increase the outsourcing of various business process to the nation.

Growth Drivers of Philippines Business Process Management Market:

Increasing Adoption of Automation and AI-Driven Process Optimization

The Philippines business process management market demand is largely shaped by the swift incorporation of automation and artificial intelligence into BPM offerings. These innovative technologies enhance workflow efficiency, minimize human errors, and speed up data-driven decision-making, leading to greater operational effectiveness and precision. Automation solutions take care of repetitive tasks allowing human talent to concentrate on more strategic and complex duties while AI improves predictive analytics and customer personalization. This dual approach boosts productivity and ensures cost-effective solutions for clients across various sectors. With the growing global appetite for advanced BPM solutions providers in the Philippines that harness automation and AI are ideally positioned to offer competitive and high-value services that meet the changing demands of both the local and international markets.

Expanding Outsourcing Services for Global Clients Across Industries

The Philippines has established itself as a premier outsourcing destination due to its skilled workforce, proficiency in English, and competitive pricing. BPM providers serve a wide range of industries including finance, healthcare, telecommunications, and e-commerce delivering specialized solutions that cater to the unique operational demands of each sector. The country's capacity to offer round-the-clock support guarantees continuous business operations for global clients thereby reinforcing long-term partnerships. Additionally, providers are broadening their range of services to incorporate analytics, digital transformation assistance, and compliance management thereby enhancing their value proposition. This mix of cost efficiency, quality, and adaptability makes the Philippines a highly appealing option for outsourcing maintaining robust demand from multinational organizations and solidifying its role as a global BPM leader.

Rising Need for Improved Customer Experience and Service Quality

The Philippines business process management market analysis shows that a heightened focus on customer experience is becoming a pivotal factor for growth. Companies are increasingly emphasizing personalized, efficient, and consistent service delivery to retain customers and foster brand loyalty. BPM providers in the Philippines are adept at delivering customer engagement solutions, providing multichannel support that includes phone, email, live chat, and social media. They leverage analytics to gain insights into consumer behavior, facilitating targeted enhancements in service processes. Customized solutions ensure that each client's customer service operations are aligned with the specific requirements of their industry, improving satisfaction levels. This strong commitment to service quality enables businesses to meet customer expectations and establishes Philippine BPM providers as reliable partners in developing sustainable, customer-centric business models.

Opportunities of Philippines Business Process Management Market:

Growing Demand for Digital Transformation Services

The worldwide transition toward digital-centric business strategies is generating significant opportunities for the Philippines' business process management (BPM) sector. Companies are in search of BPM providers that can facilitate digital transformation through cloud integration, workflow automation, and sophisticated data management. Philippine firms, supported by a talented workforce and competitive pricing, are well-equipped to effectively provide these services. They help enterprises modernize legacy systems, enhance operational flexibility, and meet changing customer demands. By delivering customized digital transformation solutions, BPM providers in the Philippines can attract a wide variety of international clients looking to secure their operations for the future. This increasing demand propels sector growth and pushes local providers to consistently innovate, embrace new technologies, and enhance their skills to stay competitive.

Expansion into High-Value Services like Analytics, AI Integration, and Robotic Process Automation

The BPM market in the Philippines is evolving beyond traditional voice-based services toward high-value offerings like analytics, AI integration, and robotic process automation (RPA). These advanced solutions enable businesses to handle large volumes of data, extract actionable insights, and automate repetitive processes with greater precision. Philippine providers are committed to enhancing their workforce's skills and utilizing advanced tools to offer these sophisticated services to global clients. By providing innovative BPM solutions, the sector can meet the needs of industries seeking improved efficiency, predictive analytics, and intelligent process management. This shift toward high-value services positions the Philippines as more than just a cost-effective outsourcing hub; it positions the nation as a strategic partner for innovation, technology advancement, and long-term business transformation in competitive international markets.

Rising Need for Industry-Specific BPM Solutions

There is a growing demand for industry-focused BPM services in the Philippines. In sectors like healthcare, BPM providers oversee medical billing, claims processing, and patient support while adhering to stringent regulations. In finance, they deal with risk analysis, fraud detection, and transaction processing, and in e-commerce, they manage inventory, logistics, and customer support. These specialized services require in-depth knowledge of sector-specific processes and regulations, which makes skilled providers in the Philippines highly desirable. By concentrating on niche markets, BPM firms can deliver customized solutions that tackle unique operational challenges in each sector. This focused strategy enhances client relationships, drives higher-value contracts, and allows providers to distinguish themselves in a highly competitive global market.

Challenges of Philippines Business Process Management Market:

Intense Competition from Other Low-Cost Outsourcing Destinations

Despite being a leading BPM hub, the Philippines is facing intense competition from countries like India, Vietnam, and Eastern European nations. These regions offer competitive labor costs, emerging technical capabilities, and increasing talent pools, posing a challenge to the Philippines’ leadership. To sustain its competitive advantage, the country needs to prioritize the development of specialized, high-value services, invest in advanced technologies, and uphold high service quality standards. Expanding service offerings and targeting niche sectors can help providers remain competitive despite cost challenges. Furthermore, building strong client relationships through innovation, reliability, and cultural compatibility can serve as a key differentiator. If these strategic adaptations are not made, the Philippines risks losing market share to rising competitors in the global outsourcing landscape.

Rising Operational Costs

The BPM industry in the Philippines is witnessing a gradual uptick in labor costs as wages rise to align with living expenses and retain skilled personnel. Additionally, expenditures on infrastructure improvements such as upgrading IT systems, enhancing cybersecurity, and expanding office spaces are contributing to rising operational costs. These financial pressures can affect profit margins, especially in a price-sensitive outsourcing environment. In response, providers are increasingly adopting automation, hybrid work arrangements, and productivity-enhancing technologies to manage costs while ensuring service quality. Moreover, by offering specialized, high-value services, providers can justify higher pricing to mitigate the impact of cost increases. Effective cost management and enhancements in operational efficiency are crucial for safeguarding long-term viability in an increasingly competitive market.

Data Security and Compliance Concerns

With the introduction of stricter global data protection regulations like GDPR and various regional laws, BPM providers in the Philippines face increased compliance challenges. Managing sensitive information in areas such as finance, healthcare, and personal data necessitates robust cybersecurity practices, ongoing audits, and adherence to industry-specific regulations. A single data breach can undermine client trust and lead to serious repercussions. This has made investments in advanced data protection technologies, encryption methods, and employee training a top priority for BPM firms. Providers that can demonstrate strong security frameworks and compliance readiness have a competitive advantage in attracting clients from regulated industries. Maintaining trust through security excellence is becoming a critical factor in sustaining and expanding BPM partnerships globally.

Philippines Business Process Management Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on deployment type, component, business function, organization size, and vertical.

Deployment Type Insights:

- On-Premises

- Cloud

The report has provided a detailed breakup and analysis of the market based on the deployment type. This includes on-premises and cloud.

Component Insights:

- IT Solution

- Process Improvement

- Automation

- Content and Document Management

- Integration

- Monitoring and Optimization

- IT Service

- System Integration

- Consulting

- Training and Education

The report has provided a detailed breakup and analysis of the market based on the component. This includes IT solution (process improvement, automation, content and document management, integration, and monitoring and optimization) and IT service (system integration, consulting, and training and education).

Business Function Insights:

- Human Resource

- Accounting and Finance

- Sales and Marketing

- Manufacturing

- Supply Chain Management

- Operation and Support

- Others

The report has provided a detailed breakup and analysis of the market based on the business function. This includes human resource, accounting and finance, sales and marketing, manufacturing, supply chain management, operation and support, and others.

Organization Size Insights:

- SMEs

- Large Enterprises

The report has provided a detailed breakup and analysis of the market based on the organization size. This includes SMEs and large enterprises.

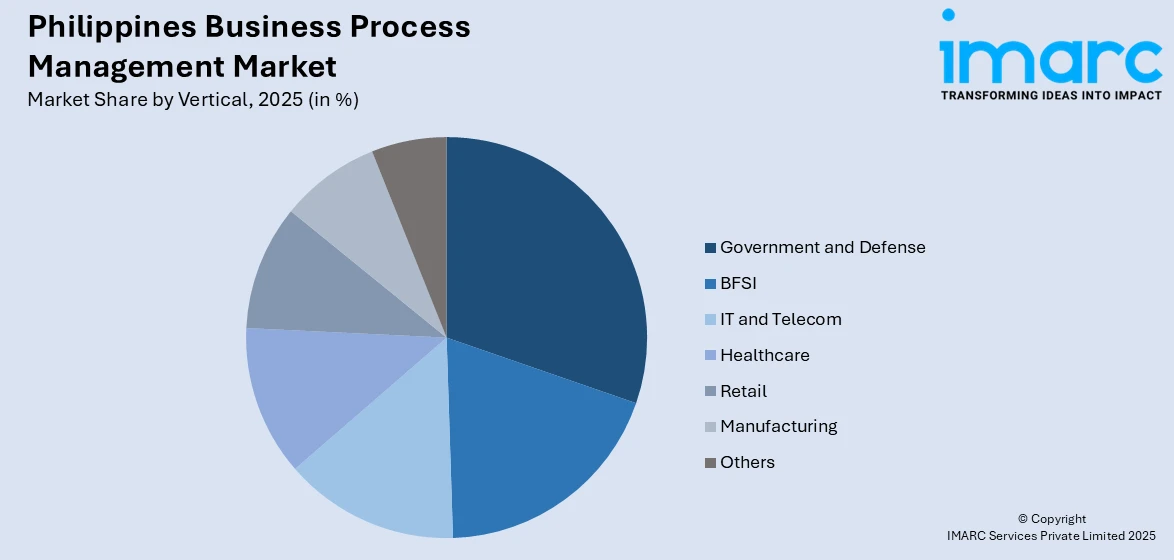

Vertical Insights:

Access the comprehensive market breakdown Request Sample

- Government and Defense

- BFSI

- IT and Telecom

- Healthcare

- Retail

- Manufacturing

- Others

A detailed breakup and analysis of the market based on the vertical have also been provided in the report. This includes government and defense, BFSI, IT and telecom, healthcare, retail, manufacturing, and others.

Regional Insights:

- Luzon

- Visayas

- Mindanao

The report has also provided a comprehensive analysis of all the major regional markets, which include Luzon, Visayas, and Mindanao.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Latest News and Developments:

- In June 2025, Techlog Center Philippines announced its plans to launch a fifth IT-BPM facility in Cebu with a USD 15.8 Million investment, creating over 900 jobs and boosting its workforce to 7,700. The site, operational by January 2026, will focus on voice and non-voice services, emphasizing sustainable practices in its operations.

- In January 2025, Helport AI opened a new office in the Philippines, establishing it as a ‘Global Center of Excellence’ for AI in the BPO industry. The launch, covered by Bilyonaryo News Channel, emphasizes the integration of AI to enhance customer service efficiency while maintaining human connections in the sector.

- In April 2024, the Philippine government, in partnership with Plug and Play, launched a national innovation platform to foster startups in the IT-BPM, migrant workers, and electronics assembly sectors. The two-year accelerator program aims to identify industry gaps, provide mentorship, and support at least 40 startups annually to enhance the services industry.

Philippines Business Process Management Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Deployment Types Covered | On-Premises, Cloud |

| Components Covered |

|

| Business Functions Covered | Human Resource, Accounting and Finance, Sales and Marketing, Manufacturing, Supply Chain Management, Operation and Support, Others |

| Organization Sizes Covered | SMEs, Large Enterprises |

| Verticals Covered | Government and Defense, BFSI, IT and Telecom, Healthcare, Retail, Manufacturing, Others |

| Regions Covered | Luzon, Visayas, Mindanao |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Philippines business process management market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Philippines business process management market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Philippines business process management industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The business process management market in Philippines was valued at USD 79.5 Million in 2025.

The Philippines business process management market is projected to exhibit a compound annual growth rate (CAGR) of 9.56% during 2026-2034.

The Philippines business process management market is expected to reach a value of USD 185.3 Million by 2034.

The major trend in the Philippines business process management market is the increased adoption of digital transformation, automation, and AI-driven solutions. There is also a notable shift toward industry-specific BPM offerings and high-value services, such as analytics and RPA, alongside growing demand for hybrid work models and advanced cybersecurity compliance measures.

Strong outsourcing demand from global industries, expanding financial inclusion through BPM solutions, and the country’s skilled, English-proficient workforce are key growth drivers. Additionally, investments in technology infrastructure, rising demand for 24/7 operations, and the ability to provide cost-effective yet specialized services contribute significantly to market expansion.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)