Philippines Cement Market Size, Share, Trends and Forecast by Type, End-Use, and Region, 2025-2033

Philippines Cement Market Overview:

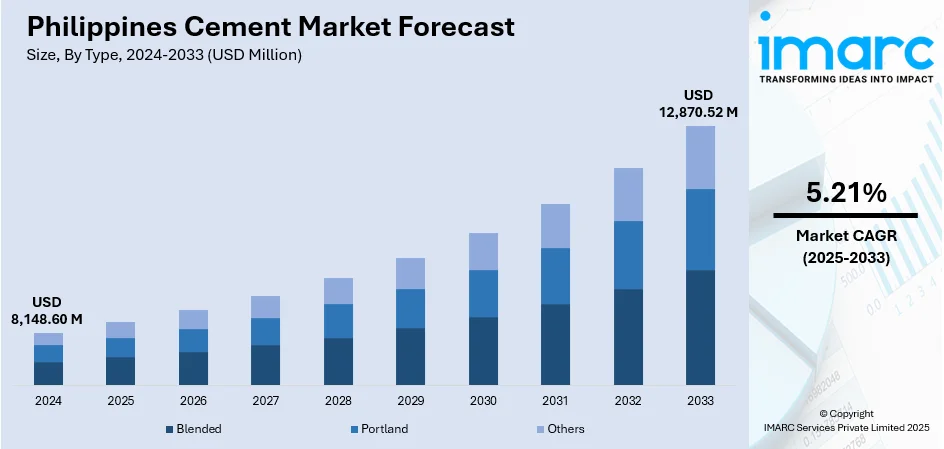

The Philippines cement market size reached USD 8,148.60 Million in 2024. Looking forward, the market is projected to reach USD 12,870.52 Million by 2033, exhibiting a growth rate (CAGR) of 5.21% during 2025-2033. Government infrastructure projects and public-private partnerships ensure steady cement demand in the Philippines. Additionally, rising environmental standards are accelerating the shift toward sustainable cement products. Together, these trends support stable plant operations, higher-margin offerings, and long-term investment across both public and private construction sectors, thereby contributing to the expansion of the Philippines cement market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 8,148.60 Million |

| Market Forecast in 2033 | USD 12,870.52 Million |

| Market Growth Rate 2025-2033 | 5.21% |

Key Trends of Philippines Cement Market:

Construction and Infrastructure Pipeline

Government-supported infrastructure initiatives and public-private partnerships continue to drive the demand for cement in the Philippines. These initiatives, ranging from highways and railways to ports and new urban areas, require notable volume of cement over extended periods, providing consistent clarity for manufacturers. For instance, in 2024, the Asian Development Bank sanctioned almost $1.7 Billion for the Laguna Lakeshore Road Network Project, a 37.5-km expressway linking Taguig City with Calamba. The initiative aimed to reduce peak travel duration by 25% and directly impact over 3.4 million individuals. It included $35.6 million in funding for climate initiatives and was a component of a larger effort for regional connectivity. Infrastructure of this magnitude requires substantial amounts of cement during its initial construction stages, especially for embankments, bridges, and concrete roads. These initiatives also initiate spillover construction, such as residential buildings, transport hubs, and utility improvements, that further strengthen the Philippines cement market growth. Due to their dependence on bulk formats and steady supply, they provide cement manufacturers with a reliable sales avenue that is less susceptible to competition from imports or downturns in the private real estate sector. With the emergence of additional high-value infrastructure projects, particularly those funded through multilateral means, the cement industry gains a stable demand foundation that enhances year-round plant operations and supports long-term capacity investments.

To get more information on this market, Request Sample

Shift Toward Sustainable Construction Materials

The rising preference for low-carbon and performance-enhanced cement products is influencing market dynamics in the Philippines. As developers and contractors align with environmental standards and green building goals, demand is shifting toward sustainable variants that reduce embodied carbon without compromising strength or durability. This change is not limited to commercial high-rises and extends to public infrastructure and institutional builds, where compliance with environmental, social, and governance (ESG) criteria is increasingly tied to financing and procurement eligibility. Cement manufacturers are responding by scaling up production of blended cement types and optimizing logistics to reduce emissions across the supply chain. These products often carry value-added positioning, allowing for better margins while supporting long-term demand. Buyers, particularly large contractors, see environmental credentials as essential, not optional, making partnerships with suppliers offering certified eco-friendly solutions more common. This trend also motivates product innovation and encourages new applications tailored to specific project needs. As adoption widens, sustainable cement products are no longer a niche and are becoming a core part of procurement strategies. In 2024, Holcim Philippines renewed its cement supply partnership with Megawide Construction Corp. to support infrastructure projects across Luzon. Holcim would provide sustainable cement solutions, including its low-carbon Excel ECOPlanet and Optimo products.

Urbanization and Housing Growth

Rapid urban growth in the Philippines is prominently influencing cement consumption as cities develop to support increasing populations. The heightened movement from rural areas to urban centers has led to considerable demand for new residential buildings, affordable housing initiatives, and commercial facilities like malls, offices, and mixed-use projects. Furthermore, the rise in household incomes and the expanding middle-class demographic are enhancing investments in contemporary housing and real estate. This spike in construction activities necessitates substantial quantities of cement to ensure durability and structural integrity. As a result, urban development and housing construction are emerging as key growth drivers effectively increasing Philippines cement market demand across various sectors.

Growth Drivers of Philippines Cement Market:

Government Infrastructure Investments

Government-led infrastructure initiatives are a significant factor in driving cement demand in the Philippines. Projects focusing on road systems, bridges, airports, seaports, and mass transit require substantial quantities of cement to ensure structural integrity and durability over time. These developments improve national connectivity and create a steady flow of construction activities resulting in consistent cement consumption across the nation. Moreover, public infrastructure expenditures facilitate private investments by enhancing access to crucial economic zones. The synergy between government and private sector efforts leads to a sustainable increase in the construction industry solidifying infrastructure development as a fundamental growth driver in the Philippine cement market.

Real Estate Development

The rapid expansion of the real estate industry encompassing residential, commercial, and mixed-use projects is markedly boosting cement consumption in the Philippines. The ongoing trend of urbanization combined with the rising need for affordable and mid-range housing continues to elevate construction activities in real estate. Additionally, the creation of shopping malls, office buildings, and modern business spaces necessitates significant cement utilization. According to Philippines cement market analysis, this phenomenon is further supported by the growing purchasing power of middle-class households and increased foreign investments in the real estate sector. As urban areas develop, the real estate sector is anticipated to continuously drive cement demand in the country.

Industrial Expansion

Industrial expansion in the Philippines is another vital driver affecting cement demand. The development of factory clusters, special economic zones, and logistics centers is based on the solid construction of warehouses, factories, and industrial facilities. Such activities predominantly rely on cement for durability, structural stability, and long-term operational effectiveness. Furthermore, the government's drive to secure foreign investment in sectors like electronics, automobiles, and food processing gives impetus to the building of industrial structures. With increasing growth in industries, demand for cement during initial establishment and subsequent expansion periods is bound to increase, forming a firm and sustainable foundation for the growth of the cement market in the Philippines.

Opportunities of Philippines Cement Market:

Green Cement Production

Sustainability has emerged as a pivotal focus in the construction industry, presenting a significant opportunity for green cement production in the Philippines. As environmental concerns grow alongside heightened awareness about climate change, the demand for low-carbon and eco-friendly cement alternatives is on the rise. Green cement, utilizing industrial by-products and alternative raw materials, lessens carbon emissions and diminishes reliance on traditional clinker-based production methods. Moreover, construction companies are increasingly compelled to adopt sustainable practices, which further amplifies interest in eco-friendly cement. This shift creates new growth prospects for local manufacturers, allowing them to position themselves effectively in a transforming market while aligning with global sustainability objectives and anticipated regulatory standards.

Smart City Projects

The emergence of smart cities throughout the Philippines indicates a notable growth opportunity for the cement sector. Planned urban development necessitates significant construction of modern housing, transport networks, energy-efficient commercial buildings, and digital infrastructure, all of which require substantial amounts of cement. Smart city initiatives prioritize sustainability, resilience, and innovative urban planning, making the demand for high-quality and advanced cement products crucial. Additionally, collaborations between public and private sectors in these projects generate sustained demand, leading to reliable market opportunities. As the government continues to advocate for technology-driven urban environments, cement manufacturers can strategically connect with these initiatives, cementing their role in the evolution of urban development in the nation.

Rural Infrastructure Growth

There is an increasing focus on rural development in the Philippines as the government aims to alleviate regional disparities and enhance connectivity. Infrastructure efforts in rural areas—such as roads, bridges, schools, hospitals, and public buildings—create substantial demand for cement. These projects elevate living standards and foster economic activity in underserved regions. For cement producers, rural infrastructure represents an unexplored market beyond conventional urban locales, ensuring broader distribution and sustained growth in consumption. As additional funding is directed toward rural development initiatives, the demand for cement is projected to increase, reinforcing its significance as a fundamental material for inclusive national progress.

Government Support of Philippines Cement Market:

Infrastructure Development Programs

The cement industry in the Philippines is significantly driven by infrastructure development initiatives. Major projects such as highways, bridges, ports, airports, and railway systems necessitate a considerable amount of cement to guarantee strength and durability. These efforts are integral to long-term national strategies aimed at enhancing connectivity, alleviating congestion, and boosting economic productivity. The government’s strong concentration on infrastructure stimulates immediate demand and establishes a pipeline for future projects, providing stability to the cement sector. By focusing on transportation networks, urban development, and public facilities, these programs greatly elevate construction activities, making infrastructure development one of the most dependable contributors to cement market expansion in the Philippines.

Investment Incentives

The investment incentives offered by the Philippine government are paving the way for growth opportunities within the cement sector. Tax exemptions, fiscal advantages, and various types of support encourage both domestic and foreign entities to enhance their cement manufacturing capabilities. These incentives assist in lowering operational expenses, attracting capital investments, and promoting technological advancements in cement facilities. By fostering a favorable business climate, the government enables producers to satisfy increasing domestic demand while remaining competitive against imported goods. Furthermore, such policies enhance investor confidence, resulting in capacity expansions and efficiency gains. These initiatives are crucial for bolstering the overall supply chain within the Philippine cement industry and ensuring sustainable market growth.

Import Regulation Measures

Regulation of imports is vital for maintaining a balanced and competitive cement market in the Philippines. As cement imports rise, leading to potential pricing pressures, government policies aim to shield local producers from unfair competition while guaranteeing sufficient supply for construction requirements. These regulations may encompass safeguard duties, quality assessments, or tariffs on imported cement, all designed to foster fair trade and support domestic manufacturing. By instituting such regulations, the government helps local manufacturers remain profitable while continuing to invest in growth and innovation. These strategies stabilize the market and enhance long-term self-sufficiency and resilience within the Philippine cement industry.

Challenges of Philippines Cement Market:

High Energy Costs

The cement sector in the Philippines encounters substantial difficulties stemming from elevated energy expenses, given that production is notably energy-intensive. Cement facilities depend significantly on coal and electricity to power kilns and grinding units, positioning energy costs as a major factor in overall production expenditures. Fluctuations in global coal pricing and local electricity supply challenges further amplify the unpredictability of operational costs. Increasing energy expenses squeeze profit margins for manufacturers and hinder their ability to compete with imported cement. In response, producers are investigating renewable energy sources, alternative fuels, and energy-efficient technologies. However, this transition demands significant investment, which can pose difficulties for smaller companies, making high energy costs an enduring issue for the industry.

Environmental Concerns

Raising environmental issues are increasingly influencing the Philippine cement sector as international and domestic regulations tighten around carbon emissions. Cement manufacturing is a leading contributor to greenhouse gas emissions due to the energy-demanding nature of clinker production. Pressure from government initiatives, environmental organizations, and global standards drives manufacturers to implement cleaner technologies and invest in sustainable practices. This includes the creation of blended cements, utilizing alternative raw materials, and minimizing dependency on fossil fuels. While these changes offer innovative opportunities, they also elevate production costs and necessitate considerable capital investment. Striking a balance between sustainability ambitions and profitability remains a significant challenge, but failure to adapt could result in regulatory fines and damage to the reputation of cement producers.

Raw Material Price Volatility

The fluctuation of raw material prices poses a significant challenge for the cement industry in the Philippines. Essential inputs like clinker, limestone, gypsum, and fuel are influenced by fluctuating global and domestic market situations, which directly affects production costs. Imported clinker, in particular, is vulnerable to currency fluctuations and international trade conditions, complicating cost management for manufacturers. This volatility can result in erratic price changes for cement, impacting both producers and end-users in the construction sector. Firms are looking into strategies such as local sourcing, securing long-term supply agreements, and material substitution to manage risks. Nevertheless, persistent variations in input prices continue to challenge profit margins, making the stability of raw material costs a vital concern for the cement industry.

Philippines Cement Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type and end-use.

Type Insights:

- Blended

- Portland

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes blended, Portland, and others.

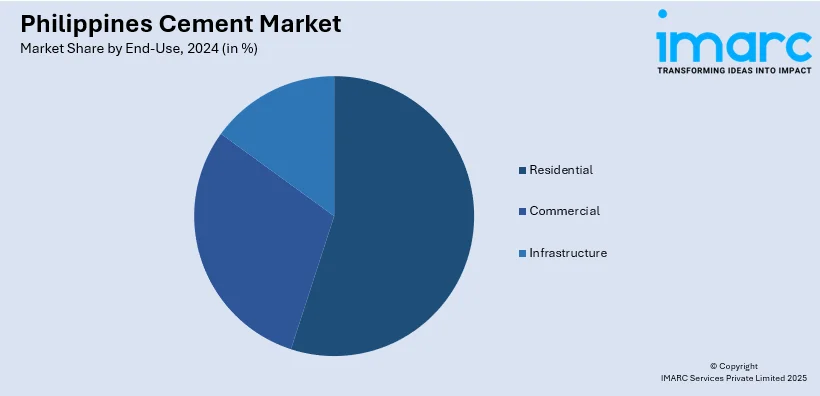

End-Use Insights:

- Residential

- Commercial

- Infrastructure

A detailed breakup and analysis of the market based on the end-use have also been provided in the report. This includes residential, commercial, and infrastructure.

Regional Insights:

- Luzon

- Visayas

- Mindanao

The report has also provided a comprehensive analysis of all the major regional markets, which include Luzon, Visayas, and Mindanao.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Philippines Cement Market News:

- In August 2024, Shera announced that its new fiber cement plant in Mabalacat, Pampanga, was 60% complete and set to launch by January 2025. This was Shera’s first facility outside Thailand, with a production capacity of 0.24Mt/year.

- In July 2024, Taiheiyo Cement Philippines launched a new US$220 million production line at its San Fernando, Cebu plant. The upgrade boosted capacity to 3 million tons per year and reduces CO₂ emissions by at least 10%. This modernization also aimed to lower import reliance and create 2,000 jobs.

Philippines Cement Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Blended, Portland, Others |

| End-Uses Covered | Residential, Commercial, Infrastructure |

| Regions Covered | Luzon, Visayas, Mindanao |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Philippines cement market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Philippines cement market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Philippines cement industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The cement market in the Philippines was valued at USD 8,148.60 Million in 2024.

The Philippines cement market is projected to exhibit a compound annual growth rate (CAGR) of 5.21% during 2025-2033.

The Philippines cement market is expected to reach a value of USD 12,870.52 Million by 2033.

The Philippines cement market is witnessing trends such as increased adoption of green and blended cement, modernization of plants with energy-efficient technologies, and rising demand from urban housing and smart city projects. Additionally, digital integration in operations and steady import reliance are shaping competitive industry dynamics.

Major growth drivers include government-backed infrastructure programs, expansion of real estate and commercial construction, and rising rural development initiatives. Industrial zone expansions, foreign investments, and growing middle-class population further accelerate cement demand, making both public and private sector developments crucial in driving market growth across the Philippines.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)