Philippines Clothing Market Size, Share, Trends and Forecast by Fiber Type, Usage, Distribution Channel, Industry Vertical, and Region, 2026-2034

Philippines Clothing Market Overview:

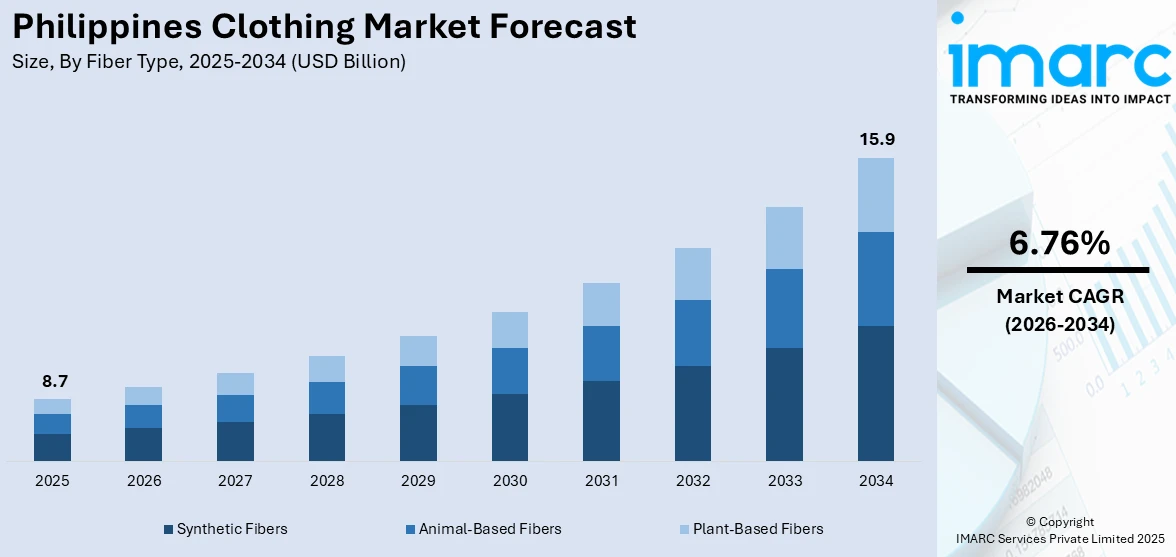

The Philippines clothing market size reached USD 8.7 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 15.9 Billion by 2034, exhibiting a growth rate (CAGR) of 6.76% during 2026-2034. The thriving e-commerce industry, which provides buyers an access to a wide range of apparel options, along with the growing number of fashion-conscious youth demographics are increasing the Philippines clothing market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 8.7 Billion |

| Market Forecast in 2034 | USD 15.9 Billion |

| Market Growth Rate 2026-2034 | 6.76% |

Philippines Clothing Market Trends:

Thriving E-Commerce Industry

An article published in 2024 on the website of the International Trade Administration (ITA) shows that the Philippines’ eCommerce market sales reached $17 billion, largely contributed by 73 million online active users in 2021. E-commerce platforms give buyers in the Philippines access to a wide range of apparel options, including multinational companies that do not have a physical presence in the country. People in both urban and rural locations now have additional fashion options because of increased accessibility. They may purchase online at any time and from any location, making it the most convenient option available. This convenience is especially desirable in a country with high traffic congestion in urban areas, where visiting physical stores can be time-consuming. E-commerce platforms frequently provide competitive pricing, regular sales, discounts, and promotions, making it more inexpensive for individuals to buy clothing. This inexpensive cost is a big selling point for budget-conscious shoppers. Online platforms can stock a considerably greater choice of products than conventional businesses. This variety covers a wide range of designs, sizes, and brands to meet the varying needs of buyers. It also helps specialized and boutique brands reach a bigger audience. Social media integration with e-commerce platforms is making it easier for people to find and buy clothing. Influencers and celebrities frequently endorse fashion items on social media, driving traffic to e-commerce websites and increasing sales. E-commerce platforms offer customer reviews and ratings, allowing customers to make more educated purchasing decisions. Positive ratings can have a substantial impact on buying behavior and increase buyers’ trust in online commerce, which further contributes to the Philippines clothing market growth.

To get more information on this market, Request Sample

Growing Youth Demographics

As per an article published in 2024 on the website of the Philippine Statics Authority (PSA), youth population reached 542,391 or 30.3% in 2020. The Philippines has a young population, and this group is more fashion-conscious and ready to follow the newest trends, which increases the demand for new and diversified clothing styles. Pop culture, social networking, and worldwide fashion trends have all had a significant impact on young Filipinos. They are eager to embrace new styles seen on celebrities, influencers, and in popular media, driving up the demand for current and attractive attire. As the economy is expanding and more young people enter the labor force, their discretionary income is increasing. This improved purchasing power enables young people to spend more money on fashion and garments, boosting clothing market sales. The youth population is digitally literate, making them the most frequent users of e-commerce sites. Their familiarity with internet purchasing, combined with the convenience it provides, leads to considerable online apparel sales, which in turn facilitates a shift in the Philippines clothing market outlook. Social media platforms are also extremely popular among Filipino youngsters. These platforms serve as both a source of fashion inspiration and marketing tools for apparel manufacturers. Influencer and peer recommendations on social media have a significant impact on purchasing decisions. Young shoppers frequently prefer fast fashion firms that offer the most recent trends at reasonable pricing.

Philippines Clothing Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2026-2034. Our report has categorized the market based on fiber type, usage, distribution channel, and industry vertical.

Fiber Type Insights:

- Synthetic Fibers

- Animal-Based Fibers

- Plant-Based Fibers

The report has provided a detailed breakup and analysis of the market based on the fiber type. This includes synthetic fibers, animal-based fibers, and plant-based fibers.

Usage Insights:

- Women’s Wear

- Men’s Wear

- Kid’s Wear

The report has provided a detailed breakup and analysis of the market based on the usage. This includes women’s wear, men’s wear, and kid’s wear.

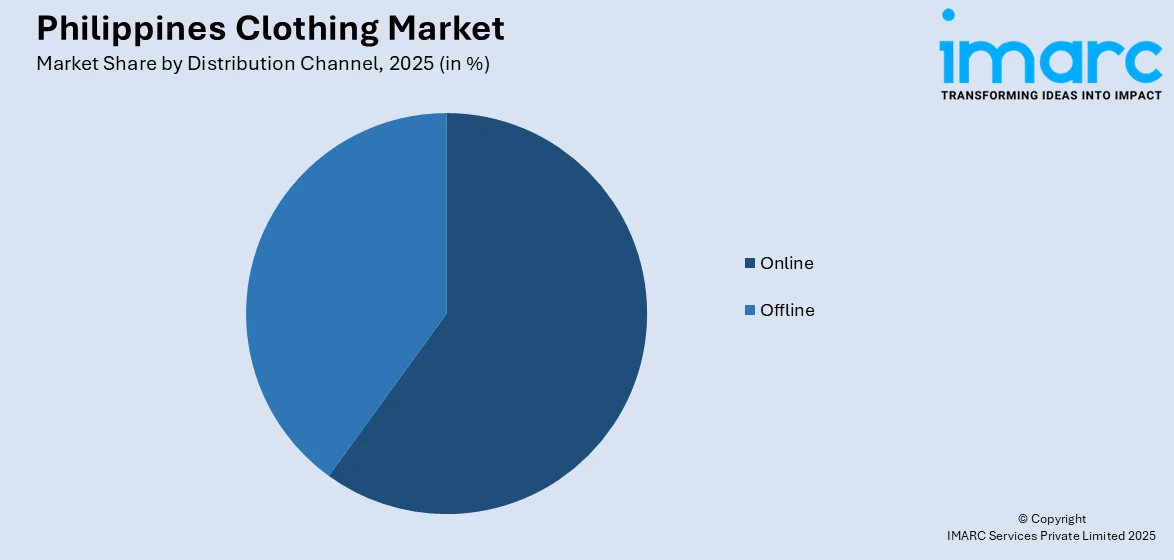

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Online

- Offline

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes online and offline.

Industry Vertical Insights:

- Fashion and Entertainment

- Sports and Fitness

- Military and Defense

- Healthcare

- Others

A detailed breakup and analysis of the market based on the industry vertical has also been provided in the report. This includes fashion and entertainment, sports and fitness, military and defense, healthcare, and others.

Regional Insights:

- Luzon

- Visayas

- Mindanao

The report has also provided a comprehensive analysis of all the major regional markets, which include Luzon, Visayas, and Mindanao.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Philippines Clothing Market News:

- October 2023: H&M opened its first Lazada store in Philippines to offer convenience to people of purchasing clothes that give style and quality at the best price in a sustainable way with just a click of a button.

- June 2024: An icon in the Philippine fashion industry, Salud created neo-ethnic clothes with international appeal to promote indigenous materials and Mindanaoan artistry.

Philippines Clothing Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Fiber Types Covered | Synthetic Fibers, Animal-Based Fibers, Plant-Based Fibers |

| Usages Covered | Women’s Wear, Men’s Wear, Kid’s Wear |

| Distribution Channels Covered | Online, Offline |

| Industry Verticals Covered | Fashion and Entertainment, Sports and Fitness, Military and Defense, Healthcare, Others |

| Regions Covered | Luzon, Visayas, Mindanao |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Philippines clothing market performed so far and how will it perform in the coming years?

- What is the breakup of the Philippines clothing market on the basis of fiber type?

- What is the breakup of the Philippines clothing market on the basis of usage?

- What is the breakup of the Philippines clothing market on the basis of distribution channel?

- What is the breakup of the Philippines clothing market on the basis of industry vertical?

- What is the breakup of the Philippines clothing market on the basis of region?

- What are the various stages in the value chain of the Philippines clothing market?

- What are the key driving factors and challenges in the Philippines clothing market?

- What is the structure of the Philippines clothing market and who are the key players?

- What is the degree of competition in the Philippines clothing market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Philippines clothing market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Philippines clothing market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Philippines clothing industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)